Today's focus is on municipal bonds, but first let's take a look at a chart from the above link.

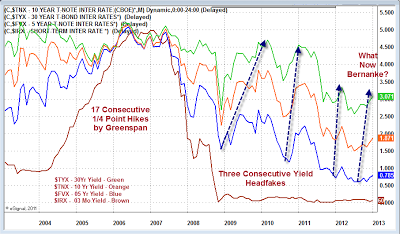

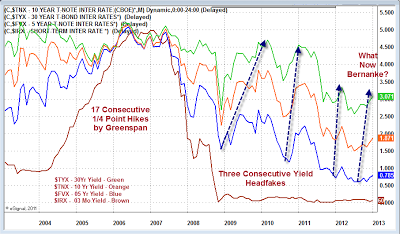

Treasury Yield Curve

click on chart for sharper image

Posted on 01/11/2013 1:42:33 PM PST by Kaslin

On Wednesday, I posted a chart of US Treasury Yields asking the question Yield Curve: Where To From Here? Extreme Complacency in Face of Bernanke Shift.

Today's focus is on municipal bonds, but first let's take a look at a chart from the above link.

Treasury Yield Curve

click on chart for sharper image

Since 1971, Gross, 68, has deftly steered PIMCO, the Newport Beach, Calif., investment firm that he cofounded and where he is currently co-chief investment officer, overseeing some $1.8 trillion in assets. He manages PIMCO Total Return Fund, the world's largest mutual fund and a stalwart of the fixed-income world that has returned more than 7.3 percent annually over the past 15 years, helping to earn Gross the unofficial title of "bond king." Gross recently spoke with U.S. News about what he sees as a "new normal" for the markets and for investors. Edited excerpts:

What have you done that has accounted for the Total Return Fund's impressive and continued success?

To be fair, the near double-digit returns are a function of falling interest rates more than anything else. It's sort of like a teeter-totter; when interest rates go down, prices go up. So the Total Return Fund, [just] as all bond funds, has done well in part because interest rates have gone down, down, down. We've also outperformed the [investment-grade bond] market by close to 2 percentage points a year. Individual strategies in terms of trading hopefully account for the track record. That leads, I guess, to another question: Can those returns be duplicated going forward?

I imagine that's on a lot of investors' minds. What should they expect?

You start with the obvious: The Federal Reserve has lowered short rates to close to zero. The investment-grade bond market, which includes treasuries and corporates and mortgages, all in one big pot, yields 1¾ percent. It's hard to manufacture near double-digit returns from that. It's the metaphorical concept of squeezing juice out of an orange; almost all of the juice has been extracted, so to speak.

So investors looking for a repeat of historical performance are bound to be disappointed, and that's why I wrote several months ago—which caused a ruckus in the market—about the [dying] cult of equity. It was the same thing with the cult of bonds, the "cult" meaning that there was a belief that historical returns could be projected into the future. They can't. They can't for bonds and they can't for stocks either, in my opinion.

What's your economic forecast for the months and year ahead?

An investor probably has to look forward to higher inflation. Slower growth and higher inflation—that's not a positive, by any means. Individuals would want it to be just the reverse. The de-levering and the check-writing on the part of central banks, that's really what produces the situation.

Are you worried about debt in the United States and Europe?

Slow growth and inflation have a tendency to accompany large deficits and increasing debt as a percentage of GDP. Unless we begin to reverse that course, we could resemble Greece within a decade. Final Thoughts

I do not foresee the inflation Gross does, at least not yet (and my track record on that score has been quite good). However, my definition of inflation involves credit, not prices.

Regardless of definitions, even if this action is nothing more than another inflation scare, I would not want to sit through the scare for the simple reason yields have a long way to rise before there is any conceivable value in them.

Readers will note that I had generally been bullish on treasuries, but I do not like them now either. There simply is no value, even if the US is back in recession, and especially if the end of QE awaits.

Thus, there is a lot of merit in saying to hell with it all and sitting in cash. Of course I would have said the same thing about munis a year ago. And I would have been overly-cautious then. Am I overly-cautious now?

Regardless, we are currently at a point where being wrong can be extremely costly. And with each drop in yield, the more likely sitting on the sidelines earning nothing is likely to be right.

From my perspective, earning 1.42% on 10-year munis is not worth the risk of being on the wrong side of a major move, whether or not bonds are the only game in town.

Interesting read. Gross always has insightful comments. Thanks for posting.

When risk of default (bad credit rating occurs) and/or hyperinflation hits, then interest rates adjust upward for new loans to “protect” purchasing power of lenders.

This will hurt outstanding bond holders lock into low interest rates on their notes. They will be forced to sell their bonds for a very low price, to “equalize” the real returns across both types of bonds.

Would hate to be one of those folks..... it’s all in the timing of when you sell those existing bonds....... I just don’t see any muni bonds as “safe” with the rapacious public unions out there BK’ing everybody locally.

How do you feel about floating rate funds? Would they be beneficiaries of rising rates?

I’m no finance professor, but anything that assures more stability and adjusts for changing conditions in the face of fibbing (politicized) ratings agencies like Moody’s — sounds like the best investment strategy.

After the sub-prime mortgage disaster, how can one trust the risk ratings now days? They were our last line of defense, but even that “assurance” fell through. :(

These are very difficult times for investors and retirees. Esp GM bond holders!! :(

Inflation creates uncertainty for lenders (investors), since we don’t know WHAT the “value” will be that we get back, long term. Just one more effect of government inflationary finance, it destroys anyone’s interest in investing/loaning money, taking risk. Just spend the money now, or hold something with stable value, a hard asset.

Thanks, government, for destabilizing and destroying:

1. the credit market

2. the willingness of savers to loan for productive new capital investment projects

3. prices (interest rates) which are affordable to the buyers’ side of the loan market — students, small businesses

4. economic growth.

Back in the 70’s interest rates soared. Money market funds were good ports in the economic storm. At least they kept up with inflation. High quality dividend stocks that have good fundamentals and a record of sustained dividend growth are also an option in these crazy times.

At some point, the wheels are going to come off and there will be an economic train wreck. Our reckless government has brought us to the edge of a calamity. Its now just a matter of waiting for it to happen.

So one should move from munis to what?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.