Skip to comments.

GDP Shows Surprise Drop for U.S. in Fourth Quarter (unexpected alert)

CNBC ^

Posted on 01/30/2013 5:46:18 AM PST by Perdogg

The U.S. economy posted a stunning drop of 0.1 percent in the fourth quarter, defying expectations for slow growth and possibly providing incentive for more Federal Reserve stimulus.

(Excerpt) Read more at cnbc.com ...

TOPICS: Breaking News; Business/Economy

KEYWORDS: contraction; defense; economy; spending; unexpected

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-112 next last

To: kabar

My business relies on mostly customers discretionary spending so the 2% has an effect. But we’re prepared and have adjusted our costs and pricing so we’ll make things work and incentivize our customers to cut back in other areas. This 2% is real money to us and our customers.

81

posted on

01/30/2013 8:18:28 AM PST

by

jimbo123

To: Perdogg

Imagine what the GDP Number would have been if Millions of Americans weren’t out buying Guns since Obama got Reelected.

Remember, all those Guns were Made In America.

82

posted on

01/30/2013 8:23:50 AM PST

by

Kickass Conservative

(I only Fear a Government that doesn't Fear me.)

To: Cringing Negativism Network

LOL. Just saying something doesn’t make it happen. Unless you can come up with a real plan or proposal you are just living in a fantasy world. You need to bell the cat.

83

posted on

01/30/2013 8:26:56 AM PST

by

kabar

To: jimbo123

I don’t doubt what you say for a moment. My point is that there are many Americans living from pay check to pay check. Even a slight decline in income causes significant problems.

84

posted on

01/30/2013 8:33:18 AM PST

by

kabar

To: jiggyboy

You hit the nail on the head.

The one thing about that imbecile Wiesenthal, he’s a perfect reverse barometer.

To: Wyatt's Torch

"most of the collapse was due to a stunning fall in military spending. That’s not good for GDP, but it doesn’t reflect the real underlying strength of the economy. [...]

"Seeing a decline in inventory buildups isn’t that big of a deal really. This number always goes back and forth.

"What’s key is that the numbers that really reflect the strength of the economy were much better.

"Personal consumption, fixed investment, and equipment/software all grew nicely. This is the real economy humming along."

Makes sense to me.

86

posted on

01/30/2013 8:39:17 AM PST

by

JustSayNoToNannies

("The Lord has removed His judgments against you" - Zep. 3:15)

To: kabar

“...Actually, by definition, the recession ended in June 2009. A recession is defined as two consecutive quarters of negative growth in the GDP....”

Oh, I certainly don’t disagree with the definition. However, the charade being perpetrated now with “cooked books” is a house of cards about to come down....UNEXPECTEDLY.

87

posted on

01/30/2013 9:00:06 AM PST

by

lgjhn23

(It's easy to be liberal when you're dumber than a box of rocks.)

To: Perdogg

“And you tell me

Over and over and over again, my friend

Ah, you don’t believe

We’re on the eve

of destruction.”

To: MNGal

I want to see figures for the number of jobs that are being changed from 2 full-time jobs to 3 part-time jobs.

89

posted on

01/30/2013 9:36:22 AM PST

by

AFPhys

((Praying for our troops, our citizens, that the Bible and Freedom become basis of the US law again))

To: Wyatt's Torch

Look at this

chart and tell me what happened in the last quarter that did not happen in all other quarters before you believe the spin. Govt spending fell by more in the first quarter of 2011 and private inventories fell by more in the last quarter of 2010. Look at all of the quarters and tell me what was different.

90

posted on

01/30/2013 10:41:06 AM PST

by

Perdogg

(Mark Levin - It's called the Bill of Rights not Bill of Needs)

To: JustSayNoToNannies

Analysis from IHS Global Insight:

The first estimate of fourth-quarter GDP was a drop of 0.1%, after growth of 3.1% in the third quarter. A steep drop in defense spending and much slower inventory accumulation held back growth, and mean that the economy is not as weak as fourth-quarter GDP suggests.

- The Commerce Department estimated that GDP fell 0.1% in the fourth quarter, after 3.1% growth in the third.

- The fourth quarter's drop should be viewed as payback for a strong third quarter, not as a signal that the economy is tipping into recession.

- Defense spending plunged 22.2%, subtracting 1.3 percentage points from growth.

- Inventory accumulation slowed, also cutting 1.3 percentage points from growth.

- Consumer spending growth quickened, as did residential fixed investment, while business fixed investment spending rebounded after a dip in the third quarter.

- Exports fell sharply, although improving foreign economies offer hope for exports to improve in 2013.

- This report is nowhere near as bad as it looks on the surface. We expect growth to rebound to about 2.0% in the first quarter, even with a drag on consumer spending from the loss of the payroll tax cut.

Real GDP fell 0.1% in the fourth quarter, after rising 3.1% in the third. The outcome was even weaker than the positive 0.3% rate that we had anticipated in our "Week Ahead" review last Friday—but the weakness came exactly where anticipated. The two factors that had helped the third quarter—defense spending and inventories—went into reverse during the fourth quarter, subtracting a combined 2.6 percentage points from the growth rate. These are massive—but temporary—corrections. Even though the trend in real defense spending is downwards—how steeply will depend on whether the sequester takes effect—the fourth-quarter drop is still a major outlier.

The news from private spending was mostly encouraging. Consumer spending growth improved from 1.6% to 2.2%, while residential investment growth accelerated to 15.3% as the housing recovery gathered pace. Business fixed investment rebounded 8.4%, after dropping 1.8% in the third quarter. Some of the bounce in equipment and software spending (which rose 12.4%) may have reflected spending pulled into 2012 ahead of the possible expiration of bonus depreciation. Only exports disappointed, dropping at a 5.7% annual rate, with very sharp drops for food exports (likely drought-related) and in aircraft exports (a volatile category).

It's hard to pin the weak fourth quarter on fiscal-cliff fears. Consumer and business fixed investment spending did better than in the third quarter—though perhaps some of the slowdown in inventory accumulation reflected caution ahead of the cliff. Hurricane Sandy also hurt growth, although it is impossible to know how severely (our assumption has been that it was a drag of 0.3 percentage point).

It would be a mistake to view this drop in GDP—driven by severe, temporary corrections in defense spending and inventories—as a possible harbinger of recession. The incoming data point to continued growth, and we expect GDP growth to rebound to around 2% in the first quarter, even though consumer spending growth is likely to slow as the end of the payroll-tax cut bites. At present, our forecast assumed that the sequester does not kick in as scheduled on March 1—if it takes full effect, that would take around a quarter-point off our growth forecast for the first quarter.

The most obvious effect of the fiscal cliff in the GDP report was on the income numbers. The Bureau of Income Analysis (BEA) estimated that an extra $26.4 billion ($105.6 billion at an annual rate) was paid to persons in special or accelerated dividends, ahead of an anticipated increase in the dividend tax rate. It also made a smaller judgmental adjustment of $15 billion at an annual rate to wages and salaries to allow for accelerated bonus and other payments. The combined effect of these two items added $120.6 billion at an annual rate to personal income in the fourth quarter. The result was that personal income rose at a 7.9% annual rate in the fourth quarter; without the extra $120.6 billion it would have risen at a 4.1% annual rate. Personal income for December, to be published on 31 January, will probably rise more than 3% month on month. We expect personal income to fall in the first quarter, as the extra dividend and bonus payments drop out, and as the elimination of the payroll-tax cut reduces income as well.

At present, we do not have information about BEA assumptions on taxes paid on the extra income, but since there was no surge in taxes paid comparable to the surge in dividends, it seems that the BEA has assumed that the taxes due on the extra dividends will be paid in final settlements in 2013.

The extra income payments assumed for the fourth quarter are irrelevant for GDP, since they do not correspond to any extra production, except to the extent that the recipients used them to finance extra spending. That effect was probably very limited. With the vast majority of the extra income being saved, the personal saving rate jumped to 4.7% in the fourth quarter, from 3.6% in the third.

91

posted on

01/30/2013 10:46:23 AM PST

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: jiggyboy

From National Review:

Ignore the Topline GDP Number

By Bob Stein

January 30, 2013 11:15 A.M.

As we wrote last week: ignore the GDP headline, which was likely to be weak, but misleading.

As it turns out, the headline was even weaker than we thought, coming in (slightly) negative for the first time since 2009 and lower than any forecast from the 83 groups making predictions. We thought inventories would subtract 1.3 points from the GDP growth rate and got that exactly right, but government purchases also subtracted 1.3 points from the growth rate of real GDP, due to the largest drop in defense (relative to GDP) since the wind-down in Vietnam in 1973.

The 0.1 percent annual rate of real GDP contraction is misleading because the key components of GDP — personal spending, business investment, and homebuilding — were all rising, and came in at a combined 3.4 percent annual growth rate, exactly as we forecast. Reductions in inventories and government purchases may hurt in the short run, but looking ahead to 2013 we think these cuts are a positive: Lower inventories mean more showrooms and shelves to be stocked; less government spending means lower deficits and the potential for lower taxes (or fewer future tax hikes).

For now, we maintain our forecast that real GDP will grow in the 2.5 percent to 3 percent range in 2013, but think the chance of an upside surprise modestly outweighs the risks of a disappointment.

92

posted on

01/30/2013 10:49:33 AM PST

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Perdogg

I posted that chart as well...

Huge declines in government spending (defense as non-defense increased) coupled with inventory destocking drove the decline. Mostly offset by strong personal consumption (durables) and FI (particularly housing which was very strong. Equipment also strong). The one area that flipped was exports as economies outside the US weakened.

93

posted on

01/30/2013 11:01:20 AM PST

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Perdogg; JustSayNoToNannies

Good analysis from Bill McBride at Calculated Risk:

Comments on Q4 GDP and Investment

by Bill McBride on 1/30/2013 10:01:00 AM

The Q4 GDP report was negative, with a 0.1% annualized decline in real GDP, and lower than the expected 1.0% annualized increase. Final demand increased in Q4 as personal consumption expenditures (PCE) increased at a 2.2% annual rate (up from 1.6% in Q3), and residential investment increased at a 15.3% annual rate (up from 13.5% in Q3).

Investment in equipment and software rebounded in Q4 (increased at 12.4% annualized rate), and investment in non-residential structures was slightly negative.

The slight decline in GDP was related to changes in private inventories (subtracted 1.27 percentage points), less Federal Government spending (subtracted 1.25 percentage points), and a negative contribution from trade (subtracted 0.25 percentage points).

Overall this was a weak report, but with some underlying positives (the increase in PCE and private fixed investment). I expect the payroll tax increase to slow PCE growth in the first half of 2013 - and for additional government austerity - but I think the economy will continue to grow this year.

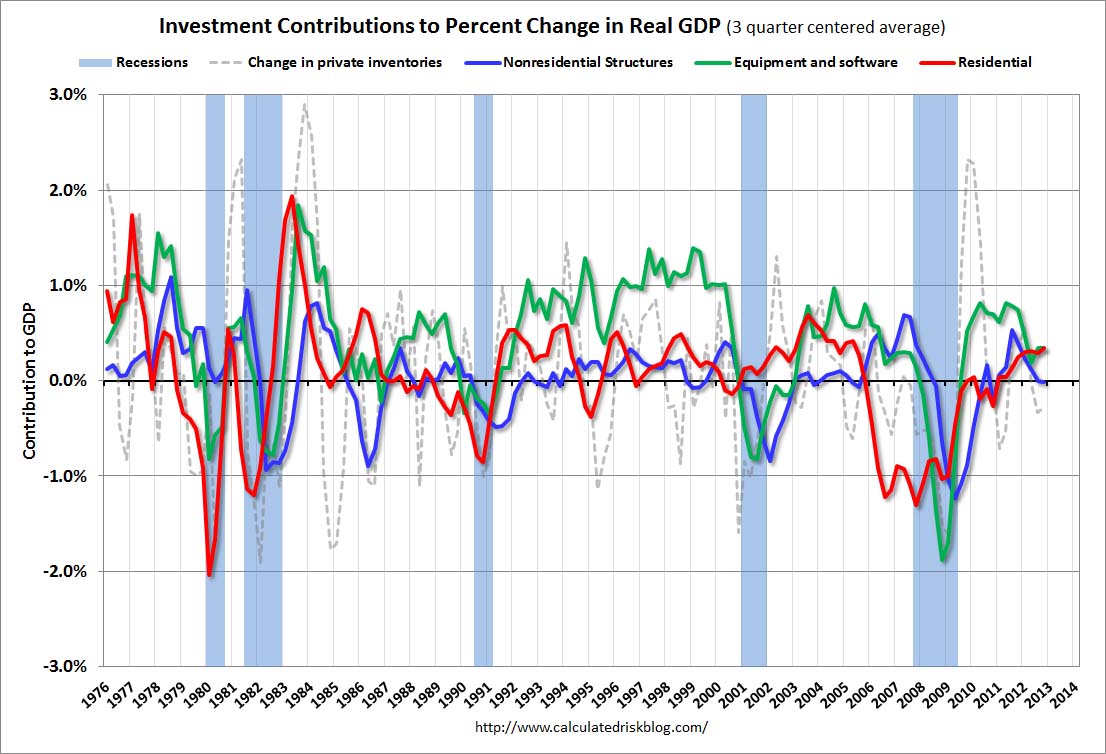

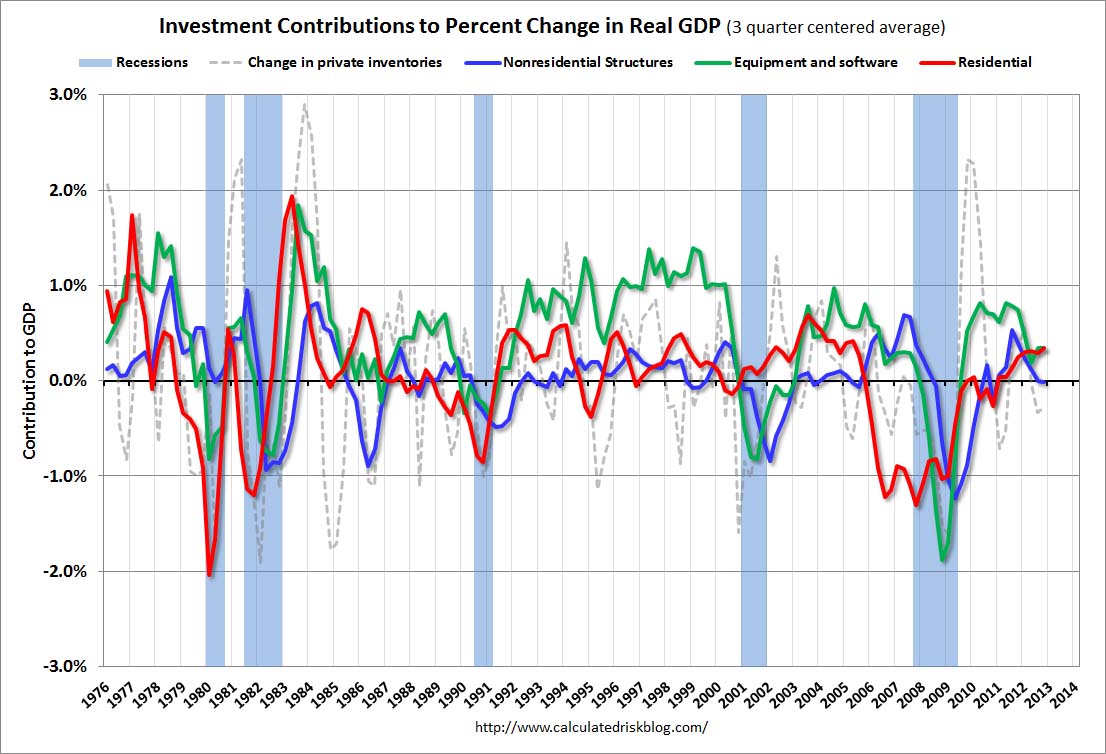

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Investment ContributionsClick on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the seventh consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment increased solidly in Q4, after decreasing in Q3. This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was slightly negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

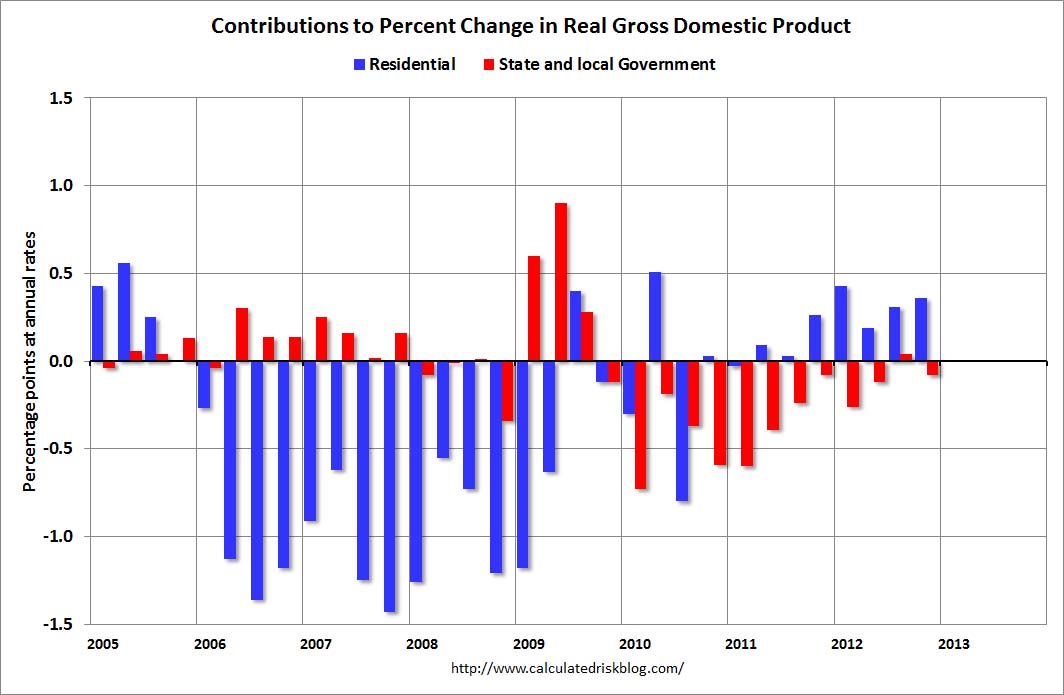

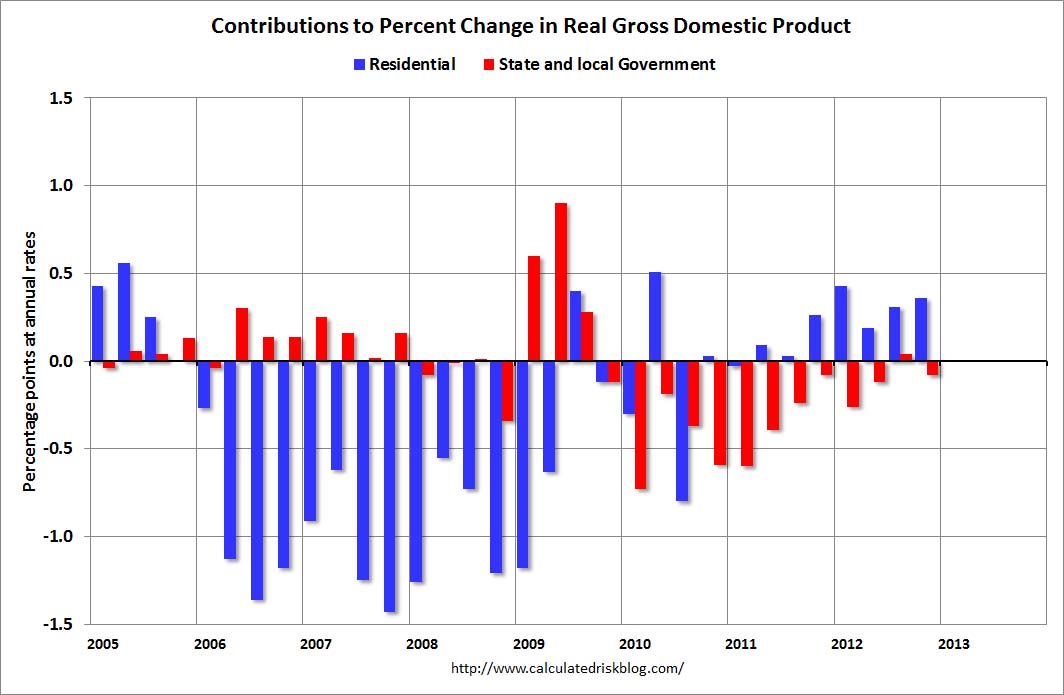

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

State and Local Government Residential Investment GDPThe blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

However the drag from state and local governments is ongoing, although the drag in Q4 was small. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline in state and local government spending has been relentless and unprecedented. The good news is the drag appears to be ending.

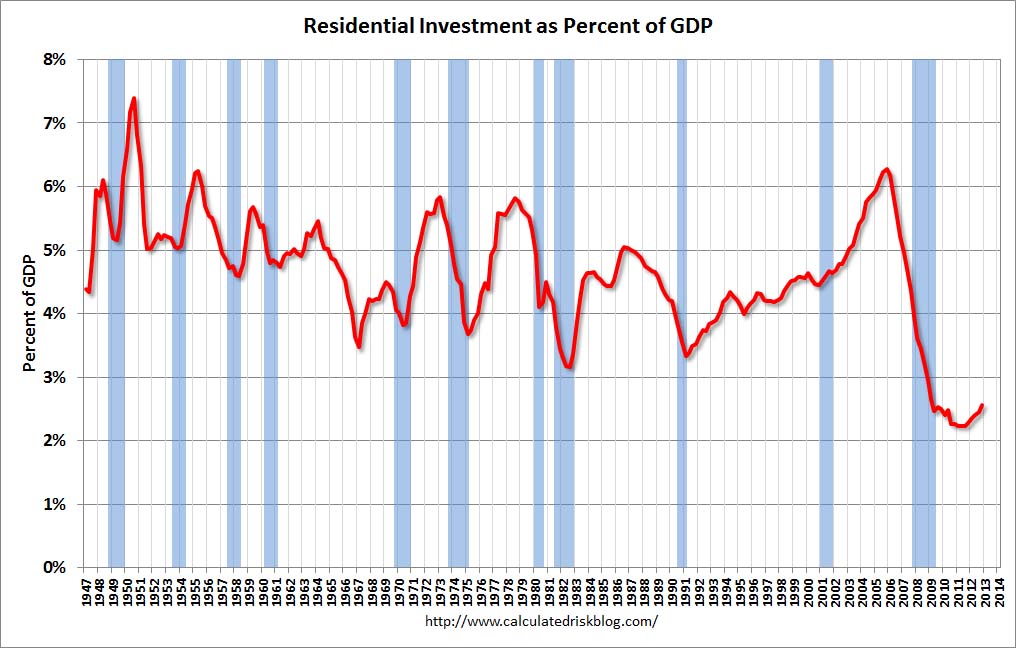

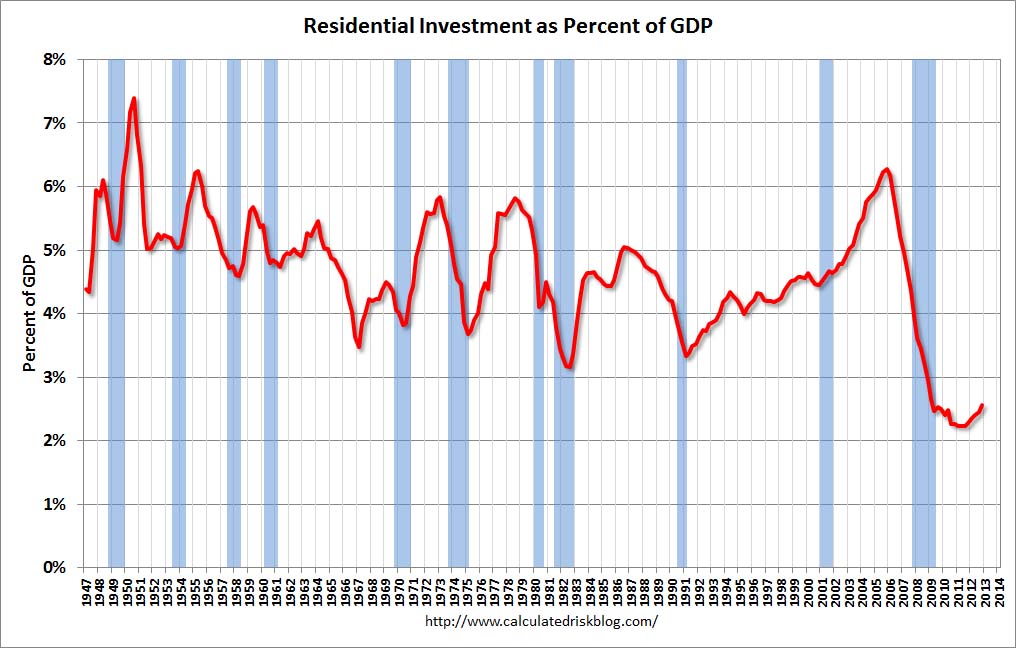

Residential InvestmentResidential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

In 2011, the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

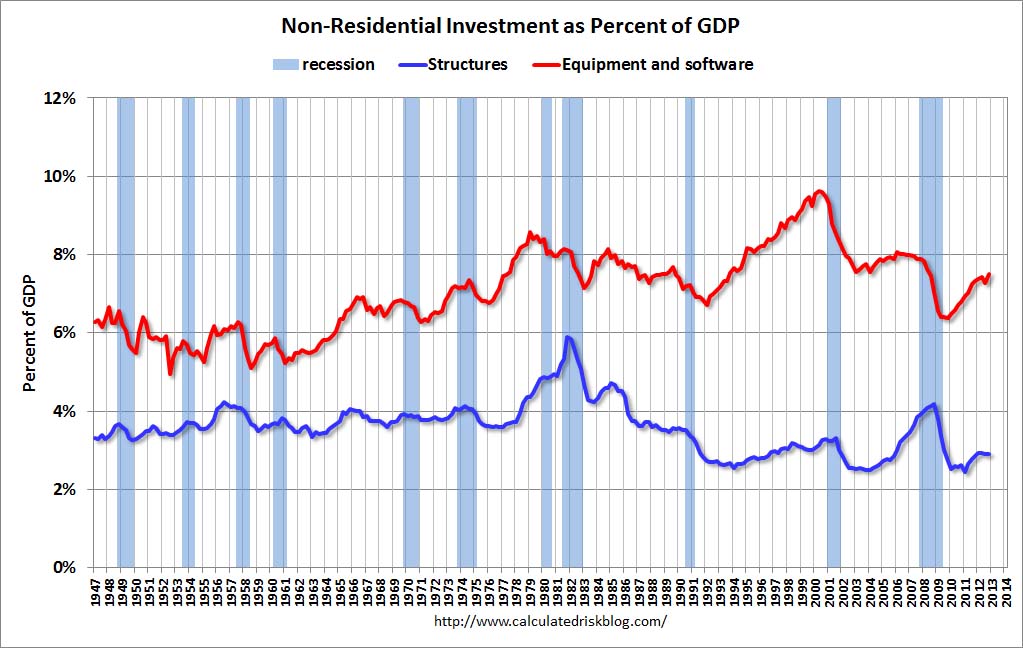

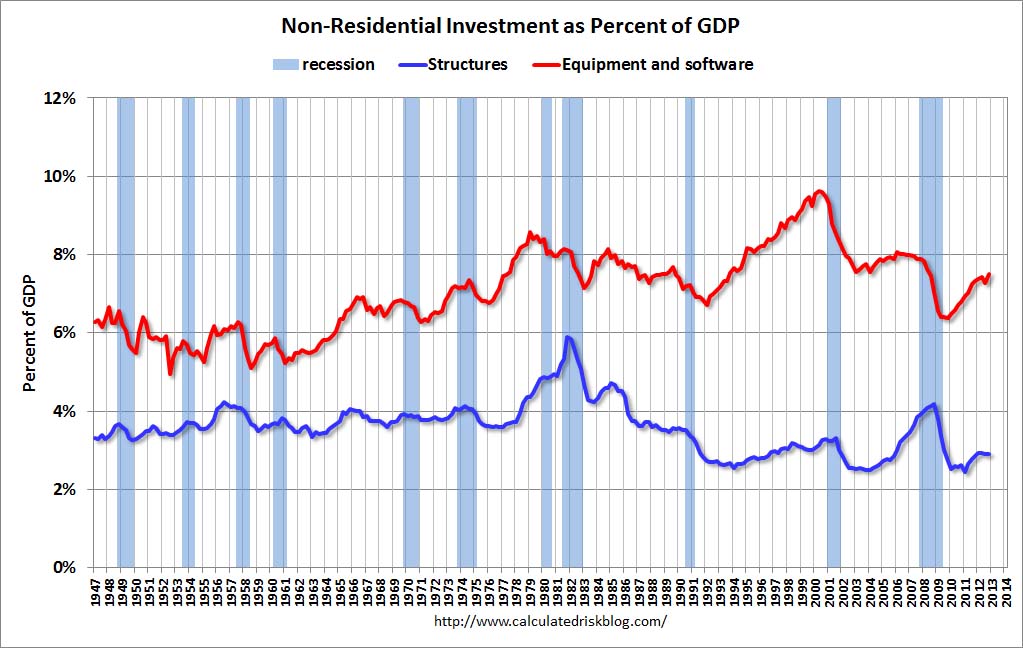

non-Residential InvestmentThe last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US). Read more at http://www.calculatedriskblog.com/2013/01/comments-on-q4-gdp-and-investment.html#LhjyTdEY0uTz9myF.99

94

posted on

01/30/2013 11:22:08 AM PST

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Wyatt's Torch

Thanks for posting those insightful analyses, WT! Conservatives shouldn't fall into the trap of mirroring the lib psychosis that portrays every event as a negative that's the current president's fault whenever said president is one of "the other guys."

95

posted on

01/30/2013 11:33:17 AM PST

by

JustSayNoToNannies

("The Lord has removed His judgments against you" - Zep. 3:15)

To: Cringing Negativism Network

What “them”? Which industry? Which jobs?

96

posted on

01/30/2013 6:23:48 PM PST

by

Fledermaus

(I'm done with the GOP. Let them wither and die. Let's start over.)

To: kabar

And how do you propose to bring back American industry NOW?

Annihilation of a few Unions would be a good start. Getting rid of the EPA, OSHA, DOT, and the rest of Obumbles Alphabet soup would also be a huge help.

Or if you like finance solutions you could repeal Dod Frank and let business finance projects again.

Considering all the regulations and laws stacked against American industry I'm surprised we do as well as we do in this country.

97

posted on

01/30/2013 7:18:29 PM PST

by

Idaho_Cowboy

(Ride for the Brand. Joshua 24:15)

To: Perdogg

It’s cue the MSM and the Dems think the recession ended. Ask anyone looking for work, any sort of work how that is going.

98

posted on

01/30/2013 8:54:25 PM PST

by

matt04

To: exit82b

“This is terrible, we need to print money faster to keep up with demand!!”

Wait a minute. You’ve given me an idea. Why not mint a bunch of trillion dollar coins and give everyone in the U.S. one? Then everyone would be rich and no one would ever have to work again.

99

posted on

01/30/2013 9:00:58 PM PST

by

catnipman

(Cat Nipman: Vote Republican in 2012 and only be called racist one more time!)

To: Idaho_Cowboy

Annihilation of a few Unions would be a good start. Getting rid of the EPA, OSHA, DOT, and the rest of Obumbles Alphabet soup would also be a huge help. Or if you like finance solutions you could repeal Dod Frank and let business finance projects again.

So Obama in the WH and the Dems controlling the Senate will approve all of the above? Let's be realistic. The poster wanted our businesses to come back NOW.

100

posted on

01/30/2013 9:27:15 PM PST

by

kabar

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-112 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson