Posted on 03/18/2013 7:54:11 AM PDT by Kaslin

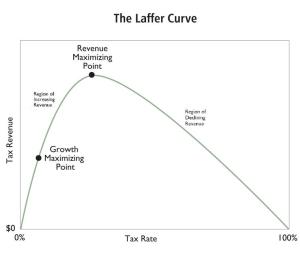

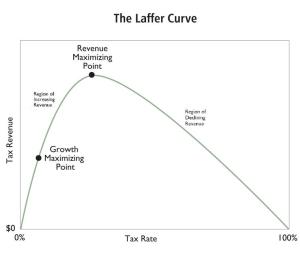

Regular readers know that I’m a big advocate of the Laffer Curve, which is the common-sense notion that higher tax rates will cause people to change their behavior in ways that reduce taxable income.

But that doesn’t mean “all tax cuts pay for themselves.” Yes, that happened when Reagan lowered tax rates on the “rich” in the 1980s, but there are also tax cuts that generate little or no revenue feedback.

The key thing to understand is that revenue feedback is driven by the degree to which a tax cut leads to more taxable income. And you tend to get bigger changes in taxable income when you lower rates on taxpayers who have considerable control over the timing, level, and composition of their income.

Who are those taxpayers?

Most of us don’t fall in that category. Cutting my tax rate, for instance, probably won’t have much impact on taxable income. My salary from Cato is already established, so there’s not much opportunity for a “supply-side” effect. Every so often I can earn some extra money by writing an article or giving a speech, but (unfortunately!) not enough for it to make a difference even if my incentives are altered.

But investors, entrepreneurs, corporate managers, and small business owners are among those who do have considerable flexibility to respond when incentives change.

Consider this new research from the Tax Foundation, which finds big “supply-side” responses from a lower corporate tax rate. Let’s start with their description of the problem.

The United States currently imposes the highest statutory corporate tax rate in the developed world. …the steep rate discourages U.S. companies from investing as much as they would otherwise and reduces their competitiveness in international markets. …A major barrier to cutting the U.S. corporate tax rate, however, is the reported revenue cost. According to conventional revenue analyses, such as those performed by Congress’s Joint Committee on Taxation (JCT), a lower corporate tax rate would be an expensive revenue loser.

The Tax Foundation then explains why the current revenue-estimating system is misguided.

In reality, the trade-off posited by conventional revenue estimates is misleading. The estimates overstate the revenue cost of cutting the corporate rate and overstate the potential revenue gains from increasing it, because they ignore tax-induced growth effects. Most notably, Congress’s JCT has adopted the static assumption that tax changes have absolutely no impact, for good or ill, on total production, employment, investment, consumption, and other macroeconomic aggregates. …The static assumption has the advantage of simplicity, and it is not too far from the truth for tax changes that either have little impact on incentives at the margin or affect parameters that do not respond much to incentives. This is an extremely unrealistic assumption, however, in the case of the corporate income tax rate.

Bingo. You can click here for more information on why the Joint Committee on Taxation is wrong, and you may be interested to know that fewer than 15 percent of CPAs agree with the JCT’s assumptions.

Using more realistic assumptions, the Tax Foundation calculates the real-world impact of a lower corporate tax rate.

The Tax Foundation’s dynamic simulation model provides quantitative estimates of the growth and revenue effects. The model estimates, for example, that cutting the federal corporate tax rate from 35 percent to 25 percent would raise GDP by 2.2 percent, increase the private-business capital stock by 6.2 percent, boost wages and hours of work by 1.9 percent and 0.3 percent, respectively, and increase total federal revenues by 0.8 percent.

Indeed, they look at a wide range of options and show us “static” estimates based on JCT-type methodology and “dynamic” estimates based on a model that includes changes in taxable income.

One very important point is that the Tax Foundation looks at the impact of a lower corporate tax rate on all forms of tax revenue.

Federal receipts include many taxes, fees, and payments other than the corporate income tax, such as the personal income tax, payroll taxes, and excises. The size of the economy strongly influences the amounts these taxes, fees, and other payments collect. This is relevant because of the corporate income tax’s big GDP effects. A wide range of federal receipts will expand when a lower corporate income tax rate grows the economy but shrink when a higher corporate income tax downsizes the economic pie.

The study then mentions that the revenue-maximizing corporate tax rate is 14 percent, but warns that this doesn’t mean policy makers should make that their goal.

Although a corporate rate of 14 percent would maximize federal receipts, counting all types of federal revenue, it would not be the optimal rate for the economy unless very little value is placed on people’s incomes and the quantities of goods and services they can consume or invest. The model estimates that while cutting the corporate rate from the revenue-maximizing rate of 14 percent to zero would cost $9 billion of federal revenue, GDP would rise by roughly $300 billion, a payoff of about 33 to 1.

Amen to that point. Our goal isn’t to maximize revenue for the clowns in Washington. The ideal point on the Laffer Curve is where you maximize growth.

If you want my two cents on the topic, you maximize growth when you raise the revenue needed to finance the legitimate functions of government – and that requires a lots less revenue than we’re collecting now according to scholarly evidence on the “Rahn Curve.”

Finally, the Tax Foundation research points out that there’s a difference between the short-run revenue-maximizing rate and the long-run revenue-maximizing rate.

The federal corporate income tax is unusual because the feedbacks there are so strong that cutting the tax’s rate would, over a broad range, more than pay for itself in terms of federal revenues, with the bonus of lifting the incomes and productivity of people throughout the economy. Nevertheless, a corporate rate cut would reduce federal revenues during a transition period, because the rate cut would begin immediately, while it would take several years for the capital stock to expand sufficiently in response to the new incentives to generate the growth needed to return revenues to their prior level.

This chart illustrates this point, using the example of a 25 percent rate.

In other words, the goal of good policy should be to improve the economy’s long-run performance. Over time, that results in more taxable income – a point that even the Congressional Budget Office acknowledges.

The one partial exception to this relationship between good tax policy and long-run tax revenue is the capital gains tax. Lowering that levy can cause big changes to short-run revenue because investors have complete control over when to sell assets. But the reason to lower – or ideally eliminate – that tax is to boost long-run prosperity.

So why aren’t policy makers embracing a lower corporate tax rate? On the right, there should be lots of support because of hostility to high tax rates. And on the left, there should be lots of support because of a desire for more tax revenue. Seems like a match made in Heaven.

But that assumes that folks on the left are motivated by a desire to maximize tax revenue. If you want to know the biggest obstacle to sensible tax policy, pay close attention beginning at the 4:34 mark of this video.

It’s not about revenue. It’s about fairness. Besides, reduced revenue is useful. Just more proof the rich aren’t paying enough. Wash, rinse, repeat.

He would prefer less tax revenue.

Easier to collapse stuff. This is why he is into just spending money in a flailing like manner. Any resulting crisis, he’d be happy to fix. In his way.

Ya’ butt! Doncha’ know that wealth trickles up . . . not down? Obambi already said that! Why would you give the evil business owners a tax break? You just know that the companies will take all that extra money and bury it out behind their parking lots.

ah, but the tax code, as obama famously said during a democrat primary debate, is about “fairness”; it’s not “fair” that wealth accumulate in any person or organization . . . unless it’s a labor union, a big dem donor, or a hollywood celebrity.

Any money raised by taxes will be spent, and then some.

No one ever asks, “How much is enough ?”

Burning down the home of a rich or middle class person won't provide a home to the homeless, but it will help make them even.

The tax on American workers has increased non stop for decades.

If the government wants more money they need to contact the people THEY hired so long ago to take my money from me all these years... THAT’S where the money IS!!

I don’t have any more money and if “O” can’t fine what has ALREADY been stolen from me under the guise of ‘taxation’...TOO BAD!!!

Obama will derive far more revenue via the printing press than he could ever derive from adjusting tax rates. The ONLY thing that concerns Obama at this point is his ability to monetize more debt. If Republicans would ever wake up to this fact and put an end to raising the debt ceiling, Obama’s ability to destroy this country would be significantly curtailed.

0bama wants more votes, not more tax revenue or problems solved.

Tax Increases on the “rich” get Democrats more votes.

Humanity has ENVY.

Democrats just leverage one of the seven deadly sins for votes.

Get over it.

It’s all about revenue alright take from the haves and give to the have nots.To the have nots he looks like Robin Hooh and to the worker bees he’s just another hood.

Everyone on the same income level Karl Marx smiles.

Oh, just go down the commandments in reverse order and you’ll see how the left is in diametric opposition to every one of them.

Amen. At this tax rate any increase will drive revenue DOWN.

What surprises me, nobody including everyone on our side, seems to be aware of this fact.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.