.png)

Posted on 05/16/2013 5:24:36 AM PDT by thackney

EOG Resources, the company with the most acreage in the Eagle Ford Shale, reported its first-quarter earnings recently. And basically, EOG is making a lot of money in South Texas.

Mark Papa, CEO and board chairman of EOG, said the Eagle Ford continues to surprise “in an upside manner.”

EOG’s U.S. crude oil production increased 24,200 barrels per day over the fourth quarter of 2012, mostly thanks to the Eagle Ford.

The company is getting a rate of return on its South Texas wells greater than 100 percent.

During the first three months of the year, EOG completed 27 “monster wells” with initial production rates higher than 2,500 barrels of oil per day. Nine of those wells started production higher than 3,500 barrels of oil per day.

“To summarize the Eagle Ford, this asset has the best large play economics in North America, and continues to provide upside production surprises,” Papa said.

EOG plans to drill 425 Eagle Ford wells this year, and while it plans wells across its acreage, it says its best property is in Gonzales County. A recent investor presentation said the company has 12 years of drilling.

Papa said the Eagle Ford (which is “steaming ahead”) and North Dakota and Montana’s Bakken Shale will be the major drivers of growing domestic crude oil production.

But he’s not concerned that the U.S. shale fields will overproduce, driving down crude oil prices.

“We think there’s only really two major driving forces of U.S. oil growth: Bakken and Eagle Ford,” Papa said. “Eagle Ford is going to surpass the Bakken likely this year as the biggest oil growth rate. Bakken is slowing down. Permian is really not on that fast of a track. And then there’s what I would classify as all others. And the all others are not growing at a very fast pace at all.

“So we’re not as concerned as others that U.S. oil growth is going to flood the total market and ruin global oil prices.”

And why is EOG getting such good results in the Eagle Ford?

Papa’s lips are sealed about what he called a “secret sauce” in its hydraulic fracturing operations.

EOG is shipping most of its crude to its terminal in St. James, La., where it fetches a better price than West Texas Intermediate. EOG got prices about $12.23 per barrel higher than WTI in the first quarter and expects a $9.25 premium in the second quarter.

You can read a transcript of EOG’s call with analysts here on SeekingAlpha.

“So we’re not as concerned as others that U.S. oil growth is going to flood the total market and ruin global oil prices.”

“EOG is shipping most of its crude to its terminal in St. James, La., where it fetches a better price than West Texas Intermediate. EOG got prices about $12.23 per barrel higher than WTI in the first quarter and expects a $9.25 premium in the second quarter.”

I note that as of late the difference in WTI and Brent is shrinking. Being here in Oklahoma I am stuck the WTI price and actually the price I get at the wellhead is a couple bucks below the futures price.

I assume the price they are getting at the La terminal is based on Brent price.

Mostly, the coast doesn’t have the pipeline bottlenecks of Cushing, OK.

Boy those 2500 barrel a day wells will pay back quickly even at the high cost of horizontal drilling and stage fracking. Wells like that existed only in my dreams when I was actively investing in drilling. Of course the cost to even own a small working interest is way out of my league.

I only hope the price stays decent so I can struggle along with my interests in stripper wells.

.png)

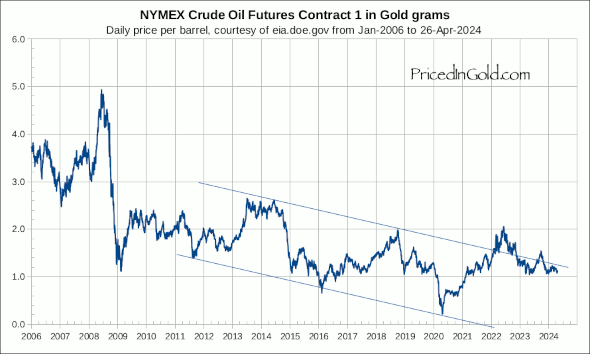

The higher price of oil is more related to the position of the dollar against other currencies than supply and demand.

Yes, I am pretty well aware of the typical production and decline rates in the Bakken as one of the brothers that owned Brigham Oil before they sold out is a friend of mine. I am sure that the monster wells that EOG found are an exception. They must have found a sweet spot.

If the Eagleford as I understand it does not have the equivalent of dolomite streak. If it has a very high levelof natural fracturing I would have guessed that the oil would have been producible without the monster frac jobs and long laterals [or perhaps the oil would have migrated out of the source rock altogether.] Any insights into what makes the Eagleford so productive ... and the bigger question are all thick oil bearing shales [e.g. the Woodford] going to at some time be very productive? Thanks. GJ

Keep in mind the article described these as monster wells, not “typical” Eagle Ford wells. The exception, not the rule.

“and the bigger question are all thick oil bearing shales [e.g. the Woodford] going to at some time be very productive? “

So far, at least here in Oklahoma the Woodford has been mostly gas. Dry gas in the SE part of the state and wet gas with a limited amount of oil in the west central part of the state.

Still makes a lot of sense that gas and light fractions would predominate because of permeability issues.

GJ

I am not aware of much activity in that area, but you can search using legal discription for intents and completion reports for sections around your properties here.

http://imaging.occeweb.com/imaging/OGWellRecords.aspx

Most of the current Woodford activity is in Canadian, Blaine and Grady counties for gas with heavy liquid content. I was lucky enough to have an override in a nice well recently completed by Devon in Canadian county.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.