Ignorance is no excuse.

Prosecute Holder and The Liar in Chief

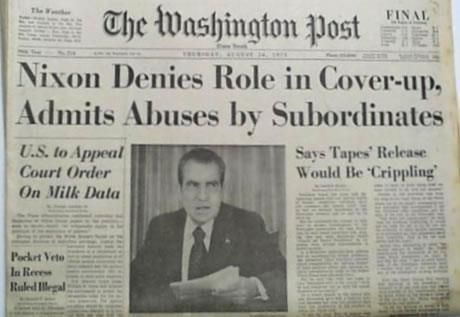

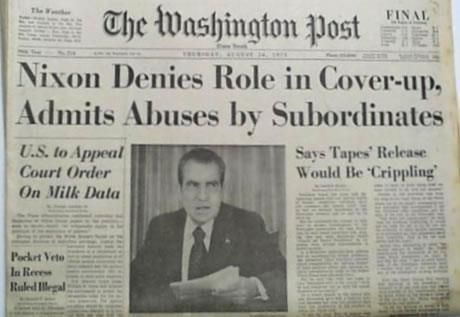

Oh, he's blaming it on his subordinates and feigning ignorance... okay...

Posted on 05/27/2013 7:20:22 AM PDT by SeekAndFind

The news of the past week has rightly been dominated by allegations of abuse in the Exempt Office (EO) of the Internal Revenue Service. The EO is in charge of processing applications for tax-exempt status under Section 501(c)(4) of the Internal Revenue Code, which authorizes these exemptions for “civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare.” Some 3,357 applications for tax-exempt status were filed in 2012, an election year, which was a 50 percent increase from the 2,265 applications filed in w 2011.

The criteria for Section 501(c)(4) organizations are open-ended. Few complex organizations are ever operated “exclusively” for any single purpose, and the many applicants have rather different definitions of what counts as “social welfare.” The deadly combination of loose standards and applications in the thousands empowers the EO to decide which applications sail through, and which are mired in delay.

The May 14 report of the Treasury Inspector General for Tax Administration’s (IG) explicitly stated that the EO’s actions were “not politically biased,” but were attributable solely to the confusions of lower staff members, who somehow for nearly three years never quite understood their jobs assignments. Don’t believe a word of that whitewash. All the nitpicking questions and pointless delays, such as those experienced by the Ohio Tea Party, were calibrated to hold off the approval of these applications until after the November 2012 presidential election.

The Larger Lesson

The dismal performance of the IRS is but a symptom of a much larger disease which has taken root in the charters of many of the major administrative agencies in the United States today: the permit power. Private individuals are not allowed to engage in certain activities or to claim certain benefits without the approval of some major government agency. The standards for approval are nebulous at best, which makes it hard for any outside reviewer to overturn the agency’s decision on a particular application.

That power also gives the agency discretion to drag out its review, since few individuals or groups are foolhardy enough to jump the gun and set up shop without obtaining the necessary approvals first. It takes literally a few minutes for a skilled government administrator to demand information that costs millions of dollars to collect and that can tie up a project for years. That delay becomes even longer for projects that need approval from multiple agencies at the federal or state level, or both.

The beauty of all of this (for the government) is that there is no effective legal remedy. Any lawsuit that protests the improper government delay only delays the matter more. Worse still, it also invites that agency (and other agencies with which it has good relations) to slow down the clock on any other applications that the same party brings to the table. Faced with this unappetizing scenario, most sophisticated applicants prefer quiet diplomacy to frontal assault, especially if their solid connections or campaign contributions might expedite the application process. Every eager applicant may also be stymied by astute competitors intent on slowing the approval process down, in order to protect their own financial profits. So more quiet diplomacy leads to further social waste.

One reason the administrative process gets so bogged down is the grandiose standards the agencies employ. The FDA’s mission statement provides one example: “The FDA is responsible for protecting the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, our nation’s food supply, cosmetics, and products that emit radiation.”

What is left unstated is how the FDA determines “the safety, efficacy, and security” of the huge list of products whose use it oversees. Clearly, absolute “safety, efficacy, and security” are unattainable, so it falls to the FDA to turn differences in kind into differences of degree. For example, just how safe is safe enough when all “safe” drugs have deadly side effects for which some FDA warnings are appropriate? The ambiguity in these key areas lets the FDA ask companies for additional trials in a two-page letter, often needlessly tacking on years to any particular application.

Similarly, “The mission of the California Environmental Protection Agency (Cal/EPA) is to restore, protect, and enhance the environment, to ensure public health, environmental quality, and economic vitality.” Once again, such a grand vision does not answer any of the hard decisions that an agency faces when the scarcity of social resources precludes perfect restoration, complete protection, and vigorous enhancement of the environment. But the mission statement does permit the agency to slow down growth, often for years, and never with compensation for the aggrieved owner.

The Federal Communications Commission is no better. It issues and reviews broadcast licenses by asking whether an application promotes the “public interest, convenience, and necessity.” This formless standard often allows the FCC to do largely what it wants. The short duration of these licenses inspire all sorts of objections at renewal time. And the want of outright ownership allows the FCC to impose a host of technical conditions that can impair the overall efficiency of spectrum use.

One Disease, Many Cures

These three mission statements share a common feature with the tax-exemptions in the IRS: They use broad mandates that foster administrative discretion and delay, both of which pose a threat to the rule of law. Even though the disease is the same in all cases, the cure surely is not. Here is a quick primer on what ought to be done in these different settings.

501(C)(4) Organizations — The IRS’s 501(c)(4) standard, “operated exclusively for the promotion of social welfare,” is an open invitation for disaster. It should be scrapped entirely. That would leave in place Section 501(c)(3), which already covers a long list of organizations that are “operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, to foster national or international amateur sports competition, to promote the arts, or for the prevention of cruelty to children or animals.” In 2012, over 66,000 organizations sought tax-exempt status under this subsection. If these organizations don’t promote the “social welfare,” then just why do they receive this preferred tax treatment? Scrapping 501(c)(4) exemptions should make it harder for all political organizations of whatever persuasion to find relief at the IRS.

The Food and Drug Administration — Turning next to the FDA, it is critical to strip it of most of its approval power. Right now, FDA approval involves three stages of clinical trials. Stage one clinical trials are small size affairs, intended to test whether a drug has serious adverse safety consequences that make it unfit for human use. Stage two and stage three trials are progressively far more elaborate productions intended to test for both safety and effectiveness before letting a drug on the market. Little time and money is spent on stage one trials. Stage two trials cost substantial sums. Stage three trials can cost thousands of lives, millions of dollars, and many years.

The best strategy to keep the FDA under control is to block it from banning a drug simply because the drug has not passed stage two or three trials. The removal of FDA oversight will allow these drugs to reach the market more quickly. People who are sick can then decide with the aid of their physicians and healthcare organizations whether to take these drugs in light of the other alternatives available to them. In so doing, they need not fly blind because many independent professional organizations right now do a far better job of evaluating drug efficacy by looking at off-label and overseas usage of drugs.

Liberalize the rules, and experimental treatments will not fall in the exclusive province of the rich and the well-connected (if indeed they are available to anyone at all). The drug companies and the patients can decide by contract how best to allocate the risk of adverse consequences. Clinical trials will not disappear, but they will be directed at satisfying potential customers, including health plan operators, and not FDA officials. There will be some losses from premature use, but far fewer losses from unconscionable delay, and far lower prices that will allow for greater access.

Environmental Protection — Endless environmental permits far too often stand in the path of sensible development. These permits require comprehensive evaluation of all potential future adverse effects, no matter how small or improbable, that might follow from the construction of a new plant or facility. Yet the parade of horribles rarely comes to pass.

This exhaustive preclearance stands in stark contrast to the private law rules that were developed in connection with just these environmental risks, and provide a clear solution to the problem: Allow the activity to proceed naturally as the market would dictate, but then draw a real red line in the sand once there is evidence that a plant or facility poses actual or imminent peril of serious harm. Then, but only then, lower the boom.

First, make them responsible for any harm caused, no excuses allowed. Second, shut the facility down immediately at the insistence of either the government or private party until the peril is corrected. Keeping that tough standard means that businesses with millions at stake in their new operations will steer clear of doubtful zones. New facilities will get online more rapidly, allowing dangerous older equipment, which is often grandfathered in under current laws, to be removed from operations more quickly. Killing the permit culture will reduce the opportunities for that deadly duo of discretion and delay.

FCC Licenses — The FCC has an inordinate and wholly unnecessary power to issue, renew, and revoke licenses to the airwaves. Their key task should be to make sure that operations taking place on one frequency do not interfere with the transmission of signals on other frequencies. Those observable events are easily remedied with the same combination of damages and injunctions available in environmental cases.

The FCC should arrange to sell off frequencies to private owners to use, develop, and sell like any other resource. That process has already allowed the government to pocket a fair piece of change in dealing with many broadband licenses. It could also rationalize and improve the operation of the broadcast licenses for radio, television, and other consumer services at a fraction of the price it now takes to run the current system. As Friedrich Hayek noted long ago in The Road to Serfdom, the function of government is to organize the traffic flow, not to determine the composition of the traffic.

The scandal at the IRS teaches a larger lesson for the overall operation of the administrative state. The best way to control the twin risks of discretion and delay is to strip administrative agencies of as much of their discretionary power as is humanly possible. Each area has its own twists, and some discretion on enforcement issues will always remain. But the larger goal should be clear: an efficient administrative state that does not incentivize discretionary bureaucratic delay. The time to start on major reform efforts is now. Here is one crisis that should not go to waste.

__________________________________________________________________________________________________________________________________________________________________________

Richard A. Epstein, the Peter and Kirsten Bedford Senior Fellow at the Hoover Institution, is the Laurence A. Tisch Professor of Law, New York University Law School, and a senior lecturer at the University of Chicago.

Ping

Abolish it. Completely, totally, drive a stake through its heart and kill it.

Replace the entire tax code with a new tax code that takes one page or less to explain. Make it so EVERYONE pays, period. No outs, no exceptions, no exemptions.

Whether it's the "fair tax" a flat tax, national sales tax - I don't care. As long as EVERYONE pays, the bill is one page or less, and it completely eliminates the IRS in every way.

That's the only way IMO to solve this problem.

The problem is the 16 amendment! The income tax is a means of enforcing tyranny! Get rid of the income tax and most of these problems go away and the jack booted thugs of the IRS disappear into History hopefully never to be repeated.

Fair Tax yes, flat tax no. Flat tax is what our current tax started as. Fair tax puts the power of taxation back in the hands of the People, where a “volutary” tax belongs. It incentivizes the Federal Government to really truly get out of the way of the economy. The more they muck it up, the lower the tax revenue, so if they want to increase revenue, there has to be real jobs being created, not government jobs.

It’ll require a Constitutional Amendment shoved upon the FedGov against their will from the States. It will have to remove the 16th, and if we’re wise, we’ll include language limiting the percentage right in the amendment, AND language limiting the Federal spending to specific Constitutional items.

Prosecute Holder and The Liar in Chief

Oh, he's blaming it on his subordinates and feigning ignorance... okay...

RE: The problem is the 16 amendment!

Well, there ya go. It is going to be VERY DIFFICULT to repeal that given that it is a hundred years old and we’ve all gotten use to it.

Couple that with the fact that you need to pass both houses to have it repealed and it has to go to a national referendum and you see the steep mountain we’ll have to climb.

And finally, you have the 47% who pay no taxes to contend with. They’er NOT going to vote to repeal it when they can live with other people’s money.

That the IRS even exists is a scandal. The Federal government should never have been granted the authority to levy taxes upon the individual or upon corporations doing business in the United States based on “wages” or “profits” alone.

All taxes are, in the end, consumption taxes, borne by the ultimate consumer. Putting a tax on the retail value of goods and/or services is the most direct way of raising revenue, and the retailer is the tax collector.

But not a VAT or a carbon tax, please

Thanks for you post. I have to admit, I'm not "up to speed" on the implications of the various alternative tax solutions. So allow me to clarify my position briefly:

First, the current IRS Tax Code AND the IRS as the enforcement agency for it must be abolished. Period. Kill the beast.

Second, any replacement for the current tax code must fit on one page and everyone ... and I mean EVERYONE pays taxes. None of this "EITC" crap re-distributing wealth to people who don't pay taxes in the first place.

Either each and every one of us has "skin in the game" going forward or inevitably we'll end up right back where we are today. That's not acceptable in my view.

I'll have to read up more on the Fair Tax -- if it meets the second criteria above, I'll be all for it.

Thanks again for your post, I'm off to read up more on the Fair Tax.

I will say, I’m not a big fan of the rates I’ve read regarding the Fair Tax, like 20-ish percent tax. I’ve seen as high as 22 % and I think it’s all WAY too much. I think it’s all based on the idea of maintaining current spending levels. If we restrict the spending to Constitutionally mandated and approved items, there wouldn’t be a need for such an ocean of cash rolling into the treasury.

In fact, the government, needing to stay out of the way as much as possible to GET tax revenue, should get smaller, and I think the tax rate should be no higher than 10% ever. Maybe 5%. If they whine, that means they’ve had their hands in the cookie jar too long.

I’m also not sure about the prebate tax thing. Giving everyone enough to cover the tax on living expense to make sure we don’t hurt the poor... seems circular. I have to think that through some more. But if I’m right about the level of taxation needed, the poor really won’t be hurt much, and the prebate may not be necessary at all. I don’t know.

Epstein is a frequent guest on the John Batchelor show. The dude can TALK. He is a college lecturer so I suppose it stands to reason but it’s impressive to hear complex thoughts flawlessly delivered. Recently he did an epic takedown on BenitObama’s SOTU suggestion to increase the federal minimum wage. A classic.

Personally I think every dime in taxes I pay is way too much.

Having said that, I'm at 39.6% on Federal taxes already. 22% for me would be a pretty dramatic reduction in my taxes.

Now, add the additional 3.5% I pay in Illinois, and another $8,500 in real estate taxes (schools, roads, etc..) here in Illinois and I'm paying just under $60k/yr. in taxes. I don't have a home mortgage deduction (house is paid for ...) and I "make too much" according to the IRS to be able to deduct my kids. Go figure, they're not the "tax breaks" they're supposed to be after all.

I DO NOT MAKE $250k. In fact, FAR LESS. I don't even make $200k. My wife doesn't work. I'm the sole bread-winner. I have one son going off to college in the next year, and another son in three years.

They're not into sports, and they don't qualify for any "assistance" because I (get this ... ) "make too much money."

Having just under $60,000 stolen from me every year by the State and Federal Governments sure doesn't make me fee like I "make too much money."

Given I'm paying 39.6% to the feds now, 22% for me is a tax cut - and I'll take it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.