Skip to comments.

The Inflation Predictions Were Just Wrong, And Now They're Hurting People

TBI - Pragmatic Capitalism ^

| 6-22-2013

| Cullen Roche, Pragmatic Capitalism

Posted on 06/22/2013 1:25:44 AM PDT by blam

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-154 next last

To: CodeToad

"Who in the world told you THAT?? Money is a storage of labor as we are paid for our labors with it. When money is devalued it devalues our labor, our lives. It is theft."Any introductory text to MacroEconomics should cover that.

You may want money to be a long term store of value. But most people want currency to facilitate transactions. I certainly would have a slowly depreciating dollar that avoids deflationary depressions than to have a dollar that was linked to some commodity like Gold or Silver that was subject to manipulation by the likes of Soros and ilk and which would cause depressions every 20 years like we saw in the 1800's.

If you want a long term store of value put your currency into real assets. Real estate, precious metals, etc. Or invest it into stocks, bonds or other financial instruments that pay a return.

101

posted on

06/23/2013 11:09:57 PM PDT

by

DannyTN

To: muir_redwoods

You're right about one thing, your post was a fail.

Be sure to come back with your real definition of inflation.

102

posted on

06/24/2013 6:35:26 AM PDT

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: DannyTN

“You may want money to be a long term store of value. But most people want currency to facilitate transactions. ...Or invest it into stocks, bonds or other financial instruments that pay a return.”

Wouldn’t need a return if the markets were not manipulated by the fed. There is this thing called “savings”. You should look it up. Most people like savings and not spend hand to mouth or expect to have to be experts in investing in order to keep what they have earned.

103

posted on

06/24/2013 6:42:55 AM PDT

by

CodeToad

(Liberals are bloodsucking ticks. We need to light the matchstick to burn them off. -786 +969)

To: DrewsMum

I see you are a sexist. I have no clue if someone is a woman. How stupid of you to have said that.

104

posted on

06/24/2013 6:43:37 AM PDT

by

CodeToad

(Liberals are bloodsucking ticks. We need to light the matchstick to burn them off. -786 +969)

To: Toddsterpatriot

Inflation is simply too many dollars chasing too few goods. It also, apparently is what happened to your ego and sense of self-importance.

105

posted on

06/24/2013 9:38:08 AM PDT

by

muir_redwoods

(Don't fire until you see the blue of their helmets)

To: muir_redwoods

Inflation is simply too many dollars chasing too few goods Food and fuel are goods.

Thanks, you're funny.

106

posted on

06/24/2013 10:05:05 AM PDT

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: CodeToad

"Wouldn’t need a return if the markets were not manipulated by the fed. There is this thing called “savings”. You should look it up. Most people like savings and not spend hand to mouth or expect to have to be experts in investing in order to keep what they have earned."If it wasn't for manipulation by the FED, we'd have deflationary depressions every 20 years, just like we had in the 1800's on the gold standard.

Sure if we were linked to a gold standard, you could hold dollars and while the purchasing value of those dollars might swing up or down 20% year to year, but over 100 years, the purchasing value would probably be much higher since enough gold isn't produced to keep up with the supply of goods. But then because of the recurring deflationary depressions you wouldn't have earned as many dollars and probably would have lost the ones you did earn.

In fact if the whole world adopted the golds standard, we'd only have less than 1 oz of gold per person. There's only been a total of 171,000 tons of gold mined in all the world. That equates to 342,000,000 lbs or 5,472,000,000 oz of gold. With over 7 billion people in the world that's just about 2/3 oz per person.

The fact is that gold based deflation is bad for the economy. Gold is subject to manipulation by the Soros's of the world. If you can hold dollars and increase your purchasing power why invest, why take risk? Deflation is horrible for capital markets.

The bankers understand this. Fortunately most of the politicians with the exception of Ron Paul and a few other kooks do too.

So you are just going to have to deal with it. We'll never go back to a gold standard and we'd be stupid if we did. And we'd abandon it quickly for all of the reasons we abandoned it before.

107

posted on

06/24/2013 10:43:49 AM PDT

by

DannyTN

To: DannyTN

“we’d have deflationary depressions every 20 years, just like we had in the 1800’s on the gold standard. “

Those were also caused by government manipulations. Banking and stock market manipulations happened long before the Federal Reserve was created.

108

posted on

06/24/2013 10:52:59 AM PDT

by

CodeToad

(Liberals are bloodsucking ticks. We need to light the matchstick to burn them off. -786 +969)

To: CodeToad

"Those were also caused by government manipulations. Banking and stock market manipulations happened long before the Federal Reserve was created."Okay, I'm not sure what you are referring to unless it's just money supply flucations caused by the extension of credit. Money is created anytime lending occurs anywhere. So unless you want us to adopt a Muslim economic model where lending is completely forbidden, then I really don't know where you are going with this.

You've basically just admitted Banking and Stock Market manipulations occurred without the FED and prior to the FED, but you want to get rid of the FED because of the manipulations????

109

posted on

06/24/2013 11:15:42 AM PDT

by

DannyTN

To: CodeToad

The fact remains prior to the FED, deflationary depressions every 20 years.

After the FED, 2 in the first 15 years and none in the past 80 years.

Seems to me, things are much better with the FED than without.

110

posted on

06/24/2013 11:17:26 AM PDT

by

DannyTN

To: Toddsterpatriot

That’s been my point from the beginning, sorry you joined us late. Any accurate description of inflation has to include food and fuel. The Commerse Department specifically excludes them as they are considered too volatile. The point I have been consistently making from the start of this conversation is the the government purposely understates the inflation rate.

111

posted on

06/24/2013 1:10:48 PM PDT

by

muir_redwoods

(Don't fire until you see the blue of their helmets)

To: muir_redwoods

Has the BLS removed food or energy prices in its official measure of inflation? No. The BLS publishes thousands of CPI indexes each month, including the headline All Items CPI for All Urban Consumers (CPI-U) and the CPI-U for All Items Less Food and Energy. The latter series, widely referred to as the "core" CPI, is closely watched by many economic analysts and policymakers under the belief that food and energy prices are volatile and are subject to price shocks that cannot be damped through monetary policy. However, all consumer goods and services, including food and energy, are represented in the headline CPI.

Most importantly, none of the prominent legislated uses of the CPI excludes food and energy. Social security and federal retirement benefits are updated each year for inflation by the All Items CPI for Urban Wage Earners and Clerical Workers (CPI-W). Individual income tax parameters and Treasury Inflation-Protected Securities (TIPS) returns are based on the All Items CPI-U.

I'll remind you of the above post of mine.

Any accurate description of inflation has to include food and fuel.

That's what my BLS post says. The one you started arguing with. Glad you realized your error.

The Commerse Department specifically excludes them

The Commerce Department doesn't calculate the indexes, the BLS does.

112

posted on

06/24/2013 1:40:08 PM PDT

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: DannyTN

things are much better with the FED than without. My guess is that most freepers would agree there but that you and I are the only ones with the stones to say it out loud. The thing that folks need to understand is that there was never one single day that we suddenly switched over from gold to current policy. It evolved over many decades and (like you say) we've never had it so good:

To: expat_panama

114

posted on

06/24/2013 2:19:02 PM PDT

by

DannyTN

To: expat_panama

115

posted on

06/24/2013 2:19:02 PM PDT

by

DannyTN

To: DannyTN

thanks!

some how it always seems that the facts end up speaking very well for themselves.

To: expat_panama

Yeah, no guarantee people will listen though. We agree that the FED is a good thing and has done a good job. But we're still worlds apart on trade policy.

In that graph, notice that GDP improvements have been sloping down and Unemployment has been sloping up since about 1950.

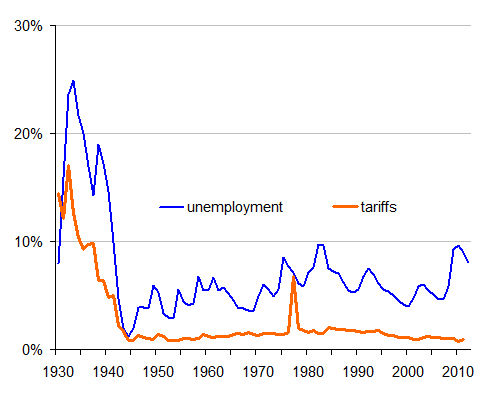

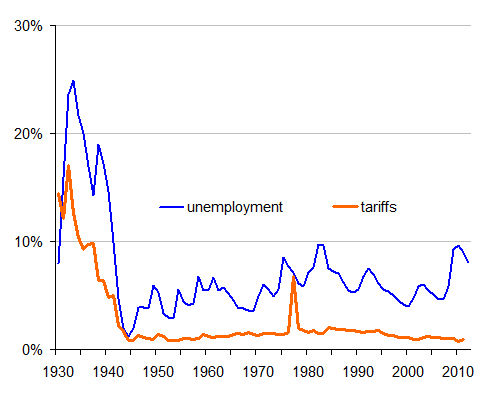

I think that has more to do with trade policy than anything else. Look at this chart and notice when we lowered the tariffs around 1950. History of Tariffs in United States History

117

posted on

06/24/2013 2:42:58 PM PDT

by

DannyTN

To: DannyTN

GDP improvements have been sloping down and Unemployment has been sloping up since about 1950. I think that has more to do with trade policyHere's a closer look at tariffs % total revenue (data & sources here) which saw the big drop from '33 to '44. Plotting that along with real gdp yr/yr--

--and with unemployment.

--shows a strong correlation between lowering tariffs and improving economic conditions.

To: DannyTN

Every year, every cent you own, loses some value. It's like compound interest in reverse. They are not just stealing from our paychecks; they are stealing from our childrens' piggy banks.

If there are fewer dollars in circulation, does the dollar not potentially become more valuable due to relative scarcity? Anyhow, even if that is not the case and assuming a deflationary depression is something to be avoided at-all-costs, isn't there some other way to combat deflation that doesn't involve giving an elite group the power to create infinite sums of money? There must be some way to decentralize this power.

Who would disagree with the adage "Absolute power corrupts absolutely?"

119

posted on

06/24/2013 6:27:45 PM PDT

by

Prolixus

(Summum ius summa inuria.)

To: Prolixus

"Every year, every cent you own, loses some value. It's like compound interest in reverse. They are not just stealing from our paychecks; they are stealing from our childrens' piggy banks."But they aren't causing inflation with the intent to steal. They are causing it because it's the best thing for the economy which then maximizes wealth for everyone.

Your kid's piggy bank may be losing a small amount of purchasing value each year. But their old man is more likely to have a job and contributing to that piggy bank.

It's similar to Churchills observation on democracy. "Democracy is the worst form of government, except for all the other forms." Similarly, The Fed and fiat money is the worst form of monetary management, except for all the other forms of monetary management.

"If there are fewer dollars in circulation, does the dollar not potentially become more valuable due to relative scarcity? Anyhow, even if that is not the case and assuming a deflationary depression is something to be avoided at-all-costs,..."

Yes fewer dollars would raise the value of the dollar which would give increased purchasing power. But then the deflationary depression starts. And the price of things yo buy falls..."YAY", but the price of things you sell falls, "Oh CR*P", and then you get laid off or your wages get cut, "Double CR*P". And why would they lay you off. Because they can just liquidate their inventory and sit on cash and increase their purchasing power. So yes deflation is something that you want to avoid. Maybe not at "all costs" but certainly at significant costs.

" isn't there some other way to combat deflation that doesn't involve giving an elite group the power to create infinite sums of money? There must be some way to decentralize this power. Who would disagree with the adage "Absolute power corrupts absolutely?"

Actually I think the FED is the right balance. Neither too centralized nor too decentralized.

First look at the results. The graph in post in 113. Tells the story. You can see how much fewer depressions/recessions we have had (the gray). And you can also see that the inflation has been more stable and avoided deflation (blue line). There were bouts of inflation with WWII and in the 70's with the oil price shock. And this current crisis also was an oil price shock among other things. The results are good, very good. The results just simply don't show the corruption you are worried about.

Second look at FED governance.

- You have the 7 members of the board of governors appointed by the President each serving 1 and only 1 14 year term, so that no individual President can have much influence and certainly not in their first year in time to influence an election. This board sets the monetary policy.

- You have the 14 members of the Federal Open Market Committee. This board determines the specifics of implementing the policies determined by the 7 member board.

- Then you have the 12 Federal Reserve banks, each of which is managed by a board of 9 directors. 3 of those directors are appointed by the Board of Governors, 6 are elected by the member banks with 1 vote per member bank. 3 of those 6 directors must come from the business community instead of the banking community, so that bank customers are represented on the boards. These 12 banks actually execute the specifics of what the FOMC has ordered.

120

posted on

06/24/2013 7:37:15 PM PDT

by

DannyTN

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-154 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson