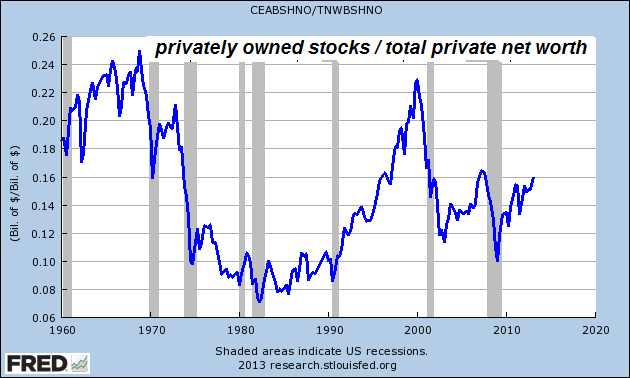

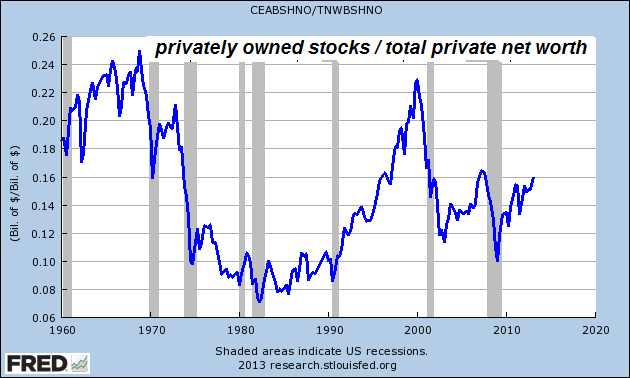

That last dip on that chart scared a lot of people off. I know some swore they would never own stocks again. It was sad really. One friend watched it go all the way to the bottom and then panicked and pulled it out after his 401k was destroyed. If he had left it alone he would have been OK but instead he moved to cash and watched it go back up. I wonder if the years of basically nothing returns have changed his mind and he went back in. I know now doesn’t seem like a good time to bail back in.

watched it go all the way to the bottom and then panicked and pulled it out after his 401k was destroyed.Supposedly the manager of the Harvard endowment did that and the college lost billions. For me one of the lessons here is never act on emotion, and the other is to always watch the long run. That big dip in '09 was big but not as low and long as the malaise daze. That was followed by a tripling of money buying stocks:

That last dip on that chart scared a lot of people off. I was fortunate enough to almost completely miss the 2000 crash... and, was given excellent timing information from a newsletter guy, Bob Brinker, to get back in the market in March 2003. Perfect!

In 2008, I was actually OUT of the market in May through August... misseed the 20% sell-off. Then, I convinced myself that the worst was over, and moved back in... :-(

The worst was NOT over... it had just started. By October, I was mostly OUT... and, stayed out for longer than I should. In fact, I've NEVER been fully in the market since. But, I have been able to catch a good deal of the upside in the past year and a half.

I'm about 50% in cash now... every instinct I have wants me to put MORE in the market... but, this is August. And, feel a LOT like I did in 2008. I keep thinking I'll wait for a pullback... but, the pullbacks have been few, and weak.

So... I'm stuck.. sitting here paralyzed.. trying to just not worry about anything.