Please let me know if you would like to be on or off a Bitcoin Ping List concerning articles and information, both pro and con, about the development, current issues, and use of Bitcoin and other crypto-currencies.

Posted on 12/24/2013 6:41:56 AM PST by narses

Bitcoin, the electronic currency whose valuation has careened wildly in recent weeks, is ripped in a report this month by a researcher at the National Bureau of Economic Research.

David Yermack examined Bitcoin's trading behavior to compare it with traditional currencies. "Bitcoin has exchange rate volatility an order of magnitude higher than the volatilities of widely used currencies," Yermack wrote, "undermining Bitcoin's usefulness as a unit of account or a store of value."

Bitcoin is "useless for risk management purposes and exceedingly difficult for its owners to hedge," Yermack wrote. He notes that the alternative currency lacks access to a banking system with deposit insurance, and is not used in consumer credit or loan contracts.

"Bitcoin appears to behave more like a speculative investment than like a currency," Yermack wrote. "Since currency investors have no easy way to bet against Bitcoin's appreciation, skeptics can only watch as optimists trade the currency among themselves at ever-rising prices."

On Dec. 23, Bitcoin prices hovered around $646. Just three weeks ago in a Dec. 5 research report, Bank of America analysts estimated that each Bitcoin is worth $1,300 after the valuation first topped $1,000 on Nov. 27. In early October the currency was valued at just $140. The San Francisco Business Times covered the Bank of America analysis here.

There are an estimated 12 million Bitcoins in circulation. New Bitcoins can only be created according to software designed by Bitcoin founders. The currency was created in 2008 by a computer programmer under the name Satoshi Nakamoto, whose true identity remains a mystery.

Entrepreneurs in Reykjanesbaer, Iceland, near the Arctic Circle, have reportedly installed a bank of computers dedicated to unlocking the complex algorithms that govern the release of new Bitcoins. One of these Bitcoin-rush entrepreneurs is Emmanuel Abiodun, who decided to locate his computer bank in Iceland because "geothermal and hydroelectric energy are plentiful and cheap. And the arctic air is free and piped in to cool the machines, which often overheat when they are pushed to the outer limits of their computing capacity," Abiodun said in a story in the DealB%k section of the New York Times.

The National Bureau of Economic Research summary, entitled Is Bitcoin a Real Currency?, is available here.

James Dunn is a senior editor at the San Francisco Business Times. Major projects include editing technology and finance beats, and Best Places to Work.

Freep-mail me to get on or off my pro-life and Catholic List:

Please ping me to note-worthy Pro-Life or Catholic threads, or other threads of general interest.

A government employee doesn’t like bitcoin, wow.

With all this rancor it might even get to the point that drivers of Peprsi trucks stop waving at the drivers of Coke trucks, right..?

Gosh.

So the core of his complaints are that the idea of a non-state contolled currency isn’t big enough yet and can’t be sold short. In that case it should be treated like the Beanie Baby bubble rather than as a huge threat. Instead those who profit from having all currency controlled by governments look at Bitcoin like they have the chance (and obligation) to strangle it in its crib.

Right. They live in fear of bitcoin. Not.

“...”Bitcoin has exchange rate volatility an order of magnitude higher than the volatilities of widely used currencies,” ...”

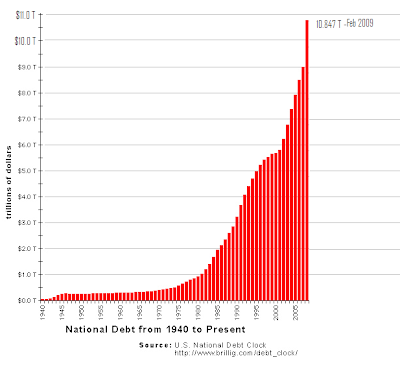

Hey, economics dork, just exactly what is our dollar worth?

And how many billions of worthless paper are printed each month?

Bitcoin itself is too small to be a serious concern. But what if a major bank decides to start issuing a private currency again? That could seriously shake things up. The governments want to make sure that private currencies are seen as a dangerous idea, lest they lose control. If Bitcoin starts to gain general traction, look for moves by government to outlaw it and to purchase and sell it at wildly variable prices to destabalize it.

“Bitcoin appears to behave more like a speculative investment than like a currency,”

Or Ponzi Scheme. :-)

Please let me know if you would like to be on or off a Bitcoin Ping List concerning articles and information, both pro and con, about the development, current issues, and use of Bitcoin and other crypto-currencies.

On Paul Krugman's Irrational Attack On Bitcoin

Any alternative to the beast's mark {i.e., fiat) will come under attack:

Almost Every Passenger On A Flight From Dubai To India Was Found Carrying 1 Kilo Of Gold

The new USD emission is offset by the increase in value that is produced all over the world. When you have more goods to trade you need more coins to exchange for those goods.

The USD, like other traditional currencies, is stabilized by the many trading contracts that are in effect, and by the huge mass of money on the market. If you decide to drop USD by massively buying the currency for, say, one barrel of oil per dollar, other speculators will gladly buy your oil, then turn around and resell it for 60 dollars. There are more dollars in the world, and more speculators, and more demand for oil, than you have oil to complete your scheme. You would succeed only if you have more goods to offer than the mass of dollars in other people's pockets.

BTC has no such backing. Nothing of economic value is traded for it. Any speculator with sufficient supply of US dollars can manipulate the price of BTC by buying it in volume, or by selling. The small and fixed number of BTC on the market makes that easier; concentration of large number of BTC in wallets of early adopters makes this ten times as easy. For example, if I declare an old airplane ticket a currency, I can ask whatever I want for it, and I could trade that ticket with my friends for any number of USD (or any amount of gold.) It's our private choice, and it has no bearing on the rest of the planet. I can choose to "sell" you that ticket for one billion dollars that I give to you. Nobody expends real USD, but the price of that piece of paper "on the market" is now $1B. What does that price signify? Nothing at all.

An independent currency is a good idea in itself. However BTC has so many problems that I don't see it as a good player here.

Fiat currencies used today are created through debt, its fatal flaw. I'm afraid the only exit is hyper-inflation, as all fiat currencies eventually fail and even real currencies are debased to satisfy the needs of the state.

One advantage that cryptocurrency offers is it takes this power out of the hands of the state and puts it in the hands of the individuals.

"One of these is an "asset" that produces no profit based on an underlying architecture with low barriers to entry, the other is a virtual currency... and remember: Bitcoin has no intrinsic value, doesn't trade at 1000x 2013 (or 340x 2014) EBITDA, and is nowehere near 40x it next year's revenues. It is, after all, simply a non-fiat currency. Which is why it is a bubble, and why, according to experts, Twitter is a screaming buy."

Excellent presentation about the need to have a realistic perspective on Bitcoin’s growth. Thanks!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.