Last week, I told you about how the "second phase" of the oil boom could make the first phase look like small potatoes (you can read the article here).

At the end of my article, I mentioned that if the price of oil drops below $70 per barrel, horizontal drilling plays could see their margins shrink considerably, along with investment returns.

I know a lot of oil investors are worried about that potential outcome, so I wanted to write this follow-up to show you why I think high oil prices are here to stay, and why over time they're likely to go higher.

If you think we've escaped "peak oil" and oil prices are destined to fall... think again.

Back in 2008, before the financial crisis got into full swing, oil prices spiked to nearly $150 per barrel. That was the year that the concept of "peak oil" really started to hit the mainstream media.

The textbook definition of peak oil is the point in time when the global production of oil reaches its maximum rate, then gradually declines. In 2008, with American oil production in seemingly permanent decline and oil prices surging on decreasing supply, it appeared that peak oil was upon us.

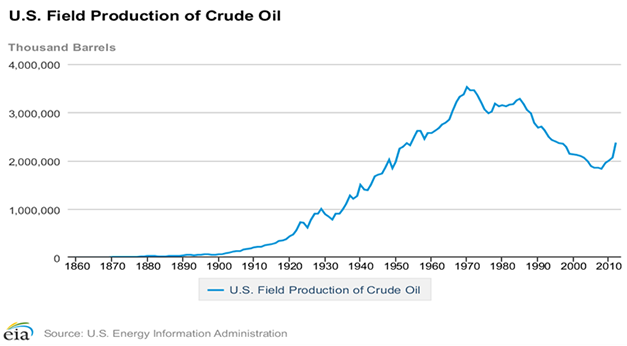

But then something happened. American oil production stopped declining and started to increase, because of new advances in drilling techniques. And that increase has been quite incredible:

The chart above from the U.S. Energy Information Administration depicts the sharp reversal American oil production has made.

The discovery of oil in Prudhoe Bay, Alaska, led to a high point of 9 million barrels a day of oil production for the United States in 1985. From there, production declined every single year through 2008 where it bottomed at 5 million barrels per day.

But then, by this past October production hit an incredible 7.7 million barrels per day -- a more than 50% increase from 2008.

Now with oil production rising, media headlines that in 2008 were warning us of peak oil have been replaced with headlines proclaiming peak oil's demise. Some are even suggesting the dawning of an era of American oil independence.

So if we're producing so much more oil, the question is why hasn't the price of oil gone down... and the share price of your oil stock with it?

The simple explanation is that "peak oil" isn't gone, and likely never will be. It's just something that I predict is going to occur in stages.

Let me explain...

Through the year 2000 we had grown accustomed to oil prices that ranged from $10 to $30. Then, with seemingly little warning, oil rose through $30 and didn't stop until it hit $150.

This rise in prices wasn't the result of running out of oil. It was a result of running out of oil that was inexpensive to produce. This is all about supply and demand.

Prior to the year 2000 we could produce enough oil that could turn a profit at $20 to meet global demand. What sent oil prices skyrocketing was that demand reached the point where it exceeded our capacity to provide a supply of oil at the prices we were accustomed to.

Those high oil prices weren’t all bad, though. In fact, they helped us to develop unconventional methods like horizontal drilling and "fracking" that made it possible to extract more oil that had previously been harder to get at. And that led to the North American oil boom we are currently experiencing.

So why aren't oil prices dropping? Because today's increased oil supply is being produced from shale or "tight oil" rocks.

Production of this oil requires drilling long and expensive horizontal wells. It also requires that the wells be "fracked" and chemicals and water be injected. And production of this oil also creates wells that exhibit rapid rates of decline.

Add all of those elements together and producers are looking at costs of production that are multiples of what they were when producing conventional barrels of oil.

With all of the costs involved and high decline rates companies lose money if they sell that oil for $30 per barrel. However, the new sources of oil make oil companies pretty good money at $100 per barrel. At $80 per barrel, some of the companies make decent money. At $60 per barrel, the economics likely don't work.

Take a look at the IEA chart below. Virtually none of today's energy resources can be produced profitably for less than $60 per barrel...

The bottom line is: If we want oil, we are going to need high prices. That's what peak oil is all about -- progressively higher prices that are going to allow us to continue to find new sources of oil.

We aren't running out of oil. We are running out of the easiest oil to extract.

With advanced (and more expensive) drilling techniques, oil prices may stay in this $90 to $110 range for a decade as we continue to exploit these new sources of oil that have opened up.

But once those sources enter a production decline (and they will), then the price of oil will likely start to move up again, until another new source of oil is opened up by even higher prices... and we enter into a new stage of "peak oil."

So if you're worried about your oil stock's share price dropping with the price of oil, I don't think you have much to worry about. In my estimation, we're not going to see oil prices drop drastically from where they are now.

The fact is we need high prices to spur innovation and oil discovery.