Skip to comments.

Where Bitcoin boosters are getting it wrong

CNET ^

| 23 January, 2014

| James J. Angel

Posted on 01/23/2014 7:59:41 AM PST by Errant

In a recent New York Times Dealbook post, venture capitalist Marc Andreessen argued that Bitcoin is here to stay because it provides a payment system better than the one we have now, particularly for online merchants and international transfers. He likened Bitcoin to other disruptive technologies such as the personal computer and the Internet.

These are great analogies. The personal computer has revolutionized the world, but Altair was not one of the winners. (Remember Altair? It was one of the many pioneers.) The Internet was not the first or even the only network for connecting computers. There were several other early networks including Bitnet (the "Because Its Time" network), which was started in 1981. It thrived for a while connecting university computers, but was eventually supplanted by the Internet as we know it today. I believe that Bitcoin will suffer the same fate as Bitnet: a technical advance that will soon be surpassed by even better advances.

Our payment system is undergoing an amazing technical revolution. In a few short years, we have evolved from a world in which most payments were made via paper to one in which most are made with electrons. This evolution has not finished and will continue. There is broad dissatisfaction with the fees involved in the Visa MasterCard duopoly, and definitely room for improvement. We will continue to see innovations that provide even better and more cost-effective payment solutions. Recent innovations include PayPal, Popmoney, and Square. Plenty more are still under development, as many innovators compete to come up with a "digital wallet" that people will actually use.

(Excerpt) Read more at news.cnet.com ...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: bitcoin; crypto; currency

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-63 next last

To: TsonicTsunami08

41

posted on

01/23/2014 4:16:55 PM PST

by

Errant

(Surround yourself with intelligent and industrious people who help and support each other.)

To: RinaseaofDs

Bitcoin is a giant, market-volunteered vote of no confidence in the global monetary system.

Best analysis I have seen....................

To: Norseman

First, you don’t appear to understand Gresham’s Law. Obviously, or at least not at your level. ;)

43

posted on

01/23/2014 4:17:51 PM PST

by

Errant

(Surround yourself with intelligent and industrious people who help and support each other.)

To: Errant

Just wanted to add that the "Gold Standard" would have been better served if it hadn't been for an arbitrary value assigned (i.e., $20). It should have been denominated by weights,I thought it was. The Gold Standard Act of 1900 defined the dollar as "consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine".

But I'm interested to know if you think I'm mistaken.

44

posted on

01/23/2014 4:19:22 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: Errant

Completely agree.Thanks. Many don't.

45

posted on

01/23/2014 4:20:26 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: BfloGuy

The US government has changed the relationship, value wise, between Gold and Silver and the dollar throughout it's history. Even when they did use a weight, that too was change after a period and the weights never appeared or stayed on any of the notes/certificates. I could be wrong about that particular fact of it once appearing (i.e. the weight) and would appreciate being corrected if I am - I'm no expert on paper currency by any means.

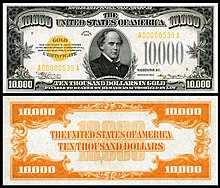

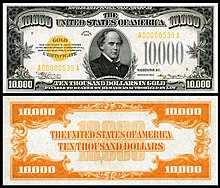

Below is an example of a Gold Certificate. Silver certificates were similar. IMHO, it would have been far better to have them denominated by amounts. For example, on the gold certificate below, it could had had: "Pay To Bearer On Demand 500 Ounces Of Gold" printed on its face instead of "as authorized by law", an arbitrary value that actually did change from time to time. Then they also set the value of gold per ounce did they not? Hence the coin should have also carried its weight as Eagles have today.

In reality, it matters not if there is a gold standard or not, governments always have ways of debasing whatever currency is being used. What's more important is who has control over the money supply - ask the Rothschilds about that. Crytocurrency may allow for control to be shifted into the hands of the people instead of governments or banksters. They're the ones most affected by the changing values.

46

posted on

01/23/2014 4:54:02 PM PST

by

Errant

(Surround yourself with intelligent and industrious people who help and support each other.)

To: BfloGuy

Of course you’re not mistaken. His understanding of the gold standard is on a par with his understanding of Gresham’s Law.

If you’re going to define a dollar in terms of gold what other measure would you use besides weight of the gold? Brightness, tensile strength, hardness? Obviously the weight of gold per dollar has to be specified for the gold backing up the dollar (the meaning of a “gold standard”) to have any meaning whatsoever.

Today, with the gold unmoored from an official amount per dollar, it moves daily in a free market. It could serve as a medium of exchange, but it’s just too inconvenient to do so, plus it suffers the same disadvantage as bitcoins; it’s price is quite volatile whereas a medium of exchange needs to be relatively stable in value from day to day for people to trust its use.

People can cheer on bitcoins as long and as hard as they want. Something as volatile in value as a bitcoin will never, ever, be accepted by the overall public as a preferred medium of exchange, i.e., as a currency.

47

posted on

01/24/2014 12:22:42 PM PST

by

Norseman

(Defund the Left-Completely!)

To: Errant

Incidentally, for those of you who think that EBay or PayPal are going to use bitcoin out of the goodness of their heart (or because they think it’s a preferred currency), consider the possibility that the real reason they would adopt its use is because they’ve found a way to make money off of people’s use of bitcoins. And they will make that money in dollars, probably by finding a mechanism by which they are always pricing bitcoins on a spread, the same as any foreign exchange transaction.

48

posted on

01/24/2014 12:31:02 PM PST

by

Norseman

(Defund the Left-Completely!)

To: Norseman

It could serve as a medium of exchange, but it’s just too inconvenient to do so, plus it suffers the same disadvantage as bitcoins; it’s price is quite volatile whereas a medium of exchange needs to be relatively stable in value from day to day for people to trust its use.Just to be clear. If the dollar were defined as a specific portion of an ounce of gold, the volatility would disappear. Americans [or any dollar-users] would buy and sell gold at the pegged weight.

It wouldn't change.

49

posted on

01/24/2014 4:01:28 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: Errant

In reality, it matters not if there is a gold standard or not, governments always have ways of debasing whatever currency is being used.Yes. I have never meant to give the impression that I believe a gold standard can overcome a dishonest government.

50

posted on

01/24/2014 4:07:10 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: BfloGuy

Sorry for the confusion on the "gold standard". I wasn't trying to redefine the meaning, I was trying to point out what I, IMO, see as some problems that existed even when the US was operating under what was referred to as a "gold standard".

Except for confusion over what this "gold standard entails vs. what it should entail, I believe we agree on what we see as many of the same problems (i.e, dishonest government, government intervention, fiat currency, etc.).

51

posted on

01/24/2014 8:12:42 PM PST

by

Errant

(Surround yourself with intelligent and industrious people who help and support each other.)

To: Norseman

Incidentally, for those of you who think that EBay or PayPal are going to use bitcoin out of the goodness of their heart Practically ALL businesses are in business for the monetary incentive - don't you think?

I'm sorry if I bruised your ego up chain, or if you're just having a bad day. I'm merely pointing out where you might want to rethink some your thinking. For example, your latest post above that gold is volatile and that the dollar is stable, is laughable considering FRNs have lost almost 98% their value since their introduction while gold has maintained its value relative to just about anything you care to compare it against (e.g., suits, automobiles, food, energy, etc.).

Have a great weekend...

Btw, Never is an awfully long time. Just sayin'....

52

posted on

01/24/2014 8:21:25 PM PST

by

Errant

(Surround yourself with intelligent and industrious people who help and support each other.)

To: Errant

You misunderstand. You didn’t “bruise my ego” You said you understand whereas I don’t; I’m saying the same of you. I’ll let others judge who they consider correct. All I’m doing is pointing out where I think you’ve gone wrong, the same as you’re doing with me.

You miss the point about my EBay/PayPal comment. They will do business in bitcoin IF they figure out a way to make money while converting bitcoins back to the dollars they prefer. When and if they do that, you will find that users of bitcoin are being charged an effective transaction fee for the privilege, and that the fee is likely to be higher than if they just used the ubiquitous dollar instead.

As for dollar/gold stability, of course you’re right over the decades. I could say the same about candy bars/money. So we should use candy bars instead of dollars? The point I’m making is that gold is volatile in terms of dollars on a day to day basis and people find that inconvenient when they’re looking for a way to conduct transactions. Dollars, relative to all products, not just gold, tend to be stable in value on a day to day basis. Granted, the Fed has done a pathetic job of protecting it’s value over the decades, but no one invests in dollars per se; they invest in assets that earn income or interest, or, like bitcoins and gold and silver, show some promise of appreciating in value relative to dollars so that they can take a profit eventually.

53

posted on

01/25/2014 10:18:15 AM PST

by

Norseman

(Defund the Left-Completely!)

To: Errant

You misunderstand. You didn’t “bruise my ego” You said you understand whereas I don’t; I’m saying the same of you. I’ll let others judge who they consider correct. All I’m doing is pointing out where I think you’ve gone wrong, the same as you’re doing with me.

You miss the point about my EBay/PayPal comment. They will do business in bitcoin IF they figure out a way to make money while converting bitcoins back to the dollars they prefer. When and if they do that, you will find that users of bitcoin are being charged an effective transaction fee for the privilege, and that the fee is likely to be higher than if they just used the ubiquitous dollar instead.

As for dollar/gold stability, of course you’re right over the decades. I could say the same about candy bars/money. So we should use candy bars instead of dollars? The point I’m making is that gold is volatile in terms of dollars on a day to day basis and people find that inconvenient when they’re looking for a way to conduct transactions. Dollars, relative to all products, not just gold, tend to be stable in value on a day to day basis. Granted, the Fed has done a pathetic job of protecting it’s value over the decades, but no one invests in dollars per se; they invest in assets that earn income or interest, or, like bitcoins and gold and silver, show some promise of appreciating in value relative to dollars so that they can take a profit eventually.

54

posted on

01/25/2014 10:18:15 AM PST

by

Norseman

(Defund the Left-Completely!)

To: BfloGuy

>>Just to be clear. If the dollar were defined as a specific portion of an ounce of gold, the volatility would disappear. Americans [or any dollar-users] would buy and sell gold at the pegged weight.<<

Of course that’s true. However, then any relatively sudden change in the supply and demand for gold would be reflected in a change in the dollar relative to all other goods. The volatility in gold’s true “value” wouldn’t change; it would just take the dollar along with it.

That’s the real problem with a gold standard. Instead of a monetary authority managing the amount of money in the system, you have the vagaries of a commodity market doing the managing. For example, a sudden appearance of a new and essential use for gold, say in 3D printing or electric car batteries, could result in an appreciation in gold’s price relative to all other goods and wages, and would take the dollar with it, resulting in effective deflation. One dollar would then purchase more labor than before, which is a reduction in the cost of labor.

Unfortunately wages are sticky (difficult to lower), and the result is usually a recession brought on by some action affecting the supply and demand for gold. This is why many economists would prefer a basket of commodities be used, rather than a single one, like gold or silver.

55

posted on

01/25/2014 10:27:46 AM PST

by

Norseman

(Defund the Left-Completely!)

To: Norseman

any relatively sudden change in the supply and demand for gold would be reflected in a change in the dollar relative to all other goodsWell, yes. But what would that "relatively sudden change in the supply and demand for gold" look like? What would cause it?

It's estimated that 90% of all the gold ever mined is still in existence -- supply wouldn't seem to be a problem.

And if the demand for gold should rise, then prices [in free economies] would drop to account for it.

That’s the real problem with a gold standard. Instead of a monetary authority managing the amount of money in the system, you have the vagaries of a commodity market doing the managing.

Because government is better than the free market, right?

For the love of Mike, what makes you [a supposed conservative for being on FR] believe that bureaucrats can manage the money supply. Why have you come to think that they can plan the economy.

How do you suppose we little idiots that compose the non-government part of the economy manage the supply of tomatoes. The way you talk we should have a Federal Tomato Board to control it.

resulting in effective deflation. One dollar would then purchase more labor than before, which is a reduction in the cost of labor.

No. If the purchasing power of the currency is rising and the wages of labor drop to match that [unlikely because it is productivity that determines wages], then labor still has the same purchasing power. Deflation is only damaging when caused by governments' yanking the rug out from under their previous easy-money schemes.

When prices drom from improvements in productivity coupled with a stable currency, it is a benefit to everyone.

56

posted on

01/25/2014 4:04:24 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: BfloGuy

Boy, you sure can jump to some strange conclusions when you either disagree with, or don’t understand, what I’m saying.

A relatively sudden change in the supply or demand for gold could easily occur. Demand, for example, could increase significantly if a new use was found for it in electronics, or in some process that isn’t even known to us today. Supply can obviously change due to either a massive new discovery, or a change in jewelry fads. The very fact that gold has varied significantly in dollar terms (over the short term now, not over decades where gold has obviously appreciated against the dollar) is a clear indication that supply/demand factors cause significant swings in the price of gold. It happens, clearly.

You’re assuming that prices will drop to account for a higher gold price caused by whatever. But that’s exactly why deflation is typically so devastating; prices, particularly wages, are resistant to falling. And if wages don’t correct, the business response is to cut labor costs by laying people off. That’s the reason deflation usually results, in the shorter term, in recessions rather than suitable adjustments of wage rates. Some people lose their jobs instead of everybody taking a pay cut.

So, I point out the obvious issues with a gold standard and suddenly I’m the enemy of free markets? That’s ridiculous. Why take that leap of logic?

If you want to continue to discuss this rationally I’m more than willing, but if you’re going to jump to unjustifiable conclusions because you don’t like what I’m saying, then let’s drop the discussion. It quickly becomes a waste of time.

And I didn’t, by the way, say that bureaucrats do a good job of managing the money supply. I did, however, say that they’ve done a better job of maintaining stable DAY to DAY prices than a gold standard would do. All you have to do is compare the short term swings in gold prices to changes in overall prices to realize that. And, as I said earlier, it’s those swings that cause problems, particularly the deflationary swings.

Granted, if wages were not sticky to the downside, deflation wouldn’t necessarily cause a recession, but swings between deflation and inflation are still harder on people generally than a relatively stable inflation rate. Also granted, stable prices would be preferable over either situation.

By the way, I also happen to believe that a fiat money system like the dollar is capable of being managed properly. Milton Friedman said that all it would take is 100% reserve requirements against transaction balances. I think he was correct, but we’ve never come close to trying that. Instead, Bernanke’s gone off the deep end and has created a situation that could easily result in explosive price inflation over the relatively near term if his successor mismanages the reversal of his easy money policy.

And to argue that my position leads to my advocating something like a Federal Tomato Board is ludicrous. I’m just trying to explain, apparently unsuccessfully, the problems that could result from going back to a gold standard. It’s not as clear cut a solution as people think.

57

posted on

01/25/2014 4:47:46 PM PST

by

Norseman

(Defund the Left-Completely!)

To: Norseman

Demand, for example, could increase significantly if a new use was found for it in electronicsYes. It certainly could. But the newly found industrial use for gold would have to be weighed against its usefulness as currency. I am certainly not, however, claiming that it wouldn't happen.

But that’s exactly why deflation is typically so devastating; prices, particularly wages, are resistant to falling. And if wages don’t correct, the business response is to cut labor costs by laying people off. That’s the reason deflation usually results, in the shorter term, in recessions rather than suitable adjustments of wage rates. Some people lose their jobs instead of everybody taking a pay cut.

The only deflation any of has seen in our lifetime is the deflation caused by governments' suddenly tightening credit after a period of extending it easily and cheaply. That type of deflation is damaging.

But, I repeat, the price deflation [we must make the distinction between monetary inflation/deflation and price inflation/deflation] resulting from a stable currency and productivity increases is beneficial to the consumer -- who is also the laborer.

So, I point out the obvious issues with a gold standard and suddenly I’m the enemy of free markets?

Your statements led me to believe that you do not think that a free market for money is workable. Perhaps, I was hasty in my judgement, but insisting that government control was necessary to regulate the amount of money certainly suggested a certain comfort with the idea of regulated markets.

It is, in my opinion, a "leap of logic" to advocate control in one market while claiming to be against it in others at the same time.

Gold is not a perfect money; but none is. But it strikes me as a very good one. If government kept out of it [a dream, yes, I know], I suspect we could all do very well with it and adjust rather painlessly to our shifting demands and its varying supply.

58

posted on

01/26/2014 4:17:17 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: Norseman

They will do business in bitcoin IF they figure out a way to make money

That is an assumption that may not be right. Many businesses are more interested in agenda than profit today.

To: Salvavida

Bitcoin has no backing from the living God. No sale. So God is now backing currency? Please let us know more about that.

And please don't come back with a lame answer like U.S. Currency. Printing "In God We Trust" on paper and coin does not make it backed by God.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-63 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson