Skip to comments.

US PAYROLLS BEAT EXPECTATIONS, UNEMPLOYMENT RATE RISES

Business Insider Australia ^

| March 7, 2014

| Matthew Boesler

Posted on 03/07/2014 5:50:10 AM PST by John W

The Bureau of Labor Statistics says 175,000 workers were added to nonfarm payrolls in December, well above Wall Street’s consensus estimate of 149,000.

162,000 of those hires were to private payrolls, above expectations for a 145,000 rise in the ranks of private-sector workers.

The unemployment rate unexpectedly rose to 6.7% from 6.6%. Labor force participation was unchanged at 63.0%.

610,000 were unable to work due to inclement weather in February, above the historical February average of 317,000.

(Excerpt) Read more at businessinsider.com.au ...

TOPICS: Breaking News; Business/Economy; News/Current Events

KEYWORDS: bs; cookingthebooks; crapolaonsteroids; fantasyisland; lerner; unexpectedly

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-95 last

To: John W

How would you describe the status of the US economy?Third World

81

posted on

03/07/2014 11:17:00 AM PST

by

Count of Monte Fisto

(The foundation of modern society is the denial of reality.)

To: John W

Good question :-) This could be a “good news is bad news” day. Hilsenrath’s comments on the taper likely the key driver. (http://blogs.wsj.com/economics/2014/03/07/hilsenrath-analysis-fed-likely-to-continue-taper-consider-changing-to-forward-guidance/)

Charles Schwab’s take:

Early Employment Enthusiasm Fades

After getting an initial boost from a stronger-than-expected U.S. February nonfarm payroll report, domestic stocks are mixed in late-morning action as the data may be furthering expectations that the Federal Reserve will continue to withdraw its stimulus measures. Meanwhile, Treasuries are seeing solid pressure on the employment report, which is more than offsetting an unexpected widening of the trade deficit. The U.S. dollar is modestly higher and crude oil prices are gaining ground, while gold is trading to the downside. In equity news, Safeway agreed to be acquired by a unit of Cerberus Capital Management for about $9.0 billion, while Foot Locker topped the Street’s profit expectations. Overseas, Asian stocks finished mixed in cautious trading ahead of the U.S. jobs report, while European equities have moved back below the unchanged mark after a brief boost from the employment data on the other side of the pond.

Zero Hedge’s take:

Having heard the great and good declare this morning’s “beat” on the headline NFP data as indicative of 1) the recovery is awesome; 2) the reason why stocks have been rallying; and 3) the recovery is awesome... it appears between a rising unemployment rate, tumbling average hourly earnings, and Gazprom’s threat in Europe, stocks are taking this “good news” as “bad news.” Confirmed by Hilsenrath that the taper is on - which is what bonds, gold, and the dollar appeared to be saying - the S&P 500 having spiked 10 points is now 13 points off its highs and in the red for the day...

To: John W

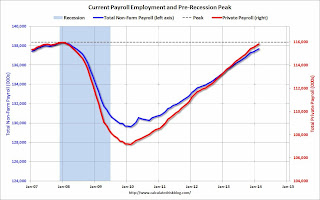

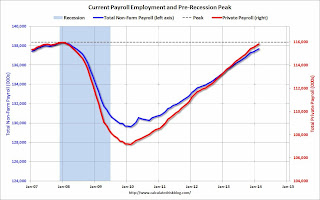

Payroll employment is getting very close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow), but reaching new highs in employment will be a significant milestone in the recovery.

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.699 million total non-farm payroll jobs, or 666 thousand fewer than the pre-recession peak.

At the recent annual pace (about 2.2 million jobs added per year), total non-farm payroll will be at a new high in June 2014.

The pre-recession peak for private payroll employment was 115.977 million. Currently there are 115.848 million total non-farm payroll jobs, or 129 thousand fewer than the pre-recession peak. It seems likely private sector employment that will be at a new high in March.

Read more at http://www.calculatedriskblog.com/2014/03/when-will-payroll-employment-exceed-pre.html#syPMCo7EpBR2qO2D.99

To: John W

Some interesting data:

Federal government reached their lowest level since the mid-1960's

Meanwhile State and Local Employees appears to have bottomed:

To: John W

The Obama recession continues....will it be the longest in the history of America? Yep, that’s what Big government does to economies.

85

posted on

03/07/2014 12:26:54 PM PST

by

1Old Pro

To: Wyatt's Torch

“Most people don’t know how or why monetary policy works. That’s evident by the “printing money is inflation” comments.”

I guess I don’t understand either. How is it not inflationary?

86

posted on

03/07/2014 5:29:37 PM PST

by

JGT

Always unexpectedly meaning the same idiots are still in charge and reporting...

But what about the drop in employment?!

87

posted on

03/07/2014 6:10:33 PM PST

by

Gene Eric

(Don't be a statist!)

To: Blennos

It surprises me that anyone still gives any credence at all to any information coming from this government.VERY good post. It is literally ALL lies.

88

posted on

03/08/2014 4:25:14 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: JGT

It depends on the printing relative to the demand for money. When there is a very high demand for liquidity, providing liquidity (ie “printing money”) is necessary. Don’t “print” enough of it and you will have DEflation. Printing can be inflationary if there is “too much money chasing after too few goods.” You cannot just assume that printing money, in and of itself, is inflationary. It’s relative to demand.

Now the issue we are currently in is that we’ve provided significant liquidity to meet demand. But the money is not getting into the economy (bank reserves have gone up by about the same amount as QE) and turning over by various parties spending/buying. The velocity of money is at a record low. That’s because of the fiscal/regulatory issues that Fisher discussed. If that gets turned around and appropriate levels of growth start to occur (3-5%) and velocity turns back up then the provided liquidity will be excess and could then be inflationary if the liquidity isn’t drained fast enough. It will be drained by the Fed selling the bonds they purchased and removing the cash from the system. Anti-QE. That’s the mechanism for manipulating the money supply to add/subtract liquidity.

To: Wyatt's Torch

the money is not getting into the economy (bank reserves have gone up by about the same amount as QE) and turning over by various parties spending/buying. The velocity of money is at a record low. Does this mean there is likely to be another meeting with the bank CEOs to have them sign more papers to make someone happy? Might be a good thing the money is being held instead of released. Difficult to say until the banks release it (the money). Then, since we are in uncharted territory there will be lessons learned (imho).

90

posted on

03/08/2014 7:05:45 AM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: Wyatt's Torch

You seem well informed, esp for an Auburn graduate. :)

91

posted on

03/08/2014 8:08:42 AM PST

by

JGT

To: JGT

Ha! Sadly my econ professors at Auburn weren’t all that great. Really sad since the Ludwig Von Mises Institute in in Auburn. My degree is in finance and they had a very good department when I was there. I learned Econ from Jude Wanniski. His book “The Way the World Works” is fantastic.

Out of curiosity did you go to USC?

To: no-to-illegals

Leading standards have certainly come down over the past few years so that helps. The bigger issue is that businesses aren’t looking to borrow as much. And as you mention it’s not a bad thing that the banks are keeping it in reserve. That could help another liquidity crisis like 2008. I know bank fractional reserve minimums were increased after 2008 as well on order to do just that.

To: Wyatt's Torch

I went to Samford University in Birmingham, but did graduate work at UA. I like to do my part in keeping the rivalry interesting. Congrats on a great season, they should be very good again this fall.

94

posted on

03/08/2014 6:54:21 PM PST

by

JGT

To: txrefugee; John W; blam; TigerLikesRooster; M. Espinola; Chunga85

95

posted on

03/09/2014 1:22:24 AM PST

by

ex-Texan

(The Time to "Wake Up" is Over !)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-95 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson