I have been taking some profits over the past year.

In accordance with the strategy known as “asset allocation,” you might want to keep some money in equities, and the rest in bonds, cash, or equivalents. The general rule of thumb is that your age minus 10 is the percentage to keep in cash and bonds.

In other words, if you’re 40, then keep 30% in bonds, the rest in equities. If you’re 70, then the percentage is 60% cash and bonds.

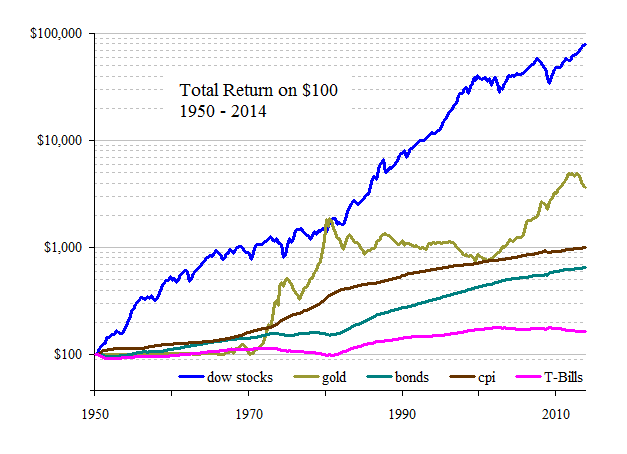

The theory is that the older you are, the less time you have to recover from a market setback, while if you are younger, then you need the compounding power of equities to build wealth.

Of course, your mileage may vary, depending upon your risk tolerance and total portfolio value.

In my case, I’m 64 years old and have been a long-term buy-and-hold investor for nearly 40 years. I’ve been through Nixon, Ford, Carter, Reagan, Clinton, two Bushes, and Obama. During that time, equities have roughly quadrupled the amount of money that I originally invested.

That includes the Dot Com bubble burst and the 08-09 meltdown. I didn’t bail out in either case, and actually added to my equity positions.

If you study the entire history of the markets for the past century and a half, it is evident that equities have been the best vehicle for creating wealth, compared to any other - bonds, commodities (including gold), land, etc.

There is no substitute for long-term disciplined investing. Obama one day will gone, and a business-friendly administration will be in office.

Never underestimate the wealth creating ability of the American Businessman and the creativity of Free Enterprise.