Skip to comments.

Investment & Finance Thread 2014 New Year(Mar. 10 edition)

Daily investment & finance thread ^

| Mar. 10, 2014

| Freeper Investors

Posted on 03/10/2014 3:29:03 AM PDT by expat_panama

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

|

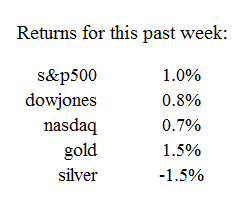

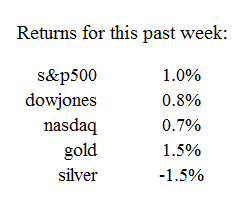

The past week sure seemed to be a lot of work getting nowhere, so I checked the comparative returns on typical investments: Doesn't seem like much of a change, but we always need to keep in mind the power of compound interest. should remember here the affect of compound interest, and a year's worth of +1% weeks yields more than sevenfold growth in assets, while a year of -1% weeks ends up being more than a 86% total loss. |

|

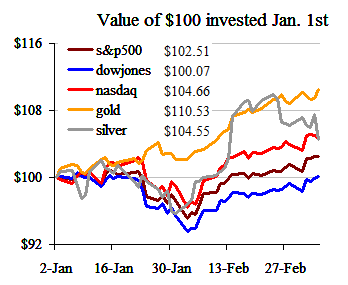

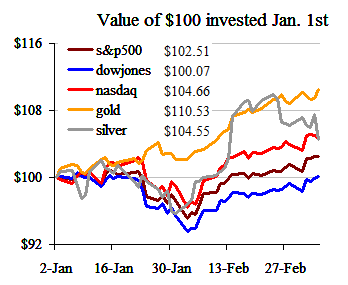

---and here are the daily values of $100 invested in various holdings; not including dividends, taxes, fees, commissions etc. |

We still hope to include here a -- --so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

To: expat_panama

21

posted on

03/12/2014 5:17:45 AM PDT

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: expat_panama

Ahead of the Bell: Dow futures are trading down 24 points and S&P futures are trading down 3 points. Concerns over an economic slowdown in China and the tug-of-war between the US and Russia over the occupation of Russian forces in Crimea are keeping investors jittery. Industrial metals, including copper, fell to a four year low and are free falling on growth prospects for the largest economy in Asia. Emerging market currencies, such as the Australian dollar, the Chilean peso, and South Africa’s rand, which are highly sensitive to commodities, all retreated. Reports suggest China’s central bank is prepared to loosen monetary policy if economic growth slows further by cutting the amount of reserves banks are required to hold. Market participants worry that China’s recent initiative to stamp out speculation on its rising currency and easy lending may have overshot, adding more strains on emerging markets.

• On the economic calendar today, the treasury budget will be released at 2:00 p.m. EST and $-218.0B is expected, vs. $-10.4B last month.

• The dollar is up against the Japanese yen and the British pound and down against the euro. Gold is trading at $1,356. Crude oil is currently trading at $98 a barrel.

• Yesterday, stocks fell from near a record while Treasuries gained, as copper and oil led commodities lower amid concern that signs of a slowing economy in China will hurt demand.

• On CNBC this morning, Charles Campbell, Executive Director at MKM Partners, talked about President Obama seeking to expand overtime pay and the slowdown in China. Campbell said every administration comes into office seeking to make their mark and this administration is tackling the minimum wage argument. On the argument that corporation are greedy, Campbell said companies seeking to make a profit are not necessarily a bad thing. The real issue is income level at American households, that is what is driving the push for raising the minimum wage. Campbell added to construct a policy that is highly popular might be dangerous. He went on to say the cause for concern over a slowdown in China is a reflection of the shadow banking system that is using copper and other industrial metals as a collateral. As a result, China is having a huge impact on emerging market currencies.

• Have a great day!

Tuesday’s Close

DJIA down 67.43 pts/-0.41%/ 16,351.25

S&P down 9.56 pts/-0.51%/ 1,867.56

Nasdaq down 27.26 pts/-0.63%/ 4,307.19

Wednesday’s Futures

Dow Futures down 24.00 pts/-0.15%

S&P Futures down 3.50 pts/-0.19%

Nasdaq Futures down 9.50 pts/-0.27%

Overseas Markets

FTSE -0.83%

CAC 40 -1.27%

NIKKEI 225 -2.59%

HANG SENG -1.65%

Overseas: Global stock markets are lower today. European and Asian markets are lower on concerns over a slowdown in China and the continuing crisis in Ukraine after Russian forces invaded Crimea.

Economic Reports: Treasury Budget ($-218.0B expected) at 2:00 p.m.

Top Headlines:

• King Digital Entertainment Plc, known for the hit mobile phone game Candy Crush Saga, said it expects to price its IPO at between $21 and $24 per share, valuing the company at about $7.56 billion. The company will list its shares on the New York Stock Exchange under the symbol “KING”.

• Media executives are questioning the Comcast-Time Warner Cable deal as it has raised questions about Comcast’s potential dominance of the US broadband Internet market if regulators allow its $45.2 billion merger with Time Warner Cable (TWC) to be completed.

• Hedge fund manager William Ackman is alleging that Herbalife Inc. (HLF) is breaking direct-selling laws in China and that he has evidence the to prove it.

Commodities/Currency:

Gold: up $12.41 to $1,356.90

Oil: down $1.40 to $98.75

EUR/USD 1.3869 +0.0012

USD/JPY 102.7305 -0.2495

GBP/USD 1.6586 -0.0030

Volatility Index (VIX): As of the close of business Tuesday, March 11, 2014 the VIX is up 0.50 at 14.70.

Companies Reporting Quarterly Earnings:

Dresser-Rand reports Q4 EPS 43c, vs. Est $1.29 and Q4 revenue $827M, vs. Est $1.09B.

Express reports Q4 EPS 57c, vs. Est 59c Reports Q4 revenue $715.88M, vs. Est $721.13M.

Today’s Opening and Closing Bells:

WGL Holdings, Inc. will visit the New York Stock Exchange. To mark the occasion, Terry D. McCallister, WGL Chairman and CEO, will ring the NYSE Opening Bell.

Glimcher Realty Trust (GRT), a premier real estate investment trust specializing in the development and ownership of retail properties, including regional malls, outlet centers and open-air centers, will visit the New York Stock Exchange (NYSE). This year marks the company’s 20th anniversary of listing on the NYSE. Chairman and CEO Michael P. Glimcher, joined by members of Glimcher’s leadership team, will ring the NYSE Closing Bell.

To: Lurkina.n.Learnin

You’re absolutely right. Thing is that these days protectionism doesn’t mean tariffs (that’s too obvious & it brings on clear consequences) it means ‘problems’ of one kind or another.

23

posted on

03/12/2014 8:17:14 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: Wyatt's Torch

Ahead of the Bell: Dow futures are trading down 24 points and S&P futures are trading down 3 points...This is what I was thinking as I began today, I even took profits on a couple with collapsing support levels. Now we got NASDAQ is up a tenth of a %. A market with no direction...

24

posted on

03/12/2014 9:15:40 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

To: Wyatt's Torch

26

posted on

03/13/2014 12:45:01 PM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

So are we at a buying opportunity or should we run for the doors?

27

posted on

03/13/2014 1:31:07 PM PDT

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: Lurkina.n.Learnin

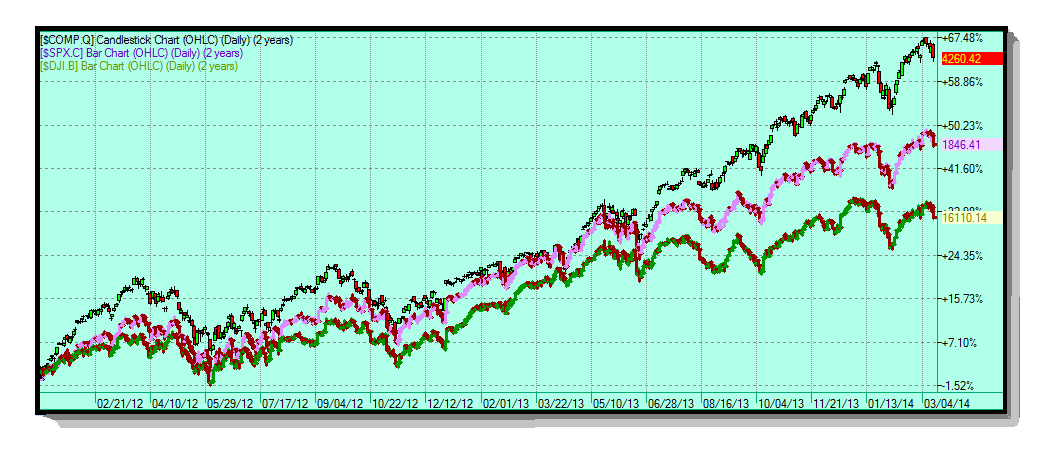

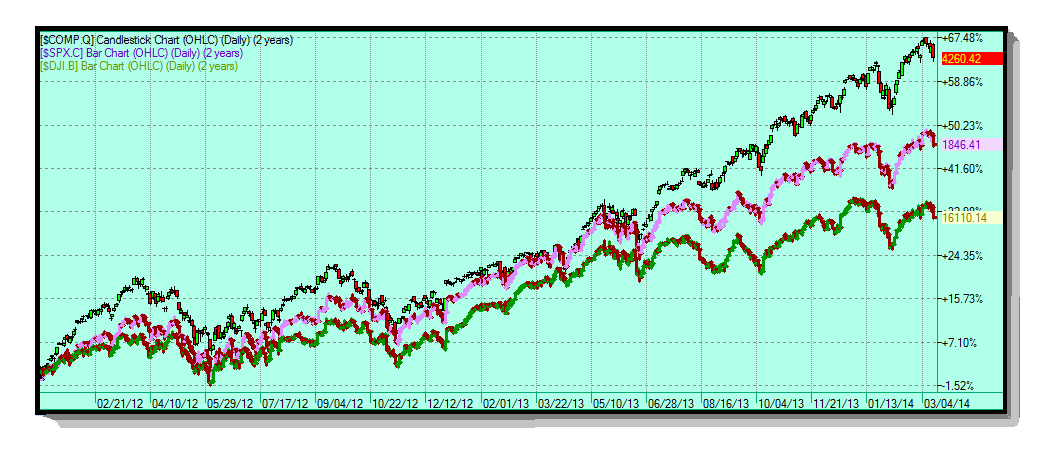

Whoa, now there's the question for the day. OK, so we all know that nobody but nobody knows for sure what tomorrow will bring, but we can know what's been going on and what's typical. Here's the past couple years for every day on the NASDAQ, the DOW, and the S&P500--

--and I'd have to say that seeing today all 3 indexes cutting down sure seems (imho) that we're looking at correcting a few more percent before continuing upward. At least that's the pattern I'm imagining, what's everyone else seeing in these 'tea-leaves'?

28

posted on

03/13/2014 3:09:12 PM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

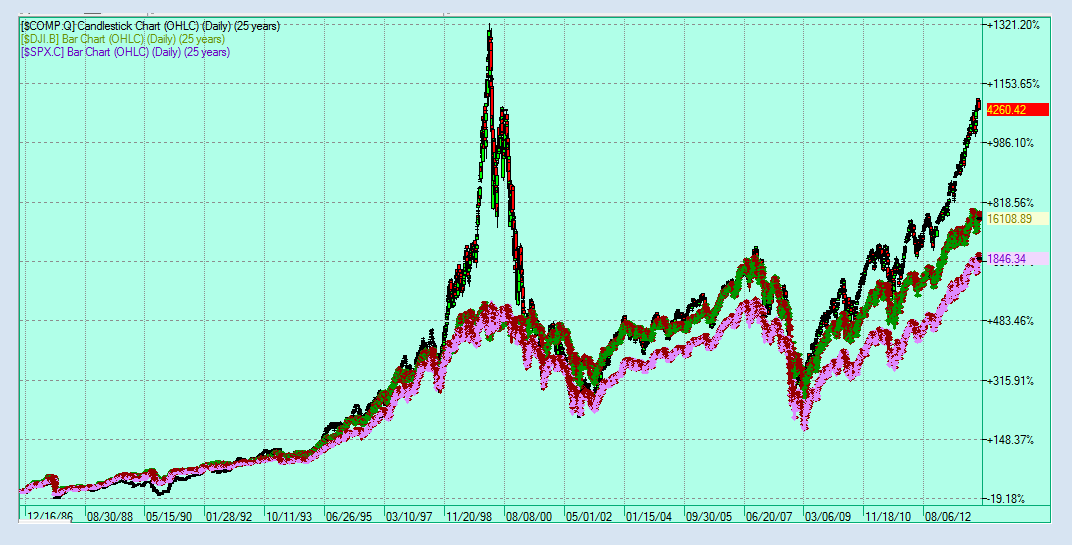

Agree. As I mentioned a couple of weeks ago I saw the head floor guy from NYSE at a NIRI event and he showed the S&P from 1990 through today. From a technical analysis standpoint it appears as if we’ve broken a double top pattern and headed higher. Also the S&P hasn’t caught up with corproate profits yet. Still some room to go.

BUY. THE. DIP.

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

So yesterday's 'festivities' was (from here) "Nasdaq lopped off 1.5%, while the S&P 500 cut 1.2%. The IBD50severed 2%. Volume rose across the board..." Before we predict the usual bounce from the fact that stock index futures are up a bit this AM, let's note that yesterday began with futures higher than what we got today. Seems the consensus on this thread is long term bullish and short term doubtful.

In the news:

Number of US millionaires hits new high

Asian shares tumble, yen gains on Ukraine anxiety

30

posted on

03/14/2014 5:03:59 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: Wyatt's Torch

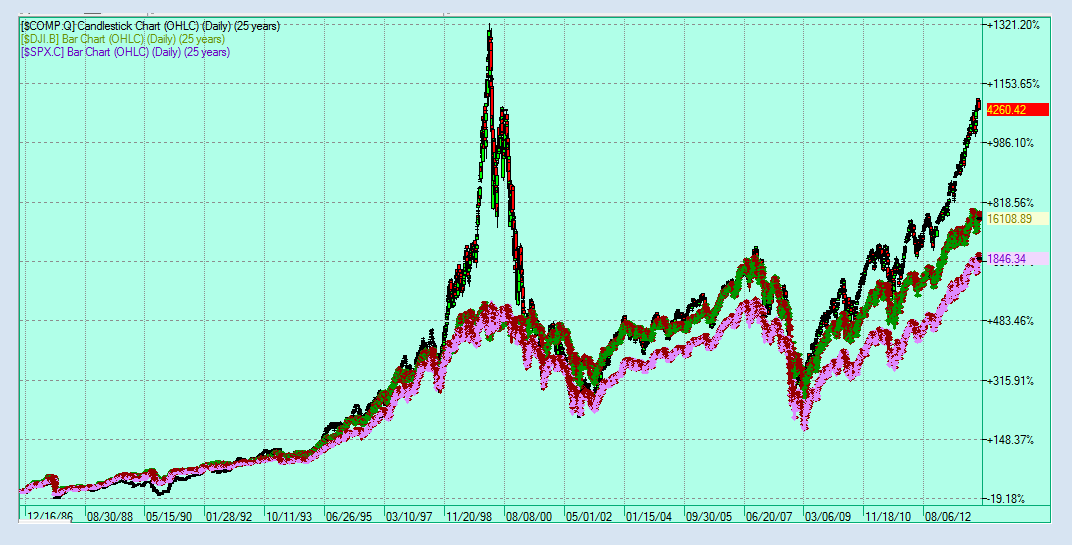

we’ve broken a double top pattern and headed higher.That's right, I've been hearing out that--

--and while there's always controversy over whether indexes follow buy/sell patterns like individual stocks do, the fact remains that this plateau we've been stock on for 15 years has outlived its usefulness and we're overdue for resumed growth...

31

posted on

03/14/2014 5:10:00 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: All

Looks like we've got some unexpected deflation:

| |

Actual |

Briefing Forecast |

| PPI |

-0.10% |

0.20% |

| Core PPI |

-0.20% |

0.10% |

32

posted on

03/14/2014 6:26:05 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

What do you think the FEDs response will be? Will they wait to see if it’s a one off?

33

posted on

03/14/2014 11:57:10 AM PDT

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: Lurkina.n.Learnin

You're right that a 'one-off' shouldn't matter, and the PPI has had them every 3 or 4 months for a few years now. That's for changes one month to the next. What I'm finding interesting is that the cumulative changes from one year to the next seem to be breaking new ground:

Of course that just for the PPI and we also need to pay attention the CPI and the GDP inflation too...

34

posted on

03/14/2014 1:42:00 PM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama; Lurkina.n.Learnin

35

posted on

03/17/2014 12:10:35 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.