Posted on 03/21/2014 11:30:11 AM PDT by Kaslin

I generally get very suspicious when rich people start pontificating on tax policy.

People like Warren Buffett, for instance, sometimes advocate higher taxes because they’re trying to curry favor with the political elite. Or maybe they feel compelled to say silly things to demonstrate that they feel guilty about their wealth.

Regardless, I don’t like their policy proposal (as you can see from TV debates here and here).

Regardless, I don’t like their policy proposal (as you can see from TV debates here and here).

That being said, I also realize that stereotypes can be very unfair, so it’s important to judge each argument on the merits and not to reject an idea simply because it comes from a rich guy.

That’s why I was very interested to see that Bill Gates, the multi-billionaire software maker, decided to add his two cents to the discussion of tax reform.

Here’s what Gates said at an American Enterprise Institute forum (transcript here and video here).

…economists would have said that a progressive consumption tax is a better construct, you know, at any point in history. What I’m saying is that it’s even more important as we go forward.

He doesn’t really expand on those remarks other than to say that it’s important to reduce the tax on labor.

That part of Gates’ remarks doesn’t make much sense for the simple reason that workers are equally harmed whether the government takes 20 percent of their income when it’s earned or 20 percent of their income when it’s spent.

But his embrace of a “progressive consumption tax” is very intriguing.

I don’t like the “progressive” part because that’s shorthand for high marginal tax rates, and that type of class-warfare policy is a gateway to corruption  and is also damaging to growth (see here, here, here, here, and here).

and is also damaging to growth (see here, here, here, here, and here).

But the “consumption” part is one of the key features of all good tax reform plans.

For all intents and purposes, a “consumption tax” is any system that avoids the mistake of double-taxing income that is saved and invested.

Both the national sales tax and the value-added tax, for instance, are examples of consumption-based tax systems.

But the flat tax also is a consumption tax. It isn’t collected at the cash register like a sales tax, but it has the same “tax base.”

Under a flat tax, income is taxed – but only one time – when it is earned. Under a sales tax, income is taxed – but only one time – when it is spent.  They’re different sides of the same coin.

They’re different sides of the same coin.

Most important, neither the flat tax nor the sales tax has extra layers of tax on saving and investment. And that’s what makes them “consumption” taxes in the wonky world of public finance economists.

This means no death tax, no capital gains tax, no double taxation of interest or dividends. And businesses get a common-sense cash-flow system of taxation, which means punitive depreciation rules are replaced by “expensing.”

So Bill Gates is halfway on the path to tax policy salvation. His endorsement of so-called progressivity is wrong, but his support for getting rid of double taxation is right.

If you like getting into the weeds of tax policy, it’s interesting to note that Gates is advocating the opposite of the plan that was proposed by Congressman Dave Camp.

Camp wants to go in the right direction regarding rates, but he wants to exacerbate the tax code’s bias against capital. Here’s what I said to Politico.

Dan Mitchell, an economist at the libertarian Cato Institute, said he didn’t see it as an individual versus business issue, but rather took issue with Camp’s punitive treatment of savings and investment. “The way Camp is extracting more money from businesses — more punitive depreciation and the like — is he is making the tax system more biased against savings and investment,” said Mitchell, who worked for Republican Sen. Bob Packwood after the historic 1986 tax act that Packwood helped negotiate as chair of the Finance Committee.

By the way, this doesn’t mean Camp’s plan is bad. You have to do a cost-benefit analysis of the good and bad features.

Just like that type of analysis was appropriate in 1986, when the bad provisions that increased taxes on saving and investment were offset by a big reduction in marginal tax rates.

The 1986 law did take aim at some popular business benefits, including a lucrative investment tax credit. But the reward was a lot sweeter. “At least then, we got a big, big reduction in tax rates in exchange,” Mitchell said.

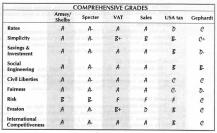

Here’s an interview I did with Blaze TV on Congressman Camp’s plan. If you pay attention near the beginning (at about the 2:00 mark), you’ll see my matrix on how to grade tax reform plans.

Dan Mitchell Explaining How to Grade Tax Reform Proposals

Now let’s circle back to the type of tax system endorsed by Bill Gates.

We obviously don’t know what he favors beyond a “progressive consumption tax,” but that bit of information allows us to say that he wants something at least somewhat  similar to the old “USA Tax” that was supported by folks such as former Senators Sam Nunn and Pete Domenici.

similar to the old “USA Tax” that was supported by folks such as former Senators Sam Nunn and Pete Domenici.

Is that better than the current tax system?

Probably yes, though we can’t say for sure because it’s possible they may want to increase tax rates by such a significant amount that the plan becomes a net minus for the economy.

Not that any of this matters since I doubt we’ll get tax reform in my lifetime.

P.S. Speaking of taxes and the rich, you’ll enjoy this very clever interview exposing the hypocrisy of wealthy leftists.

Still goes to the same barber after all these years.

sure looks like it

If it ain’t broke...

Still goes to the same barber after all these years.

Putting aside taxation burdens and the size of government, the reason to use a consumption tax is that it lets individuals lead private lives not scrutinized by the government.

Merchants will still be scrutinized, but the people that own and operate those businesses still get to go home at the end of the day to their private lives.

And getting taxing out of income means getting the IRS out of examining political charities, and churches.

And it doesn't tax saving and investment, which any income tax, even a "flat" one does.

Either a flat tax or a sales tax would work but only if all other taxes are scrapped .

Once again, pontificators who don’t know what they are talking about. Interest is not “double taxed”. Read the darn code...it is taxed as it is earned just like other income. If the guy cannot get the basics, he ought to get off the soap box.

“Still goes to the same barber after all these years.”

It looks like he got caught in a fence and ripped it out.

A consumption tax would totally screw the poor and middle class, they have to spend most of their earnings just to survive.

A business owner would run most of their consumption through their business tax free.

The rich can do their spending overseas.

A flat tax is more fair to everyone. Just do away with deductions and keep the rate low enough that everyone can live with it, and make sure it is one rate for everyone.

The More we lower their taxes the fuewer conservatives we have in this group and the feckless the remaining ones are. No more tax cuts or reforms for these people until the border is secure and their media stops being a Democrat mouse piece. Goes against the grain on most of us but with their support of amnesty and the country club war on conservatives I say don’t give them anything until they get right with us.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.