Posted on 03/30/2014 5:37:23 PM PDT by expat_panama

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow we'll go on with our--.

Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

======================

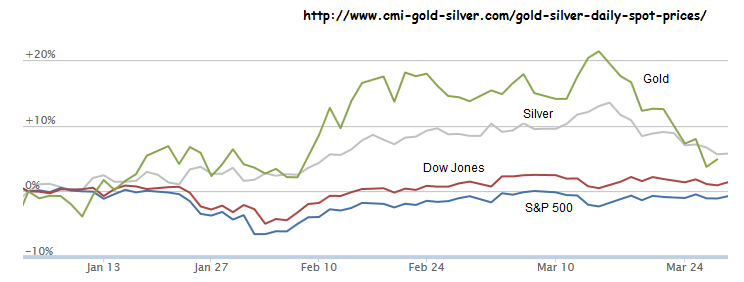

Year to date trends with stocks'n'metals--

--along with 'end-week' articles:

Amid signs that many technology and biotech stocks may have peaked -- the Nasdaq fell 3 percent last week -- markets will look to this coming Friday’s U.S. March employment report for support. The rout in tech and biotech stocks last week has some investors worried that a bubble has indeed [...] Forbes

This Fool sees a limb to go out on. And another. And another. Motley Fool

Stocks discussed on the in-depth session of Jim Cramer's Mad Money TV Program, Friday March 28 . 11 Things to Watch In The Week Ahead: CarMax ( KMX ), Monsanto ( MON ), Buffalo Wild Wings ( BWLD ), Micron ...Seeking Alpha

NEAT!!! tx...

Just the same, all this market ‘fairness’ talk is a crock. I think ‘access’, and if it’s not fraud then it’s ok.

It's fascinating and important stuff if you are a trader/institution that has to worry about 1/10th of a quarter point when buying/selling huge blocks. I'm now a long term investor only looking at 1-10 years into the future. I look at investments, determine whether I am willing to buy/sell them and then place buy/sell orders. I don't have to trade around my position. That's it. Now, this brilliant Katsuyama screams to the world that the "Market is Rigged". I don't like the drama queen ploy he used to sell his book.

First - not his book. Lewis wrote it.

Second - Lewis points out that the retail investor isn’t harmed by the pricing. It’s the large traders/firms that make up 95% of the trading volume.

I thought Katsuyama was very poised. O’Brien was incredibly defensive and belligerent. Borderline hysterical.

NYSE MAC DESK MID-DAY MARKET UPDATE:

DOW 16,500 (+42 points), S&P500 1879 (+7 handles), Brent Crude $106.21/barrel (-$1.55), Gold $1,281.00/oz. (-$2.40)

MARKET DRIVERS: (Stocks are looking strong again today, as the S&P 500 touched a new all-time intraday record high. An increase in the ISM manufacturing index has boosted investor-optimism on the state of the U.S. economy.)

• The U.S. Institute for Supply Management’s manufacturing index increased to 53.7 in March from 53.2 in the prior month; falling short of the Street’s projected reading of 54. Readings above 50 indicate growth.

• In addition, construction spending rose 0.1% in February, as expected..

• PMI data from China was “mixed”, with the official gauge, which focuses on larger state-owned enterprises, edging up to 50.3 in March from 50.2 in February. However, the HSBC index, which gives more weight to smaller private companies, slipped to 48 from 48.5. HSBC said that its reading confirms the weakness of domestic demand and that it implies 1Q GDP growth of below the annual goal of 7.5%.

• Euro-zone manufacturing PMI slipped to 53 in March from 53.2 in February. The survey indicated that production rose 1% in Q1 and GDP was +0.5%. Meanwhile, euro-zone unemployment held steady at 11.9% in February, coming in below consensus of 12%.

A lot of market factors in our favor today… First day of a new month and a new quarter has a solid history of an upside bias as we usually see new money being put to work by money managers. In addition, history also dictates that the month of April is the best month of the year for the Bulls… Then, when we got to the floor at the crack of dawn this morning, we saw global markets rallying on hopes that more China economic stimulus is on the way after more disappointing economic data came out of the world’s second-largest economy. China’s official purchasing managing index inched up to 50.3 in March from 50.2 in February, (small expansion); however, some economists argue it still suggest weakness because activity usually picks up more after the Lunar New Year. Meanwhile, the Markit/HSBC Purchasing Managers’ Index, which focuses more on the private sector, slid to an eight-month low of 48.0 last month. Look for the powers-that-be in China to make a ‘stimulative’ move very soon… In following, US ISM hit the tape after the opening bell and was cheered by traders; pushing the major indices to session-highs and, particularly, moving the S&P 500 to a new intraday high… To this point, traders contend that the most important issue going into Q2 is: will the economy pick up? We need GDP to lift from 1.5 to 2% in Q1 to at least 2.5% in Q2 and over 3% in the second half. Hence, the big debate on trading desks for Q2: growth versus value. The popular trade going into Q1 was to be long growth and short non-growth. However, many traders have been hurt badly in the last few weeks on that trade. A lot of the debate is over whether the growth names with big run-ups remain ‘buys’ at the higher prices… Time will tell… Moving on, the Dow has settled into a narrow trading range, and volume is heavier, with ~260M shares on the tape at this time… Internally, breadth is bullish across the board. Advancing Issues: 2631 / Declining Issues: 1603 — for a ratio of 1.6 to 1. New 52-Week Highs: 205/ New 52-Week Lows: 17… Meanwhile, in the trading pits, The yield on the 10-year Treasury note ticked up to 2.752% on a slight sell-off. In addition, gold is furthering losses to a near seven-week low… Still hearing much buzz about Michael Lewis’ book, “Flash Boys”. If you have questions or concerns feel free to shoot me a note. This topic, and the topic of equity market structure in general is right in my wheelhouse. Bottom-line, the current structure of equity markets is waaaay too complex and needs real reform… Would love to discuss over a few cold ones with anyone who is available! -— Good for now… Have a tremendous day!

1) I believe I addressed your point by stating this: It's fascinating and important stuff if you are a trader/institution that has to worry about 1/10th of a quarter point when buying/selling huge blocks.

2) Right in the beginning Katsuyama to agreed that the Markets are Rigged.

I have no dog in this hunt, but claiming that “The Market is Rigged” puts (pun intended) me off. ; ) I'll let you big boys sort this out. BTW, I agree with Lewis to keep regulators far away from this issue because the smart people will find away to get around the new regs. I also agree with Brad, that they are talking their books.

Thanks for that ping. Good stuff. Thought we were going to see a WWE match.

The only thing that's 'rigged' is the loopy extreme leftwing press that demanded O'Brian explain his 'unfair' profits. That part put me off even more. Of course the bottom line here is that the loopy-lefty press is fact of life --just like all the fact that we got a mob of union-loonies infesting FR "capitalism-is-rigged" threads.

We just need to remember that life is good, and if it were too easy it wouldn't be any fun.

Talking about life being good and fun! My sister clued me into the travel coffee show “Dangerous Grounds.” Todd Carmichael went to your neck of the woods and came up with this coffee. I still haven't seen the Panama episode, I will let you know when I do. He built his coffee company from scratch. It is now worth $20 million. He searches the world for the perfect bean.

http://shop.lacolombe.com/products/panama-hacienda-la-esmeralda

Yesterday the S&P500 cut a new high with indexes higher with volume. IBD TV says the market's officially back in an uptrend, and this morning's metals and index futures point to more of the same.  Other news:

Other news:

- Stocks: Pushing cautiously onto new ground CNNMoney - an hour ago Markets look ready to grind higher Wednesday, as investors make a cautious push into uncharted territory. U.S. stock futures were edging up, and global markets posted gains, after the S&P 500 closed at an all-time high Tuesday.

- Caterpillar hearing morphs into tax-code debate USA TODAY - 10:06am The Senate committee hearing was scheduled to focus on heavy machinery giant Caterpillar's avoidance of $2.4 billion in U.S. taxes by shifting profits to a wholly owned Swiss subsidiary.

- World stocks rise on US data, Japan stimulus hopes World stock markets pushed higher Wednesday on signs of a pickup in the U.S. economy and expectations of further stimulus in Japan.

- Gold nudges up but still near seven-week low; China demand rises

- U.S. construction spending barely up as homebuilding tumbles U.S. construction spending barely rose in February as outlays on private residential construction projects recorded their biggest decline in seven months, a sign that severe weather continues to hobble the economy. Construction spending edged up 0.1 percent to an annual rate of $945.7 billion, the… Reuters

- Google investors are about to get GOOG and GOOGL shares in stock split Google stock is set to split Wednesday in a move meant to give founders Larry Page and Sergey Brin more control. MarketWatch GOOG $1,134.90 1.83%

Now we got stock futures churning around the break even point, I’m very much looking forward to the MID-DAY MARKET UPDATE to hear what other shoes we got dropping...

That Michel Lewis is going to be on Imus in the morning about 8:30 if anyone cares.

5:30 here though. In 15 minutes.

Looks like this is becoming the new story being used to distract us from Obamanomics --replacing that Malaysian airliner. This is from just this morning:

U.S. stock-index futures were little changed, after the Standard & Poor’s 500 Index reached an all-

time high, as investors awaited reports to gauge the strength of the recovery in the world’s biggest economy.

MannKind Corp. doubled in early New York trading after its inhaled treatment for diabetes won the recommendation of a U.S. advisory panel. Netflix Inc. climbed in New York as Les Echos reported it will seek to avoid French rules on financing and promoting French-language movies when targeting that market. Apollo Education Group Inc. slipped 2.7 percent in pre-market trading after it received a subpoena from the Education Department for marketing and recruitment records.

Futures on the S&P 500 expiring in June added 0.1 percent to 1,879.7 at 7:25 a.m. in New York. The equity gauge climbed 1.3 percent in the first three months of 2014, its fifth consecutive quarterly advance. Dow Jones Industrial Average contracts gained 21 points, or 0.1 percent, today.

“Today’s ADP numbers will be the most important signpost for markets,” Witold Bahrke, who helps oversee $55 billion as a senior strategist at PFA Asset Management in Copenhagen, wrote in an e-mail. “Growth appears not too strong to feed the Fed’s hawks but neither too slow to question the recovery, re-

emphasizing the sweet-spot concept — which should be the most favorable environment for risky assets in 2014.”

Federal Reserve Chair Janet Yellen said last week that “considerable slack” in the labor market is evidence that the central bank’s unprecedented accommodation will be needed for “some time” to put Americans back to work.

A report from ADP Research Institute at 8:15 a.m. New York time may show that U.S. companies added more workers last month than in February, according to economists’ forecasts. A separate release from the Commerce Department at 10 a.m. may show factory orders rose in February. The data showed weakness earlier this year as the unusually harsh winter curtailed economic activity.

Most European stocks climbed as investors awaited reports that may show the U.S. economic recovery is gathering pace following the harsh winter. U.S. index futures were little changed, while Asian shares advanced.

Deutsche Post AG added 3.6 percent after Europe’s largest mail service predicted operating profit will rise through 2020. Neste Oil Oyj rallied 5.4 percent after a U.S. Senate committee proposed extending a tax credit for biodiesel. Deutsche Boerse AG dropped 2.5 percent after confirming that one of its

businesses has become the subject of a criminal investigation.

The Stoxx Europe 600 Index gained 0.2 percent to 337.11 at 12:37 p.m. in London as more than three stocks rose for every two that fell. The benchmark has climbed 3.9 percent since March 24 as better-than-forecast U.S. consumer-confidence data signaled the world’s largest economy has rebounded from the bad winter. Standard & Poor’s 500 Index futures increased 0.1 percent today. The MSCI Asia Pacific Index added 0.4 percent, advancing for the sixth day.

• Support:1877, 1869, 1858

• Resistance: 1889, 1893, 1905

Home prices in the U.S. are poised to rise as housing regains its historical standing as a way to minimize the risks of inflation, according to Rod Smyth, chief investment strategist at RiverFront Investment Group LLC.

As the CHART OF THE DAY illustrates, the median price of a single-family home has risen by an average of 1 percentage point more than the consumer price index since 1969. The comparison is based on data provided by the National Association of Realtors and the Commerce Department.

Twelve-month averages of real, or inflation-adjusted, home prices are displayed in the chart. The latest average, for the 12 months ended in February, surpassed $200,000 for the first time since May 2009.

“Housing has been a good hedge against inflation, except following periods of house-price speculation,” Smyth wrote two days ago in a report featuring a similar chart.

Prices turned higher in March 2012, three years into the current bull market in U.S. stocks. The average real price rose 17 percent through February, which trailed a 32 percent advance for the Standard & Poor’s 500 Index in the same period.

“A recovery is under way” that will make housing more competitive with stocks as an investment, Smyth wrote. The Richmond, Virginia-based strategist collaborated with two colleagues on the report.

Lewis was on Jon Stewart’s show last night :-)

I've been trying to figure out how I get screwed if I have a limit order in at say $30.05, how they will sell it to me for 30.06. Of course they may sell a boat load of stock to someone for 30.06 and cut me out if it never gets to 30.05, but that's my choice to keep my order in at 30.05 and not raise it to get filled.

I just put an order in at a price I'm willing to pay and then go eat breakfast. If someone else makes a penny or two, what does that have to do with me? What I DON'T like is looking at a streaming quote box with fictitious buy and sell orders there. The price moves up and down without ANY trades at the prices shown and the shown prices are just canceled and moved and no trades happen. How can I interpret interest in a stock or option if all the bids and asks are false? On options, you can see a list of bids for say, .38, .39,.40, with 500 to 1000 beside each one, then the price moves from .40 to .35 and NONE trade, each one disappearing as the price moves through each price. I've watched all day on some trades and the volume might be 110 at the end of the day and all day I was looking at thousands ready to trade. It's all made up, just a machine making up numbers to make it look as someone was interested. I once sold some PCAR puts short in the AM and bought them back in the PM and I was the only trades all day. The daily volume was 20. I sold and bought 10 for that day. All day long the options moved up and down with several hundred listed beside the calls and puts. As it turned out, I was the only trades that day. I suppose I sold the puts to a market maker and then bought them back from the same guy at the end of the day. He was probably hedging some bet he made in the underlying stock. I made $1800 in a few hours just on the stock move with no other option traders. Strange day.

I agree this is being blown completely out of proportion. I can see if I was trading hundreds of thousands of shares that it would be a problem but to say the entire market is rigged is hogwash. Last year a lot of people stayed away because of their fears of losing a big chunk of their life savings so they kept their money in a bank account that might have paid them .25% instead of being in the market that fairly easily would have paid 25%. A guy that had $100,000.00 could have put 1% of his money in the market and made $250 or the same amount he would have made off of his entire savings at .25%. One of the hardest things to overcome in investing is paralysis. This is reinforcing that paralysis across a wide spectrum of society. The lord only knows what the political hacks are going to do with this.

Interesting that this is the wording that we seem to hear more often than not and I have to agree with it. We're not hearing "the U.S. economy's expanded to record levels"; OK so we could argue that percapita real GDP's reached an all time high ($52,323 for Q3 2013), but we've also got too many other factors on the downside (imho).

This has always been about the institutional investors and never about the individual/retail investor. Lewis never claimed it was. Katsuyama never claimed it was. Absolutely nobody is saying the retail investor is being harmed. If they are they are making up their own premise because it’s not part of the actual discussion. Retail investor are sub 5% of the volume.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.