Posted on 04/02/2014 3:55:29 PM PDT by BfloGuy

The fear of deflation serves as the theoretical justification of every inflationary action taken by the Federal Reserve and central banks around the world. It is why the Federal Reserve targets a price inflation rate of 2 percent, and not 0 percent. It is in large part why the Federal Reserve has more than quadrupled the money supply since August 2008. And it is, remarkably, a great myth, for there is nothing inherently dangerous or damaging about deflation.

Deflation is feared not only by the followers of Milton Friedman (those from the so-called Monetarist or Chicago School of economics), but by Keynesian economists as well. Leading Keynesian Paul Krugman, in a 2010 New York Times article titled “Why Deflation is Bad,” cited deflation as the cause of falling aggregate demand since “when people expect falling prices, they become less willing to spend, and in particular less willing to borrow.”[1]

Presumably, he believes this delay in spending lasts in perpetuity. But we know from experience that, even in the face of falling prices, individuals and businesses will still, at some point, purchase the good or service in question. Consumption cannot be forever forgone. We see this every day in the computer/electronics industry: the value of using an iPhone over the next six months is worth more than the savings in delaying its purchase.

Another common argument in the defamation of deflation concerns profits. With falling prices, how can businesses earn any as profit margins are squeezed? But profit margins by definition result from both sale prices and costs. If costs — which are after all prices themselves — also fall by the same magnitude (and there is no reason why they would not), profits are unaffected.

If deflation impacts neither aggregate demand nor profits, how does it cause recessions? It does not. Examining any recessionary period subsequent to the Great Depression would lead one to this conclusion.

In addition, the American economic experience during the nineteenth century is even more telling.

Twice, while experiencing sustained and significant economic growth, the American economy “endured” deflationary periods of 50 percent.[2] But what of the “statistical proof” offered in Friedman’s A Monetary History of the United States? A more robust study has been completed by several Federal Reserve economists who found:

... the only episode in which we find evidence of a link between deflation and depression is the Great Depression (1929-34). We find virtually no evidence of such a link in any other period. ... What is striking is that nearly 90% of the episodes with deflation did not have depression. In a broad historical context, beyond the Great Depression, the notion that deflation and depression are linked virtually disappears.[3]

If deflation does not cause recessions (or depressions as they were known prior to World War II), what does? And why was it so prominently featured during the Great Depression? According to economists of the Austrian School of economics, recessions share the same source: artificial inflation of the money supply. The ensuing “malinvestment” caused by synthetically lowered interest rates is revealed when interest rates resort to their natural level as determined by the supply and demand of savings.

In the resultant recession, if fractional-reserve-based loans are defaulted or repaid, if a central bank contracts the money supply, and/or if the demand for money rises significantly, deflation may occur. More frequently, however, as central bankers frantically expand the money supply at the onset of a recession, inflation (or at least no deflation) will be experienced. So deflation, a sometime symptom, has been unjustly maligned as a recessionary source.

But today’s central bankers do not share this belief. In 2002, Ben Bernanke opined that “sustained deflation can be highly destructive to a modern economy and should be strongly resisted.”[4] The current Federal Reserve chair, Janet Yellen, shares his concerns:

... it is conceivable that this very low inflation could turn into outright deflation. Worse still, if deflation were to intensify, we could find ourselves in a devastating spiral in which prices fall at an ever-faster pace and economic activity sinks more and more.[5]

Now unmoored from any gold standard constraints and burdened with massive government debt, in any possible scenario pitting the spectre of deflation against the ravages of inflation, the biases and phobias of central bankers will choose the latter. This choice is as inevitable as it will be devastating.

Humans need to consume to survive and want to consume to improve their lives. That prices are dropping won't change that.

Now, if the government decides it must control prices and announces a schedule under which all prices must drop by such-and-such a per cent each month, then, perhaps, the fears of deflation might be true. Given a timetable, consumers might, indeed, alter their buying habits to take advantage of future savings.

But given a stable currency and an economic climate where investment in production resulted in gradual improvements in efficiency [and, therefore, price decreases], no such unwillingness to consume would happen.

The 1880s saw the greatest increase in per-capita GDP in American history. Unemployment fell to 2.5%, despite high immigration. Real wages rose 23% between 1879 and 1889. The country boomed, led by heavy capital investment. The amount of rail track laid, for example, grew from 2,665 miles in 1878 to 11,568 miles in 1882. The value of building permits increased by 150% between 1878 and 1883.

And here’s the most fascinating part of the story… prices steadily fell from the end of the Civil War until the early 1890s, when they finally stabilized. You’d be hard-pressed to find a working economist today on Wall Street who could explain why the greatest decades of economic growth in American history could have been achieved during a period of deflation.

We could all stand with some "deflation" in food and energy prices. And by the way, food and energy are the two things that the Bureau of Labor Statistics does NOT count when calculating inflation. How convenient.

Debtors will not repay loans with dollars worth much more than what they borrowed causing massive, systemic default. Widespread default means there are fewer people willing and able to loan money.

Of course that's only a problem for those who are debtors and without money.

Like 90% of the voters in the USA.

Bet on inflation. The Fed is a political animal.

There is a difference between falling prices, because of increased productivity and innovation......and falling prices because the economy is being starved of money.

There are other facets of deflation that should not be ignored. An important one is a strong decline in economic *velocity*. Velocity is how rapidly the same money travels through the economy.

For example, you are paid a dollar, then you immediately spend that dollar to buy a candy bar. The same day the store that sold you the candy bar purchases more inventory, and their wholesaler pays one of its employees with that dollar. This is substantial economic velocity.

However, during deflation, when you are paid that dollar, though prices are dropping, you hang on to it instead of buying things, or only spend it on essentials.

Gresham’s law (bad money pushes out good) happens with just the single currency, by slowing down economic velocity. That is, deflated money is the good money, which you save, and bad money is *not* buying things, even though their price is dropping.

>>There is a difference between falling prices, because of increased productivity and innovation......and falling prices because the economy is being starved of money.<<

Yes, and the biggest problem presented by deflation caused by a monetary contraction is that wages are sticky. Businesses can cut costs in many areas during a deflation, but it’s very difficult to cut wages.

Instead, costs are cut by laying off employees (rather than imposing a, say, 5% across the board cut on them.) As the deflation of the 1930’s continued, more and more people were laid off and jobs became scarcer and scarcer. Had the Fed simply maintained a steady supply of money, the Depression need not have happened. The didn’t, and it did.

The late 1800’s might have been a wonderful success story over the long run, but I believe bank panics were common during that time, and the immediate aftermaths weren’t pretty.

Why would anyone *ever* drop the price of...anything?

...and the answer is: to sell something faster.

If you don’t want to sell something faster, then you can simply hold your price instead of dropping it.

So the answer to the question of deflation, falling prices, is that dropping prices speeds up sales.

Or viewed from the other angle: slowing sales cause Sellers to lower their prices.

On Sale Now! Hurry!

It is all about moving money faster.

Ping

True!

“The 1880s saw the greatest increase in per-capita GDP in American history. Unemployment fell to 2.5%, despite high immigration. Real wages rose 23% between 1879 and 1889. The country boomed, led by heavy capital investment. The amount of rail track laid, for example, grew from 2,665 miles in 1878 to 11,568 miles in 1882. The value of building permits increased by 150% between 1878 and 1883.”

Yes, and also, everyone, from state governments backing railroad bonds, to state and federal governments giving public land for railroads rights of way, to foreign and domestic investors, to bankers, investors and individuals of every economic level borrowing to invest were investing in railroads. At the end it was followed by the period of the highest rate of bankruptcies in American history and opened American law and jurisprudence to much if what we have in bankruptcy law today. Yes, the boom in railroads fueled a growing economy in the late 1800s, and was followed by the panic of 1893, as the railroads and all the investment in them based on debt proved to be an unrealistic bubble -

“people rushed to withdraw their money from banks and caused bank runs. The credit crunch rippled through the economy. A financial panic in the United Kingdom and a drop in trade in Europe caused foreign investors to sell American stocks to obtain American funds backed by gold.[91] People attempted to redeem silver notes for gold; ultimately the statutory limit for the minimum amount of gold in federal reserves was reached and US notes could no longer be successfully redeemed for gold.[91] Investments during the time of the Panic were heavily financed through bond issues with high interest payments. The National Cordage Company (the most actively traded stock at the time) went into receivership as a result of its bankers calling their loans in response to rumors regarding the NCC’s financial distress. As the demand for silver and silver notes fell, the price and value of silver dropped. Holders worried about a loss of face value of bonds, and many became worthless. A series of bank failures followed, and the Northern Pacific Railway, the Union Pacific Railroad and the Atchison, Topeka & Santa Fe Railroad failed. This was followed by the bankruptcy of many other companies; in total over 15,000 companies and 500 banks failed (many in the west). According to high estimates, about 17%–19% of the workforce was unemployed at the Panic’s peak. The huge spike in unemployment, combined with the loss of life savings by failed banks, meant that a once-secure middle-class could not meet their mortgage obligations. As a result, many walked away from recently built homes. From this, the sight of the vacant Victorian (haunted) house entered the American mindset.”

http://en.wikipedia.org/wiki/1890s

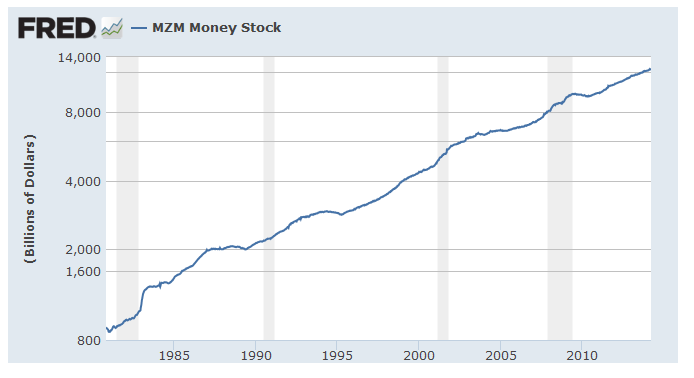

Let's get real. Money supply August 4, 2008: $8,788,900M. March 17, 2014: $12,413,100M. Money supply growth's been steady for decades:

Deflation is a problem in an economy built on debtors.

If there are debtors then there are lenders. Economic activity means there are debtors and lenders. Deflation is a problem in an economy built on economic activity.

tx. good way to start the new day ;)

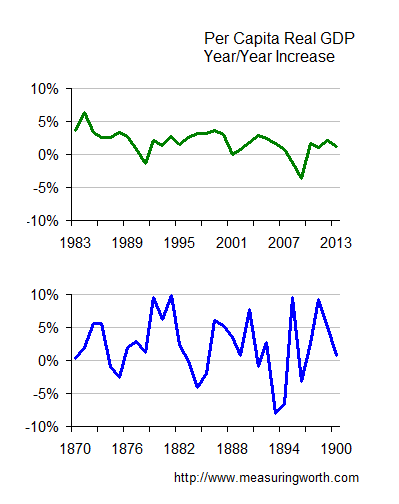

From 1870 to 1900 percapita gdp rose by $2,964 to $6,004 --in 2009 dollars. Compare that to the most recent three decades where our per capita gdp's increased by $20,844 to $49,797 --also in 2009 dollars. Most people would prefer what we have today.

Something else is the fact that growth in the late 1800's was chaos --we'd fall by 7% one year and soar by 10% the next:

Looking at the two eras side by side makes it impossible to say the economy of the late 1800's was "stabilized".

Heh. Good trick, using this new-fangled "MZM". Sort of like how the feds keep re-defining CPI.

But we have become over-indebted because the Fed has fixed the price of interest too low. It has done that by inflating the currency. The two are one and the same.

You can't just fix one and then worry about the other later.

I disagree. The velocity of money is an interesting but, ultimately, meaningless metric.

Money is an asset. People earn money and, as long as they hold on to it, they own it. That's all there is to it.

No one talks about the velocity of furniture or, I don't know, the velocity of automobiles. And why would they? You own them and you sell them when and if you feel like it.

Money is no different. The economy does not depend on the spending of money ever more quickly from one person to the next. That is the great mistake of Keynesianism.

Economic growth is not caused by consumer spending; it occurs when money is saved and then lent to entrepreneurs who use it to expand production or make current production more efficient.

Production causes economic growth -- not consumer spending.

Yes!

But the economy can only be "starved" for money when it has previously been fed too much by the government which suddenly yanked it away. A free market in money would adapt to changes in its supply just as it adapts to changes in the amount of oil available or the number of tomatoes available for sale.

I don’t think the velocity of money is particularly Keynesian. It actually makes more sense than imagining an economy as a static zero sum game, because it envisions economics as a dynamic model, which more accurately reflects its behavior.

I actually can talk about velocity with automobile production. Car companies do not make a batch of cars and sell them before making the next batch. They continually make new ones as the old ones are selling. A dynamic system. Even their intra-company money velocity matters. As soon as they are paid for a car, the money circulates through their system, paying wages and buying new materials, as well as funding future products r&d.

For them to have too much cash on hand is a real problem. They need to keep it moving and doing things to remain a vital company.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.