Posted on 04/16/2014 9:34:35 AM PDT by Kaslin

I realize this may be a thought crime by DC standards, but it sure would be nice to eliminate the high tax rates that undermine economic growth and reduce American competitiveness.

At the risk of sharing too much information, I fantasize about a world without the internal revenue code. In addition to getting rid of high tax rates, I also want to abolish the pervasive double taxation of income that is saved and invested.

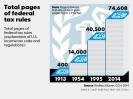

Just as important, I want to wipe out the distorting loopholes that tilt the playing field in favor of politically connected interest groups. And I daydream about how much easier tax day would be if ordinary people didn’t have to figure out how to comply with an ever-changing tax code.

Just as important, I want to wipe out the distorting loopholes that tilt the playing field in favor of politically connected interest groups. And I daydream about how much easier tax day would be if ordinary people didn’t have to figure out how to comply with an ever-changing tax code.

But perhaps you’re a normal person and you don’t dwell on these topics. Your fantasies probably have nothing to do with fiscal policy and instead involve that hottie in your neighborhood.

That’s fine. I’m actually envious of well-adjusted people who don’t fixate on the cesspool of Washington.

But – at the very least – I want you to agree that America needs fundamental tax reform. And to help persuade you, here are some fresh stories to remind you that the tax code and the IRS are a blight on society.

For instance, how do you feel about the IRS engaging in partisan politics, asreported by the Washington Times.

Even as the IRS faces growing heat over Lois G. Lerner and the tea party targeting scandal, a government watchdog said Wednesday it’s pursuing cases against three other tax agency employees and offices suspected of illegal political activity in support of President Obama and fellow Democrats.…the Office of Special Counsel…said it was “commonplace” in a Dallas IRS office for employees to have pro-Obama screensavers on their computers, and to have campaign-style buttons and stickers at their office. In another case, a worker at the tax agency’s customer help line urged taxpayers “to re-elect President Obama in 2012 by repeatedly reciting a chant based on the spelling of his last name,” the Office of Special Counsel said in a statement. …Another IRS employee in Kentucky has agreed to serve a 14-day suspension for blasting Republicans in a conversation with a taxpayer.

For more information about this nauseating scandal, read the wise words of Tim Carney and Doug Bandow.

Or what about the time, expense, and anxiety that the tax code causes for small businesses? Heck, even the Washington Post has noticed this is a big issue.

More than half of small employers say the administrative burdens and paperwork associated with tax season pose the greatest harm to their businesses, according to a new survey by the National Small Business Association.Forty-seven percent say the actual tax bill hits their companies the hardest. On average, small-business owners spend more than 40 hours — the equivalent of a full workweek — filing their federal taxes every year. One in four spends at least three full weeks on the annual chore. There is also the expense of doing that work. Only 12 percent of employers filed their taxes on their own this year, down from 15?percent last year — and hiring help can be pricey. Half spent more than $5,000 on accountants and administrative costs last year. One in four spent more than $10,000.

I was tempted to say compliance costs add insult to injury, except that understates the problem. Watch this video if you want to understand why the tax code needs to be junked.

And let’s not forget that high tax rates are pointlessly destructive and bad for America. Dozens of companies have redomiciled in other jurisdictions to get out from under America’s punitive corporate tax system. And more are looking at that option. Here are some excerpts from a report in the U.K.-based Financial Times.

Walgreens has come under pressure from an influential group of its shareholders, who want the US pharmacy chain to consider relocating to Europe, in what would be one of the largest tax inversions ever attempted. …The move, known as an inversion, would dramatically reduce Walgreens’ taxable income in the US, which has among the highest corporate tax rates in the world. …In a note last month, analysts at UBS said Walgreens’ tax rate was expected to be 37.5 per cent compared with 20 per cent for Boots, and that an inversion could increase earnings per share by 75 per cent. They added, however, that “Walgreens’ management seems more hesitant to pull the trigger near-term due to perceived political risks.”

By the way, “perceived political risks” is a polite way of saying that the team at Walgreens is worried that the company might be targeted by the crowd in Washington. In other words, it will be attacked if it does the right thing for workers, consumers, and shareholders.

But that’s blaming the victim. All you really need to know is that America’s corporate tax system is so harsh that companies don’t just escape to Ireland, Switzerland, the Cayman Islands, and Bermuda. They even find better fiscal policy in Canada and the United Kingdom!

Last but not least, do you trust the IRS with your confidential financial data? If you answer yes, seek help right away from a mental health professional and check out these stories.

According to the Washington Times:

A new cost-saving computer technology being implemented by the IRS has left the agency vulnerable to hacking, putting taxpayers’ info at risk, an investigative report has found. …although the IRS has developed cybersecurity guidelines, many of the servers aren’t following them, said a report by the agency’s internal watchdog, the Inspector General for Tax Administration. In fact, the servers failed 43 percent of the tests investigators put them through, though they aren’t releasing what those tests and settings are due to security concerns.

I have the same fantasy, Dan, as you do.

Your fantasy flat tax will not do the trick, though.

BUT, the FairTax will!

The income tax system is exactly how the ruling elite want it: easily manipulated to punish or reward.

TAXES AND A CIVILIZED SOCIETY

4 ½ minute video

http://www.youtube.com/watch?v=FmYXEwbK1k0&list=UUFDlhK80EdO28R-iGTXiGaw

THE FAIR TAX WOULD BE THE BIGGEST TRANSFER OF POWER FROM DC BACK TO THE PEOPLE IN THIS COUNTRY’S HISTORY.

The FairTax is replacement, not reform. It replaces federal income taxes including personal, estate, gift, capital gains, alternative minimum, Social Security, Medicare, self-employment, and corporate taxes.

The FairTax brings jobs back to America by allowing companies to operate on our soil tax free rather than paying the current corporate income tax of 35 percent. Under the FairTax, various economists have predicted higher economic growth ranging from 7 to 14 percent over the current system, more jobs, and higher wages.

With the penalty for working harder and producing more removed, Americans are free to keep every dollar they earn, and a new era of economic growth and job creation is unleashed. Hidden taxes are history, Americans are able to save more, and businesses invest more. Capital formation, the real source of job creation and innovation, is facilitated. Gross domestic product (GDP) increases by an estimated 10.5 percent in the first year alone. The FairTax as proposed raises the economy’s capital stock by 42 percent, its labor supply by 4 percent, its output by 12 percent, and its real wage rate by 8 percent.

As U.S. companies and individuals repatriate, on a tax-free basis, income generated overseas, huge amounts of new capital flood into the United States. With such a huge capital supply, real interest rates remain low. Additionally, other international investors will seek to invest here to avoid taxes on income in their own countries, thereby further spurring the growth of our own economy.

There has never been a better time to make it happen.

Yes, I know that.

That is why I keep promoting passage of the FairTax, in part to disempower the ruling elites!

Great post!

Taxman Bravo Zulu!

One of the huge strengths of the fair tax is that it makes the taxation rate transparent to the payer.

Something else that would accomplish this would be to eliminate withholding.

Make everyone pay taxes by writing a quarterly check.

Better yet, make them write an annual check and move tax day to Oct 31. Right before elections.

Freepers who would like to be added to the FairTax Ping List should ping or FReepmail me. Likewise if you would like to be taken off the list.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.