Skip to comments.

Investment & Finance Thread (Apr. 27 edition)

Daily investment & finance thread ^

| 04/27/2014

| Freeper Investors

Posted on 04/27/2014 4:06:29 PM PDT by expat_panama

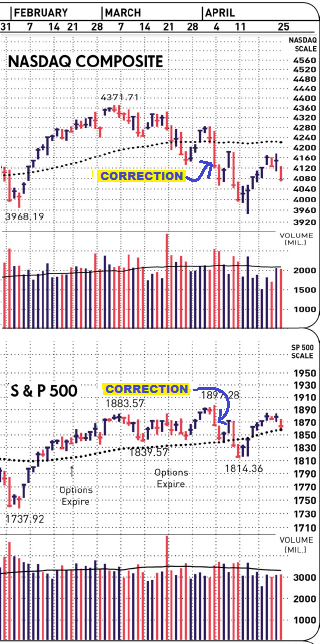

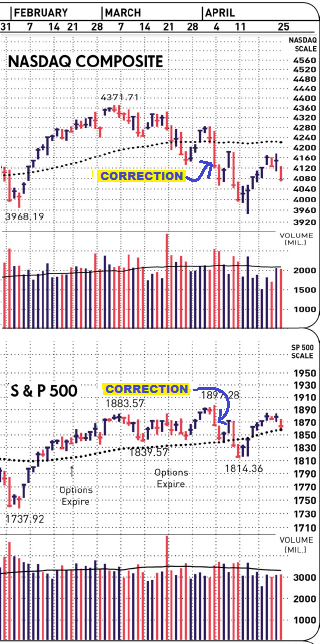

While we've all been asking 'which way' for the past few weeks all we've been getting is 'nowhere in particular'.

|

OK, so in the past 3 months we've seen everything leap up but then they all flop back to next to nothing just sitting there for a few weeks. Seems IBD called it right by saying the correction began 3 weeks ago with no 'uptrend' so far. Major indexes have given us new lows and descending highs --with volume on the bearish side. We got all kinds of pundits predicting all kinds of directions, but imho the "usually reliable" signs say we may as well get ready for more of the same. Unless we get a follow thru day tomorrow. 8P btw, IBD's clear on that follow-thru stuff saying it's no guarantee of things to come. It's just that (like they say) while not every FTD brings in a good uptrend, we know that every good up trend has had a FTD. |

|

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

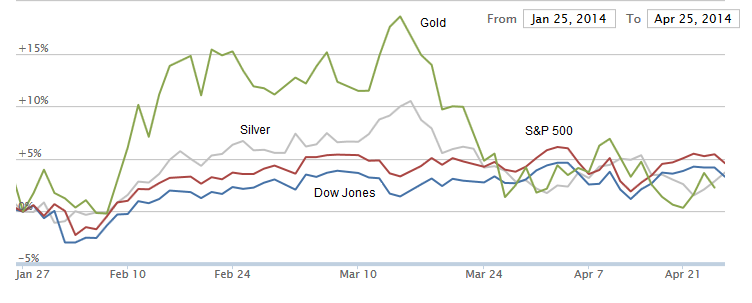

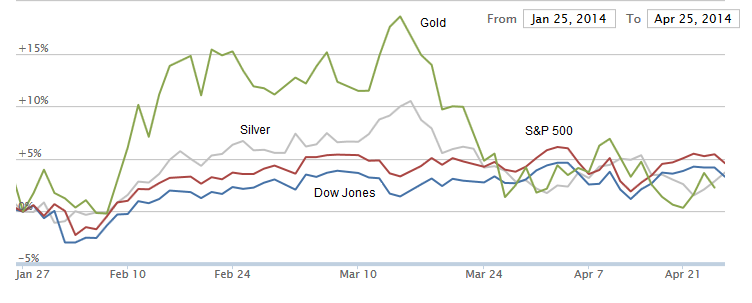

A lovely new day to all! After yesterdays "mixed in higher trade" we now got index futures soaring and metals coming out the other end. News:

To: Lurkina.n.Learnin

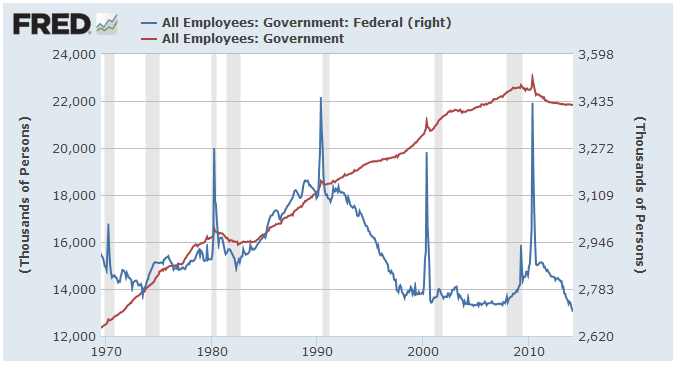

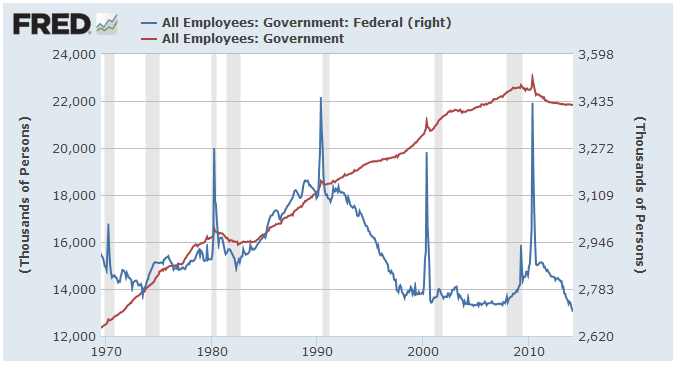

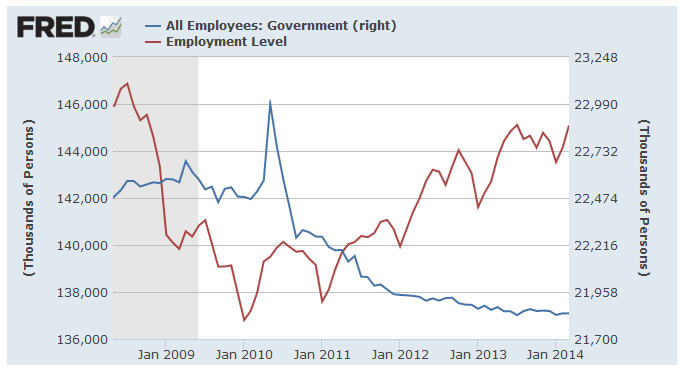

State and local payrolls have been very hard hit the last 6 years:

State:

Local:

To: Wyatt's Torch

There is a smidgeon of good news in Louisiana this morning.

http://theadvocate.com/home/9027645-125/retirement-age-increased-by-bill

Retirement age increased by bill

Capitol news bureau

April 28, 2014

A House-passed bill that would raise the age state employees could retire headed Monday to the full Senate.

The Senate Retirement Committee advanced House Bill 38. HB38 would change the retirement age to 62 years of age, after five years of service. The current age is 60.

The committee amended the legislation to set a July 1, 2015, start date for the change.

HB38 sponsored by state Rep. Kevin Pearson, R-Slidell, now moves to the Senate floor for debat

23

posted on

04/29/2014 4:45:02 AM PDT

by

abb

To: Wyatt's Torch; Lurkina.n.Learnin

...State and local payrolls have been very hard hit the last 6 years...That may not be a given. Another way of looking at it is that we're seeing more of a corrective 'downsizing'---

--like how we see in the private sector with productivity rising with a recession. What I'm saying is rather than being 'very hard hit', that gov't payrolls can also be seen as resetting to more appropriate levels.

must be federal employees only.

That may be true; problem is that iirc it includes overseas military as well as stateside civilian, that plus one's from Census Bur. data and the fed graph uses BLS numbers.

To: expat_panama

Oh I don’t disagree that it was needed. But people can;t have it both ways. They can’t complain about the slow job growth when it is being impacted by declines in government employees. Also on NFP days you will see people say that the job growth is “all government” when that is factually false. People here are their own worst enemies because they refuse to be informed.

To: expat_panama

Good morning expat:

Any idea if Warren Buffett dumped a bunch of shares of BAC prior to their recent ‘miscalculation’? Not that he would act on inside information...

26

posted on

04/29/2014 6:05:18 AM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: expat_panama

To: Wyatt's Torch

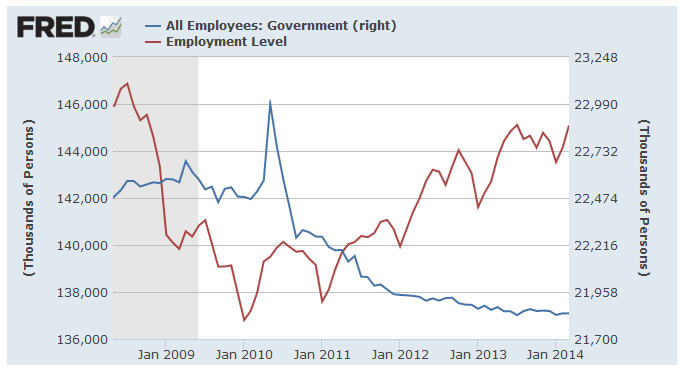

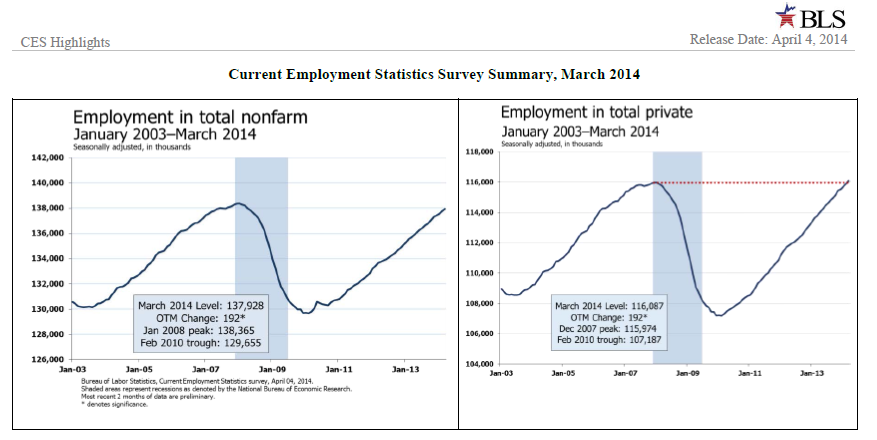

can’t complain about the slow job growth when it is being impacted by declines in government employeesSure they can --and they do it all the time. OK, we're talking about justified complaints. Seriously, there's reason to consider that the impact of gov't payroll declines can actually increase job growth. The thing is that since Jan. '08 we've had a negative correlation between gov't payrolls and total employment--

--so whether or not we're seeing a causal relationship here, we can pretty much accept that boosting gov't payrolls has not measurably helped total employment levels and cutting gov't payrolls hasn't seemed to hurt..

To: MichaelCorleone

gm Mike,

Funny how he always seems to get a pass on everything, like backing the president by calling for higher taxes for the rich (& his secretary shows up at the SOTU address) --just so the IRS would ease up w/ the hundreds of millions in unpaid taxes that Buffet's Berkshire Hathaway owed.

Then again, his status may be changing now --"Why Is Buffett So Quiet With Executive Pay? - Joe Nocera, New York Times".

To: Lurkina.n.Learnin; expat_panama

Does it include private contractors doing jobs once done by government employees?

30

posted on

04/29/2014 8:00:37 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

That is a good point. Also the computer advances during that time period should have had a large impact.

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

huh, we got a weird Wednesday morning with futures traders, all sectors are down! --metals lead the way and stock indexes follow. For stocks it makes sense after the way yesterday's modest gains came in on light trade (w/ big money expecting a downside). The gains were never quite able to crack though their resistance ceilings and now they've run out of steam. Other news:

- Europe Stocks Hit by Increase in Inflation Rate Wall Street Journal - 2 hours ago The euro edged higher and a recent rally in European stocks stalled Wednesday, with a pickup in inflation inside the currency bloc denting expectations that the European Central Bank is set to provide further monetary stimulus any time soon.

- Why Investors Expect To "Sell In May And Go Away" After a volatile month, ETF investing strategists expect the stock market to follow the seasonal "sell in May and go away" script as many technical indicators are warning that a sell-off lies ...Investor's Business Daily

- Playing Defense In a Market In Transition - Kevin Marder, MarketWatch

- Economy Acts As Predicted, Except When It Doesn't - Irwin Stelzer, TWS

- As Prices Rise, the Housing Recovery Wobbles - Paul Davidson, USA Today

- It Would Be a Shock If the FOMC Changes Direction - Stephen Oliner, RCM

- Fed expected to take further step toward ending bond buying

- The Largest LBO Ever Finally Hits Bankruptcy - Matt Levine, Bloomberg

- 2 giant banks, seen as immune, become targets Prosecutors are looking to address public outrage and alter the belief that Wall Street institutions are “too big to jail.”

- Senate ready to sink effort to boost minimum wage

- The Minimum Wage Has Its Origins In Racism - Carrie Sheffield, Forbes

To: Lurkina.n.Learnin

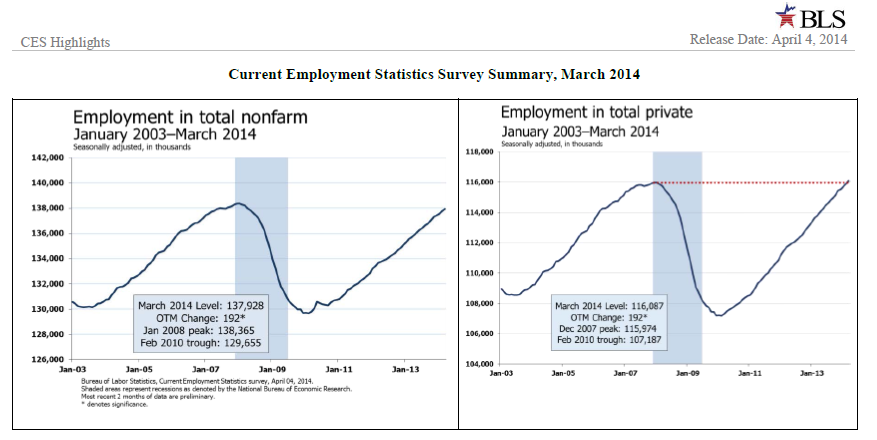

Wouldn’t the same be true (and even more so) of private payrolls which are now at an all time high?

To: expat_panama

ADP out at 8:30 Consensus Est = +200K (Source: FactSet)

We have our earnings call this morning so I’m out of pocket most of the day. Good luck to all!

To: Wyatt's Torch

Act ADP +220K

Prior month revised up from +192K to +209K

To: expat_panama

To: Lurkina.n.Learnin; 1010RD

contractors doing jobs once done by government employees?a good point. Also the computer advances

The BLS numbers are employee/payroll lists, suppliers/contractors would be on other lists. My take is we're seeing a lot of downsizing/outsourcing like everywhere else. Years ago I could call someone at the IRS for questions, later it was an offshore 'tech support', and now it's all FAQ's online. What would be nice would be if the savings went to lower taxes, but instead we get tax hikes w/ gov't growth.

To: Wyatt's Torch

Wouldn’t the same be true (and even more so) of private payrolls which are now at an all time high?That's true for private payrolls where efficiency spawns growth, but not all sectors need to grow. We're better off with an improved designed car that uses less structural steel to produce a car that's stronger and safer --that means info/design employment grows and steel production employment falls even while total employment is higher.

We're talking gov't employment here which is down --and rightly so-- their payrolls replaced by tech improvements and outsourcing. This is also why total private employment is like you said--

--at an "all time high" (just barely)-- while total payrolls (including gov't) are still "not quite".

To: expat_panama; Lurkina.n.Learnin

That is what makes me suspect that a lot of the government payroll deduction is actually being shifted to contractors and perhaps at a higher price.

39

posted on

04/30/2014 6:23:44 AM PDT

by

1010RD

(First, Do No Harm)

To: All

GDP came in at 0.1% --here's how the good positive upbeat news is reported (

from here):

by Bill McBride on 4/30/2014 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the first quarter (that is, from the fourth quarter of 2013 to the first quarter of 2014), according to the "advance" estimate released by the Bureau of Economic Analysis.

...

The increase in real GDP in the first quarter primarily reflected a positive contribution from personal consumption expenditures (PCE) that was partly offset by negative contributions from exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

--and compare that take to how they reported the beginning of THE GREAT RECESSION (from here):

Q4 GDP Plummets to .6%

By Kimberly Amadeo January 30, 2008

The BEA reported that the advance U.S. GDP growth for Q4 2007 plummeted to .6% from an 4.9% in Q3, and 3.9% in Q2. The total GDP for the year was 2.2%, down from the 2006 growth rate of 2.9%. The decline in growth was due to the housing market slowdown and related weak consumer spending. (Source: GDP News Release)

Coincidentally, it is the exact same number as GDP growth in Q1 2007. The last time GDP was that low was in Q1 2003, the tail-end of the last recession. A healthy growth rate is about 2-3%. For a review of the most recent GDP reports, see GDP Current Statistics.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson