Skip to comments.

Investment & Finance Thread (Apr. 27 edition)

Daily investment & finance thread ^

| 04/27/2014

| Freeper Investors

Posted on 04/27/2014 4:06:29 PM PDT by expat_panama

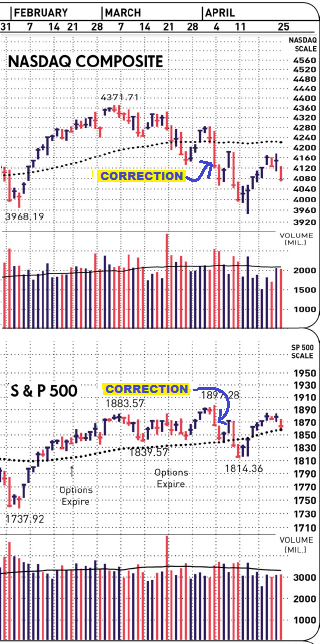

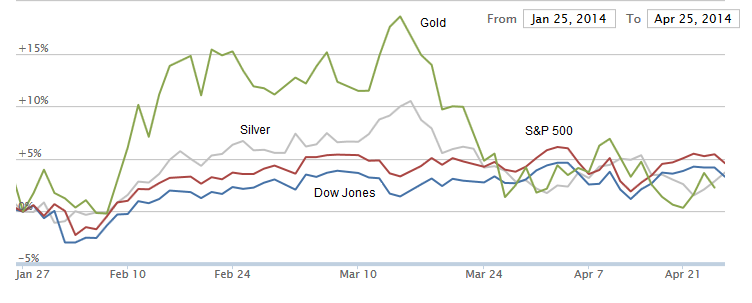

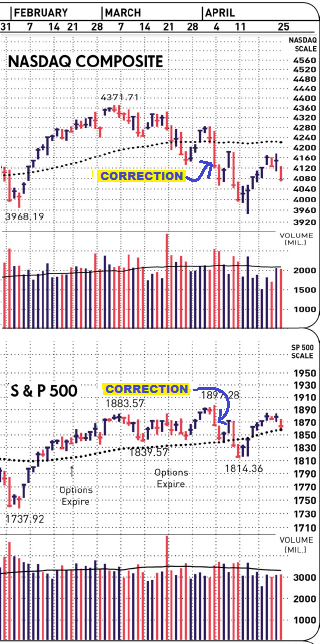

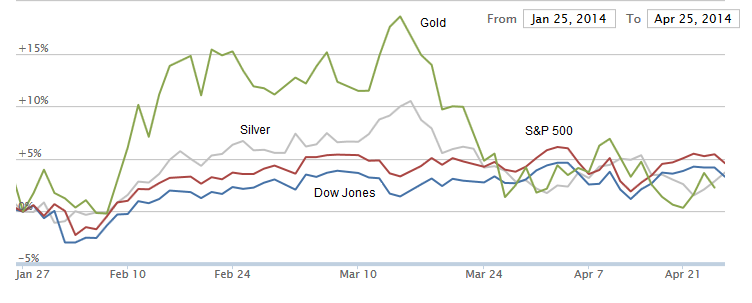

While we've all been asking 'which way' for the past few weeks all we've been getting is 'nowhere in particular'.

|

OK, so in the past 3 months we've seen everything leap up but then they all flop back to next to nothing just sitting there for a few weeks. Seems IBD called it right by saying the correction began 3 weeks ago with no 'uptrend' so far. Major indexes have given us new lows and descending highs --with volume on the bearish side. We got all kinds of pundits predicting all kinds of directions, but imho the "usually reliable" signs say we may as well get ready for more of the same. Unless we get a follow thru day tomorrow. 8P btw, IBD's clear on that follow-thru stuff saying it's no guarantee of things to come. It's just that (like they say) while not every FTD brings in a good uptrend, we know that every good up trend has had a FTD. |

|

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

To: 1010RD

...government payroll deduction is actually being shifted to contractors and perhaps at a higher price...Agreed that we see a problem of sweetheart deals in 'sole-source' contracts breeding political paybacks, but most competitive bid contracts make costs much less as the private sector can get the job done sooo much better than gov't employees can.

To: expat_panama

To: Wyatt's Torch

It is strong at 3.0, but that’s down from 3.5 in Q4 2013.

To: expat_panama

And half of it related to healthcare spending...

We Just Saw The Biggest Explosion In Health-Care Spending In Over 30 Years, And It Had A Big Impact On GDP surgeon, doctor, OR

Spending on health care grew an astounding 9.9% in the Bureau of Economic Analysis' advance estimate of first-quarter GDP.

It's the biggest percent change in health-care spending since 1980, when health-care spending jumped 10% in the third quarter. Analysts said it's primarily due to a consumption boost from the implementation of the Affordable Care Act. Adjusted for inflation, America is spending more on health care than ever before.

Personal consumption grew by 3.0%, about half of which was due to the growth in health-care spending, said Ian Shepherdson, chief economist for Pantheon Macroeconomics.

"If health-care spending had been unchanged, the headline GDP growth number would have been -1.0%," Shepherdson said.

A BEA representative said the uptick "reflects additional spending associated with the implementation of the Affordable Care Act."

The first-quarter advance estimate reflects spending from January through March, the first three months when millions of people who gained insurance by signing up on exchanges established by the law or by qualifying for Medicaid coverage under the program's expansion.

Jared Bernstein, the former chief economist to U.S. Vice President Joe Biden and now a senior fellow at the Center on Budget and Policy Priorities, speculated that the growth was more likely associated with the Medicaid expansion at this point.

Sign-ups through the exchanges exploded in March, the last month of the first open enrollment period. Of the more than 8 million people who eventually enrolled in insurance plans, nearly half signed up in March or in a special two-week extended period in April. This means the uptick in health-care spending could be even bigger next quarter.

The detailed consumption data in the advance GDP report displays that spending on doctors and hospital services began to rise rapidly last fall, when the law known as Obamacare was implemented.

"Both are now running at more than twice their pre-Obamacare trend, indicating that pent-up/hidden demand for healthcare was huge," Shepherdson said.

"Next question: How long will it last?"

Here's a chart from Pantheon that shows the growth over the past year in spending on doctor and hospital services, the two factors that dominate the health-care portion of GDP: Obamacare chart

Ian Shepherdson/Pantheon Macroeconomics

Here's a chart from Business Insider's Andy Kierz that shows the annualized quarterly change since 1980: Health care spending

Andy Kiersz/Business Insider

To: Wyatt's Torch

“”If health-care spending had been unchanged, the headline GDP growth number would have been -1.0%,” Shepherdson said. “

That doesn’t sound good.

To: Wyatt's Torch

...due to a consumption boost from the implementation of the Affordable Care Act. Adjusted for inflation, America is spending more on health care than ever before....

Wait a second.

We're saying that "affordable" equals "spending more than ever before"?

To: expat_panama

We have a government that is too big to be honest. Even if it were the most moral, ethical and careful government in the history of the world its reach and scope are so broad that it cannot know what it is doing.

47

posted on

04/30/2014 11:17:51 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

When they hold a gun to your head forcing you to spend more it is not good. It robs you of the money you want to spend on things you want. The ACA will deplete the free cash flow of our economy.

To: expat_panama

49

posted on

04/30/2014 12:01:48 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

Yellen is Obama’s baby.

She’ll pump up QE again if this goes sour. GDP as something like .1% growth this past quarter.

It will stay that way until republicans take over the congress. Then the bottom will fall out, and Hillary and everyone else will be fumigating about how the republicans screwed everything up.

Boehner and McConnell will agree with them and agree to pay reparations. Then they will run

50

posted on

04/30/2014 12:07:57 PM PDT

by

xzins

( Retired Army Chaplain and Proud of It! Those who truly support our troops pray for victory!)

To: Chgogal

"China poised to pass US as world’s leading economic power this year"A lot of people have been kicking around that story for a while, and depending on which currency conversion used some say China's already bigger. Back in the early 1950's America's gdp was more than half the world's total and now we're "only" about 30%; somehow I don't see how being richer is a bad thing if others get rich too.

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Good morning! Yesterday we saw stocks rise a bit in slightly higher trade and this morning's future traders call for more advances today with metals off. News:

Stocks brush off China, U.S. data misses, euro bulls run May Day holidays in Europe and much of Asia muted the market impact on Thursday of data showing China's vast manufacturing sector just missed forecasts, a day after U.S. growth numbers had also disappointed. That and persistent doubts about the European Central Bank's policy plans helped lift the euro, something the ECB, which meets…

Fed tapers, markets shrug but Dow manages record close

Daily Ticker

American justice is blind, likes the sound of money: Taibbi

Dow at Record: Time to Sell In May and Go Away? - Adam Shell, USA Today

Why Investors Expect to 'Sell In May and Go Away' - Trang Ho, Investor's

There Are 17 Good Reasons to Stay Invested - Mark Hulbert, MarketWatch

Global Warming 'Deniers'? Let's Talk Market Deniers - Chad Nelson, RCM

To: xzins

...Yellen is Obama’s baby. She’ll pump up QE again ...That's what a lot of people have been thinking but the word's out that the Fed's lost its magical powers on economic growth--

--and we're going into this new downturn with no ammo left.

To: 1010RD

We have a government that is too big to be honest... --and we put it there, so we'll change it back. America's been a force for good for hundreds of years and that can't change over night.

To: expat_panama

I had read something about QE having lost its ability to artificially undergird/stimulate the economy. My guess is they’ll try higher than 85B before they give up on it. They’ll go to 100B maybe. That’ll send the market soaring.

It’s conceivable that the exit strategy is to let the republicans win the 2016 election and blame the market crash and hyper-inflation on them. Hillary shouldn’t be so confidant of victory.

55

posted on

05/01/2014 4:44:24 AM PDT

by

xzins

( Retired Army Chaplain and Proud of It! Those who truly support our troops pray for victory!)

To: xzins

"I had read something about QE having lost its ability to artificially undergird/stimulate the economy."

Quote from Dallas Fed Chairman Richard Fisher:

It is my firm belief that the fault in our economy lies not in monetary policy but in a feckless federal government that simply cannot get its fiscal and regulatory policy geared so as to encourage business to take the copious amount of money we at the Fed have created and put it to work creating jobs and growing our economy. Fiscal policy is not only “not an ally of U.S. growth,” it is its enemy. If the fiscal and regulatory authorities that you elect and put into office to craft taxes, spending and regulations do not focus their efforts on providing incentives for businesses to expand job-creating capital investment rather than bicker with each other for partisan purposes, our economy will continue to fall short and the middle-income worker will continue being victimized, no matter how much money the Fed prints. I don’t want to ruin your evening after such a pleasant dinner. But if you wish to know who is at fault for hollowing out the welfare of middle-income workers and the American economy, kindly do not look at me or my colleagues at the Fed. When you go home tonight look at yourself in the mirror. We at the Fed are providing more than enough monetary accommodation. You elect our fiscal and regulatory policymakers. It is time for them to do their job, to ally themselves with us to achieve a fully employed, prosperous America. Only you, as voters, have the power to insist that they craft policies that are needed to restore American prosperity. Please do so.

Have a most pleasant evening!

To: expat_panama

KCG: THE LOOK…May 1st, 2014

U.S. stock-index futures were little changed, after the Dow Jones Industrial Average climbed to a

record yesterday, as investors awaited data on jobless claims and manufacturing.

DirecTV rose 8.2 percent in early New York trading after a report said AT&T Inc. approached the satellite-television company about a possible acquisition. Yelp Inc. gained 8.7 percent after raising its forecast for 2014 revenue. Sprint Corp. rallied 6.1 percent after a report said it plans to pursue a bid for T-Mobile US Inc. Viacom Inc. may move after a report that it will buy the U.K.’s Channel 5. and posting second-

quarter profit that beat projections.

Futures on the Standard & Poor’s 500 Index expiring in June added less than 0.1 percent to 1,878.3 at 7:38 a.m. in New York. Dow contracts were unchanged at 16,511. The 30-stock equity gauge rose 0.3 percent yesterday, topping the previous record it reached on Dec. 31.

“The waters are never completely clear of tips of icebergs to hit markets or economies, but things are optimistic for the U.S.,” Nick Beecroft, the London-based chairman and senior market analyst at Saxo Capital Markets U.K. Ltd., said by telephone. “Although the Ukrainian situation is very disturbing, for a software developer in Palo Alto or a pharma company in the Midwest, it must seem a million miles away. I don’t think it will derail the U.S. economy.”

The S&P 500 posted a 0.6 percent gain in April as better-than-estimated economic data and corporate results offset escalating tensions between the U.S. and Russia over the latter’s intentions on Ukraine.

Data at 8:30 a.m. in Washington may show first-time claims for unemployment benefits fell to 320,000 in the week to April 26, from 329,000 in the previous period, according to economists polled by Bloomberg. A Labor Department report tomorrow may show employers added 215,000 workers in April, the most since November, according to economists’ projections.

A separate report from the Institute for Supply Management at 10 a.m. may show a gauge of manufacturing in the U.S. increased to 54.3 in April, from 53.7 in March, economists projected in a survey. Fifty is the dividing line between expansion and contraction.

U.K. stocks rose for a fourth day as Lloyds Banking Group Plc led banks higher on better-than-

estimated earnings. Commodities fell after Chinese manufacturing expanded less than forecast.

The FTSE 100 Index of U.K. shares rose 0.3 percent at 7:50 a.m. in New York in the longest winning streak since February. Markets from China to Germany and France are closed for holidays.

• Support:1876, 1868, 1855

• Resistance:1888, 1893, 1905

U.S. auto sales running at the fastest pace since 2007 are driving up imports of palladium, according to Barclays Plc.

The CHART OF THE DAY shows palladium exports from Switzerland to the U.S. climbed to the highest since October 2012 last month, using data from Barclays and the Swiss Federal Customs Administration. Russia, the biggest producer of the metal used in automobile catalytic converters, typically exports the metal to Switzerland for storage.

“Switzerland remained a net exporter of palladium in March with exports reaching 180,000 ounces, nearly double year over year,” Christopher Louney and Suki Cooper, analysts at Barclays, said in an April 25 report. “The notably high shipments to North America point towards improving auto demand.”

Palladium rose 13 percent this year to $807.88 an ounce, beating gains in gold, platinum and silver and heading for the best start to a year since 2010. U.S. cars and light trucks sold in March at a 16.3 million annualized rate, the most since May 2007 and up from 15.3 million in February.

Palladium used in auto catalysts accounted for 72 percent of demand last year, according to London-based Johnson Matthey Plc, which has produced one of every three of the devices. North America was the biggest user of palladium for catalysts, with a 26 percent share, Johnson Matthey data show.

To: xzins

Just curious as to what your solution is to a liquidity crisis?

To: expat_panama

“Dow at Record: Time to Sell In May and Go Away? “

Boy they sure are pushing that. I keep hearing it everywhere.

To: Wyatt's Torch

I haven’t really thought about it. If the Fed under Yellen keeps spending the way they do why would banks stop lending is what I’d ask myself.

If QE is stopped, then everything will contract. I think I’d encourage businesses to focus on their core business and operate it without borrowing. Go back to the same values they had when they were a young, vigorous start-up and couldn’t borrow.

Another possibility would be a world war and cut everything including social security, medicare, etc. as part of the war effort. (/sarc)

60

posted on

05/01/2014 6:22:37 AM PDT

by

xzins

( Retired Army Chaplain and Proud of It! Those who truly support our troops pray for victory!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson