Skip to comments.

Triple Storm For Natural Gas Fails To Break $5/Mcf

Forbes ^

| 4/27/2014

Posted on 04/28/2014 12:14:01 PM PDT by thackney

For nearly my entire career, natural gas producers have complained that prices were too low. Only when they soared briefly, as in 2008, did companies seem satisfied. However, the inability to distinguish between secular trends and cyclical behavior has long bedeviled the petroleum industry, most recently with Chesapeake Energy spending freely in the belief that abnormally high gas prices would remain.

When prices dropped from over $10/Mcf in 2008 to under $2/Mcf in 2012 (wellhead average), howls of pain emitted from the Southwest as many drillers could not cover costs, even excluding those who overpaid for acreage. And drilling did, in fact, respond, with the number of gas directed rigs in the US falling to 300 from the high of 1500.

But analysts expecting a quick price recovery ignored the role of natural gas liquids. The various substances like propane, butane and ethane (along with condensate) can be worth more than the produced methane (natural gas) and essentially pay for the cost of development, making the natural gas a byproduct that still produces profits at low prices. Not all shale gas was “wet,” but drillers sought out the wettest spots they could find within their operating areas.

At the same time, shale oil (tight oil) was becoming attractive, making gas drilling less competitive. Although the pessimists (and there are always pessimists) insisted that liquid petroleum molecules could not be extracted by hydraulic fracturing (fracking) because they were too big and that the Bakken was an exception—just as the Barnett shale was said to be an exception when natural gas began pouring forth. (Some lessons are never learned, including the fact that engineers can overcome many challenges.) Still, even with the much lower drilling levels, the 20% or more decline in gas production predicted by pessimists did not occur...

(Excerpt) Read more at forbes.com ...

TOPICS: News/Current Events

KEYWORDS: energy; naturalgas

Excerpted for Forbes Content

The also discuss demand increasing 12% in January due to our very cold winter.

1

posted on

04/28/2014 12:14:01 PM PDT

by

thackney

2

posted on

04/28/2014 12:35:02 PM PDT

by

MileHi

To: thackney

The also discuss demand increasing 12% in January due to our very cold winter.And Joe Bastardi is predicting an even colder winter for 2014-2015. What will that do to natgas prices? My guess, with the pressure to export, and increased use as a motor fuel, not to mention power plant changeover from coal, will push gas to the magic $6.00 land.

3

posted on

04/28/2014 12:50:50 PM PDT

by

Wingy

To: Wingy

I doubt it. The point of the article was that even with all the reasons many folks expected the price to exceed $5, it did not.

The exporting won’t begin by this winter, so it can not have an effect. The increases in use for vehicle fuel is creeping slowly. No real way for either to make an noticeable effect in pricing in less than a year.

4

posted on

04/28/2014 1:06:55 PM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

When prices dropped from over $10/Mcf in 2008 to under $2/Mcf in 2012 (wellhead average), howls of pain emitted from the Southwest as many drillers could not cover costs, even excluding those who overpaid for acreage. And drilling did, in fact, respond, with the number of gas directed rigs in the US falling to 300 from the high of 1500.There is an obvious answer to this problem. Those with skills, and possibly equipment, should market drilling and fracking overseas.

I consider a producing well in Argentina, Poland or Oz almost as big a boost to US energy independence and national security as one here.

Our longterm goal should be to make energy common and its production widespread. This will cut off the power of Russia and the Muslim countries more effectively than just about anything else we can do.

Due to the higher inherent costs of this type of production, it's unlikely we'll ever be able to bankrupt them, but their power, as opposed to income, is a result of a cutoff in deliveries or a mere threat to do so. If Europe was as close to independent in energy as we are becoming, our adversaries' leverage would be greatly reduced.

To: Wingy

The also discuss demand increasing 12% in January due to our very cold winter.

And Joe Bastardi is predicting an even colder winter for 2014-2015. What will that do to natgas prices? My guess, with the pressure to export, and increased use as a motor fuel, not to mention power plant changeover from coal, will push gas to the magic $6.00 land. Recent research also suggests that production can increase substantially–to allow for LNG exports—without having a noticeable impact on prices. This is certainly good news for consumers, although producers should again be warned against irrational exuberance.

6

posted on

04/28/2014 3:05:01 PM PDT

by

conservatism_IS_compassion

("Liberalism” is a conspiracy against the public by wire-service journalism.)

To: Sherman Logan

I consider a producing well in Argentina, Poland or Oz almost as big a boost to US energy independence and national security as one here. Our longterm goal should be to make energy common and its production widespread. This will cut off the power of Russia and the Muslim countries more effectively than just about anything else we can do.

Excellent point.

7

posted on

04/28/2014 3:06:39 PM PDT

by

conservatism_IS_compassion

("Liberalism” is a conspiracy against the public by wire-service journalism.)

To: thackney

Hi, Hack --

You know me, I'm just a trader, therefore the

immediate geopolitical side of things is of little interest. Longer term, of course, and assuming the a-holes in the goobermint get the hell out of the way, export LNG is a terrific opportunity for us. Which, btw, I strongly encourage.

That said, and barring a VERY hot cooling season starting fapp immediately (and barring more silliness regarding Ukraina, a rather more serious proposition), there is not an immediate bull case to be made for natty. Sure, I saw the price action today; who didn't. And, absent continuation phenomena, it is utterly meaningless.

Roughly until 3rd week of July, absent untoward events (Russia taking over Ukraina is actually a bearish prospect, because both "sides" will have a vested interest in restoring flow at that point), the only way to trade natty just now is to write puts on dips and calls on rallies. Earlier today, one could write a June Ng $1.00/MMBTU wide strangle for $500. Given the S/D and overall world flow situation, that's just money for jam. Expires on 5/27. Take your best shot, mate.

Good trading, m'FRiend!

8

posted on

04/28/2014 4:44:07 PM PDT

by

SAJ

To: thackney

Yet despite these three major bullish pressures, the price on the long-term futures strip remains below $5/Mcf. Possible explanations include speculators who are afraid that shale gas production will come roaring back; producers who, seeing prices above $4/Mcf, sold on the futures market to lock in revenues; and the prospect that, actually, the long-run equilibrium price is about $4/Mcf. There has not been a major increase in drilling at these prices but production has stabilized.

Which, oddly enough, is about where prices settled out after the long nightmare of price controls (from 1954) and phased decontrol (1978-85), adjusting for inflation of course. For those of us who have long argued that energy prices tend to be mean-reverting, this is a pleasant affirmation.

..................

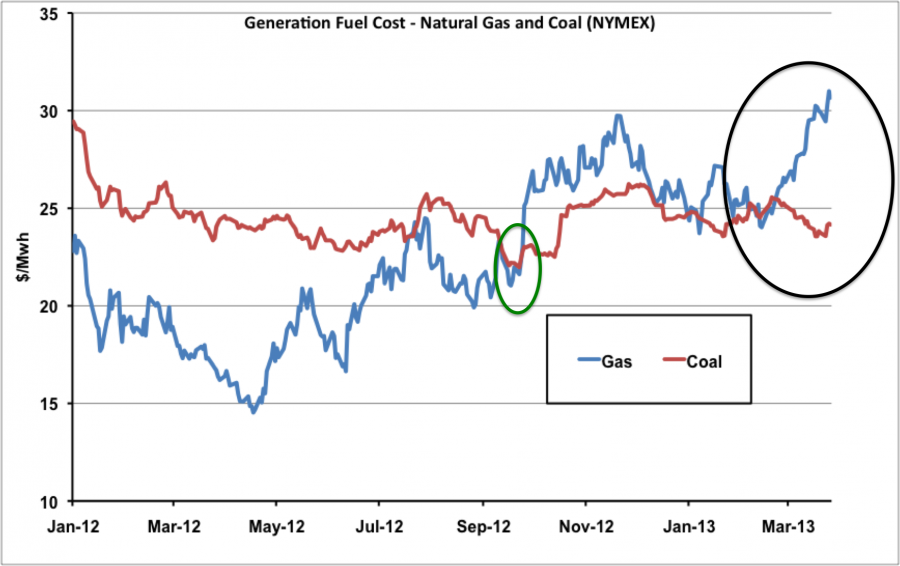

We got into this discussion a couple months back to the effect that the mean price of natural gas is in the $4 range which was similar in terms of price per btu’s to the current price of coal. And that both coal and natural gas were near their long term mean price. But oil in terms of btu’s was much higher. That the mean long term price for oil in terms of equivalent btu’s for oil gas and coal was somewhere in the $40@barrel range.

We were unable to confirm that with hard numbers.

9

posted on

04/28/2014 4:52:05 PM PDT

by

ckilmer

To: thackney

Historical Crude Oil Prices (Table)

March 6, 2014 by Tim McMahon

Oil Prices 1946-Present

The first table shows the Annual Average Crude Oil Price from 1946 to the present. Prices are adjusted for Inflation to January 2014 prices using the Consumer Price Index (CPI-U) as presented by the Bureau of Labor Statistics.

Note: Since these are ANNUAL Average prices they will not show the absolute peak price and will differ slightly from the Monthly Averages in our Oil Price Data in Chart Form.

Note: Since these are ANNUAL Average prices they will not show the absolute peak price and will differ slightly from the Monthly Averages in our Oil Price Data in Chart Form.

Also note that although the monthly Oil prices peaked in December 1979 the annual peak didn't occur until 1980 since the average of all the monthly prices was higher in 1980.

Inflation adjusted oil prices reached an all-time low in 1998 (lower than the price in 1946)! And then just ten years later Oil prices were at the all time high for crude oil (above the 1979-1980 prices) in real inflation adjusted terms (although not quite on an annual basis).

Prices are based on historical free market (stripper) oil prices of Illinois Crude as presented by IOGA . Price controlled prices were lower during the 1970's but resulted in artificially created gas lines and shortages and do not reflect the true free market price. Stripper prices were allowed for individual wells under special circumstances (i.e. the wells were at the end of their life cycle) but the oil they produced represented the actual free market prices of the time.

See also our price comparison of Oil vs. Gold. At $1000 is Gold Expensive? Oil Prices- Where Now?

Annual Average

Domestic Crude Oil Prices

(in $/Barrel) |

| 1946-Present |

| Year |

Nominal Price |

Inflation Adjusted Price |

| 1946 |

$1.63 |

$19.23 |

| 1947 |

$2.16 |

$22.60 |

| 1948 |

$2.77 |

$26.96 |

| 1949 |

$2.77 |

$27.22 |

| 1950 |

$2.77 |

$26.96 |

| 1951 |

$2.77 |

$24.96 |

| 1952 |

$2.77 |

$24.41 |

| 1953 |

$2.92 |

$25.48 |

| 1954 |

$2.99 |

$26.05 |

| 1955 |

$2.93 |

$25.55 |

| 1956 |

$2.94 |

$25.32 |

| 1957 |

$3.14 |

$26.13 |

| 1958 |

$3.00 |

$24.32 |

| 1959 |

$3.00 |

$24.07 |

| 1960 |

$2.91 |

$23.04 |

| 1961 |

$2.85 |

$22.30 |

| 1962 |

$2.85 |

$22.04 |

| 1963 |

$2.91 |

$22.24 |

| 1964 |

$3.00 |

$22.63 |

| 1965 |

$3.01 |

$22.33 |

| 1966 |

$3.10 |

$22.34 |

| 1967 |

$3.12 |

$21.88 |

| 1968 |

$3.18 |

$21.35 |

| 1969 |

$3.32 |

$21.18 |

| 1970 |

$3.39 |

$20.43 |

| 1971 |

$3.60 |

$20.80 |

| 1972 |

$3.60 |

$20.14 |

| 1973 |

$4.75 |

$24.82 |

| 1974 |

$9.35 |

$44.29 |

| 1975 |

$12.21 |

$53.04 |

| 1976 |

$13.10 |

$53.86 |

| 1977 |

$14.40 |

$55.55 |

| 1978 |

$14.95 |

$53.65 |

| 1979 |

$25.10 |

$80.14 |

| 1980 |

$37.42 |

$106.36 |

| 1981 |

$35.75 |

$92.10 |

| 1982 |

$31.83 |

$77.21 |

| 1983 |

$29.08 |

$68.32 |

| 1984 |

$28.75 |

$64.75 |

| 1985 |

$26.92 |

$58.54 |

| 1986 |

$14.44 |

$30.80 |

| 1987 |

$17.75 |

$36.54 |

| 1988 |

$14.87 |

$29.45 |

| 1989 |

$18.33 |

$34.58 |

| 1990 |

$23.19 |

$41.40 |

| 1991 |

$20.20 |

$34.70 |

| 1992 |

$19.25 |

$32.09 |

| 1993 |

$16.75 |

$27.13 |

| 1994 |

$15.66 |

$24.71 |

| 1995 |

$16.75 |

$25.72 |

| 1996 |

$20.46 |

$30.50 |

| 1997 |

$18.64 |

$27.17 |

| 1998 |

$11.91 |

$17.10 |

| 1999 |

$16.56 |

$23.20 |

| 2000 |

$27.39 |

$37.19 |

| 2001 |

$23.00 |

$30.40 |

| 2002 |

$22.81 |

$29.64 |

| 2003 |

$27.69 |

$35.22 |

| 2004 |

$37.66 |

$46.60 |

| 2005 |

$50.04 |

$59.88 |

| 2006 |

$58.30 |

$67.63 |

| 2007 |

$64.20 |

$72.30 |

| 2008 |

$91.48 |

$99.06 |

| 2009 |

$53.48 |

$58.20 |

| 2010 |

$71.21 |

$76.38 |

| 2011 |

$87.04 |

$90.52 |

| 2012 |

$86.46 |

$88.11 |

| 2013 |

$91.17 |

$91.54 |

10

posted on

04/28/2014 6:11:52 PM PDT

by

ckilmer

To: ckilmer

11

posted on

04/29/2014 6:37:51 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

That link you posted had the clinching info

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf

In BTU terms, $1 of natural gas can obtain 200,000 units of

energy (at a spot rate of $5/million BTU) compared to $1 of

WTI oil which garners 60,000 units of energy (at a spot rate

of $97/barrel). This is a whopping 330% energy content

price gap – even after the polar vortex and deep freeze

have raised natural gas prices. This massive energy price

gap raises questions about how long it may persist, and our

read of the market consensus appears to measure the time

required to narrow the gap in decades, while our own base

case scenario is that it could happen in just three to five

years.

..................

330% means oil has to go down to the low 30’s @ barrel in order to have comperable btu/price to coal and natural gas.

Or natural gas has to move up in price.

The article goes on to speculate on the direction of prices. The article is all over the place on this point Probably the safest guess as to the direction of prices is held by the options market which currently points to higher natural gas prices and lower oil prices in the next five years.

at this point you’d have to go well duh.

12

posted on

04/29/2014 3:12:36 PM PDT

by

ckilmer

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Note: Since these are ANNUAL Average prices they will not show the absolute peak price and will differ slightly from the Monthly Averages in our Oil Price Data in Chart Form.

Note: Since these are ANNUAL Average prices they will not show the absolute peak price and will differ slightly from the Monthly Averages in our Oil Price Data in Chart Form.