Posted on 05/04/2014 6:21:54 PM PDT by expat_panama

Investment & Finance Thread (May 4 edition)

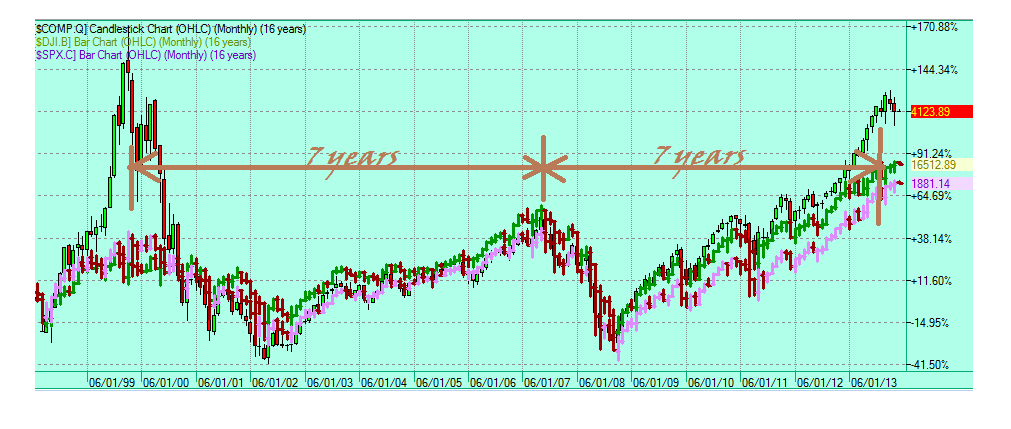

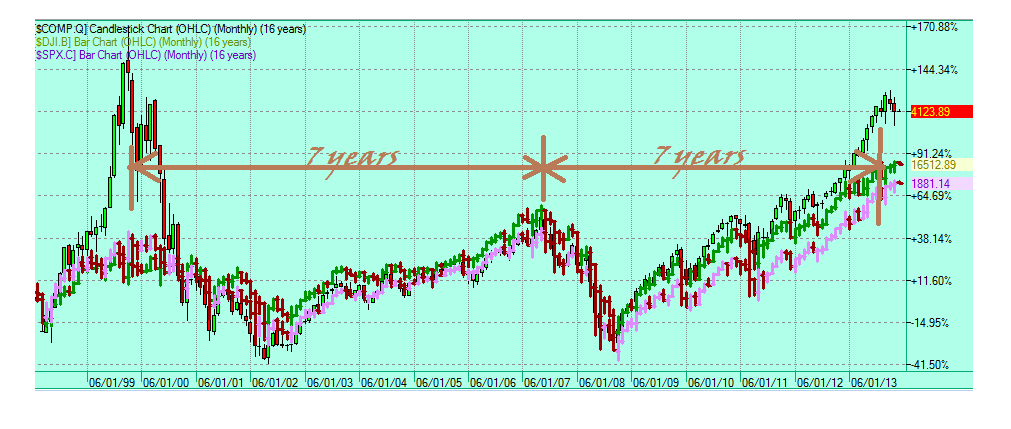

Something different we got while we begin this week is that we're also beginning a new month. Now, lot's of folks say May's are always a good time to sell (while I crunch that to see if it's true, everyone's welcome to check out "How to Use This Shockingly Simple Method to Immediately Improve Your Investment Returns"), what different this time is that if we look a the past couple hundred months--

--we're seeing that it's been as long since the '07 peak that was the same seven years after the dot-com peak. Coincidence?

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

Sunday nite head start ping

What direction will interest rates take?

Higher rates will cause major headaches. Higher mortgage rate mean lower housing starts mean lower/slower economy.

It’s sad. Sooner or later they will have to hike rates. Then it will really hit.

Here’s How Much Money Someone Has To Make To Be In The 1%

Hi gang, stock futures down, can't chat now --fighting w/ a bad monitor. Later..

KCG: THE LOOK…May 5th, 2014

U.S. stock-index futures fell, following weekly gains for benchmark indexes, as a measure of

Chinese manufacturing missed estimates, and investors watched the situation in Ukraine.

JPMorgan Chase & Co., the world’s biggest investment bank by revenue, declined 2.1 percent early in New York after saying a trading slump has deepened. Pfizer Inc., the drugmaker that has offered to buy Britain’s AstraZeneca Plc, fell as it reported earnings.

Futures on the Standard & Poor’s 500 Index expiring in June lost 0.4 percent to 1,867 at 7:23 a.m. in New York. Dow Jones Industrial Average contracts decreased 60 points, or 0.4 percent, to 16,387.

“We are still overweight equities, but we know where the risks are,” said Joost van Leenders, who helps oversee about $650 billion as a strategist at BNP Paribas Investment Partners in Amsterdam. “We had good years for equities but the mood among investors seems to have changed a bit from risk-on to

profit taking.”

U.S. stocks rose last week, with the Dow average reaching an all-time high, as earnings topped forecasts and the Federal Reserve said it would further trim bond purchases as the economy gains momentum. The S&P 500 added 1 percent, taking its gain this year to 1.8 percent.

China’s manufacturing contracted for a fourth month in April. HSBC Holdings Plc and Markit Economics said their purchasing managers’ index rose to 48.1. That missed the median estimate of 48.4 and the preliminary reading of 48.3. Numbers below 50 indicate contraction.

Ukraine sought to dislodge separatists from its eastern industrial heartland over the weekend as violence that’s spread to the Black Sea gateway of Odessa threatens to loosen Kiev’s control of the regions. Fighting in the eastern city of Kramatorsk left seven people dead, according to the website Kramatorsk.info. Clashes continued in Odessa yesterday.

European stocks fell, following a third week of gains for the region’s equities, as violence intensified in eastern Ukraine, while a report showed Chinese manufacturing contracted for a fourth month. U.S. stock-index futures also declined, while Asian shares were little changed.

Credit Suisse Group AG dropped 2.4 percent after JPMorgan Chase & Co. forecast that its trading revenue will slide this quarter. Wincor Nixdorf AG slumped 6.2 percent after the maker of self-checkout tills in supermarkets posted worse-than- expected earnings. Wacker Chemie AG dropped 4.1 percent after

the chemical maker also reported earnings that missed estimates.

The Stoxx Europe 600 Index slid 0.8 percent to 335.12 at 1:05 p.m. in London. The benchmark gained 1.3 percent last week, its largest rally in a month, amid renewed mergers-and-acquisitions activity. The U.K. market is closed for a holiday today. Standard & Poor’s 500 Index futures fell 0.4 percent, while the MSCI

Asia Pacific Index lost less than 0.1 percent.

• Support:1875, 1870, 1858

• Resistance:1888, 1896, 1909

Australian stocks, which have never cost so much relative to a gauge of Asia-Pacific shares, may get more expensive as an economic recovery broadens, said a global money manager at Equity Trustees Ltd.

The CHART OF THE DAY’s top panel shows Australia’s S&P/ASX 200 Index trades for 15.3 times estimated earnings and the MSCI Asia Pacific Index has a price-earnings ratio of 12.7, based on Bloomberg forecasts for profits. The lower panel shows the spread between the valuation measure for the two gauges sank at the end of April to the narrowest since Bloomberg began compiling the data in 2005.

Investors are paying for earnings growth in the region’s fourth-biggest equity market as record-low interest rates drive a recovery in housing and consumer spending. The S&P/ASX 200 reached the highest level in almost six years last month.

“We’ve got more stable global conditions and low interest rates, suggesting some premium for future earnings is warranted,” said George Boubouras, Melbourne-based chief investment officer at Equity Trustees, which oversees $32 billion for clients. Valuations “are expected to expand in the year ahead.”

Benchmark stock gauges in Japan, Hong Kong and China fell in 2014, dragging valuations lower for Australia’s larger regional peers. Australia’s S&P/ASX 200 hasn’t diverged from the MSCI World Index, a global developed-market measure that counts nine U.S. companies among its 10 most-heavily-weighted firms.

Australian gross domestic product growth will quicken to 2.8 percent this year from 2.4 percent in 2013, while Asia’s expansion will slow to 6.2 percent from 6.3 percent, according to the median forecasts of economists surveyed by Bloomberg.

That's the conventional wisdom, but is it wisdom? The only reason the rates are so low is there is no "wisdom" in the money supply. The gov printed money, the feds called it "quantitative easing" and said that it's money owed to them. Meanwhile, interest rates are low because the feds have to be paid back money that wasn't even theirs.

So raise the rates. People who want to sell their houses will take a few thousand dollars less to compensate. Homeowners will get that mortgage deduction every year and the tax refund will pay their property taxes, making it less likely they'll go into foreclosure. And seniors and others who've been getting near-zero percent interest on their savings will put that interest almost totally in local economies.

Assume the stock market goes "poof"? And it will, and those who control when the slide happens will cash out in time, profitting again. Us little folk will be left with the tax bill for money that wasn't real but ended up with the banking and corporate elite.

Why should the Federal Reserve be paid back at all? Wouldn't not doing so take care of a lot of unsustainable debt? Then, abolish a few federal agencies and let what's left of the American innovative spirit figure out the mess the globalists and the bankers have left for us.

Holder Signals Criminal Charges Coming Against Some Banks

http://www.bloomberg.com/news/2014-05-05/holder-signals-criminal-charges-coming-against-some-banks.html

Some more looting coming up.

Yeah that was neat! Somehow I thot there was a thread on that piece but now I don’t see one so maybe I’ll post it. Thing is that one out of eight Americans is at one time in the 1%.

Here’s How Much Money Someone Has To Make To Be In The 1%

http://www.freerepublic.com/focus/f-news/3152143/posts

Is what got me is that when every one talks about “the rich” they talk like it is static. People float in and out all the time. Some stay there.

JEFF GUNDLACH: Short The Homebuilders

Jeffrey Gundlach

Bond god Jeffrey Gundlach, the CEO of DoubleLine Capital, is bearish on single-family homes.

Gundlach said single-family housing is “over-believed and over-rated.”

His trade is to short XHB Homebuilders ETF.

It’s trading down about 1.3% today.

During his presentation, Gundlach highlighted a bunch of housing data points.

“We seem to be on the cusp of something of a change with existing home sales now negative,” he said.

He pointed out that new home sales also falling.

He said that the bulls use affordability for their argument. However, Gundlach believes that affordability is “bleak.”

Gundlach said that young people were scared by the housing crisis, so they’re not buying homes. Instead, they’re renting because that’s much more appealing.

He doesn’t see homeownership rates rebounding any time soon.

If Mr. Gundlach is correct, will this lead to some downside pressure on mortgage rates do you think?

I like most others believed that these were going up. This new downward trend is troublesome, as I believe that it is a symptom of a sick economy more in trouble than most realize. We are reliving the '30's more than anyone realizes. It is just the Obama government would rather lie than admit it.

Renting is also much, much more flexible. What many people are seeing is the Democrat Urban Model failing them. The cities run by Democrats are expensive and services are plummeting. Who wants to be trapped there?

A tenant can, even in the middle of a lease, up and leave the city or state for a new or better job. What landlord is going to sue in federal court or pursue a debt across state lines? Not for residential rent rates. It doesn’t pay and it will never or rarely show up on a credit report if you do. Landlords aren’t that sophisticated or interested.

You cannot do that with a mortgage. The consequences are dire. Incentives work, just not always the way you think they will.

Happy morning all! Looks like metals & stocks came out even yesterday, atm futures are slightly up again for both. All we get today is the trade balance tho tomorrow more labor stats. This morning's news:

- Is Stock Market Volatility Increasing? May 5, 2014 Ronald Delegge. Is stock market volatility rising or falling? For most of this year, stock market volatility has actually outperformed the stock market itself.... Read More

- The S&P 500 Finds Itself In Another Fine Mess - Avi Gilburt, MarketWatch

- Piketty Recycles Carter-Era Economics - Stephen Moore, Washington Times

- Humble Student Of The Markets

- A Bearish Verdict From Cycle Analysis

- Yes, Inflation Really Is Low - Cullen Roche, Pragmatic Capitalism

- An incredible explanation for why interest rates are low US interest rates are still fairly low but you'll be shocked by what one strategist says is the reason. Talking Numbers

talked to Ivy Zelman’s lead analyst on friday and his comment was that renting/buying is pretty agnostic to single family home starts. demographics will drive the demand and a lot of Millennial’s are completely fine with renting a single family home after they get married and start having kids.

Did he mean that producers don’t care about the end product’s use? Because the buy/price point of a homeowner end user v. an investor holding for rental income are different enough that you’d go bankrupt trying to sell a single product to both.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.