Posted on 05/04/2014 6:21:54 PM PDT by expat_panama

Investment & Finance Thread (May 4 edition)

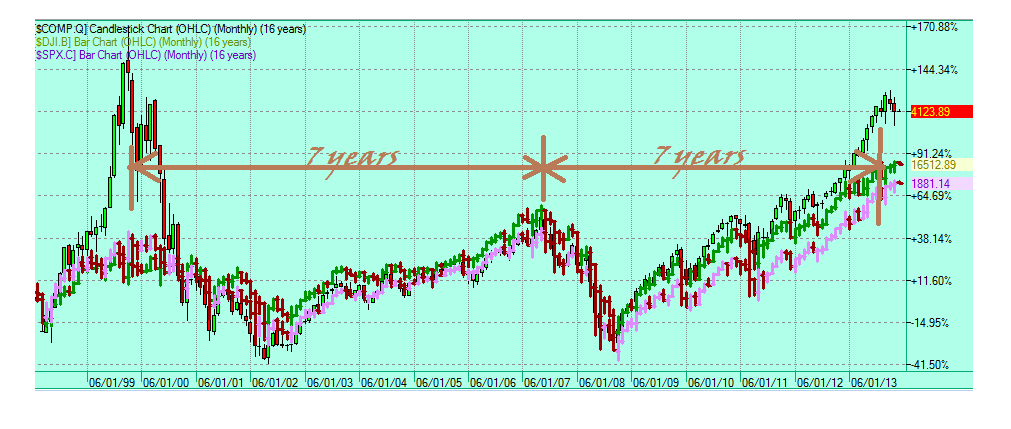

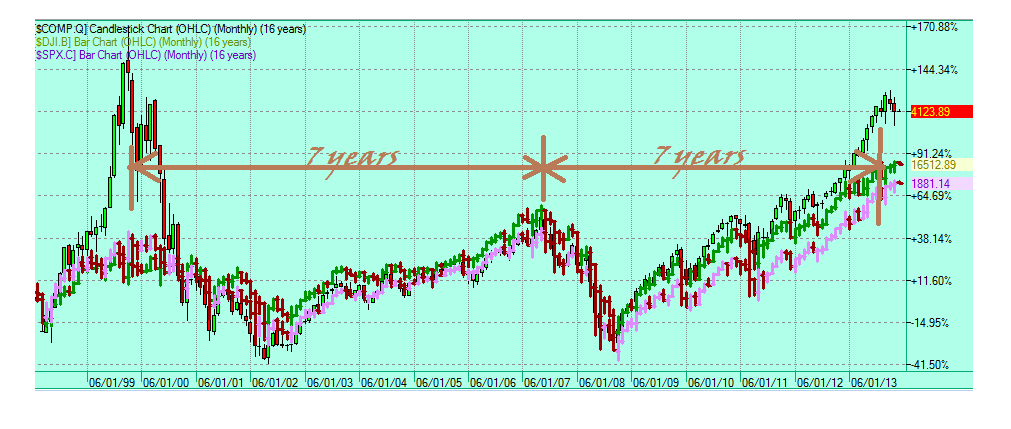

Something different we got while we begin this week is that we're also beginning a new month. Now, lot's of folks say May's are always a good time to sell (while I crunch that to see if it's true, everyone's welcome to check out "How to Use This Shockingly Simple Method to Immediately Improve Your Investment Returns"), what different this time is that if we look a the past couple hundred months--

--we're seeing that it's been as long since the '07 peak that was the same seven years after the dot-com peak. Coincidence?

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

No the consumer doesn’t care. Millenial’s, who will drive household formation for the next decade plus don’t care if they own or rent.

I like most others believed that these were going up.

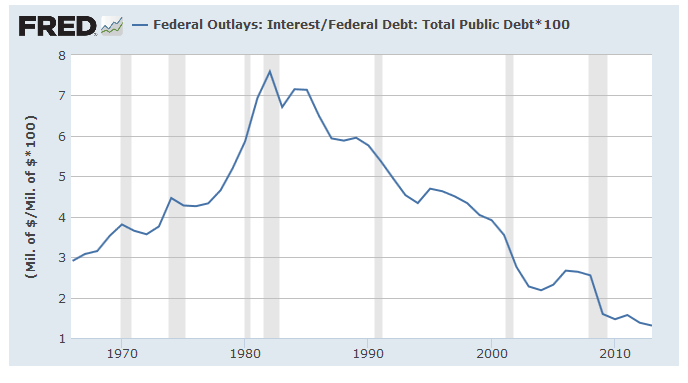

We've been having T-bills at a tenth of a percent which is so close to zero that any more serious lowering means negative rates --happening already in places like Switzerland where you got to pay to loan them money. Seems very very unlikely for the U.S., an invitation for deflation. Rates need to go up and that spells disaster for both federal budget outlays for debt interest and for any hopes for future economic expansion.

That’s logical for them. Their major economic experience has been the RE crash and Obama’s recession. But I think they’re much more geographically flexible. They grew up with the Internet and face to face interaction isn’t as critical to them. Plus, you have a free agent mentality. They’re not loyal employees and don’t see temporary gigs as a negative. They have a big tax advantage if they are self-employed over being an employee as well.

Homebuilders do care though. Rental homes are very different than homes to the retail market.

For one thing it means that almost 2 $T in treasuries have to hit the market this year, and those auctions will be bound to affect interest rates. Right now the U.S. gov't is paying record low rates for debt which is why up til now we've been getting away with it.

When this changes and rates go back up then we'll be paying several $T per year on interest alone.

1980 levels would sure put a bite on their discretionary spending, and then some.

That’s exactly what I was thinking, even if interest just nudges up to 2006 levels (imho very probable) that alone doubles interest outlays and add to that having to refinance short term debt means we’ll see interest outlays go from $1/4T up to $1T.

Something has to give. Raising tax rates is easy for the left knowing the DC right are such wimps, but all that’s going to do is further crash the economy which cuts revenues and increases interest outlays even more. I’m seeing huge spending cuts. Eventually.

Bill Ackman Has Made The Ultimate Bet Against The US Political System

Bill Ackman

Oxford Said Business School

Yesterday at the Sohn Investment Conference, Bill Ackman treated everyone in attendance to a 110-slide presentation/history lesson/pitch on government housing insurers Fannie Mae and Freddie Mac.

It was part long thesis, part political speech. The activist investor believes that the stocks, currently trading around $4.20 a piece, could head up somewhere between $23 and $47.

That is, of course, if Washington doesn’t go ahead with its plan to dismantle the two insurers and totally reimagine the way Americans buy their homes. Politicians have wanted to dismantle Fannie and Freddie ever since the two entities were caught up in the center of the financial crisis and needed gigantic bailouts.

The way Ackman sees it, the 30-year fixed rate mortgage is as American as apple pie and monster truck rallies, and Fannie and Freddie are the only two entities big enough to handle all the demand from Americans who want to live the dream. Plus, since they’re over 70% owned by the American government, if they succeed we all succeed.

But that’s not the way Washington sees it. To politicians, “big” is part of the problem with Fannie and Freddie. They’re scarred from 2008 and want to reduce systemic risk associated with size — the kind of risk that made it necessary for the government to take Fannie and Freddie into conservatorship during the financial crisis.

Ackman, for his part, doesn’t see a problem with size, he sees a problem with bad loans. In his plan Fannie and Freddie get to stay huge, but are reformed to take on less risky assets.

The only change he would make would be to get rid of a little something called the ‘net worth sweep.’ The short version is that back in 2012 the government amended its agreement with Fannie and Freddie so that it was the only shareholder that got any of their profits. That also happened to be the year Fannie and Freddie became profitable.

Naturally some shareholders were furious, including hedge fund Perry Capital, which started suing the government over this in the summer of 2013.

A win for Perry Capital is the ideal situation for Ackman. In that scenario, for Ackman to win this battle the government has do to something it has excelled at recently — which is nothing. For the government to win this battle, it has to pass a bill.

“They [investors like Ackman and Bruce Berkowitz] have taken a calculated, educated risk that the government’s not going to do what needs to be done,” former Treasury Secretary Hank Paulson told Business Insider in January.

Paulson is on the government’s side on this one.

The most well-known plan to wind down Fannie and Freddie and turn them into something smaller is sitting in a congressional committee right now. It was proposed by Senators Bob Corker (R-TN) and Mark Warner (D-VA) last June. It’s called the The Corker-Warner Housing Finance Reform and Taxpayer Protection Act, and Ackman seemed to be countering that plan throughout his presentation yesterday.

The bill would wind down Fannie and Freddie in five years and set up the Federal Mortgage Insurance Corporation (FMIC). The FMIC would act as insurance the same way the FDIC does for banks, protecting 10% first-loss, private capital in the mortgage market.

It would also be required to hold “a minimum reserve balance of 2.5 percent of the outstanding balance of covered securities as a catastrophic backstop that would only be utilized in the event that the 10 percent first-loss private capital is completely wiped out,” according to the bill.

In his presentation Ackman made a couple arguments that referenced ideas in this plan.

First off, he said that there isn’t enough private capital floating around to cover that 10% figure, which would be about $500 billion. How does he know? Because over the last decade private companies in the United States have only shelled out about $386 billion for IPOs.

You can decide whether or not you think that’s a fair comparison.

He also said that the pain of subprime losses will scare away investors — which is something you should ask all the hedge funds specializing in mortgage strategies that have killed it over the last couple of years.

Another private sector problem, he said, is that banks simply wouldn’t do their part and pick up the slack of left-over mortgages not held by the FMIC. Their share of the mortgage market has actually declined slightly since the Savings and Loans crisis of the 1980s, and in 2013 Fannie and Freddie made up 61% of the mortgage market.

But here’s the thing — these Fannie and Freddie mortgages are making money. That’s why the government is finding them so hard to wind down. It’s also why Ackman wants them to live on for his investors.

Ackman correctly points out that we don’t know what Fannie and Freddie would look like in their next life, but if they’re making money now, it’s not crazy to think Wall Street would see opportunity in their reincarnation.

SEE ALSO: Here’s Bill Ackman’s big presentation on making a fortune on Fannie Mae

Related Notes

Soured Mortgages Attract Institutional Dollars - NYTimes.com - NYTimes.comSoured Mortgages Attract Institutional Dollars By MATTHEW GOLDSTEINApril 27, 2014, 7:55 pm Andrew H. Walker/Getty ImagesDonald R. Mullen Jr. wants to set up a $1 billion fund to buy troubled home loa...

Hank Paulson: This Is What It Was Like to Face the Financial Crisis - BusinessweekHank Paulson: This Is What It Was Like to Face the Financial Crisis September 12, 2013 Sept. 15, 2008:Lehman Brothers files for Chapter 11 in the largest-ever U.S. bankruptcy People weren’t taking Di...

I think betting on status quo is a smart bet. It’s why we still have the stupid Dept of Ed and Energy. Nothing big will happen, even if the GOP gets a majority in the Senate. Unless they get 60 or more seats. Then Obama will really start to suffer, if the stupid party doesn’t cave.

The stupid party is in on it too... They are all part of the same club and they are all getting rich. They don’t want to change (save a few people who want to actually do the right thing).

--and a happy mid-week to all as our adventure continues yesterdays higher volume plunge into today's pessimistic futures. Great day to stay indoors! Headlines:

- Wall Street falls in broad selloff Independent Online - 5 hours ago New York - US stocks fell broadly on Tuesday, closing at session lows, with AIG pulling financial shares lower after disappointing earnings and as a slide in Twitter took down other names in the technology and Internet space.

- Asian shares slip after Wall Street losses Channel News Asia - an hour ago Asian markets fell on Wednesday with a stronger yen sending Tokyo tumbling after a long weekend, while a sell-off on Wall Street and tensions in Ukraine added to downward pressure.

- Tech jitters, Ukraine weigh on world stocks Jitters over the valuations of technology companies pulled stock prices lower from Tokyo to London on Wednesday. European shares got off to lackluster start, with Britain's FTSE 100 down 0.3 percent to .

- Gold likely to reach four-year low in 2014 - consultancy LONDON (Reuters) - Gold prices have probably peaked this year and could sink to their lowest since 2010 at $1,100 an ounce as the U.S. economic recovery gathers pace, consultancy Metals Focus said on Wednesday..

- Russia, Twitter, Cannabis & Approaching Volatility Storm - Minyanville

Thinking that there are a lot more factions involved here, that the ones we're able to hear are the loud ones and that there're lots more that know better. On the left we got blacks hating gays hating Arabs hating Jews hating etc., and on the right we got the same shattered disorganization. Good folks like us are in back of everything trying to make sense of it all and find a way in.

Things change, and will change more every day.

I think I will be buying some if it gets to triple digits. That is well below expected support levels, but one can dream.

This stuff changes minute by minute. Right now stock index futures are leading up and metal futures are leading on the downside.

Our drunken sailors in DC will just view this as additional outlays.

OK so we've had ten million lose their jobs and they think it's the fault of 'the rich'. The question is what will folks decide after the next 10 million --and the next...

The executive and legislative branches establish spending. How is not their fault?

Top'o'the morning, future trades have indexes down and metals up after yesterday's mixed but heavier trade. More uncertainty? I'm not sure...

Asian stocks boosted by China trade, Yellen stance Economic Times - 3 hours ago SEOUL: Asian stock markets were mostly higher Thursday after China's trade improved and Federal Reserve Chair Janet Yellen vowed low interest rates would continue until the US job market is healthy.U.S. cash home purchases surging as rates rise Cash is keeping residential sales trudging along. All-cash home purchases surged to a record 43% of U.S. deals in the first quarter, more than double the share a year ago.

Ahead of the Bell: US Unemployment BenefitsAP - 2 hrs 4 mins ago WASHINGTON (AP) — The U.S. Labor Department reports on the number of people who applied for unemployment benefits last week. The report will be released at 8:30 a.m. Eastern time Thursday. (full story)

Obama taps tech world for cash amid privacy debate By JIM KUHNHENN - AP - Thu May 08, 2:32AM CDT LOS ANGELES (AP) — They come from different worlds — the buttoned-down political culture of Washington and the entrepreneurial, socks-optional, let's-do-this-faster ethos of Silicon Valley. (full story)

Fear of economic blow as births drop around world By BERNARD CONDON - AP - Wed May 07, 11:02PM CDT NEW YORK (AP) — Nancy Strumwasser, a high school teacher from Mountain Lakes, New Jersey, always thought she'd have two children. But the layoffs that swept over the U.S. economy around the time her son was born six years ago helped change her mind. Though she and her husband, a market researcher, managed to keep their jobs, she fears they won't be so fortunate next time. (full story)

Actually, the house by itself could stop spending today if it wanted, and they'd do it if the American people as a mass clearly told their reps that spending cuts were required for reelection. What we got is the house will do whatever the president wants because they sincerely believe it's what the public wants.

It's so much easier to blame our helplessness on others but we ourselves need to do what no one else can do. My rep knows my vote depends on spending cuts. My current project is figuring out how to explain to those around me that they must do the same or we all face the consequenses.

Mighty quiet out there today.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.