Skip to comments.

The Bakken Shale Hits a Billion. How Much More Is Left in the Tank?

fool.com ^

| May 5, 2014

| By Matt DiLallo

Posted on 05/07/2014 8:04:22 AM PDT by ckilmer

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

1

posted on

05/07/2014 8:04:22 AM PDT

by

ckilmer

To: thackney

2

posted on

05/07/2014 8:07:43 AM PDT

by

ckilmer

To: ckilmer

current technology will allow the industry to recover about 3.5% of its oil estimate, or about 32 billion barrels of oil...

an improvement in the recovery factor to 5% means the industry could eventually extract as many as 45 billion barrels of oil

BTTT

3

posted on

05/07/2014 8:13:15 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

And we haven't even begun to do oil recovery in the Marcellus Shale in the northeastern USA. That could be several tens of billions of barrels of oil that too could be extracted from improved

fracking techniques.

In short, OPEC will find out in the next 25 years what happens when Russia, USA and Canada become the world's biggest oil and natural gas producers. The free ride the Sunni Arabs got from all the all production in the southern Persian Gulf could soon be over.

4

posted on

05/07/2014 8:19:14 AM PDT

by

RayChuang88

(FairTax: America's economic cure)

To: RayChuang88

5

posted on

05/07/2014 8:29:06 AM PDT

by

ryan71

(The Partisans)

To: ckilmer

I’m curious. If we have pulled a billion barrels of oil out of the ground why is gasoline still running over $4 per gallon? Why haven’t we seen a drop in price consistent with the increase in supply?

6

posted on

05/07/2014 8:48:26 AM PDT

by

P-Marlowe

(There can be no Victory without a fight and no battle without wounds)

To: P-Marlowe

Why haven’t we seen a drop in price consistent with the increase in supply? For one reason, wells in tight formations like shale with 2 mile long horizontals and 2 or 3 dozen hydraulic fracturing stages are not cheap. If the price for oil was dropped significantly, this oil would stay in the ground.

7

posted on

05/07/2014 8:52:14 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: RayChuang88

8

posted on

05/07/2014 8:56:53 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

Does that mean that if someone were to find a huge conventional oil find, like they just found in the gulf, that this could conceivably shut down a lot of the current shale boom?

9

posted on

05/07/2014 9:02:36 AM PDT

by

P-Marlowe

(There can be no Victory without a fight and no battle without wounds)

To: P-Marlowe

Because oil prices are set worldwide.

Natural gas prices are set locally.

The reason for this is that you can move oil around the world pretty easily/cheaply. Not so with natural gas.

The US imports may 5 million barrels a day. higher production displaces imports. But there is so much demand for oil in other parts of the world—that the world wide price of oil does not fall.

There is another thing. The USA/Canada is one of the very few places in the world where oil production is rising significantly. (The other is Iraq.) Most of the rest of the world’s oil comes from old oil fields where its everything the producers can do just to maintain production. Many don’t. Like in Venezuela and Mexico.

USA fracking methods will eventually come to other parts of the world but that’s likely still 5 years away before volume actually comes in.

10

posted on

05/07/2014 9:05:26 AM PDT

by

ckilmer

To: RayChuang88

In short, OPEC will find out in the next 25 years what happens when Russia, USA and Canada become the world’s biggest oil and natural gas producers. The free ride the Sunni Arabs got from all the all production in the southern Persian Gulf could soon be over.

.....

My betting is that Saudi oil is the cheapest to extract. Any fall in prices will constrain production of American frackers first.

However, the government there gets most of their revenue from oil. So the saudi government would be sorely crimped by falling oil prices. Same goes for the Russians. Both would have have less money available for adventures.

11

posted on

05/07/2014 9:09:48 AM PDT

by

ckilmer

To: P-Marlowe

Does that mean that if someone were to find a huge conventional oil find, like they just found in the gulf, that this could conceivably shut down a lot of the current shale boom?

..........

imho the answer is no. Its expensive to extract oil from the gulf.

12

posted on

05/07/2014 9:11:32 AM PDT

by

ckilmer

To: P-Marlowe

Does that mean that if someone were to find a huge conventional oil find, like they just found in the gulf, that this could conceivably shut down a lot of the current shale boom? You would have to first show me the field you are talking about, but i think there is no way any find could possibly impact that production.

We import 7.8 million barrels a day. A large offshore field might produce 0.1~0.2 million barrels a day.

13

posted on

05/07/2014 9:35:34 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: ckilmer

My betting is that Saudi oil is the cheapest to extract. Any fall in prices will constrain production of American frackers first.Cost varies.

Oil Basin Breakeven Estimates as of late-2013 ($/bbl): Eagle Ford $65, Bakken Core $75, Permian $80, Niobrara $80, Bakken Fringe $85, Utica $85, Mississippian $85, Cana Woodford $90, Ardmore Woodford$95. (all unconventional) [source], plus, for all types:

[source]

To: ckilmer

15

posted on

05/07/2014 11:20:10 AM PDT

by

Smokin' Joe

(How often God must weep at humans' folly. Stand fast. God knows what He is doing.)

To: Kennard; thackney

Thanks. Great graph.

You know, it seems to me that the last time I saw the numbers for Baaken, Eagle Ford, Niobrara and Permian. The production costs for them were 10 dollars a barrel higher—except for woodford which was the same..

This graph is for 2013. Maybe the earlier one I saw was for 2012.

..................

US oil production had been going up steadily after WWII. It stopped in 1970 and started trending down—with a brief pitch up in the 1980’s under reagan during some years when the saudis were throttling back their production.

The reason US production had been trending down since 1970 was because saudi oil production in a few short years went from 3 million barrels a day to 9 million barrels a day. They could pull oil out of the ground at that time in 1960-70’s dollars for .25-.50 a barrel and ship it anywhere in the world for 1.25@ barrel in 1970’s dollars. (I think that if you multiply that number by 3.5 or so you’ll get current dollars)

The USA could not extract oil — nor anyone else for that matter — for the same price that the saudis could. It was cheaper just to import the oil.

Now once placed in a monopoly position the saudis jacked up the price of oil and nationalized the oil companies.

Today the saudis cannot get oil from the ground nearly as inexpensively as they could 40 years ago. But I would be surprised if their costs of extraction exceeded $30 @ barrel in today’s dollars. (I don’t know if they publish their production costs.)

16

posted on

05/07/2014 12:00:00 PM PDT

by

ckilmer

To: Kennard; thackney

The costs listed on this IEA table for the middle east list $16 for middle eastern production costs but only go through 2009 —so they’re out of date. None of the number reflect fracking costs. The saudis don’t frack today but they do do enhanced recovery. I don’t know how much that ads to their tab.

http://www.eia.gov/tools/faqs/faq.cfm?id=367&t=6

17

posted on

05/07/2014 12:06:09 PM PDT

by

ckilmer

To: P-Marlowe

There's another big hog at the trough....

18

posted on

05/07/2014 12:07:55 PM PDT

by

nascarnation

(Toxic Baraiaq Syndrome: hopefully infecting a Dem candidate near you)

To: nascarnation

For now I like this.

Given my druthers, I’d druther, high US production rate increases and high US gas prices over.

Over slightly lower gas prices and much lower US oil production rate increases.

The reason for this is that high US production rate increases are saving the US dollar and keeping the US economy afloat during the Obama business disaster years.

The every extra year of high prices allows more fracking to go on the the fracker to chisel down their costs.

In three or four years —when US production rates are 5 million barrels@ day higher and the USA is oil independent....and the frackers have got their costs30% lower ...that’s the time to lower prices.

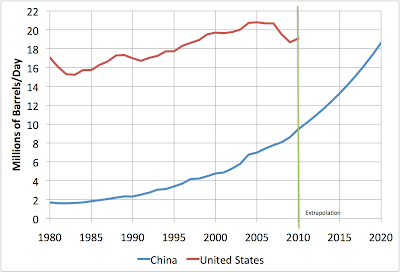

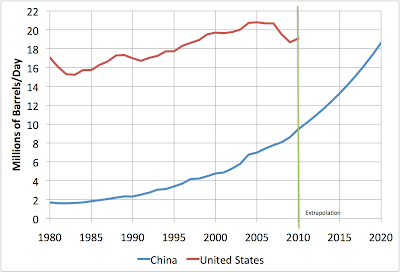

Of course, I have no clue as to what will happen but judging by the steep incline of Chinese consumption—it looks like there will be plenty of new demand to soak up extra supply.

19

posted on

05/07/2014 12:57:26 PM PDT

by

ckilmer

To: Kennard; thackney; nascarnation

check out nascarnation’s graph above of rising Chinese oil demand.

Never mind India or fast rising demand from the rest of the world — that Chinese demand curve alone is almost sufficiently steep over the next five years —to soak up extra north american supply.

Now its likely that the 5-10 years from now the chinese will have figured out how to bring volume production of natural gas online. and the first inroads of natural gas trains buses trucks plus electric cars will start. But that’s all past 2020.

Meaning that there is good evidence that even without disruptions— prices will stay high for the next couple years.

20

posted on

05/07/2014 1:14:47 PM PDT

by

ckilmer

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson