Posted on 05/13/2014 6:03:44 AM PDT by thackney

Oil production will continue to soar in the six major U.S. shale plays, with more barrels pumped per rig, according to federal projections released Monday.

Total oil production in the six regions is expected to grow to 4.43 million barrels per day in June, an increase of 75,000 barrels per day compared to May, according to the U.S. Energy Information Administration. The federal agency expects oil rigs will produce an average of 271 barrels per day each, an increase of one barrel over May.

The projection reflects the growing efficiency of rigs since the U.S. energy boom began. In June 2007, each rig produced an average of just 116 barrels per day in the most efficient region, the Bakken Shale.

The United States is home to more than half of the world’s approximately 3,400 operating rigs, though rig counts have declined or stagnated in many of the major drilling regions amid improved efficiency.

The six shale regions analyzed account for 95 percent of the oil production growth in the United States: the Eagle Ford in South Texas, the Permian in West Texas and New Mexico, the Bakken in North Dakota and Montana, the Haynesville in Louisiana and East Texas, the Marcellus in the Northeast, and the Niobrara largely in Colorado.

Eagle Ford Shale

The largest share of the oil production growth in June will occur in the Eagle Ford Shale. The South Texas region is expected to produce 1.4 million barrels per day, an increase of 27,000 barrels over May’s rate. The region also will add 6 rigs to its fleet of 470 currently, according to the EIA projections.

In the Eagle Ford , oil production per rig for new wells will grow from 470 barrels per day in May to 476 barrels per day in June.

By comparison, oil rigs in the region produced just 36 barrels per day each in June 2007.

Oil rigs in the Permian Basin in West Texas are projected to produce 132 barrels per day each in June, an increase of two barrels over May’s rate. In the Bakken, home to the greatest rig efficiency, average production is expected to rise from 498 barrels per day in May to 505 barrels per day in June.

Rapid well declines

However, while each rig is bringing more new oil production on line, the rate of well production decline also has accelerated, according to the EIA data.

In May, oil production from existing Eagle Ford wells dropped by 107,987 barrels per day — the most rapid decline among the six analyzed regions. By comparison, production for all existing Eagle Ford wells in May 2007 declined by just 1,802 barrels per day.

The Bakken was home to the second largest decline. Existing wells there produced 69,035 fewer barrels per day in May than in April, according to the EIA.

Still, the energy boom will ensure that net production continues to move in a positive direction. While existing Eagle Ford wells will produce 110,738 fewer barrels per day in June, the new wells will pump 137,000 more barrels, for a net increase of about 26,000 barrels in the South Texas region.

Natural gas

The trend toward more efficient rigs also is evident in the nation’s most prolific natural gas fields.

Total natural gas production in the six regions — home to all of the nation’s natural gas growth — is expected to grow to 39.3 billion cubic feet per day in June, an increase of 480 million cubic feet per day compared to May. In the nation’s largest natural gas region, the Marcellus Shale, each rig produced an average of 6.48 million cubic feet per day in May, an increase of 40,000 cubic feet per day compared to April.

In the Haynesville Shale, each rig produced an average of 5.23 million cubic feet per day in May, compared to an increase of 80,000 cubic feet per day compared to April.

In the early days of the shale gas boom, each rig produced about 461,000 cubic feet per day in the Marcellus and about 1 million cubic feet per day in the Haynesville.

Drilling Productivity Report

http://www.eia.gov/petroleum/drilling/pdf/dpr-full.pdf

May 2014

For key tight oil and shale gas regionsThe six regions analyzed in this report accounted for 95% of domestic oil production growth and all domestic natural gas production growth during 2011-13.

Note: Permian Basin oil production shows a significant increase this month, based on new data from the Railroad Commission of Texas.

- - - - - -

The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil and natural gas wells to provide estimated changes in oil and natural gas production for six key regions. EIA’s approach does not distinguish between oil-directed rigs and gas-directed rigs because once a well is completed it may produce both oil and gas; more than half of the wells do that.

Note: Permian Basin oil production shows a significant increase this month, based on new data from the Railroad Commission of Texas.

...................

that green line for the permian well productivity should turn up somewhere along the line to be in line with productivity from the eagle ford and baaken.

The Railroad Commission’s latest data published on line show an unexpected drop.

http://www.rrc.state.tx.us/permianbasin/permianbasinoilproduction_2006-2013.pdf

I suspect this is a correction.

get our gasoline prices at the pump down - down to $3 this, year, to $2 next!!

If the price of gasoline went down to $42 per barrel including the taxes, we won't be producing much crude oil in this country.

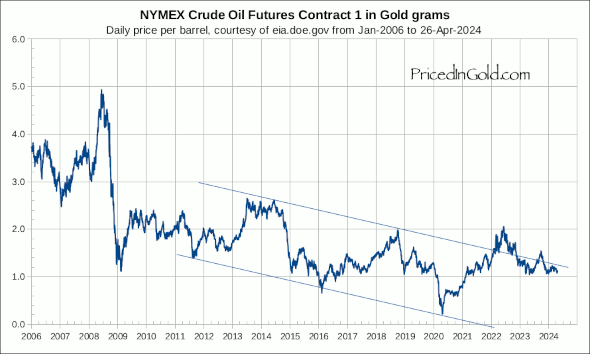

You might also consider the price of oil in dollars is a reflection of how the value of a dollar has dropped.

EOG Resources Inc. (NYSE: EOG) will drill 520 wells in the Eagle Ford Shale this year, completing the “vast majority” of its 2014 drilling obligations in the basin’s oil-rich section by July, its top officer told analysts.

“We’re currently running 26 rigs in the play,” CEO Bill Thomas said on an earnings call this week. “(The) Eagle Ford was the biggest contributor to our first-quarter oil growth and the reason we exceeded our first-quarter oil production guidance.”

Houston-based EOG increased its total crude oil and condensate production by 42 percent for the quarter, compared to the same prior year period, according to its earnings filings. Its U.S. crude oil and condensate production rose 45 percent quarter-to-quarter.

The company is one of the largest acreage holders in the Eagle Ford. Some of its operations related to the South Texas shale play are located in San Antonio.

During the quarter, EOG also improved the productivity of its Eagle Ford wells, Thomas said, pointing out that some had output of more than 4,000 barrels of oil daily.

Based on recent modeling, EOG expects to draw free cash flow from the Eagle Ford over the next 10 years, according to Thomas.

“If we increase this year’s 520 net wells by a modest amount and hold that number flat through 2024, our Eagle Ford oil volumes increase every year,” he said.

“The measure of a man is what he does with power.” ~Plato

If the price of gasoline went down to $42 per barrel including the taxes, we won’t be producing much crude oil in this country.

................

imho that will likely happen in 15 years if current trends to natural gas trains trucks and buses and electric cars...accelerate—as they have for the last two years. imho for at least the next five years however— it will be all supply can do to keep up with demand. so we’ll have high priced oil.

Plus now the Russians have learned from the arabs that they can build a risk price into oil by rattling their swords.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.