Posted on 05/23/2014 4:01:57 PM PDT by Kaslin

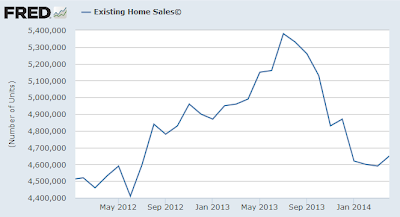

Yesterday, headline news stories talked of a "rebound" in existing home sales and why rising inventory is good for the market.

Let's separate the hype from reality starting with the hype. Please consider Existing Home Sales Rebound, Inventory Increases.

U.S. home resales rose in April and the supply of properties on the market increased, suggesting the housing market was regaining its footing.

The National Association of Realtors said on Thursday existing home sales increased 1.3 percent to an annual rate of 4.65 million units, marking the second increase in sales in nine months.

Though an usually cold winter depressed activity, a dearth of homes for sale also stymied demand. Sales are expected to gradually trend higher for the rest of 2014 as job growth and the overall economy accelerate.

And there is reason to be optimistic. The inventory of unsold homes on the market increased 6.5 percent from a year-ago and the median home price increased at its slowest pace since March 2012.

The months' supply increased to 5.9 months, the highest since August 2012, from 5.1 months in March. Six months' supply is normally considered as a healthy balance between supply and demand.

Headline Hype vs. Reality

Let's now compare the hype with the reality, starting with a pair of seasonally adjusted existing home sales graphs.

"Rebound" in Home Sales

Second Rise in Nine Months

Fundamental Reality

There is absolutely nothing in the above charts that remotely suggests a reason to be optimistic or that housing is "regaining its footing".

Moreover, the author failed to discuss interest rates, student debt, investor demand, or household formation.

Here's the reality: Interest rates are up, prices are up, and affordability is down. Investor demand was a huge portion of the market, and rising suggests investors are more discriminating.

Sales may increase in spite of those fundamentals, but virtually nothing suggests that outcome.

The author describes the increase in supply as "healthy". In context, it's not. While six month's supply may be normal, the more important fact is supply is outpacing demand by a quite a bit.

The expected result should be for prices to drop. While I consider that a good thing, most don't. And if the supply trend continues, it will provide evidence of pent-up-demand, not to buy, but to sell.

Finally, given all the emphasis on the "usually cold winter", one might wonder why the rebound was as small as it was, and also why the rebound was "less than expected".

The above article is about as slanted as it gets, including this line: "Sales are expected to gradually trend higher for the rest of 2014 as job growth and the overall economy accelerate."

Did someone from the NAR write that article?

The relevant fact here, I think.

Also, isn't it true that a significantly high number of homes were bought with cash (no mortgage)? Not many have that kind of loot just lying around...

Also, a lot of investors are the ones buying up most of the homes (mostly foreclosed ones) in order to flip them, either now or at a later date when (if?) the economy recovers.

However, the 15 year refi is at an average of 3.18% per today’s Bloomberg market data. That’s the lowest it’s been since the 2.9 seen last year right before the fed began signaling the end of QE last year.

Low rates and low prices make it a buyer’s market. The drag is the stricter loan requirements, but that’s a good thing. Had one young friend sell at a loss this year, but in his case it was better to take that hit, because he had to move a house that a divorce had stuck him with.

Reminds me of FR back when housing was going to hell... Posters attacked anyone with common sense! When (in Central Florida) a developer advertised a "Free Harley with your Home Purchase..." (FOR REAL), I knew it was soon to go down the drain!

For Realtors and assorted housing types..., it is ALWAYS a good time to buy!!!

All real estate is local. Here in Sacramento sales of existing houses have been very hot relative to supply for about a year and a half, though somewhat cooled off the last couple of months. Hot as in multiple offers above listing price the first weekend. Now it’s getting to be a more “normal” market, but still way better than the last five years before that.

Must be an election coming up. The state controlled “media” toads are starting to pimp for their DemocRAT “massas” hard. And I mean hard.

People in know in new home sales say a large number of homes are being bought by investors. This same thing happened in 2007. And we know what happened.

From other reports I have read, any present pick-up in “Existing home” sales is mostly churning among “existing home” owners, of any and every variety thereof because what is missing in all home sales is that not many are “first time” home buyers AND it is there that real housing market expansion comes.

In essence it seems that only existing home owners moving for one reason or another, and investors - not first time home buyers - are registering most all of the pick up in home sales. It is a false positive for home builders in general, though there are local markets that are contrary to any nationwide stats.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.