Source: Chesapeake Energy.

Posted on 05/29/2014 8:58:34 PM PDT by ckilmer

|

May 29, 2014 | Comments (3)

Source: Chesapeake Energy.

Former Chesapeake Energy (NYSE: CHK ) CEO Aubrey McClendon once boasted that the Utica Shale would prove to be "the biggest thing economically to hit Ohio, since maybe the plow." He called it a half-trillion dollar opportunity because "it sounds bigger" than a $500 billion opportunity. Unfortunately for McClendon, the Utica Shale didn't work out exactly how he envisioned it would. Many of his peers pulled back on the play after it turned out to be less oily than expected.

McClendon, however, never backed down. It's a good thing too because his former employer, Chesapeake Energy, is now certain that he was right and that the Utica Shale is a world-class energy asset. He likewise remains certain that the Utica's best days lie ahead as he's making a multibillion-dollar bet on the play through his new company, American Energy Partners.

McClendon's big bets

So far, McClendon has raised a whopping $8.7 billion to drill U.S. shale plays after recently raising another $4 billion. A third of these funds are earmarked toward the Utica Shale as McClendon also has his sights set on the Marcellus Shale and Permian Basin, where he is forming two new companies to target those plays.

What's interesting, given McClendon's history, is he actually has a lot of money to pursue his grand plan. What he doesn't have right now is the people nor the deals. In fact, he recently told a Houston energy conference that "I need deals and I need people" and one of the reasons he was presenting was because he was there on a recruiting mission.

That being said, this is a man who has already completed three Utica Shale deals this year. He spent $924 million to buy the 74,000 Utica Shale acres that Hess (NYSE: HES ) sold earlier this year. On top of that, he completed a deal with ExxonMobil's (NYSE: XOM ) XTO Energy unit to fund 100% of the near-term drilling costs of 55,000 net acres in a "core area" of the Utica Shale. In return, McClendon's company will receive ownership of 30,000 net acres from ExxonMobil in the Utica Shale. A third deal brought the company's total haul in the Utica Shale up to 130,000 net acres, which doubled its holdings in the region.

Source: Hess.

Just getting started

Despite all of this wheeling and dealing, McClendon is hungry for more. This is despite the fact that some of the acreage he is buying didn't hold compelling economics for the seller. Hess, for example, noted that the acreage it sold was primarily dry gas. The company concluded that the potential returns from the investment at both current and projected natural gas prices didn't justify retaining and drilling the acreage. That, however, doesn't mean it won't be economically appealing for McClendon's company to drill.

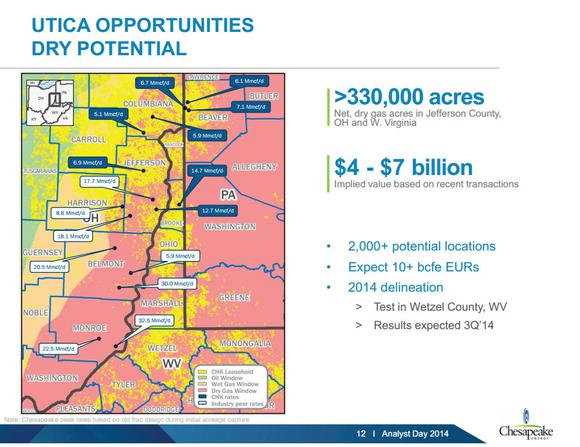

One thing that his former employer, Chesapeake Energy, is finding is that the dry gas potential of the Utica Shale is proving to be more lucrative than investors realize. The company and many of its peers are drilling impressive wells as seen on the following slide:

Source: Chesapeake Energy investor presentation (link opens a PDF).

As the slide notes, these wells have the potential to produce more than 10 billion cubic feet of natural gas equivalent during the lifespan of the well. To put that into perspective, the gas produced during the lifetime of one well is enough gas to supply all of the energy needs for 100,000 American homes for one year.

With the right cost structure, these wells can be highly profitable. It's a cost structure that Chesapeake Energy has, which is why it sees so much value in the more than 2,000 future well locations it possesses. It's this same value that McClendon sees in the Utica whether it's in the dry gas portion or the currently more lucrative liquids-rich section of the play.

Investor takeaway

The Utica Shale is starting to become the economic powerhouse that McClendon envisioned. While it won't fuel returns for everyone, which is why Hess is pulling out of the dry gas portion of the play, it is moving the needle for companies like Chesapeake Energy and is likely to do the same for McClendon's new venture. Needless to say, investors shouldn't be writing off the Utica Shale as it still has the potential to fuel returns for the right companies.

fyi. the natural gas flow rates from the utica and marcellus are just enormous.

McClendon is a fool. He nearly bankrupted Cheasapeake.

He drilled and discovered a lot of oil and gas but always over promised, over paid and under delivered.

He gets a lot right but does not seem to listen to the bean counters.

but i betcha he’s having fun. i don’t like bean counters either.

Costs are critical at $4.60/mcf.

Costs are critical at $4.60/mcf.

no one likes the bean counters, but McClendon really needed to listen to them because he almost put Cheasapeake into bankruptcy because of it.

the potential returns from the investment at both current and projected natural gas prices didn’t justify retaining and drilling the acreage

the potential returns from the investment at both current and projected natural gas prices didn’t justify retaining and drilling the acreage.

..................

I don’t disagree with you. That seems to be the conventional wisdom. But, neither of us have skin in the game.

However, Aubrey McClendon and his backers do have skin in the game to the tune of 6-7 billion dollars. They’re not just gambling. They’re taking calculated risks. I would like to hear their calculations.

But even without knowing the details, we do know that there are a couple of companies drilling profitably for natural gas in the utica/marcellus basin including McClendon’s old company Chesapeake. So since drilling for natural gas can be done profitably—it would be natural to assume that McClendon would know how to do it.

I don’t disagree — but McClendon’s old company— Chesapeake is one of a couple companies that are profitably drilling for natural gas in the utica/marcellus basin even at low prices.

Its likely, McClendon was able to raise 6-7 billion because people believe he has the know how to drill for natural gas profitably. Its impossible that his current backers did not express the same kinds of doubts about his leadership as have been expressed here.

Yet he was able to trick these fools into laying out 6-7 billion for the joy of gambling on McClendon jism? Not likely.

It would be interesting to hear some of the calculations/presentations that McClendon’s backers heard that caused them to lay out 6-7 billion.

(one calculation has to be that natural gas prices have absolutely nowhere to go but up.)

“the potential returns from the investment at both current and projected natural gas prices didn’t justify retaining and drilling the acreage.

..................

I don’t disagree with you. That seems to be the conventional wisdom. But, neither of us have skin in the game.

However, Aubrey McClendon and his backers do have skin in the game to the tune of 6-7 billion dollars. They’re not just gambling. They’re taking calculated risks. I would like to hear their calculations.

But even without knowing the details, we do know that there are a couple of companies drilling profitably for natural gas in the utica/marcellus basin including McClendon’s old company Chesapeake. So since drilling for natural gas can be done profitably—it would be natural to assume that McClendon would know how to do it.”

Aubrey is just a snake oil salesman at the highest level.

He is a landman who is not interested in the assets other than to make a deal to make money off another sucker. He would be just as comfortable selling cars at a used parking lot than oil and gas.

Look around at the carnage he has laid. He does not develop, but tries to draw up new plays by getting out front of the competition by tying up leases, drilling a few wells, selling the deal and skedaddling away to go do it again somewhere else.

A promoter is the kindest thing I can say about him. What this country needs and deserves are more old-fashioned stay and play oil companies who ride the assets down to depletion like the Seven Sisters. Unfortunately, they are now down to only 4 now.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.