Posted on 06/01/2014 5:53:52 PM PDT by expat_panama

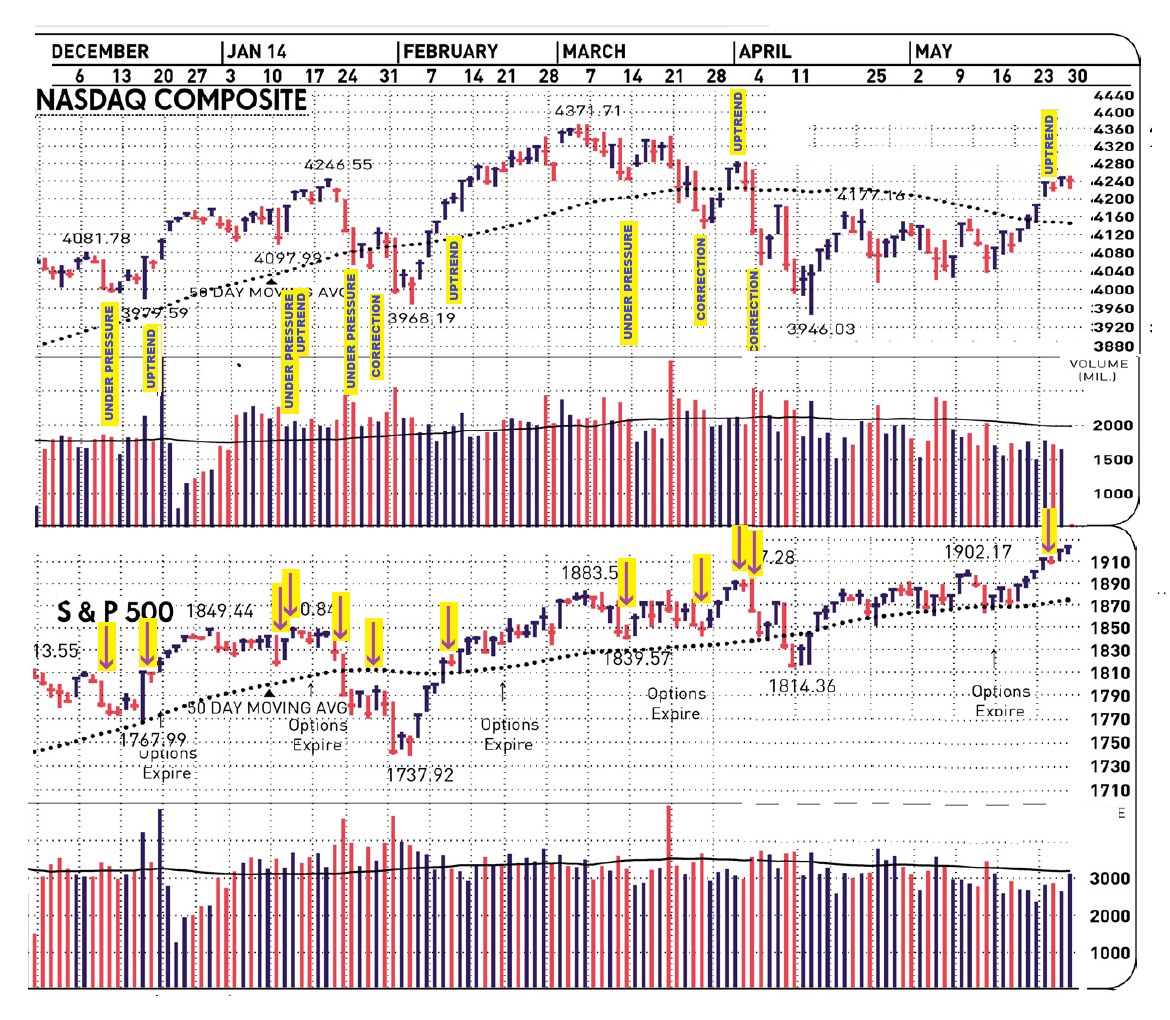

Big news this week: stock prices are officially in an IBD 'uptrend' as of last Tuesday night! We can see it on the plot to the left (click on it to enlarge).

OK, so we all can see that if we'd have sold on the 'uptrend' announcements and bought on the 'corrections' this year we'd be better off, but imho that only proves we're in a goofy backwards market. That's good; first, because now we know it's goofy, and second because we all need more entertainment in our daily lives.

In the meantime let's all memorize the eleven cognitive bias's posted last week (hat tip to Osage).

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

Amen. Just returned from a trip to the Smoky Mtns. What an exquisite piece of real estate that is!

QQQ hit a new high today.

Yesterday we ended flat in light trade and on this Thursday morning futures traders are seeing more of the same. Reports today include claims, job cuts, and gas inventories, and here's what caught my eye this AM:

THE ERA OF NEGATIVE INTEREST RATES HAS BEGUN

mario draghi ecb

REUTERS/Francois Lenoir

The ECB lows benchmark interest rate to 0.15.%, from 0.25%.

The deposit rate goes meanwhile has now gone negative to -0.1% from 0.0%.

The deposit rate was widely expected to go into negative territory.

This will be followed by a press conference with ECB head Mario Draghi.

Markets will also be watching for any announcements on an asset purchase program, or quantitative easing.

Claus Vistesen at Pantheon Macroeconomics doesn’t expect the ECB to fire any sort of bazooka today though. Draghi already announced a three-step response the current weak growth and low inflation plaguing the eurozone.

“The first step involves a reduction in interest rates to put downward pressure on rising money market rates, and to depress the exchange rate,” writes Vistesen. This is expected in today’s announcement.

“The second step responds to sluggish credit growth by targeting lending to non-financial corporates through either an LTRO or private QE,” writes Vistesen. “The final step sees a broad- based asset purchase program to counter a persistent lurch lower in inflation expectations.”

Here’s the full decision:

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.15%, starting from the operation to be settled on 11 June 2014.

The interest rate on the marginal lending facility will be decreased by 35 basis points to 0.40%, with effect from 11 June 2014.

The interest rate on the deposit facility will be decreased by 10 basis points to -0.10%, with effect from 11 June 2014. A separate press release to be published at 3.30 p.m. CET today will provide details on the implementation of the negative deposit facility rate.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 2.30 p.m. CET today. Further monetary policy measures to enhance the functioning of the monetary policy transmission mechanism will be communicated in a press release to be published at 3.30 p.m. CET today.

Now to the new banking paradigm...... we are in territory where when you deposit $1000 in a money market, it might be $999.95 next month with no activity. The Japanese are already familiar with this process. To a huge amount of Americans, they will find this to be an unacceptable concept, and mattress volumes are going to start to rise.

Kudos to Santelli. He has been saying this is coming for at least a year.

I am rooting for gold to get down to triple digits. I will jump in big time.

Notice that the first 7 employment recoveries are pretty much random in their duration. And that the last 4 are in chronological order. Even to the point that if a new recession pops up now(which is a strong possibility), we actually never recovered.

I know there are a million reasons, but if I fingered one, it would be the economic mismanagement by our government.

Well that’s what the ECB did to ON deposits. They are now charging 10 bps for them. The theory is that if the banks are charged they will lend more and velocity will increase. There is only €29 billion deposited though so it will likely have no effect. Draghi says no deflation though... LMAO!

I guess now the parents have to tell them that they need to get their ass going so they can save more and invest in strategic ETF's.

ECB and our central bank are pretty much joined at the hip. It’s just a matter of time here.

expat....the article on Russell 2000 and S&P links to a Forbes Bitcoin article.

Bingo! We are in the era of NIRP

tx, got the link from RCM but seems they put it up before their morning coffee. They must have been thinking about this piece ---the two indexes are in the buzz lately.

In the past gold's prices has spent most of its time in the triple digits.

Average since 1790 is $526 and since '79 it's been $828 --in 2014$.

Internationally there are some gov't bonds that have already been selling @ minus interest for a year or two now. While I like to look at various signals of a future expansion, this deflation is a very very bad sign (imho)...

SEC set to announce new rules for HFT and dark pools.

That ought to be interesting.

Indeed. I’m almost through the Michael Lewis book. Fascinating stuff. Something needs to be done about HFT and the dark pools. I just have zero confidence in this administration in choosing the correct path.

I’m just worried that they will do more to the little guy than the guys they are after. Obama seems to be pretty good at missing the target.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.