Posted on 08/03/2014 2:06:47 PM PDT by expat_panama

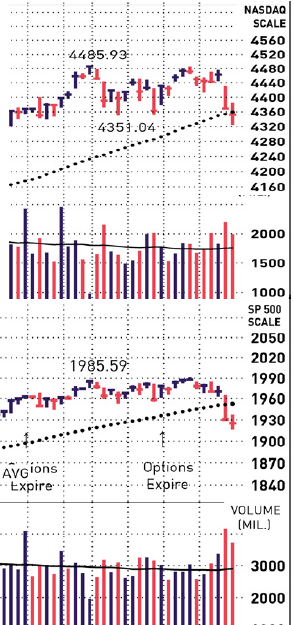

Yo! What we got this past week is the economy's officially in terrific shape and both stocks and metals are tanking.

Now, while it's never good to be too convinced about what we think is going to happen next in the future, I personally am having a hard time trying to decide what I think is happening right now. Somehow the more I know about what's going on the less I know about what's going on.

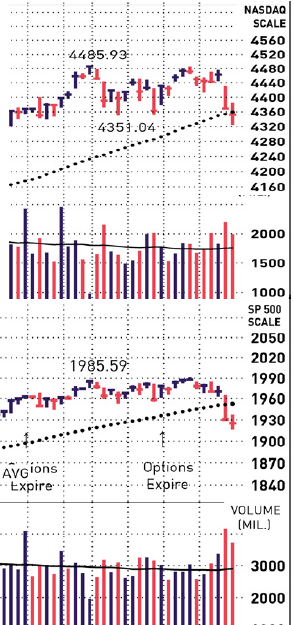

Oh yeah, IBD says stocks are still in an 'up-trend'.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

(re posts 34 & 37) still waiting or the S&P to reach 1900...

That's only 1% away.

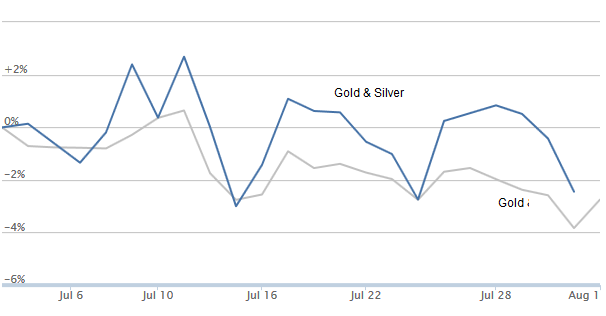

So oil has crashed through to $96/bbl... That’s not usually a good sign. Is the “wolf” here?

Murdoch pulled TWX bid. TWX down 11% after hours.

Fox is announcing earnings tomorrow. Maybe not so good news?

Oil prices are volatile, just like most commodities. Sometimes it matters and sometimes it doesn't.

IBD went to Market in Correction.

Happy back-to-cash Wednesday to all! Yesterday saw drops in both gold and stocks and this morning's futures are voting for more of the same. Still hard to tell what this morning's MBA Mortgage Index, Trade Balance, and Crude Inventories reports will mean here, but for stocks we're wrapping up a lovely ten-week uptrend!

Plenty of market updates at Yahoo, Google, and Real Clear Markets, but imho the best stuff this morning is here on the FR:

Stocks fall hard; Ukraine-related reports cited by traders

As cash flow flattens, major energy companies increase debt, sell assets

Why It’s Worrying That U.S. Companies Are Getting Older

It sure did! IBD followers scarfed up some tidy advances this time...

Thomson Reuters

LONDON (Reuters) - The U.S. economy continues to recover from the depths of the Great Recession, although its speed, trajectory and cruising altitude remain the subject of fierce debate.

What's indisputable, however, is that one of the economy's engines has persistently failed to ignite, despite record fuel levels in the tank.

Corporate America has never been more flush with cash. But business investment or capital expenditure - "capex" - has remained depressed, puzzling economists and strategists who have long predicted its resurgence and attendant impact on growth.

Instead, companies have chosen to dip into their collective $1.8 trillion pile of cash to re-hire workers, fund merger and acquisitions activity or buy back their own shares. Boosting growth and returns through long-term investment in their business hasn't registered nearly as highly.

This suggests underlying demand for goods and services is weak - certainly weaker than it should be, given that the economy is five years into a recovery - and not strong enough to sustain a potential growth rate of around 2.5-3 percent.

The problem then becomes circular: weak demand holds back capex, which drags on growth, which depresses demand.

"Waiting for business investment to accelerate has been a painful and thankless exercise," wrote Morgan Stanley in a recent 14-page report on capex. "A close examination of this underinvestment paints a grim picture of productivity rates and the economy's trend growth potential."

Since the 2008-09 economic and financial meltdown, U.S. capex has fallen short of the trend seen over 1990-2007 by more than 15 percent. That's an annual $400 billion gap today, never mind the shortfall accumulated over the previous five years.

On some levels, this reluctance from firms to invest is puzzling.

Productivity growth in the United States - the rate of growth in the level of output per worker - is near its lowest in 30 years, according to Bridgewater Associates. Spending on research, development and technology, would surely improve this trend.

The need for capex spending is also pressing because firms are reaching the point where they simply have to replace aging equipment. According to Morgan Stanley, the average age of industrial equipment is now almost 10.5 years, the highest since 1938.

M&A BOOM

But just replacing old equipment will not be enough to have a notable impact on economic growth. That will require businesses to spend over and above simple replacement rates, and so far that hasn't happened.

If company executives can be convinced demand can hold up, the conditions for splashing the capex cash are certainly there. Firms have nearly $2 trillion cash, they've reduced their leverage and indebtedness, and funding remains cheap and easy.

The positive impact of capex spending would be felt both in the long- and short-term, according to Bridgewater.

The effect of boosting productivity helps the economy's longer-term growth potential, while corporate profits and margins are "front-loaded" because outlays are amortized over time, yet related sales are booked instantly.

But executives have instead preferred to hoard cash in record amounts. And even when it has been spent it has been diverted to pretty much anywhere but capex.

The global year-to-date dollar volume of M&A deals stands at $2.5 trillion, or an increase of 70 percent on the previous year, led by North America ($1.2 trillion, up 83 percent) and Europe ($773 billion, up 85 percent), according to Deutsche Bank.

This year is almost certain to be the best year for M&A since the crisis.

There has also been a drive to increase dividend payments to shareholders and a resurgence of high-profile share buybacks.

Oil services company Halliburton has just increased its buyback authorization to $6 billion, oil major Exxon Mobil spent $3 billion in the second quarter alone, and consumer goods giant Johnson & Johnson announced a $5 billion repurchase program last month.

Buybacks and dividends may not be giving the U.S. economy any discernible boost, but they've done the stock market no harm at all, as Wall Street roared to a record high late last month.

Despite the numerous false dawns since the Great Recession, analysts still expect capex to pick up. If it does, then the broader economy should benefit.

Morgan Stanley is confident it will, and predicts growth of around 5 percent. Bridgewater also expects a "gradual acceleration", which could strengthen the economic recovery.

But the danger is that it fails to pick up enough. "A more historically normal cyclical pickup, something in excess of 8 percent annually, simply looks unrealistic," Morgan Stanley said.

(Editing by Will Waterman)

This article originally appeared at Reuters. Copyright 2014. Follow Reuters on Twitter.

Word for today—

Pork bellies

Their futures are up up and away and bacon will cost more, already does

--except for oil companies?

LOL

http://www.freerepublic.com/focus/news/3182854/posts?page=73#73

~Ronald Reagan

please click the pic

donate today!

Help support Free Republic

I’ve been saying for a while that this recovery is sub-optimal. 1.5-2% growth at best. Quite weak particularly given the depths of the recession. All thanks to Obama’s crushing regulations.

When trading gets tough, investing professionals tend to turn to the charts for guidance. And with tender geopolitical situations cropping up around the world, European economies in question and stocks getting closer to "correction" territory, many say the S&P 500's 100-day moving average is beginning to take on an outsized importance.

Known as a "smoothing mechanism," the 100-day moving average takes the average closing price from the prior 100 trading days, and thus provides an overall idea of the market's trend. The fact that the average takes into account precisely the prior 100 trading days (rather than 95 or 105, say) makes the exact level of the indicator somewhat random. v However, since 100-day moving averages are widely watched on Wall Street, the level that the S&P 500's moving average happens to be sitting on can begin to matter big time.

In fact, many traders point out that on Wednesday mornings, the S&P 500 bottomed just 2 points (or 0.1 percent) away from its 100-day moving average, which comes in at 1,913.25. For chart watchers, this is a very good sign.

"We bounced right off the 100[-day moving average], and that's encouraging," Rhino Trading Partners' chief strategist, Michael Block, told CNBC.com. "If we broke it, that would be a concern. But we're right on that level, so let's see what happens."

Over the past year, buying the S&P whenever it has gotten down to its 100-day moving average has made for some terrific trades. Going back to June 2013, the S&P has touched its 100-day moving average six times—and each time, it has bounced back like clockwork.

The question now is whether this delicate dance between the index and its smoothing mechanism can continue—or if the music is about to stop.

"It's all about the close," advises Rich Ilczyszyn of iiTrader. "Bears want a close below the 100-day, which then opens the door to a 5 percent or more correction down to 1,888 in the S&P e-mini futures."

Some traders say it will be much worse than that.

"Buying dips in the S&P has worked like a dream for three years. But like a lot of trading strategies, it works until it doesn't," said Scott Nations of NationsShares. "Buying a bounce off the 100-day moving average is one of those strategies. When it finally quits working—and that's likely to be soon—it's going to be ugly."

"The day that the euphoria is broken, the market will have a violent, shattering move downward," agreed Jeff Kilburg of KKM Financial.

Of course, others remain bullish.

"I do believe that buying the 100-day moving average might work again here," wrote Brian Stutland of Equity Armor Investments. "Interestingly, the market made a new low as it hit the 100-day moving average, but the VIX did not make a new relative high, meaning traders were likely selling out their fear or protections. Usually this is a buy signal, as expectations for a rally brew."

Either way, the S&P's dance with its 100-day moving average seems to merit close watching right now.

"This is more important than all this Ukraine noise and everything else," Block said. "The price action is going to tell us something—albeit on anemic, August 2014 volume."

—By CNBC's Alex Rosenberg.

So yesterday metals leapt and stocks held steady even while the Regime stole "more than $9 Billion in shareholder wealth". It's decision time for market trends and so far this morning our futures people are voting rebound for both indexes and metals as we watch for today's reports on Claims, Credit, and Gas Inventories.

—— It’s decision time for market trends ——

My thought is that it is August and such weighty trend setting will be delayed till September when everybody is back to work

I discount August from reality of events

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.