Skip to comments.

Investment & Finance Thread (Labor Day week edition)

Weekly investment & finance thread ^

| Aug. 29, 2014

| Freeper Investors

Posted on 08/30/2014 3:08:28 PM PDT by expat_panama

This morning looking in today's Real Clear MarketsGet I got a real kick out of this link that appeared : Kick Off Labor Day Weekend With Some Depressing Charts - Quartz.

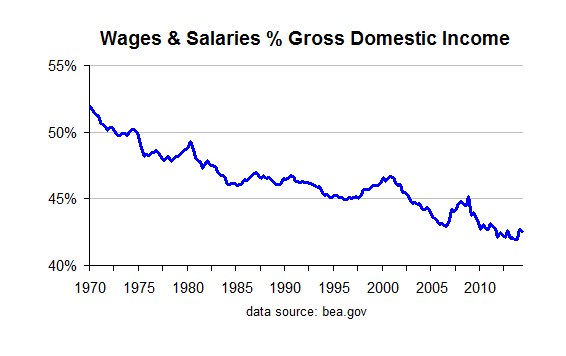

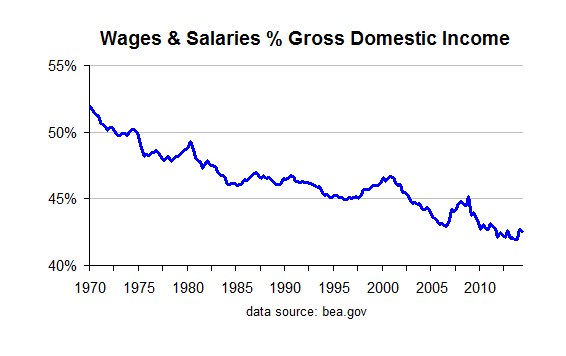

What the Quartz guys were wetting their pants over was how employee pay % total Gross Domestic Income was falling. Here's a plot of the numbers they stole from the American Tax Payer supported BEA.gov: (Note: Freepers can't post Quartz articles because of an alleged copyright complaint) |

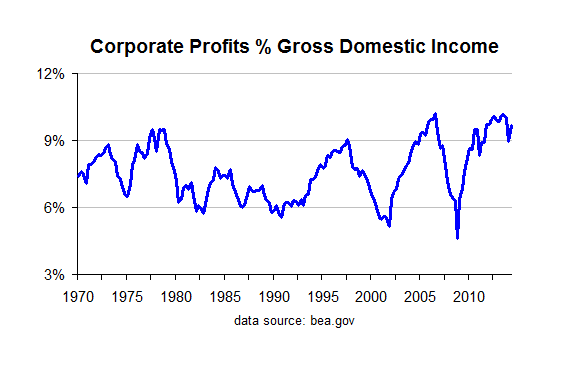

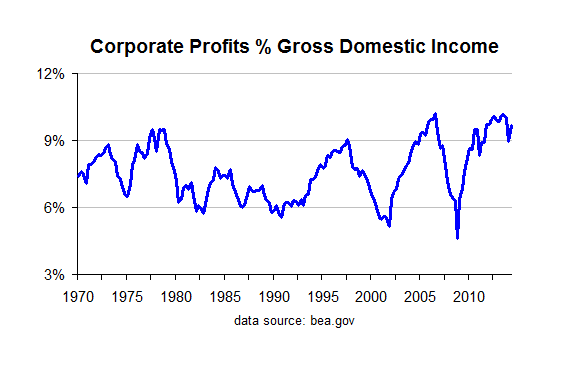

Apparently what's really got them upset is that the evil capitalist is exploiting the American Worker and the the share for evil corporate profits was climbing --here're the numbers the plagiarized from the BEA to 'prove' their point'. OK, like everyone's probably guessed, they left out a lot. One thing is the fact that-- |

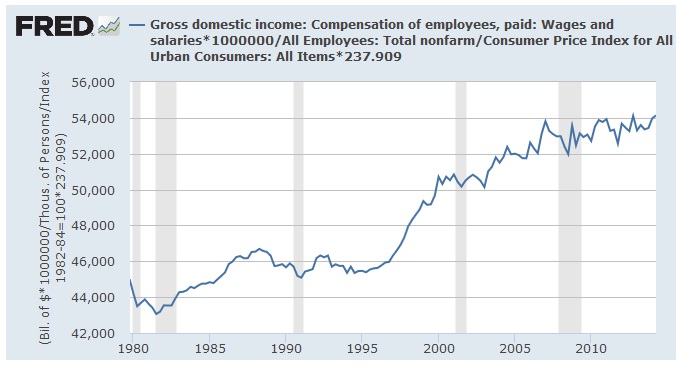

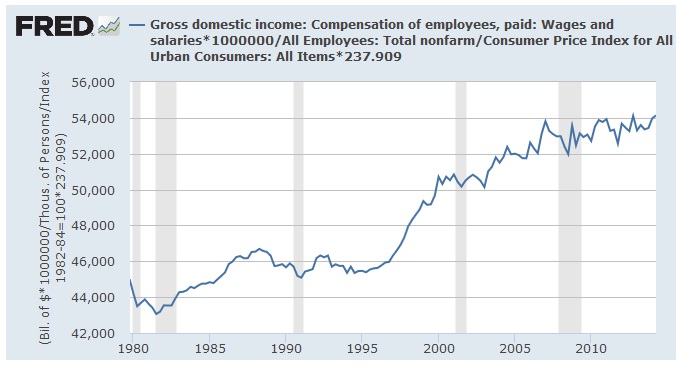

---total employee compensation per worker is at an all time high, even after adjusting for inflation. FWIW, the % plot at the top only showed wages and salaries, not total comp like this one does. Over the years employees have been getting and ever increasing % of their pay as benefits --obamacare etc.. |

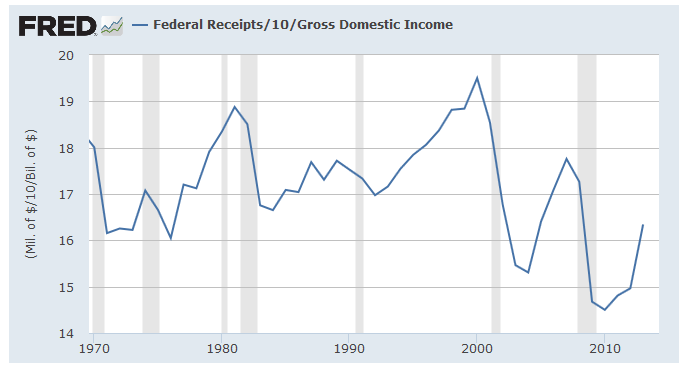

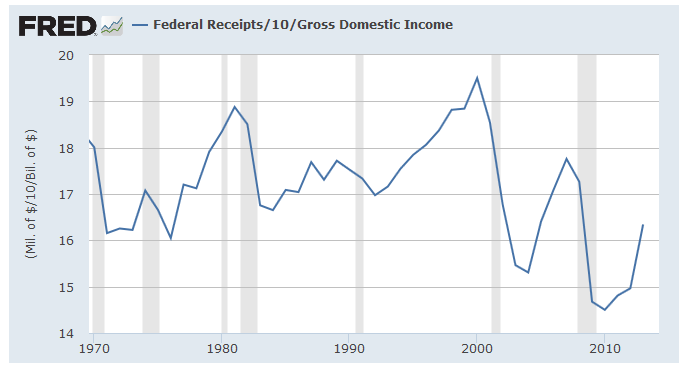

One other thing we ought to keep in mind while we ponder relative percents of the pie, namely the slice that the federal government's gobbling up. Looking at those numbers it seems that the good news is that it's been going down since the turn of Y2K, though lately we're seeing a rebound. Let's hope the Nov. elections help there. Almost forgot; the evil corporate profit %'s shown above that were used in the Quartz op-ed was based on profits before taxes. The real world after tax profit numbers are much smaller... |

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: expat_panama

The GS forecast for "everything":

To: expat_panama

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; ...

Welcome back to work! Futures have gold seriously down and stocks strong; ISM Index and Construction Spending today.

There is a time-honoured way of protecting taxpayers from picking up the bill for the failure of a systemically important financial institution. It involves central banks and finance ministries pressing ...

Financial Times

U.S. stocks are poised to kick off September on a high note on Tuesday, with futures moving broadly up ahead of data expected to show healthy U.S. factory activity in August.

MarketWatch

To: expat_panama

Good morning, and welcome to September! Here’s what you need to know.

1. Cantor Goes To Wall Street. Former U.S. House Majority Leader Eric Cantor will join investment bank Moelis & Co as vice chairman and managing director, Reuters reports. He will help the firm compete for business and advise clients on deals, the Wall Street Journal says. Founder Ken Moelis is the former president of UBS Investment Bank. Cantor will also be elected to its board. Moelis and Cantor have known each other for more than three years, according to the Journal. Cantor resigned from Congress in August.

2. Dollar General Still Hungry For Family Dollar. The Goodlettsville, Tenn.-based firm announced it is boosting its offer to $80 a share, for a total value of $9.1 billion. According to its release, it is also increasing the number of stores that it would be willing to agree to divest to 1,500 if ordered by the Federal Trade Commission and, has agreed to pay a $500 million reverse break-up fee to Family Dollar relating to antitrust matters. All other terms and conditions of the proposal remain unchanged.

3. S&P 3,000? Here’s a fun call to welcome us back from summer vacation: Morgan Stanley’s Adam Parker and Ellen Zentner say U.S. equities find themselves surrounded by forces that could push the S&P to 3,000 in the next five years. “Our best guess is that an S&P500 peak of near 3,000 is possible should the US expansion prove to have five or more years left to it, based on 6% per annum EPS growth through that time frame and a 17x price-to-earnings ratio,” Parker writes. Here’s BI’s Sam Ro: “Like many experts on Wall Street, Parker reminds us that our recent experience of crisis to recovery is not like most of history’s boom and bust cycles. He also reminds us that bull markets and economic recoveries don’t just end because they’ve gone on for a long time. ‘We believe a prolonged period of deleveraging in the US, coupled with an uneven global recovery, are just two of the reasons why this could prove to be the longest US expansion – ever,’ he writes.”

4. Court Bans Uber In Germany. A regional court has banned the San Francisco-based ride-sharing service, overruling an earlier verdict that had allowed the firm to continue operating, arguing drivers lacked required licenses, the Wall Street Journal reports. In case of violations, the company could be fined up to €250,000 ($328,225) per trip. Uber says it plans to appeal and will not halt operations.

5. Chinese PMI Comes In Lite. On Sunday, we learned China’s official PMI came in at 51.1 versus expectations for 51.2, while HSBC’s reading hit 50.2 against 50.3 expected. Although any reading above 50 signals expansion, analysts remain concerned. “We think the economy still faces considerable downside risks to growth in the second half of the year, which warrant further policy easing to ensure a steady growth recovery,” HSBC chief economist Hongbin QU said. Dariusz Kowalczyk at Credit Agricole said ahead of the reports that, “The data will highlight renewed downward pressure on the Chinese economy emerging in the summer, but it should also prompt more policy easing measures from Beijing, and is therefore going to have only a limited negative impact on market sentiment.”

6. Europe PMI Ugly. On Monday we got the following PMI readings for Europe:

Germany: 51.4 in August, down from 52.4 in July and an 11-month low.

UK: 52.5 in August, down from 54.8 in July

France: 46.9 in August, down from 47.8 in July, the fastest fall in 15 months

Spain: 52.8 in August, down from 53.9 in July, though still the ninth-straight month of expansion

Italy: 49.8 in August, down from 51.9 in July and the first month of contraction since June of 2013.

Total Euro zone: 50.7, down from 51.8. Output shrank to a 14-month low

“France remains a real concern, as does Italy’s descent from solid expansion to stagnation. Signs that growth impetus waned in the key industrial engine of Germany, and in Spain and the Netherlands too, is also less than reassuring,” Markit Economics economist Rob Dobson said. “The slowdown in industry is likely to add further fuel to the fire for analysts expecting additional monetary or fiscal stimulus to be implemented.”

7. Expectations Tempered For Dovish ECB Thursday. Though many major Eurozone economies have now seemingly ground to a halt, expectations that ECB President Mario Draghi will put easing into overdrive are getting dimmed as the region’s hawks have begun pushing back. After stating at the K.C. Fed’s Jackson Hole conference that there was more room for government spending to help boost demand, Draghi received a phone call from German Chancellor Angela Merkel and German Finance Minister Schaeuble asking for clarification, Reuters reports. The specter of moral hazard has also been raised. “With euro zone bond yields already at record lows, the impact of a QE program could be limited while banishing any pressure on governments to pursue structural economic reforms. ‘The ECB council will likely worry about the moral hazard aspects of QE, which could easily tempt governments in Italy, France and elsewhere to go even slower on reforms,’ Morgan Stanley analysts said in a research note.”

8. UK Bright Spot. This morning we learned the United Kingdom’s construction PMI reading climbed at the fastest pace in seven months in August t0 64.0 from 62.4. “UK construction firms saw one of the sharpest rises in output for seven years in August, with increasing workloads driven by an array of factors including surging homebuilding activity, greater infrastructure spending and renewed confidence within the commercial development sector,” Markit’s Tim Moore said per the FT. “A broad-based upturn in construction demand has created a boom in job creation this summer, as construction companies look to replace capacity lost in the aftermath of the recession.”

9. Data. At 9:45 we get the U.S. PMI manufacturing for August. The prior reading was 58. At 10 a.m. we get ISM manufacturing. Consensus is for a reading of 57 versus 57.1 prior. Also at 10 a.m. we get construction spending for July, which is estimated to have climbed 0.8% after falling 1.8% in June.

10. Markets. Stocks in Asia ex-Japan were lower as Hyundai sank 2.8% after reporting weaker than expected sales, and Samsung shares fell to a two-year low. European stocks were up, led by Germany’s DAX at 0.9%. U.S. futures were higher, with S&P futures up 0.2%.

To: Wyatt's Torch

...anyone who thinks the GOP isn’t in on the game in DC just take a look...That's the only factional strategy the extreme left can still use these days: the old "well the Reps are just as bad". It was used successfully in the '12 elections --what happened is that Obama was reelected not by Dems (who stayed home) but by Reps (who stayed home more). Contrary to what the extreme left says, elections really do have consequences and there really is a right and wrong choice here.

To: Wyatt's Torch

The GS forecast for "everything"huh, looking at gdp, stocks, metals, somehow their guesses seem well, reasonable...

To: Wyatt's Torch

...Uber says it plans to appeal and will not halt operations...This fuss somehow reminds me of the continuing flak over online file sharing, one of fondly held orthodox belief versus simple reality.

To: Lurkina.n.Learnin

...BI seems to always peer from the left side...--and it seems they're ratcheting up for the elections --re the big spread on Cantor we were mulling.

To: expat_panama

PMI takeaways:

To: expat_panama

It was announced today so they aren’t really reaching. But yes their editors are Dems (Blodgett and Weisenthal). Overall they are pretty fair and they do a great job on the economy and finance pieces.

To: Wyatt's Torch

...Overall they are pretty fair and they do a great job on the economy and finance pieces...My rating is closer to "very useful and worth following". At the very least I know that I need to be aware of what they report even if I have to follow up w/ checking the facts myself.

Of course, that's also how I rate the WSJ.

To: expat_panama

At least SOMEONE at the Fed has looked at velocity...

What Does Money Velocity Tell Us about Low Inflation in the U.S.?

By Yi Wen, Assistant Vice President and Economist, and Maria A. Arias, Research Associate

Inflation is typically described as a persistent increase in the general price level, such as in the consumer price index. One of the most important theories to explain inflation is the monetarist view that, according to Milton Friedman, “Inflation is always and everywhere a monetary phenomenon.”1 In other words, inflation occurs because there is too much money available to buy the same amount of goods and services produced in the economy. This view can also be represented by the so-called “quantity theory of money,” which relates the general price level, the total goods and services produced in a given period, the total money supply and the speed (velocity) at which money circulates in the economy in facilitating transactions in the following equation:

MV = PQ

In this equation:

M stands for money.

V stands for the velocity of money (or the rate at which people spend money).

P stands for the general price level.

Q stands for the quantity of goods and services produced.

Based on this equation, holding the money velocity constant, if the money supply (M) increases at a faster rate than real economic output (Q), the price level (P) must increase to make up the difference. According to this view, inflation in the U.S. should have been about 31 percent per year between 2008 and 2013, when the money supply grew at an average pace of 33 percent per year and output grew at an average pace just below 2 percent. Why, then, has inflation remained persistently low (below 2 percent) during this period?

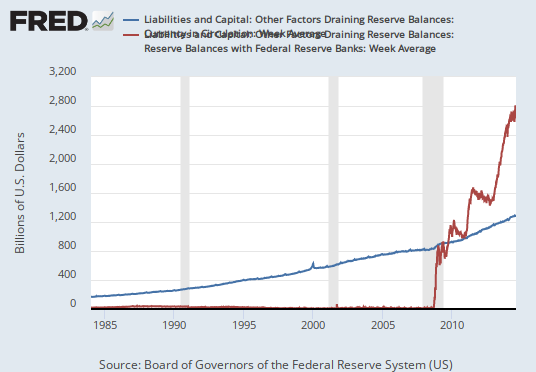

Declining Velocity

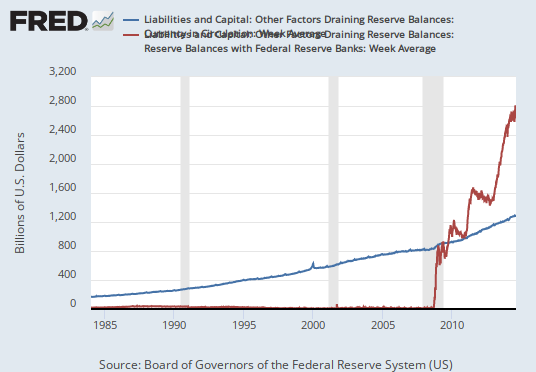

The issue has to do with the velocity of money, which has never been constant, as can be seen in the figure below . If for some reason the money velocity declines rapidly during an expansionary monetary policy period, it can offset the increase in money supply and even lead to deflation instead of inflation.

The velocity of money can be calculated as the ratio of nominal gross domestic product (GDP) to the money supply (V=PQ/M), which can be used to gauge the economy’s strength or people’s willingness to spend money. When there are more transactions being made throughout the economy, velocity increases, and the economy is likely to expand. The opposite is also true: Money velocity decreases when fewer transactions are being made; therefore the economy is likely to shrink.

During the first and second quarters of 2014, the velocity of the monetary base2 was at 4.4, its slowest pace on record. This means that every dollar in the monetary base was spent only 4.4 times in the economy during the past year, down from 17.2 just prior to the recession. This implies that the unprecedented monetary base increase driven by the Fed’s large money injections through its large-scale asset purchase programs has failed to cause at least a one-for-one proportional increase in nominal GDP. Thus, it is precisely the sharp decline in velocity that has offset the sharp increase in money supply, leading to the almost no change in nominal GDP (either P or Q).

So why did the monetary base increase not cause a proportionate increase in either the general price level or GDP? The answer lies in the private sector’s dramatic increase in their willingness to hoard money instead of spend it. Such an unprecedented increase in money demand has slowed down the velocity of money, as the figure below shows.

And why then would people suddenly decide to hoard money instead of spend it? A possible answer lies in the combination of two issues:

A glooming economy after the financial crisis The dramatic decrease in interest rates that has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds

In this regard, the unconventional monetary policy has reinforced the recession by stimulating the private sector’s money demand through pursuing an excessively low interest rate policy (i.e., the zero-interest rate policy).3

Indeed, during the prerecession period, for every 1 percentage point decrease in 10-year Treasury note interest rates, the velocity of the monetary base decreased 0.17 points, based on a linear regression model of the velocity onto interest rates. Since 10-year interest rates declined by about 0.5 percentage points between 2008 and 2013, the velocity of the monetary base should have decreased by about 0.085 points. But the actual velocity has gone down by 5.85 points, 69 times larger than predicted. This happened because the nominal interest rate on short-term bonds has declined essentially to zero, and, in this case, the best form of risk-free liquid asset is no longer the short-term government bonds, but money.

Notes and References

1 Friedman, Milton. “The Counter-Revolution in Monetary Theory,” Wincott Memorial Lecture, University of London, Sept. 16, 1970.

2 The monetary base includes notes and coins in circulation as well as bank reserves.

3 See our article “The Liquidity Trap: An Alternative Explanation for Today’s Low Inflation” in The Regional Economist for a more detailed explanation.

To: expat_panama

FYI TSLA and AAPL hit new highs today.

To: Wyatt's Torch

FUD is why people are hoarding money. We are in a recovery but it feels like it could disappear at any time.

34

posted on

09/02/2014 2:04:38 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Another data breach. It’s Home Depo’s turn in the barrel this time. I don’t buy a lot off of the internet because I don’t like having my credit card number in every data base that you deal with. I wish they would go to a purchase order type of system. If I want to buy something from ACME then I contact my CC co and tell them to pay ACME. No reason for ACME keeping anything other than shipping info and a PO number.

35

posted on

09/02/2014 2:38:18 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

...the best form of risk-free liquid asset is no longer the short-term government bonds, but money...Makes sense but reality does not always have to make sense. If money was really replacing bonds then bonds would lose value. They haven't. Then again, T-bill prices may be being propped up by the fed --but if that were true then the 'taper' should be demolishing bond prices. 'They haven't.

This is giving me a headache; let me know when reality starts making sense again

To: Lurkina.n.Learnin

—say w/ a prepaid debt card or a paypal purchase? Both are getting more and more popular these days...

To: Wyatt's Torch

38

posted on

09/02/2014 6:53:53 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

I need to talk to my credit union and see if they have a prepaid debit card. The one I have now is tied to my checking which I don’t like. Never have used it. If not enough funds then deny it.

39

posted on

09/02/2014 7:00:14 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

A lot of supply spiders look at velocity as a proxy for demand. The conclusion of the piece is that demand is extreme (I.e. “hoarding”) then accommodation is the right solution. And the fact that velocity had not improved is indicative that accommodation has been in place for the right amount of time (at least). One could argue that it hasn’t been enough :-)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson