Posted on 10/06/2014 5:09:54 AM PDT by thackney

Spurred by drilling across Texas and led by the Eagle Ford Shale and Permian Basin, crude oil production in Texas rose more than 23 percent in August compared to August 2013, according to the Texas Petro Index.

Oil production totaled an estimated 95.56 million barrels in August compared with 77.6 million barrels in August 2013, according to economist Karr Ingham, who developed and maintains the Texas Petro Index.

In addition, the 307,700 employees who are estimated to work for drilling and oil-field service companies surpassed 300,000 for the second time since the index was launched in 1995. Employment rose 8.3 percent for the month compared to August 2013.

“It was another strong month, even though crude oil prices declined,” said Ingham, who prepares the index for the Texas Alliance of Energy Producers, a state association of independent oil and gas producers.

With the state’s crude prices in August averaging $92.70 a barrel, the value of oil from Texas wells totaled almost $8.86 billion, 22 percent more than in August 2013. Texas’ natural gas output was estimated to be 703.7 billion cubic feet, a year-over-year monthly increase of about 0.5 percent.

The value of Texas-produced natural gas was $2.63 billion in August, an 8 percent increase compared to August 2013, as the prices of gas in August averaged $3.74 per thousand cubic feet.

Ingham noted that average oil prices in August were down about $10 or $12 a barrel from June’s prices.

“I don’t have too much doubt that we’ll begin to see these numbers flattening a little bit if (oil) prices remain the $90 range or go lower,” he said.

But if oil prices stay about the same as at present, he doesn’t expect to bring about “any wholesale scale-back” in exploration and production activity.

And it’s a plus that rising U.S. domestic oil production adds an element of stability to fuel prices, especially for gasoline.

The beginning of the U.S. bombing campaign in Syria and Iraq last week “was met with absolutely no response at all in terms of spiking prices in crude oil markets,” Ingham said. “You’d expect that at least for a few days it would cause crude oil prices to spike upward, and that didn’t happen at all.”

There has been such an increase in domestic production that “that’s in part what’s pushing prices lower,” he said.

“We have great supply, lower prices and very welcome stability, at least for the time being.”

AND ... lower prices means lower profits so bigoil is not becoming more wealthy.

Imagine that. Prices decline, demand and production go up.

It's almost as if there's an invisible hand at work.

So what if big oil becomes more wealthy as long as tehy provide a good product at a good price. (and from what I understand, the profit margin on a barrel of oil isn’t all that much.)

If I read correctly, enough oil production in Texas in a single month to satisfy all of the U.S. oil consumption needs over four days, four hours and forty minutes, (or something very close to 100 hours exactly, if I’m close to being correct).

I hope they lobby the shit out of congress and get rid of all of those epa formulae ... especially ethanol

thanx thack ... I never knew that

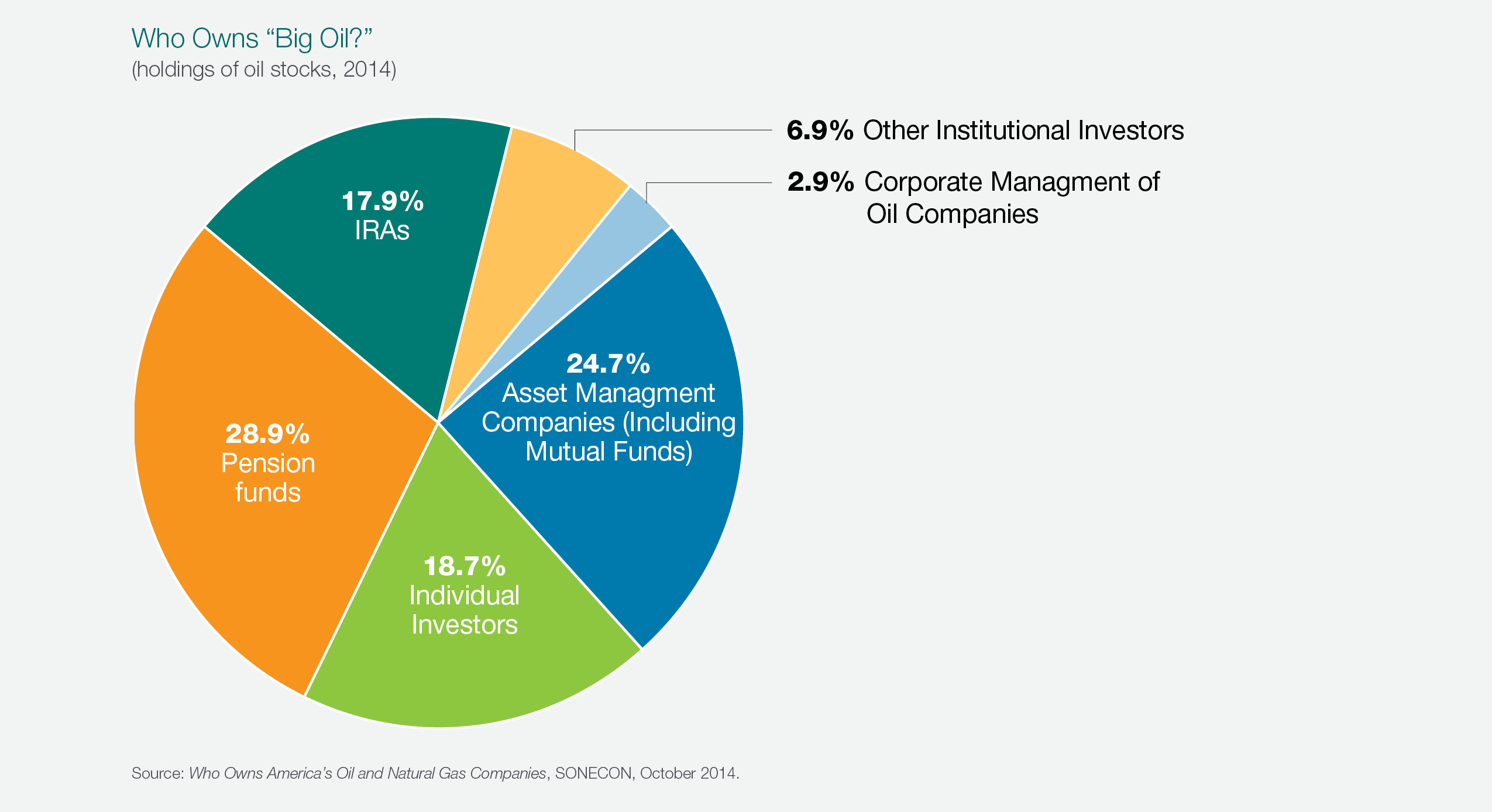

Almost every major public traded company is mostly going to be individual investors, or institution investors, like mutual funds, which is a group of individual investors.

Big oil is grandma...

I recall the Urban Cowboy days. I am happy things are booming and all of those jobs are being added. I hope they are saving for the rainy day that will inevitably come.

Oh, good grief! Read the ONE comment to that piece. Some “settled science” d-bag posted a response the article yammering about Gorebull Warming and blah, blah, blah.They are everywhere... and I feel a big offended, like I am reading an engineering trade magazine and there is a letter to the editor badmouthing technology.

“AND ... lower prices means lower profits so bigoil is not becoming more wealthy.”

Much more importantly, since oil price is global, it means the Arabs, Iranians, Venezuelans and Russians who depend the most on oil prices will suffer much more greatly.

This is good news for America and a win/win

1. Americans achieve improved standards of living as costs are less.

2. Those enemies who depend upon oil suffer.

USA ! USA ! USA !!!

Yes Sir’ree thats what markets like to hear. That word stability.

Even though we consumers would like to see gas prices to go lower, at least the prices are remaining stable.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.