Posted on 01/05/2016 8:01:14 AM PST by SeekAndFind

If McDonald's suddenly cuts the price of its French fries in half, would its store profits fall or rise? If the price cut caused more people to come to its stores and spend more on other items, such as Big Macs, revenues and profits might rise, provided that competitors do not cut their prices in response. Airlines have learned to adjust their prices for each flight and almost each seat on what seems to be an hourly basis, depending on supply and demand, all in the interest of maximizing profit.

Any business person who does not understand the laws of supply and demand will soon go bankrupt. It is only the political class who fails to (or wishes not to) understand this basic economic concept, particularly when it comes to tax rates. Politicians get away with destructive tax policies because they know that many voters are grossly ignorant when it comes to basic economics.

Those who have not studied economics often rely on the press, who are often equally ignorant of economics and, hence, are unable to differentiate between sense and nonsense. While The Wall Street Journal (and particularly the editorial page) normally gets it right, The New York Times and many other newspapers too often let political bias get in the way of the facts.

It is particularly disappointing when a former great news magazine, The Economist, allows very sloppy reporting and analysis on serious economic topics. This week, The Economist published an article on the tax reform proposals of the Republican candidates in which it charges all of them of putting forth "hugely expensive" plans before "accounting for economic effects." The whole point of tax reform is to reduce the economic drag of the current tax code -- which The Economist correctly describes as a mess.

(Excerpt) Read more at washingtontimes.com ...

But its not about raising revenue ...

it’s about punishing hard-working people. That’s what the IRS is for.

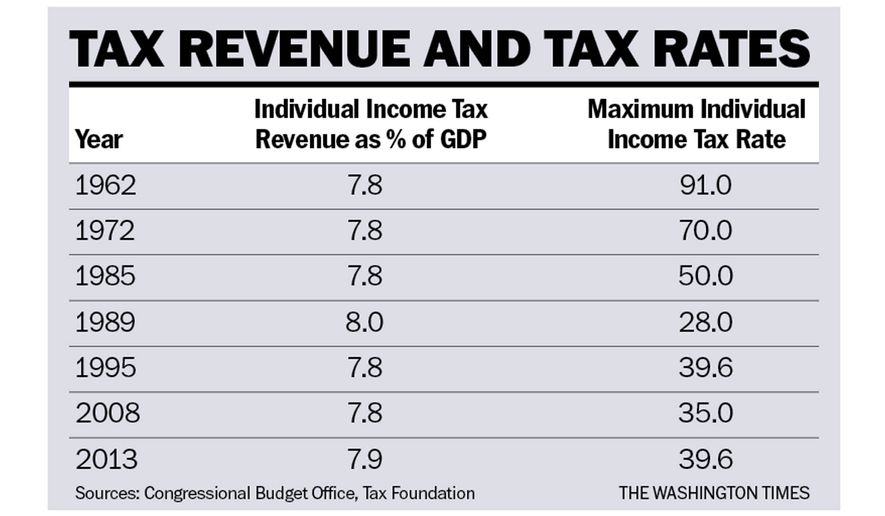

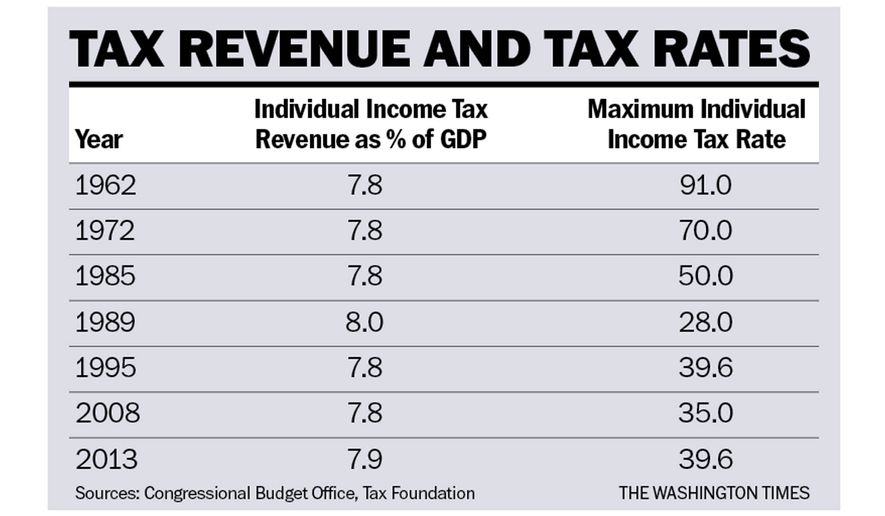

The Laffer Curve illustrates the relationship between tax rates and resulting revenue.

I find it interesting how ‘journalists’ continually present what is new and novel to them as new and novel to everyone.

It’s a marvel of modern media propaganda that the Laffer curve is popularly considered to be fraudulent. The only thing that can be argued is the exact position of the maximum revenue point.

Revenue to whom? Higher taxes ALWAYS means LESS revenue to ME. Something is wrong with the media's lingo.

Who besides government cares about government revenue? I care about MY revenue. People care about THEIR revenue. Screw government revenue.

I loathe and despise the government-view economic lingo the MSM has adopted since I-don't-know when. Our country never was, is not now, nor never will be about the government. America is about US - U.S. - US, the individual American. Our lingo should revolve around the individual not government, and the effect upon the individual not government. Nobody except government cares about government except keeping it small and out of our lives.

As far as the economy goes, the key to individual and corporate prosperity is individual and corporate revenue, NOT government revenue. Let's start talking about the economy and the results of taxation in terms of INDIVIDUAL AND CORPORATE REVENUE.

Let's force the government to quit balancing their books on our backs as though THEIR revenue was the most important factor in our economy. Government revenue is LEAST important.

Let's fix our lingo to reflect that.

The Kennedy and Reagan tax cuts, along with the Laffer Curve, should convince anyone that tax cuts often increase tax receipts, not decrease them. Experiments in India and the UK show the same results.

As to raising taxes on the rich...Really? The top 10% of income earners currently (2014) pay almost 70% of the total tax receipts for the federal gov’t. To me, a flat tax where everyone pays, say 17% of gross income, is a better way to go. If not that, then add a qualifier that says if you don’t pay any federal taxes, you can’t vote in federal elections. Nothing in the game, why should you? I’d apply the same rate to corporations.

As to the rich who says taxes aren’t high enough (e.g., Buffet, Gates, etc.), I’ve yet to see them take out their checkbooks and add another couple of million to their tax payment. If they aren’t willing to do that, then STFU. Us poor people pay enough, and the rich are the people who hire us, not the non-tax paying deadbeats.

higher taxes reduces aggregate saving, which reduces aggregate productive expenditure, which reduces capital accumulation and productivity of labor, which reduces average real wage rate and standard of living for the average worker.

Is it the job of government to maximize the taxes it collects?

Or is it the job of government to do its job with the least amount of taxes needed?

Obamanomics:

The government orders McDonalds to shut down profitable franchises owned by whites and give them at no cost to minorities (just like GM).

The company is ordered to pay all employees the same salary as the CEO, to give its French Fries and other foods for free to democrat victim groups and to double the price for whites.

Then the government demands all their revenue as taxes.

When they can’t pay the taxes the government takes all the outstanding common stock gives half of it to minority burger flippers and the other half mysteriously just seems to disappear.

When McDonalds goes bankrupt the government holds it up as a glaring example of why capitalism is a bad economic system and doesn’t work.

They don’t even care about the money they raise, they just spend what they want irregardless.

Agreed.

Raising taxes isn’t about increasing revenue. It’s the desire to control other people’s behavior. It’s called behavior modification.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.