FBI notes from Dec. 22, 2015, interview with Bryan Pagliano

Posted on 09/29/2016 4:01:55 AM PDT by NYer

Tax deductions that Bill and Hillary Clinton took for computer maintenance expenses match up closely with payments they made to Bryan Pagliano, Hillary Clinton’s personal email technician, a Daily Caller investigation reveals.

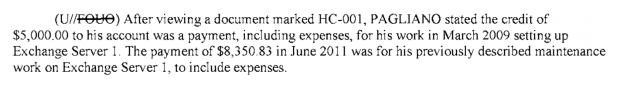

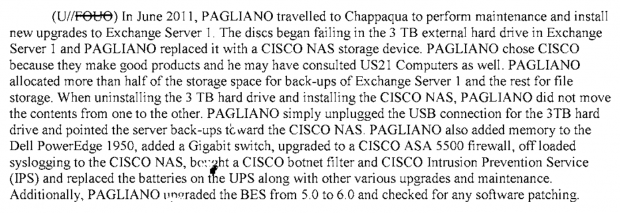

The payments to Pagliano were revealed in notes released on Friday from his Dec. 22 interview with the bureau. Investigators cited documents showing that the Clintons made a $5,000 transfer to Pagliano in 2009, and another in June 2011 for $8,350.83.

FBI notes from Dec. 22, 2015, interview with Bryan Pagliano

The Clintons’ publicly available tax filings show that the former first couple deducted similar amounts from Bill Clinton’s speechmaking income for computer maintenance expenses in those same years.

The Clintons also depreciated computer equipment that was put in service in June 2011 — the same month Pagliano traveled to the Clintons’ home in Chappaqua, N.Y. to work on the server — as well as at other times when major changes were made to the off-the-books email system.

The similarities in the deductions and server payments are not definitive proof that the Clintons wrote off the money they paid to Pagliano. But none of the available evidence rules it out.

Notably, the tax deductions are larger than the payments to Pagliano. If the inverse was true — if the tax deductions were smaller than the payments to Pagliano — that would suggest that the deductions were for something other than the payments to the technician. The Clintons and Pagliano could help settle the matter, but they did not respond to requests for comment.

The IRS does not allow taxpayers to deduct personal expenses, and Clinton treated the private email server as a personal device. She declined to tell the State Department she used it, and she kept it at her home in Chappaqua, N.Y.

Tax deduction timeline

Pagliano, who was granted immunity to cooperate with the FBI, began creating the Clinton email system in early 2009 after being contacted by Justin Cooper, a longtime aide to Bill Clinton who helped the former president coordinate his official government activities, his business endeavors, and his Clinton Foundation work.

The IT director for Hillary Clinton’s 2008 campaign, Pagliano used equipment left over from that failed effort to build the system, which was activated in March 2009. He took a job at the State Department months later, in May, but did not tell the State Department about payments he received from the Clintons.

The new server hosted three email domains: wjcoffice.com, presidentclinton.com and clintonemail.com, the one Clinton and her aide Huma Abedin used for email.

The Clintons’ tax filings show that they took no deductions for computer maintenance in the years before Pagliano started building the email network.

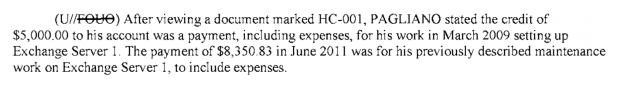

But that changed in 2009, when Pagliano completed the creation of the off-the-books email system and was paid for it. There is a $6,388 deduction for “computer/phone” on the Schedule C form for Bill Clinton’s speechmaking business. Clinton was paid $7,359,592 for his speeches that year.

Bill and Hillary Clinton 1040 Schedule C, 2009

In 2010 there was only a $328 deduction for computer services. The FBI notes do not detail any major work on the Clinton server that year.

The Clintons 2011 tax returns show an uptick in maintenance expenditures.

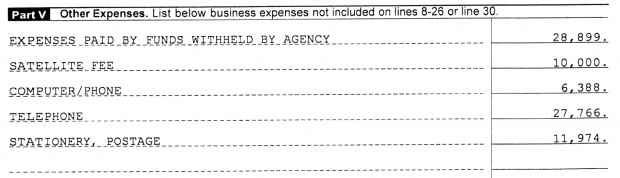

They took a $8,743 deduction for “computer maintenance” that year, an amount that is close to what they are known to have paid Pagliano in June 2011. Clinton raked in $13,864,072 for his speeches.

Bill and Hillary Clinton IRS filing, 2013

Also that year, for the first time, the Clintons began depreciating computer equipment. There is a $6,501 entry for “computers” on the tax form. The equipment is rated 100 percent for business use.

The FBI’s notes show that Pagliano travelled to the Clinton’s house in New York in June 2011 “to perform maintenance and install new upgrades” to the server. The notes then list all of the equipment Pagliano added to the system.

The Clintons deducted computer maintenance expenses over the next three tax years, their IRS filings show.

In 2012 there was a $1,239 expense for “computer services.” They also took a $5,220 for computers. In 2013 and 2014 there were deductions for computer work of $3,726 and $3,284, respectively.

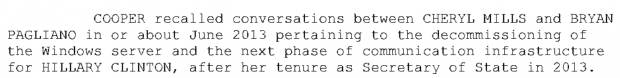

In June 2013, the Clintons began depreciating other computer equipment. There are entries of $5,909 and $1,986 for computers put into service on June 30, 2013. That is also a key month in the Clinton computer system timeline. According to the FBI notes, Cooper told the FBI that he, Pagliano, and Hillary Clinton’s former chief of staff Cheryl Mills began working on transitioning the administration of the server to Platte River Networks, a Denver-based firm that is also embroiled in the email scandal.

FBI notes from Justin Cooper interview

As with Pagliano and the Clinton campaign, Cooper did not respond to a request for comment.

If, as the evidence suggests, the Clintons wrote off their payments to Pagliano, they could argue that the deductions would be justified if they were used for Bill Clinton’s speechmaking business. But that claim would be undermined by the fact that the server was kept at the Clintons’ private residence.

Pagliano also indicated to the FBI during one of his two interviews that he understood the server to be for personal communications. He told investigators that he declined a suggestion from a State Department colleague to put extra protections on the server because he believed it was being used for personal communications.

Additionally, Pagliano had no associations with Bill Clinton’s business endeavors.

The Clintons deducting payments to Pagliano would not be a surprise, the president of one watchdog group says.

“The Clintons are no strangers to questionable tax deductions, going back to their Arkansas days,” Ken Boehm, the president of the National Legal and Policy Center, told TheDC.

“It goes without saying that it is improper to take a tax deduction for a server or anything else which was used or maintained by the government. The Clintons and their hired help have tied themselves in knots refusing to answer questions about the notorious server. That is not the conduct of anyone with nothing to hide.”

Move along, nothing to see here. No violations and you should not be peering at other’s tax returns anyway.

How about the payments that went to Comey’s brother, Peter?

Nothing to see there?

THEY ALL BELONG IN PRISON WITH THE GOP ENABLERS.

Bookmark

The IRS is very exacting when it comes to claiming work deductions for home offices... well, at least for the little people.

Hey Chaffetz -

You’re powerless to oversee, so you had one purpose - form logical questions to get Comey to admit the truth of statements like “Hillary is above the law.” FAIL

Those deductions should be disallowed! IMHO they fail the “ordinary and necessary” requirements and the certainly were NOT for the convenience of her employer! In fact, the server was decidedly an inconvenience to the State Department, resulting in tens if not hundreds of thousand dollars in expense. And who issued the 1099-Misc to “Stonetear”? Audit time!!!

Of course, but since the IRS works for the Democrat party, just as the FBI and the DOJ do, nothing will happen.

Now we have the Clinton Crime Family foundation which is nothing more than an extension of their political operation. Note how freely those in the campaign move between the two.

Recently, the witch (misspelled) said she worked hard for her money. These two would not know hard work if it bit them in the arse. Note she still have not released the content of the speeches to various wall street firms. Interesting that no one has mentioned what was said, one would think someone would have or is it a situation where there were no 20 minutes speeches and the checks were just for doing nothing. Perhaps if someone speaks at a non political event, the firms can deduct the speech expenses?

The whole dem party is nothing but bribes, bribes and damnable bribes (pardon the reference)

True ... but we haven't yet seen what the departing Obama administration will leave behind.

but we haven’t yet seen what the departing Obama administration will leave behind.

I am reserving the platinum standard for that POS.

Wasn’t Al Capone sent to prison for income tax violations? :=)

LOL!

Sometimes I think about politicians’ getting what’s coming to them ... like the Ceaucescus.

Oh, there’s plenty to see. And President Trump will have his US AG investigating thoroughly to be sure...

Both Clintons were paid plenty during this period.

If they used the computers or email server in any of their business that brought in money (hard to see they would not), it appears to be an allowable business expense.

Please share.

Note the confession contained in the tax documents.

The Clintons deducted the e-mail server expenses as a cost of Bill’s “speech” business. That is valid only if his speaking gig were procured, managed, and, facilitated by the private server. The private e-mail server was set up for Hillary’s “convenience” as Secretary of State. Hillary being SoS is related in the Clinton’s minds and tax returns to Bill getting this income.

Also that year (2011?), for the first time, the Clintons began depreciating computer equipment.They didn't take a deduction on the earlier server because they likely converted it to personal use by taking it from the campaign.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.