Skip to comments.

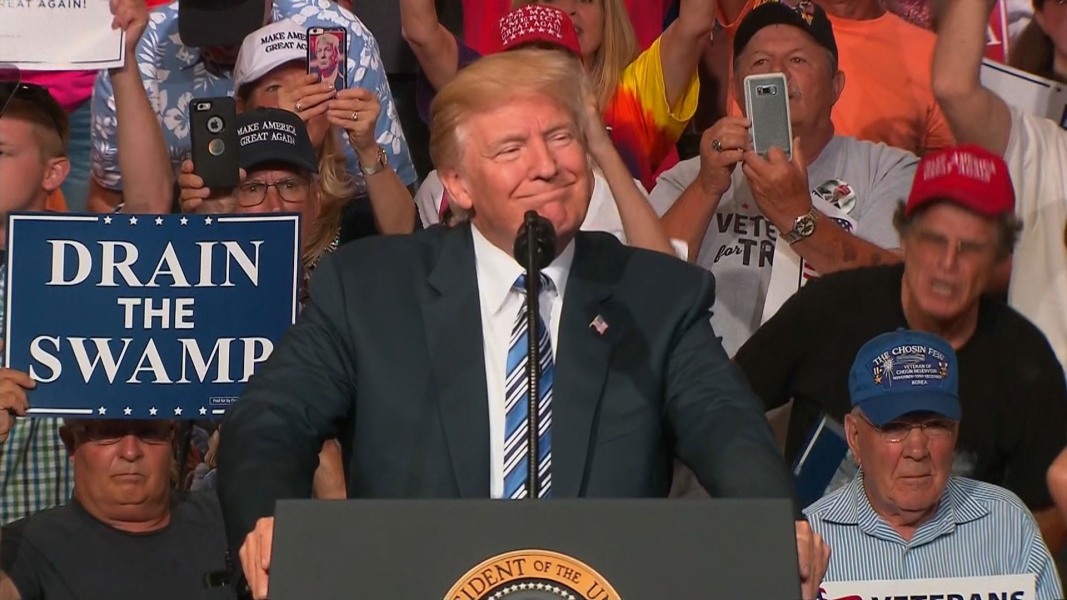

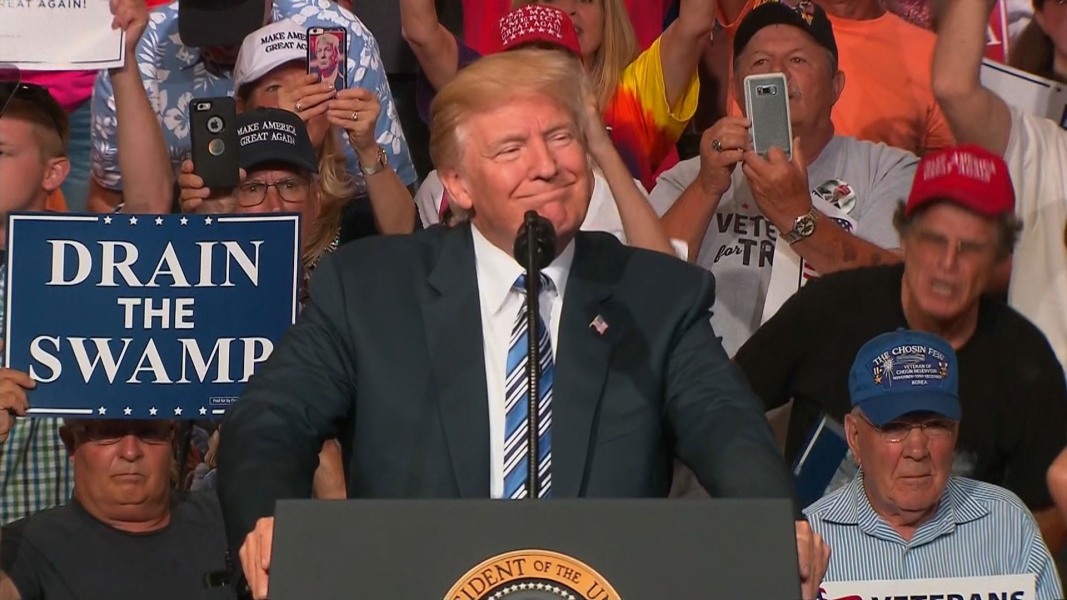

Trump Tax Cuts Gain Momentum as Senator Rand Paul Goes 'All In'

Reuters/AOL ^

| Oct 20th 2017 11:48AM

Posted on 10/20/2017 2:33:48 PM PDT by drewh

U.S. Republican senator Rand Paul on Friday appeared to back the Trump administration's sweeping tax cut plan, saying he was "all in" for massive tax cuts even as the Senate passed a key budget measure without his support one day earlier.

On Thursday, the Republican-controlled Senate approved the budget resolution for the 2018 fiscal year, with Paul casting the lone Republican vote against it. That approval paves the way for their tax-cut proposal that would add up to $1.5 trillion to the federal deficit over the next decade to pay for the cuts.

U.S. President Donald Trump on Friday signaled optimism for passage of the cuts, saying Paul would back the proposed tax measure when it comes up for a vote.

"The Budget passed late last night, 51 to 49. We got ZERO Democrat votes with only Rand Paul (he will vote for Tax Cuts) voting against," Trump wrote on Twitter. "This now allows for the passage of large scale Tax Cuts (and Reform), which will be the biggest in the history of our country!"

Paul responded with his own tweet, saying, "I’m all in for tax cuts @realDonaldTrump. The biggest, boldest cuts possible - and soon!"

The Kentucky Republican had said he would not vote for the budget measure unless it in kept in line with previously enacted federal budget spending caps.

Republicans are still hammering out their tax legislation after releasing an initial outline. The administration has said it would deliver up to $6 trillion in tax cuts to businesses and individuals.

The Senate budget must be reconciled with a markedly different version passed by the House, a process lawmakers have said could take up to two weeks.

TOPICS: Breaking News; Business/Economy; Government; News/Current Events

KEYWORDS: budget; paul; randpaul; taxes; trump

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 next last

To: SecAmndmt

I would far rather see the personal income tax zeroed, partially replaced by tariffs, with corporate income tax reduced to be sufficient to pay for the military budget. Maybe a special levy to pay for the border wall, and military deployment to the border. Reasonable. But the current plan very clearly stakes out "winners" and "losers." It stinks of Paul Ryan. The language even sounds like his 2013 Budget Agreement with Sen Murray (D-WA). Even the "over ten years" garbage is Ryan's writing. In that agreement, he screwed over military veterans by slashing pensions - even for 100% disabled veterans due to their combat injuries.

Ryan has a history of reckless actions that lead to political suicide.

This tax bill is one of them.

41

posted on

10/21/2017 9:27:55 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: palmer

Then they ought to eliminate it for both. But they are not. That's the point. Please don't switch gears here.

When asked by corporations would be allowed to still claim the state and local tax deduction, a GOP member on the Ways and Means Committe said: "Without that break, they would go out of business!"

I am serious. He/she said that.

This is now an issue where Chuck Shumer is making more sense than our side.

42

posted on

10/21/2017 9:30:01 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: drewh

It is not a tax cut until we see an actual tax rate schedule with real numbers on it.

43

posted on

10/21/2017 9:31:59 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

Tax cuts are all well and good, but they mean nothing without spending cuts.

44

posted on

10/21/2017 9:33:26 AM PDT

by

dfwgator

To: dfwgator

Sending and taxing are not related. Cutting taxes increase revenue thought the fiscal stimulation tax reductions have on the economy. Linking the two together is stupid.

45

posted on

10/21/2017 9:36:05 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

It is not a tax cut until we see an actual tax rate schedule with real numbers on it. It doesn't matter to K Street and the publicists.

They will call it a "Tax Cut" even if is creams the middle class. As I said, 44 Million Americans claim the state and local tax deduction. They are going to make all of us pay more so that the corporations can pay much, much less. There have to be "losers" to "pay for" the cuts - you see.

I guess K Street is ca$shing in all those donations to Congre$$. The bill is written to pay off those who paid them off.

46

posted on

10/21/2017 9:41:59 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: central_va

Cutting taxes increase revenue thought the fiscal stimulation tax reductions have on the economy I agree with you. But they want to make the tax cuts "Revenue Neutral."

That means that these are not really tax cuts for everyone. They are screwing over some people and paying off other people.

You know this is true.

47

posted on

10/21/2017 9:43:29 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

I am holding out hope for the same or a little less. Naive I guess.

48

posted on

10/21/2017 9:43:49 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: dfwgator

but they mean nothing without spending cuts. That would mean Entitlements, and they are not even part of the discussion in Washington. And they won't be.

49

posted on

10/21/2017 9:44:35 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

And usually tax cuts in one area are made up in another area, so the net effect is minimized.

50

posted on

10/21/2017 9:45:43 AM PDT

by

dfwgator

To: SkyPilot

The best way to increase federal and state revenues is to stipulate the economy. The best way to stimulate the economy is through tax cuts. It is real simple. “They” don’t get it.

51

posted on

10/21/2017 9:46:25 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

I am holding out hope for the same or a little less I guess that is all we can hope for, but Millions of Americans paying more.

Congress FAILED us on repealing Obamacare, funding the wall, passing National Reciprocity laws to protect concealed carry permit holders nationwide, appointing conservative judges (dozens of nominees are are not even given a vote), and many other failures.

With the worst legislative record in Congressional history, the House and Senate GOP members have to do something. And what is that? Paying off their donors.

That is why the middle class will be screwed by this tax bill.

52

posted on

10/21/2017 9:48:19 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: central_va

Cutting taxes increase revenue thought the fiscal stimulation tax reductions have on the economy. Linking the two together is stupid.

Yes, more revenue to feed the government Leviathan.

53

posted on

10/21/2017 9:49:47 AM PDT

by

dfwgator

To: SkyPilot

When are we going to see the new rate schedule? How has the normally porous government kept this a secret? My God everything leaks. Why not this? This actually affects peoples’ lives directly.

54

posted on

10/21/2017 9:51:04 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: dfwgator

Face it. Living in the USA, even with all of it's supposed freedoms, is a miserable proposition for the non moneyed class, unless the economy is going gang busters. Socialism is better than living in a free market economy like the USA with an annual 1.5% GDP growth. This can't economic malaise go on for much longer.

It has taken a lifetime to learn this truism.

55

posted on

10/21/2017 9:55:59 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

When are we going to see the new rate schedule? Not until the conference committee resolves any differences between the House and Senate bills.

They have told us that the standard deduction will be "doubled" - but don't believe even that. This is a bone thrown to the public, but all aspects are still in negotiation. But ending the deduction for state and local taxes? That is a certainty in the bill. When the Democrats introduced an amendment to stop it, it failed 51-47.

So Congress is going to screw the middle class over on that on. There is talk of an income layer of limiting the deduction, but I don't have a lot of hope on that. Congress wants their pound of flesh of taxes from someone in order to give corporations a massive break. And to "pay for it" they are targeting homeowners and the middle class.

Trump indicated he was willing to ease this burden - but I have heard nothing from him on this in recent days. That means to me that he is so desperate for a "win" in Congress that he will sell out 44 million American taxpayers in order to get it.

When taxpayers figure out how much they have been screwed over, they will not be happy, to say the least.

56

posted on

10/21/2017 9:59:17 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: dfwgator

This economic malaise can't go on for much longer.

Fixed.

57

posted on

10/21/2017 10:00:23 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: SkyPilot

Corporations and businesses don’t pay their taxes, the consumer of their product pays their taxes. You knew that didn’t you?

58

posted on

10/21/2017 10:22:00 AM PDT

by

Durus

(You can avoid reality, but you cannot avoid the consequences of avoiding reality. Ayn Rand)

To: drewh

Do you know if this tax cut proposal is retroactive to January 2017, or delayed until next year, 2018? I have tried to track down the current date for enactment and no luck. There are some sources that are against 2017 for, what seems to me, bookkeeping and other inconveniences that would occur. I recall Pres Trump mentioning early on that he was including a retroactive date but it is now not mentioned in anything current that I have read. I think that a retroactive, Jan 2017, date should be touted as often as possible. People need help right now. If that is included in the tax bill it would motivate voters to push for it through their congress people.

To: SkyPilot

So you believe in socialism? Taxes are being lowered for most of the country. You are the one who chose to live in a highly taxed area!

60

posted on

10/21/2017 11:10:40 AM PDT

by

Brown Deer

(America First!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson