Posted on 05/01/2021 9:13:56 PM PDT by SeekAndFind

This week, President Biden proposed taxing capital gains at death at a tax rate of 39.6 percent plus the 3.8 percent investment tax. He proposed a $1 million exemption. For an individual with less than $11.8 million in net worth, this would create a new death tax from whole cloth.

President Biden’s new death tax would result in estates that currently are not remotely close to having sufficient net worth to pay a death tax paying a death tax. It can be named a ‘capital gains tax at death’; it is a new death tax.

For a long-term real estate investor, President Biden’s plan could confiscate an entire estate. For many others, estates that would have been passed tax-free to children would see very, very large percentages of their estates reduced by Biden’s new death tax.

The proposal falls into the kind of ‘question’ one might have asked young children when something went woefully wrong: “Don’t tell me what you were thinking, please tell me if you were thinking.”

If an individual’s only asset were an apartment that he purchased thirty years ago and that apartment was currently encumbered by debt, a capital gains tax of 43.4% could easily exceed the net cash that would be received on the sale of the building by the individual’s family upon the individual’s death. The Biden capital gains tax at death would eliminate the taxpayer’s entire estate.

If the decedent purchased the apartment building for $2,000,000 in 1981, the entire building would be depreciated resulting in a tax basis (cost) for the building of zero, so only the initial value of the land would offset the gain at sale. Assume $500,000 was the cost basis of the land when the building was purchased.

Should the building have a fair market value of $10,000,000 and current debt of $7,000,000, the taxable capital gain at death would be $8,500,000 after the $1,000,000 exemption. The Biden death tax would be 43.4 percent of the gain: $3,689,000. The calculation would be very straight forward: the building would be sold for $10,000,000, the debt of $7,000,000 would be paid and the net proceeds would not be sufficient to pay Biden’s death tax.

The result, an individual who thought he was going to leave $3,000,000 to his children would see 100% of that amount taken by the government. (The numbers only get worse if the decedent’s state of residence also imposes a capital gains tax at death.)

How common a problem would this be? Very, very common is the answer. Real estate developers borrow on old properties to build or buy new properties. Real estate developers borrow on old properties to make charitable contributions. The Biden proposal would confiscate 100 percent of the assets for some real estate owners and take very large percentages of the estates of many other real estate investors.

Until this week, an individual owning assets with a fair market value of $20,000,000 and debts of $11,000,000 had a net worth of $9,000,000. Under current law, the $9,000,000 would be passed along tax-free to his children. In some cases, Biden proposes to take it all. In other cases, Biden proposes to take most and in all cases, Biden proposes a new death tax out of whole cloth.

This new death tax does not stop at real estate. Oil drillers essentially have little or no cost basis in their wells. As a result, after the million dollar exclusion, Biden is proposing a new 43.4% death tax on existing royalty interests.

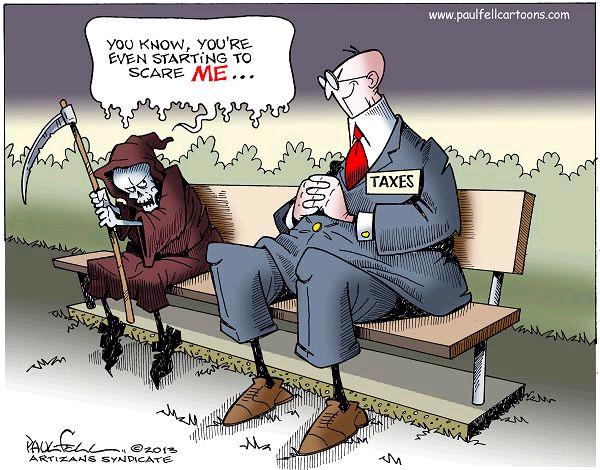

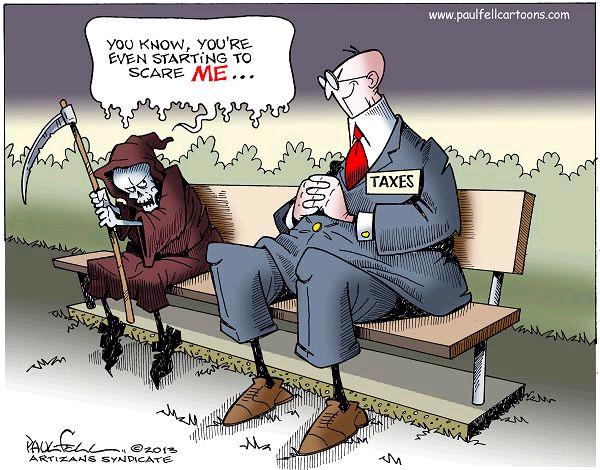

The United States does not need the government appearing with its hand out standing next to that guy with the sickle.

so screweeeeeeeeed

Hey Joe,

What is the Tax Rate on extortion from a foreign Country.... Just asking for a friend?

What are the chances this will make it through the Senate tho? It’s one thing to propose these crazy left wing ideas but it’s another to actually turn them into law. I just don’t see enough idiots in Congress who would pass this.

Start a closed family corporation.

RE: What are the chances this will make it through the Senate tho? It’s one thing to propose these crazy left wing ideas but it’s another to actually turn them into law

I hasten to remind you that:

1) The Senate is 50-50 with Kamala Harris as the tie breaker

2) Our rotten election system that elected Raphael Warnock and Jon Ossoff in Georgia IS STILL IN PLACE. So, any chance of the GOP taking over the Senate in 2022 are slim unless the corrupt election system is eliminated.

So they water it down a bit and steal only 2/3 of your life savings and estate. That will make me feel a lot better.

I’m guessing that at the end of the day, this was the opening salvo to meet in the middle. Originally, they were talking about rolling it back to $3.5 million. They’ll wind up in the mddle.... around $5 million. The question becomes, do they go Retroactive or from the date of the billcommencement of discussion?

Sssssh!!

You’ll spoil the surprise for those that are happy that Orange Man Bad is gone.

“Opening salvo” — my take exactly.

“Retroactive” — exactly what I’ve been thinking they will do.

This is all huge confiscation of wealth from whitey and handing it to POC. It is reparations by another means — wipe out all inter-generational transfer of wealth.

Sorry, but I’m concerned with my own skin. I don’t care one iota about them

Oh believe me, I hear ya.

Just got a letter, couple of days ago, from Uncle Joe that $1,400 is coming.

Yeah, that happened already.

That being said, will they do another one? My guess is yes.

We are on our way to Zimbabwe.

No problem, just a little to wet their beak.

And all those graveyards will still, even after this, continue to vote reliably 90% plus for Bidet.

Although this is horrible there is one thing that should be pointed out in the example used. The building was purchased for $2m in 1981 and it is worth $10m now. Why do they owe $7m on it? My guess is the owners lived large on the increasing value by borrowing on it.

Regardless of what they thought the tax laws would be, smarter would be to pay it off as soon as possible and live large on the income without the uncertainty of future tax law. They would still be getting ripped off but there would be something left over.

It is the baby boom $ they are after. Can’t wait to hear about retro active changes to retirement accounts. That is also one of the tenants of gov health care. There will be a continuing increase in health care needs and they want control of the $ and the lives.

The Democratic Tax Man COMETH!

When Biden dies, I’ll pay the “death tax-i” bill for his trip to Hell.

So unfair, we are taxed on earnings then with our sweat money if we are lucky we get gains and dividends and we pay

more taxes on our sweat savings already at 20 percent.

It should be going down to 15 percent like Trump promised

What braindead Biden forgets is that even Dems have IRA and 401 accounts and they live off them in retirement. Dems

will lose the votes of retirees if they touch their nest egg

accounts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.