To: marcusmaximus

Marcus is worried for Russia!

To: marcusmaximus

4 posted on

08/15/2023 6:24:27 PM PDT by

TornadoAlley3

( I'm Proud To Be An Okie From Muskogee)

To: marcusmaximus

To: marcusmaximus

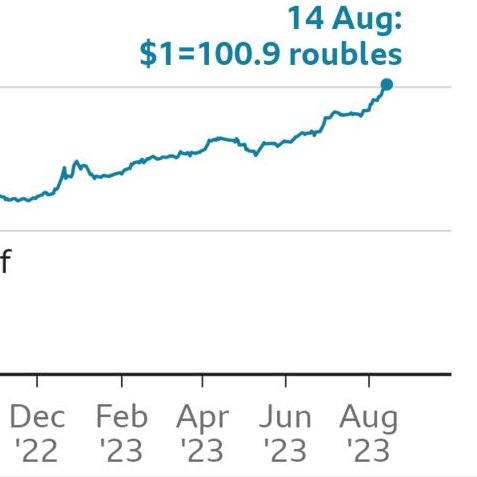

"Moscow looks to halt a rapid depreciation of the country’s ruble currency." Which is beyond Moscow's control, since no one wants to buy, or trade anything in Rubles, including Rubles on currency exchanges. Both India and China are telling Russia to buy and sell in Rupees and Yuan respectively. That tells how much the world trust the Russian Central bank and the Ruble's stability.

Hyperinflation, anyone?

12 posted on

08/15/2023 7:46:05 PM PDT by

Widget Jr

(🇺🇦 Слава Україні! 🇺🇦 Sláva Ukrayíni! 🇺🇦 ☭ No CCCP 2.0 ☭)

To: marcusmaximus

The Central Bank of Russia hiked the key interest rate to 12% (from 8.5%) after a public request from the Putin's administration. Apparently, the symbolism of $1 trading for 100 Rubles matters. (Right now, Sberbank, the largest bank in the country, sells $1 for 104,90 Rubles.) This is really about symbolism. Such a hike cannot stop the general trend of the weakening ruble. (It's been weakening against all major currencies.) The strong ruble of 2022 was an accident caused by a dramatic fall of imports that followed the invasion, sanctions, and business withdrawals.

Nowadays the main pressure on ruble comes from the ever-increasing war spending. It's not yet fully "money printing" as the government cuts spending on health care, education, etc. Yet the deficits are widening, both because of the fall in revenues and increase in military spending. For the same reason - all the current "growth" comes from the increased military spending, which is not affected by market rates, the key rate hike will not have a big effect on the economy. Of course a higher key rate depresses economic activity, but it is already depressed so no much room for a large effect here.

18 posted on

08/16/2023 1:14:35 AM PDT by

dennisw

(Never attribute to incompetence-stupidity, that which is adequately explained by malice)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson