Skip to comments.

And the budget says

townhall.com ^

| Aug 18,2004

| Larry Kudlow

Posted on 10/17/2004 11:04:02 PM PDT by oldtimer2

And the budget says...

Larry Kudlow

October 18, 2004

Is there more sanity in the federal budget than people think?

The latest budget numbers closing out fiscal year 2004 show slower spending growth, stronger tax receipts, and a $413 billion deficit that came in about $100 billion less than the Office of Management and Budget predicted at the start of the year and $64 billion lower than the Congressional Budget Office estimate.

Overall, according the Treasury Department, tax receipts increased 5.5 percent in fiscal year 2004, compared to a 3.8 percent decline in fiscal year 2003. Income-tax withholdings gained 2.5 percent versus a loss of 2.2 percent in the prior year. Corporate tax collections exploded 43.7 percent on the shoulders of near-record corporate profits. What's going on? It's clear: At lower marginal tax rates, the rising economy is throwing off a lot more tax revenues. Score one for the supply-siders.

(Excerpt) Read more at townhall.com ...

TOPICS: Business/Economy; Government; Philosophy

KEYWORDS: goodnews; kudlow; lowtaxworks

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-42 next last

1

posted on

10/17/2004 11:04:02 PM PDT

by

oldtimer2

To: oldtimer2

So there was a slightly smaller deficit than expected and thus HOORAY WE WIN?

Sorry, just sounds they are digging for a diamond in a large pile of excrement.

To: BushIsKing

You didn't read the whole article or you'd be even more disgusted. More "spending increased, but less than expected." Or "spending is in line with inflation or GDP"

Funny no mention of the $7 Trillion debit and all the added consumer debt. No advocation of debit reduction, controlled spending or curbing inflation. Blah, blah.

3

posted on

10/17/2004 11:25:21 PM PDT

by

endthematrix

(Bad news is good news for the Kerry campaign!)

To: endthematrix; BushIsKing

I would prefer that Bush campaigned as a balanced budget

president, but that has proven to be a loser. The first duty for Bush is to be elected. This shows that his programs will tend toward a balanced budget while allowing him to be elected.

Our choice is between Bush and Kerry. This is not a perfect world.

4

posted on

10/18/2004 7:19:48 AM PDT

by

oldtimer2

(When in doubt hit the throttle. It may not help but it ends the suspense...A. J. Foyt)

To: BushIsKing

It's a 19.5% smaller deficit, hardly what you would call a "slightly smaller deficit".

5

posted on

10/18/2004 7:23:14 AM PDT

by

tort_feasor

(www.swiftvets.com)

To: tort_feasor; fooman; remember; BushIsKing

a 19.5% smaller deficit, ... slightly smallerNo deficit is good enough because it's not a surplus.. A surplus that pays off the entire debt is not good enough because it doesn't provide for extra assets for next year, and on and on.

The doom'n'gloomers will never be satisfied because they've made up their minds to be miserable. The rest of us are happy doing what others are willing to pay us to do, and we vote for those who let us.

To: expat_panama

I would like to see us get to 25% debt to gdp over time with a deficit of 1% pa.

7

posted on

10/19/2004 6:11:49 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: expat_panama

Having said the above this is good news. I would like to see spending relentlessly trimmed to where it grows at only 0-1% per year with 4-5% gdp gowth. We would then be able to meet the above target in less than 10 years.

8

posted on

10/19/2004 6:20:22 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: endthematrix

This number is still less than 70% of GDP. One thing that is bad in adding the social sec liability. That should be accounted for seperately, so it can attacked as seperate self funded problem.

Otherwise the inevitable tax hikes will come which will kill off growth and we would then enter euro death spiral.....

9

posted on

10/19/2004 6:23:00 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: fooman

25% debt to gdp over time with a deficit of 1%I vote for doing what works and not getting ourselves married to arbitrary rules. The FY 2000 deficit was only 0.2% gdp I wouldn't call that too low and I wouldn't say it caused the recession of 2001, but it sure as hell didn't help us.

Flexibility with an eye on proven consequences has worked just fine. We had a huge debt in '45 because we needed to win the war. The doom'n'gloomers were saying we won the war but lost the peace but they were wrong, because we paid it down to a comfortable level and we've been doing just fine.

To: expat_panama

we worked our butts off during the 50s and early 60s to get THAT beast under control. Coolidge had to do the same thing.

11

posted on

10/19/2004 7:12:20 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: fooman

Interesting-- I've heard a lot of people describe "the 50s and early 60s" as a prosperous time that we need to replicate. Once again, I'm not saying the war debt helped us, but as usual the pessimists were wrong.

To: expat_panama

They WERE prosperous and they saved our bacon. Japan and Europe have fallen into the economic black hole and we would too if we ever let our debt get to 150% of GDP.

So it is best to keep some debt around, but leave some capacity for emergencies.

13

posted on

10/19/2004 7:32:38 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: fooman

That about covers it --we're on the same page.

To: oldtimer2; BushIsKing; endthematrix; expat_panama; fooman

Is there more sanity in the federal budget than people think? The latest budget numbers closing out fiscal year 2004 show slower spending growth, stronger tax receipts, and a $413 billion deficit that came in about $100 billion less than the Office of Management and Budget predicted at the start of the year and $64 billion lower than the Congressional Budget Office estimate.

Overall, according the Treasury Department, tax receipts increased 5.5 percent in fiscal year 2004, compared to a 3.8 percent decline in fiscal year 2003. Income-tax withholdings gained 2.5 percent versus a loss of 2.2 percent in the prior year. Corporate tax collections exploded 43.7 percent on the shoulders of near-record corporate profits.

What's going on? It's clear: At lower marginal tax rates, the rising economy is throwing off a lot more tax revenues. Score one for the supply-siders.

No, score one for the cherry-pickers. I took a look at the year-end monthly treasury statements back to 1998 at http://www.fms.treas.gov/mts/ and http://fms.treas.gov/mts/backissues.html. The following table gives the outlays, deficits, and receipts (from individual income tax, corporation income tax, and total):

RECEIPTS, OUTLAYS, AND DEFICITS (billions of dollars)

Classification 1997 1998 1999 2000 2001 2002 2003 2004

------------------------------------------------------------------------------

Individual income tax 737.5 828.6 879.5 1004.5 994.3 858.3 793.7 809.0

Corporation income tax 182.3 188.7 184.7 207.3 151.1 148.0 131.8 189.4

------------------------------------------------------------------------------

Total Receipts 1579.0 1721.5 1827.3 2025.1 1991.0 1853.2 1782.1 1879.8

Total outlays 1600.9 1652.2 1702.9 1788.1 1863.8 2011.0 2159.2 2292.4

Surplus or deficit (-) -22.0 69.2 124.4 236.9 127.3 -157.8 -377.1 -412.6

The following table then gives the percent changes:

RECEIPTS, OUTLAYS, AND DEFICITS (percent change)

Classification 1998 1999 2000 2001 2002 2003 2004

-----------------------------------------------------------------------

Individual income tax 12.4 6.1 14.2 -1.0 -13.7 -7.5 1.9

Corporation income tax 3.5 -2.1 12.2 -27.1 -2.0 -11.0 43.7

-----------------------------------------------------------------------

Total Receipts 9.0 6.1 10.8 -1.7 -6.9 -3.8 5.5

Total outlays 3.2 3.1 5.0 4.2 7.9 7.4 6.2

Surplus or deficit (-) -415.4 79.6 90.5 -46.3 -224.0 139.0 9.4

As can be seen, the table verifies Kudlow's figures for the growth of total receipts the past two years and the growth of corporate income tax receipts in 2004. Kudlow's figures for "Income-tax withholdings" (-2.2% in 2003 and 2.5% in 2004) don't quite match receipts from individual income taxes but then they are not measuring the exact same thing. In any case, the table also verifies Kudlow's numbers for the growth in total outlays the past two years.

The table also shows that all shown categories of receipts went down in 2001, 2002, and 2003. To get a better view of how much receipts, outlays, and deficits have changed since 2000, the following table shows them all indexed with the year 2000 equal to 100:

RECEIPTS, OUTLAYS, AND DEFICITS INDICES (2000 = 100)

Classification 1997 1998 1999 2000 2001 2002 2003 2004

------------------------------------------------------------------------------

Individual income tax 73.4 82.5 87.6 100.0 99.0 85.5 79.0 80.5

Corporation income tax 87.9 91.0 89.1 100.0 72.9 71.4 63.6 91.4

------------------------------------------------------------------------------

Total Receipts 78.0 85.0 90.2 100.0 98.3 91.5 88.0 92.8

Total outlays 89.5 92.4 95.2 100.0 104.2 112.5 120.8 128.2

Surplus or deficit (-) -9.3 29.2 52.5 100.0 53.7 -66.6 -159.2 -174.1

Kudlow stated "It's clear: At lower marginal tax rates, the rising economy is throwing off a lot more tax revenues". But he fails to mention that this increase in revenues is only a partial recovery from a very steep decline. As the table above shows, revenues from individual income taxes have recovered to only 80.5% of their 2000 level. Revenues from corporation income taxes have recovered just 91.4% of the 2000 level, even after they "exploded 43.7 percent on the shoulders of near-record corporate profits". In any case, total revenues have recovered just 92.8% of the their 2000 level. The fact that they have recovered more than revenues from individual or corporation income taxes is not surprising. They include revenues from the FICA tax whose rate was NOT cut. Score one against the supply-siders.

Kudlow is an economist and should know better than to cherry-pick numbers like this. Then again, he would not be the first economist to let his political leanings affect his work.

15

posted on

10/20/2004 1:49:17 AM PDT

by

remember

To: remember

Tech Jobs are up in Cali according to a FR article, if you are half this digent finding knats in the data you will do well.

Lowering tax RATES worked with Coolridge, Kennedy, Reagan and now Bush.

The tax act of 86 got rid of lots of shelters where capital was being ineffiently held, putting the capital to productive use.

high tax rate policies will put us on a track to low growth like canada, cuba and france.

Cuba is supposed to have livable metrics like low infant mortality, but I dont see people taking their treasure and flocking there, though they could easily do so through mexico.

16

posted on

10/20/2004 6:58:54 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: expat_panama

17

posted on

10/20/2004 6:59:16 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: remember; fooman

| Your work was impressive Rem, it got me off my fanny and inspired me to do my homework –thanks! The gist of Kudlow’s approach was that we’re doing pretty well and yours is that we’re not, and as you’ve proven there are a lot of ways to look at it. |

| |

|

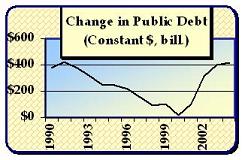

| I took the public debt numbers from The Debt To the Penny and converted the change of public debt (my favorite definition of a 'deficit') to constant dollars (1990=1) and came up with the graph. You can see my numbers here. We had a spike in 2001. The all time high taxes of 2000 didn't do a bit of good in the face of the slow economy, and evidently the taxcuts didn't do a bit of harm to the growth of the debt. Of course all this stuff is secondary to me because what I care about is can we feed our families. These days there are more people doing just that and taking less time to do it. |

What these debt numbers tell me is that a reasonable person would expect these good economic conditions to continue with additional tax cuts.

To: expat_panama

Tax revenue in the late 90s was based on a bubble economy with unsustainable PE numbers on top fraudulent earnings numbers ( enron, anderson consulting etc).

In addition we had not been fighting a war starting with WTC I in 1993, which finally spiraled out of control leading to an attack on us in 2001.

19

posted on

10/20/2004 10:09:58 AM PDT

by

fooman

(Get real with Kim Jung Mentally Ill about proliferation)

To: fooman

I see your point, but perhaps those PE numbers might have been less "unsustainable" if the Clinton justice dept. hadn't declared war on tech companies (beginning with Microsoft) around the turn of the century.

IMHO there's two things that definitely were unsustainable. One was tax reciepts at 22% of gdp (higher than was needed during WWII even). The other was thinking terrorism was not a war that needed a military response, but instead a mere criminal activity that could be stopped by a couple FBI agents.

Sheesh!

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-42 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson