Skip to comments.

Is the Next Bubble Unavoidable?

yahoo ^

| Oct 06, 2009 09:35am EDT

| John Carney

Posted on 10/06/2009 8:02:28 AM PDT by BenLurkin

The Federal Reserve is now faced with a challenge that is akin to threading a needle by throwing a spool of thread across a football field. It is attempting to keep loose money and quantitative easing policies in place long enough not to stymie the nascent recovery while pulling them back in time to avoid massive inflation. It's a Hail Mary pass with an impossibly small target while facing a blitz.

In today's Wall Street Journal, Nouriel Roubini and Ian Bremmer lay out a series of policy prescriptions for how they think the Fed might be able to avoid creating another dangerous asset bubble without triggering a double-dip recession. They are very clear that this is an enormously difficult task--but even their assessment might be too optimistic.

Here's the problem. They agree that the operations of the Federal Reserve need to be subject to political review because it is clear that the New York Fed has been captured by Wall Street. The Fed's worries about its independence being compromised make no sense when it seems that its independence is already compromised to the our powerful financial firms.

But Congressional oversight is likely to result in pressure to keep monetary policy too loose for too long. There will be intense political pressure to repeat the "fateful mistake" of the last recession, keeping monetary policy too easy for too long.

Is there are way out? Unfortunately, the way out may be the way back. The government, including the Fed, need to restore the credibility of market processes by letting a too big to fail institution go insolvent. In short, we need another Lehman. And a policy that depends on failure to succeed is certainly not a happy one.

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy

KEYWORDS: bhoeconomy; economy; fed; thecomingdepression

Navigation: use the links below to view more comments.

first previous 1-20, 21-27 last

To: LomanBill; Nathan Zachary; ex-Texan; Travis McGee

Will the Bubbles Attack?

Will Evile Barry pop Bernie Bernankie's Barely inflated Bubble and push over the Fed, or will Bernie pull a miracle out of his.. errr... somewhere... and recover his Balance?

Tune in next week!

Same Bubble Channel - Same Bubble Time...

21

posted on

10/06/2009 3:35:41 PM PDT

by

LomanBill

(Animals! The DemocRats blew up the windmill with an Acorn!)

To: LomanBill

That is one of the funniest things I have seen!! Paulson’s head would have done well with Helicopter Ben too. :)

22

posted on

10/06/2009 3:39:58 PM PDT

by

WV Mountain Mama

(The difference between genius and stupidity is that genius has limits. Einstein)

To: WV Mountain Mama

[Elvis Voice -ON]

Thank you, Thank you very much.

[Elvis Voice -OFF]

23

posted on

10/06/2009 3:44:39 PM PDT

by

LomanBill

(Animals! The DemocRats blew up the windmill with an Acorn!)

To: WV Mountain Mama

24

posted on

10/06/2009 4:07:50 PM PDT

by

LomanBill

(Animals! The DemocRats blew up the windmill with an Acorn!)

To: LomanBill

25

posted on

10/06/2009 4:16:33 PM PDT

by

WV Mountain Mama

(The difference between genius and stupidity is that genius has limits. Einstein)

To: LomanBill

To: Nathan Zachary

Our dollar is hovering around .76.2 cents, down from .95+ cents in January. That alone is a 20 cent reduction in spending power. The US dollar index peaked at about 88 in March, now it's about 76.3. About a 14% drop. And only on your foreign purchases. Most people still buy most of their stuff in dollars from American producers.

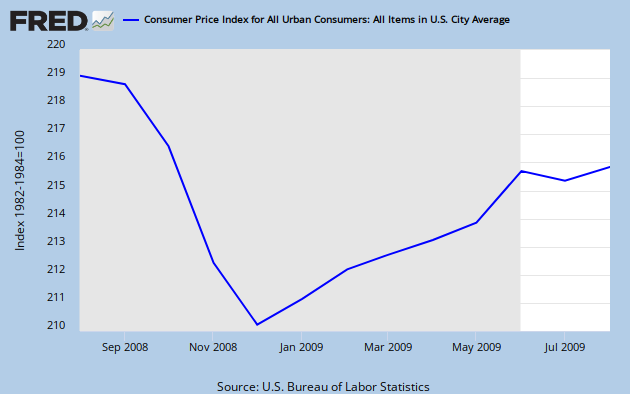

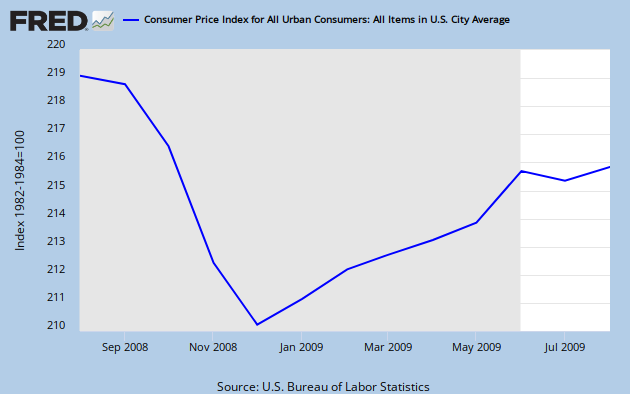

You can see from these two things alone the massive amount of inflation that we have had over the past year.

Over the past year, we've had deflation.

27

posted on

10/07/2009 10:18:08 AM PDT

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-27 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson