Click the Kitteh

Happy Kitten Loves Monthly Donors

Abolish FReepathons

Go Monthly

Posted on 10/17/2011 11:08:56 AM PDT by RockyMtnMan

Do you know why candidates for office tend to be reluctant to propose detailed plans? Because they know the plans will be flyspecked and picked apart by just about everyone. Inviting criticism doesn’t help you to get votes.

But fear of criticism prevents you from conceiving solutions to problems. So even if avoidance of criticism helps in propelling you to an election victory, how are you supposed to effectively govern? How are you supposed to fix the problems you told everyone you were going to fix? That’s why I’m happy to see so much criticism of the 9-9-9 plan I’ve proposed. It shows that people are thinking seriously about a substantive idea. When people stop obsessing over “gaffes” and campaign strategy, and start honing in on fixing the country’s economic problems, we are getting somewhere. This is not to say, of course, I’m going to leave poorly founded criticisms of the plan unanswered. Certain objections to the plan are circulating in the usual places, driven by the same kind of thinking that has left us with a stagnant economy, $14 trillion in debt and mounting entitlement obligations. These criticisms deserve responses, and here they are:

Claim 1: The 9 percent sales tax, which is one third of the formula, is regressive and hurts the poor, many of whom pay no federal income taxes now. Response: This claim ignores some important aspects of the plan. One is that we eliminate the 15 percent payroll tax, which allows for no deductions at all – not even for charitable contributions. Some critics have argued that the poor still come out behind because employers pay much of the payroll tax. That demonstrates a basic misunderstanding about how compensation works in the business world. An employer decides to accept a certain cost-of-employment for each employee, and the employer’s share of the payroll tax is part of that cost. It comes out of your compensation whether you realize it or not. Also, a flat tax is not – by definition – a regressive tax. Everyone pays the same rate. And it is not an added tax, but a replacement tax, whose total burden is determined by the consumer’s spending decisions. Finally, the best way to help the poor is by spurring economic growth, which the current tax code will never do, and which the 9-9-9 plan is specifically designed to do.

Claim 2: Creating a new tax is merely setting the stage for higher rates on all taxes, as untrustworthy politicians will surely raise them. Response: First of all, that is not a criticism of the 9-9-9 plan. It is a criticism of politicians. If you don’t want the rates raised, don’t elect politicians who will raise them. Even if we repealed the 16th Amendment and eliminated the income tax, as some demand in return for establishing a consumption tax, politicians could raise that rate too. What’s far more important here is the fact that the very simple, flat-rate structure of the 9-9-9 plan, which allows no deductions, loopholes or exemptions (with the exception of charitable contributions for the income tax), is a far more growth-friendly tax structure than the mangled mess of rates, taxes, exemptions and ill-conceived incentives we have today. It virtually eliminates the massive compliance costs of the current tax code, and it restrains the size of government. By taking away the politicians’ gateway drug of loopholes and deductions, we make it much more difficult for them to mess with the tax code. Having said that, any plan could be criticized for what it would look like if someone messed it up. The plan as I’m proposing it is a huge improvement over the status quo.

Claim 3: The plan redistributes wealth from the poor to the rich. Response: It does no such thing. It is fair and neutral, taxing everything once and nothing twice. What’s more, we are getting ready to propose empowerment zones for economically struggling areas in which the rates will be even lower. That will allow the poor to benefit even more from the plan than they already would.

Claim 4: The plan should have included a pre-bate to offset the sales tax. Response: The last thing we need is to establish another federal entitlement, which the proposed pre-bate would quickly become. And it’s not necessary. The consumption tax replaces ones already embedded in prices. It’s not the prices that would increase, but the visibility of the taxes being paid. Right now, money is deducted from your paycheck and you never see it, so it doesn’t feel like you paid a tax. But you did. With the 9-9-9 plan, you feel it, and I suspect a good many people who clamor for higher taxes will start to feel differently as a result. But they won’t be paying more than before. They’ll just be more aware of it.

Claim 5: The business tax represents a new tax on labor. Response: Paul Krugman of the New York Times makes this claim because we do not allow businesses to deduct the cost of labor from their taxable revenue. But the claim is bogus for several reasons. First, we are reducing the corporate tax rate from 35 percent to 9 percent, so the tradeoff is a much lower rate paid on more of a company’s income. Second, we treat capital and labor the same, both with the corporate tax and with the income tax. That is fair and neutral. What’s more, the current system taxes both capital investment by business and capital gains by individuals. That’s a double tax, and the 9-9-9 plan eliminates it.

Claim 6: The numbers don’t add up. The 9-9-9 tax wouldn’t generate enough revenue. Response: Several groups apparently “ran the numbers” and came to this conclusion, including Bloomberg News and the Center for American Progress. Our report, which they do not appear to have read, demonstrates that it generates the same revenue as the current tax code, and our methodology is visible for anyone to see. Those who are making this claim should release their scoring so their methodology is as visible as ours.

Claim 7: The 9-9-9 plan is a really an 18 percent value-added tax plus a 9 percent income tax. Response: That’s an argument? That some might be able to give it a disagreeable label? What we have done is split the incidence of the tax so it is harder to evade – since you’d have to dodge two taxes, not just one, to save the 18 percent. And by eliminating loopholes we’ve made that virtually impossible to do anyway. I don’t really care what people call it. What matters is how it works.

Claim 8: Some people (like Herman Cain) who may live off capital gains, would pay no income taxes. Is that fair? Response: First, one of the benefits of the 9-9-9 plan is that, even if someone doesn’t pay much or any of one of the taxes, he or she is still likely affected by the other two. More to the point, though, everyone has the same opportunity to work hard, earn capital and put that capital at risk. Whatever I have earned has come from hard work, good decisions (and some bad ones), a willingness to take risks and a constant honing of strategy. Nothing is stopping anyone else from doing the same thing. I realize many are being told there are no opportunities available to them, but that is not true and I wish people – for their own sakes – would stop listening to such doom and gloom and come to understand all the opportunity that truly exists, and learn how to access it.

Claim 9: It won’t pass. Response: Politicians propose things that can pass. Problem-solvers propose things that can work. One of the worst instincts of Washington types is to judge an idea not on its substantive merits, but on their perception of its political viability. I do not underestimate the challenge of getting any good idea through Congress, but I have said all along that if you propose a good idea, and the people understand the idea, they will pressure Congress to pass it. So there. I welcome the robust discussion and the many questions that are being raised about the 9-9-9 plan. Asked and answered. What else do you want to know?

He misses the point, either deliberately because he can't answer it, or because he doesn't understand the point, which I doubt.

The problem is that people who have SAVED money did so under the old income/payroll tax rates. When you spend money you previously saved, you will now get hit with a new 9% tax that you didn't before, but you don't get any of the "savings" from the 9% income tax. You DO get savings from the drop in corporate tax rates, but it's not enough to offset the 9% sales tax.

A really good company has a 25% profit margin. So if they produce a $1000 product, they make $250, and pay 35% tax on that $250, or $87.50. Under Cain's plan, they now pay 9% tax or $22.50. So, before the purchaser paid $1087.50 for the product. Now the purchaser pays $1022.50, plus the 9% tax on $1022.50 (92.02), for a total of $1114. That's a $27 increase in the cost, or 2.7%.

For someone who saved money, that's a 2.7% tax on their savings. That is the disparity the pre-bate is supposed to address, and Cain is ignoring it.

I'll also note a glaring inconsistancy in his argument here.

In THIS answer to a "false claim", he says: "The last thing we need is to establish another federal entitlement, which the proposed pre-bate would quickly become." Thus, he acknowledges that anything put into his plan could easily be misused and abused. But in an earlier "false claim" answer, he chastized his opponents for arguing that politicans couldn't be trusted with a new tax, saying that wasn't his problem and we should elect better politicians.

Well, if we can just elect better politicians, and we aren't supposed to judge plans based on what they "might become", why is he saying we can't have a rebate because we can't control what it would "become"? His new sales tax is a brand new taxing authority, and we aren't allowed to argue this is a danger. And he proposes empowerment zones, which are clearly a new federal "entitlement" to go with his 9-9-9 plan, and I'm guessing we aren't allowed to argue that THOSE would be abused either. But here we can't ask for a pre-bate, because it is a new federal entitlement?

Sorry, but on the pre-bate, Cain is dead wrong. His new propsal is a tax on savings, hurting those who lived within their means, those who saved for a rainy day, and those who retired with their own nest egg. It is great for people who have no savings, who maxed out their credit cards, because their purchases weren't taxed, and now the income they get to pay for those purchases is taxed lower because we are supposed to get the money when they spend it. But they already DID. (Hmm -- I wonder how he took THAT into account, the hundreds of billions of income dollars that won't get taxed at all because it's paying off purchases already made).

This argument is largely correct. Except here Cain acknowledges that you could call it a VAT, and it wouldn't matter to him. Of course, he opposed a VAT, and people have argued that his plan isn't a VAT for some reason that Cain apparently doesn't agree with. It looks like a VAT, if you believe that every dime you pay for a product was profit to someone. I don't think it is, but maybe once you have eliminated all the business deductions it WOULD be. Certainly under CURRENT tax code that isn't the case. Maybe under Cain's plan the corporate income tax ends up taxing 100% of the value of a product. Clearly the 9% sales tax does.

But Cain acknowledges in his own plan outline that the final result is the FairTax. The 9-9-9 plan is a bastardized, intermediate step which will be thrown out.

Why? Because Cain said we needed politically to work through intermediate steps, we couldn't pass a FairTax. But now he is arguing that problem-solvers propose things that work. So, why not just do the FairTax and be done with it? That's where we end up under his plan anyway, and it would keep us from having to completely disrupt our economy TWICE.

Sorry, but when you specifically propose a sub-optimal plan because you know your real plan won't pass, you don't get to then argue that considering whether you can pass your plan isn't germaine.

I’ll respond with almost the exact same answer to the post on WND:

It still adds a new tax (sales tax) to the system that can (and will) be abused and the defense of “If you don’t want the rates raised, don’t elect politicians who will raise them.” is about as dumb of an answer as -don’t elect someone who hasn’t a clue how to run a company much less the country- (a.k.a. Obama). Need I say more on that?

Realized capital gains IS AN INCOME and should be taxed at the same 9% rate. Otherwise you’ll have corporate CEO’s not taking a salary but getting their ‘income’ some other way that avoids the tax.

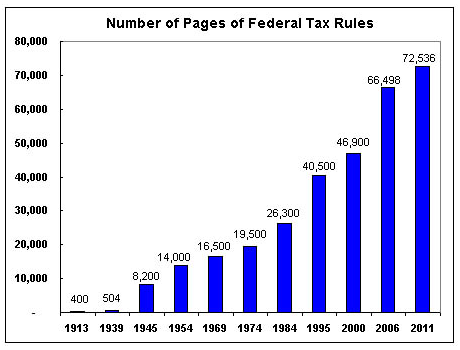

What's important right now is that Cain is advocating doing away with the current tax code. The following graphic explains why...

Of course it isn't "fair". Cain never says otherwise, he simply explains why being not fair is OK. But the real question is this: Why are capital gains not taxed, but interest earned is taxed? Why are dividends taxed? Why do I have to pay tax on interest from my savings account, but can't deduct the interest I pay to my same bank for my mortgage?

Eliminating capital gains tax while leaving dividend and interest taxes just interferes in the market again. It's government picking winners and losers. A company which pumps it's profits back into the company and raises it's value generates capital gains, while a company which pumps it's profits back to the investors pay dividends. Why should government make one better for the investors than the other? Shouldn't companies make those decisions based on market forces, not government desires?

In a world where government doesn't choose winners and losers, all investments would be treated equally. Earned interest would be offset by paid interest, to any source. And it would be taxed relative to inflation; if I earn 3% interest, but inflation is 4%, I should actually get a deduction, because I lost money.

If I think it is good to save $30,000 for a rainy day, and borrow $30,000 for a car, I shouldn't have to pay more in taxes than the guy who takes the $30,000 out of his bank account to buy the car. Cain's plan discourages savings, just as it taxes existing savings.

A real conservative would never vote for Romney in the primaries so Cain should not be splitting the conservative vote with him.

In this claim, he argues that we can't have a pre-bate, because politicians would make it into an entitlement. That's the opposite of the argument in claim 2, where he says we should elect politicians who wouldn't do this kind of thing.

You have never been told by any Cain supporters you cannot depend on the web site. What was said to you is that not all of the details about 999 are listed on the website, because that is a “snapshot” of the plan.

But if you don’t trust the website, there is plenty of other evidence in interviews, speeches and writing to show that Cain is a supporter of cutting gov’t:

Herman Cain - Cutting Spending

http://www.youtube.com/watch?v=e-Sm8F6zIhA

Cain Would Eliminate the EPA

http://video.foxnews.com/v/1176885406001/herman-cain-would-eliminate-epa/

Herman Cain: GOP Taking “Soft Approach” On Budget

http://www.realclearpolitics.com/video/2011/05/10/herman_cain_gop_taking_soft_approach_on_budget.html

“Liberals Will Say You’re Taking Away Benefits From Old People, Puppy Dogs & Kids!” Herman Cain

http://www.youtube.com/watch?v=A_gnPRwNdZ4

Spend-and-tax epidemic

August 31, 2005

By Herman Cain

http://economicfreedomcoalition.com/news/press-opinion-083105.asp

Spending Madness in Congress

March 22, 2006

By Herman Cain

http://economicfreedomcoalition.com/news/press-opinion-032206.asp

Herman Cain in Washington to Support Cut, Cap, Balance

http://townhall.com/tipsheet/katiepavlich/2011/07/27/herman_cain_in_washington_to_support_cut,_cap,_balance

Q: As President, if you could enact any policy to fix the economy without congressional approval what would it be?

A: As President, I would reduce the regulatory authority of executive agencies in order to ease burdens on businesses. I would limit the EPA, Department of Energy and other executive agencies from getting in the way of businesses. A President Cain would lower the regulations that the government puts on businesses and cut through all possible bureaucracy.

Source: 2011 Republican primary debate on Twitter.com , Jul 21, 2011

Especially since later he argued that we can’t have a pre-bate because bad politicians would make it into an entitlement program.

BTTT is another one you may see that means "Back To The Top". Same effect.

Perry never endorsed TARP. After the first TARP was voted down, and before the 2nd was written, he co-signed a letter from the Republican GOvernor’s association (he was the president) and the DGA which asked Congress to go back and act for the good of the country. Some have argued that TARP was the only thing on the table, but it had just been voted down, so it could well be they were looking for something DIFFERENT.

And right after TARP passed, Perry co-authored an editorial clearly opposing the TARP bailouts. Cain has acknowledged that his support for TARP was a mistake, but he actively pushed for it. All Perry did was write a letter urging congress to do SOMETHING, a letter with no indication that TARP was what was wanted.

Thank you for your illustration of why Cain’s Lame Brain National Sales Tax is bad for business. At a time when increased sales of new products are needed, Cain’s National Sales Tax discourages new product sales and encourages used product and black market sales.

When faced with paying a 15 to 19% sales tax on a new product vs. no tax on a used product under Cain’s Sales Tax Scheme, consumers will buy used which will be a jobs killer for USA Manufacturers of new products.

He needs to get off of this loser quickly!

He blows it right off the bat with claim #1.

He offers straw arguments to cover the obvious fact that social security recepients, who are a huge portion of the victims of the plan’s regression, pay no “payroll tax” on their SS benefits, and usually no income tax at all, unless they have substantial investment income. Thus it is a massive new tax for these people.

Obama is going to be able to use this so-called rebuttal to kill him if he is the nominee. Tax issues are something that an effective politician would leave until after getting elected.

Actually, for most people, the 401K avoided their tax for the purpose of paying a much lower tax at retirement, since we wouldn’t be making nearly so much money as retirees. In exchange, ALL the money in 401K gets taxed as INCOME, even if the gains were capital gains.

Turns out that, under ordinary assumptions, a good number of people would have been better off paying tax on the income, and investing it in funds that didn’t churn their assets. Assuming they doubled their money over their lifetime, the amount they would save being taxed at the capital gains rate on their earnings would have far outweighed the initial loss to income tax.

That is the theory behind the ROTH Iras, that for many people it’s better to get your earnings tax-free, than to defer your initial income.

I wonder if Cain is throwing out ROTH IRAs as part of his plan. Does he even address IRAs?

The point the original poster makes is that if you no longer pay payroll tax, but still have income, Cain’s plan is much worse for you, because you get no benefit from the 15.3% payroll tax cut, but you pay sales tax to “make up for” the payroll tax cut.

The pre-bate would help this, except Cain opposes a pre-bate because he doesn’t trust politicians not to make it an entitlement.

>> “My gut tells me Zero won’t run again.” <<

.

He won’t have to if he can get enough of these “Occupy” insurrections going to declare martial law and block the elections. :o)

>> “In 2010 Congress got a strong message from we the people, I suspect in 2012 it will be stronger..those in Congress who survive 2012 will probably be running for the Cain Train to hop aboard...and not be left behind. Think sea change.” <<

.

That comment would carry more weight if the candidate were Palin, rather than Cain, but Cain won’t be poised to do as much for congress as a Palin campaign would have. We need to reset our sights for the election, and probably make bigger donations too.

I am happy to read this. I do have some questions I hope Mr. Cain can answer:

Many critics say that the 9% sales tax will apply through the entire chain of suppliers. Using the same recent example of the loaf of bread, they claim that the farmer who grows the wheat will charge 9% tax to the flour company for the wheat he sells. The flour company will charge 9% tax to the bread maker. The bread maker will charge 9% tax to the bread distributor. The bread distributor will charge 9% tax to the retail store. The retail store will charge 9% tax to the sanwich shop. The mom and Pop sandwich shop that buys their bread from Costco will charge 9% tax to the customer who eats it.

Is this how the 9% sales tax will work under the 999 plan? Or is the 9% tax only charged at the retail level - by the Costco's and other supermarkets, and/or by the sandwhich shops who purchase from a wholesaler?

The bread maker is an interesting case because bread, buns, etc are goods where the retail-end-user may not be so easy to identify. If I own a hot dog stand, it is a very small business, and it is often cheaper to buy hot dogs and buns and condiments and cleaning supplies by the bulk at Costco than to buy them from a distributor who often has minimum orders and charges shipping costs. Since stores like Costco sell to both business customers and consumers, if resellers are not charged the 9% how will Costco know whether to charge a pack of hot dog buns at 9% or not?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.