The Social Security "trust fund" contains nothing more than IOUs that have no value beyond a promise to impose higher taxes on present and future workers - period. Social Security, every dime of it, is funded by current taxes on working people and debt.

You are the one creating your own reality. Yes, there is a SSTF. Yes, it contains $2.6 trillion of non-market, interest bearing T-Bills. Yes, it represents the good faith and credit of the USG to redeem them in much the same way that we owe money to the Chinese who hold our T-bills or US Savings Bonds.

There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government. The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been "put into the general fund of the government."

Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the "unified budget." This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are "on-budget." This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken "off-budget." This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are "on-budget" or "off-budget" is primarily a question of accounting practices--it has no effect on the actual operations of the Trust Fund itself.

"Far from being "worthless IOUs," the investments held by the trust funds are backed by the full faith and credit of the U. S. Government. The government has always repaid Social Security, with interest. The special-issue securities are, therefore, just as safe as U.S. Savings Bonds or other financial instruments of the Federal government. "

I agree that if Social Security really had been fenced off from looting (before Johnson and the Democrats got their hands on it), and if SS Disability, SS to Illegals, etc - had been kept out, there would be Trillions in an actual fund today.

Most likely this myth comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the "unified budget." This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are "on-budget." This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken "off-budget." This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are "on-budget" or "off-budget" is primarily a question of accounting practices--it has no affect on the actual operations of the Trust Fund itself.

You are missing the point. Even if the SSTF contained market T-Bills, real transferable assets as distinct from the non-market T-bills, SS would still go broke. It almost did in 1982 when Reagan and Tip O'Neill struck a Faustian bargain to keep the system going. The SSTF was exhausted.

The assets of the larger trust fund (OASI), from which retirement benefits are paid, were nearly depleted in 1982. No beneficiary was shortchanged because the Congress enacted temporary emergency legislation that permitted borrowing from other Federal trust funds and then later enacted legislation to strengthen OASI Trust Fund financing. The borrowed amounts were repaid with interest within 4 years.

We have raised SS taxes more than 40 times since its inception. The payroll cap goes up almost every year. Still, it won't be enough because the baby boomer generation is retiring and people are living longer. In 1983 they raised the taxes and reduced benefits including raising the retirement age for full benefits from 65 to 67. SS is now permanently in the red. The 2% payroll tax holiday for the past two years has reduced revenue into the system requiring more T-bills to be redeemed to make up the shortfall.

Source: CBO "Combined OASDI Trust Funds; January 2011 Baseline" 26 Jan 2011. Note: See "Primary Surplus" line (which is negative, indicating a deficit)

Matters are even worse than this chart shows. In December, Congress passed a Social Security tax reduction. Workers are temporarily paying 2 percentage points less, from 6.2 percent to 4.2 percent, in Social Security payroll taxes this calendar year. Since the government is making up the shortfall out of general revenues, CBO’s deficit projections for the trust funds do not include that. But CBO’s figures predict that the "payroll tax holiday" will cost the government’s general fund $85 billion in this fiscal year and $29 billion in fiscal year 2012 (which starts Oct.1, 2011.) Since every dollar of that will have to be borrowed, the combined effect of the " tax holiday" and the annual deficits will amount to a $130 billion addition to the federal deficit in the current fiscal year, and $59 billion in fiscal 2012.

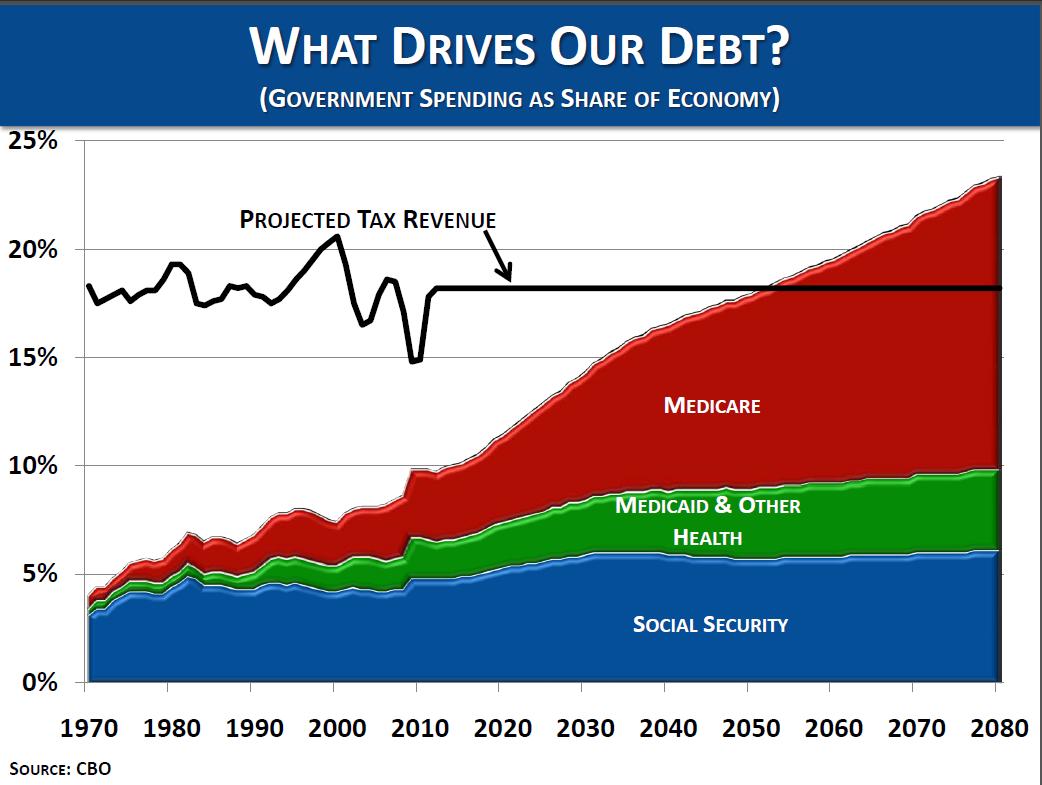

Social Security has passed a tipping point. For years it generated more revenue than it consumed, holding down the overall federal deficit and allowing Congress to spend more freely for other things. But those days are gone. Rather than lessening the federal deficit, Social Security has at last — as long predicted — become a drag on the government’s overall finances.