Posted on 12/20/2012 8:36:08 AM PST by Kaslin

There aren’t many fiscal policy role models in Europe.

Switzerland surely is at the top of the list. The burden of government spending is modest by European standards, in part because of a very good spending cap that prevents politicians from overspending when revenues are buoyant. Tax rates also are reasonable. The central government’s tax system is “progressive,” but the top rate is only 11.5 percent. And tax competition among the cantons ensures that sub-national tax rates don’t get too high. Because of these good policies, Switzerland completely avoided the fiscal crisis plaguing the rest of the continent.

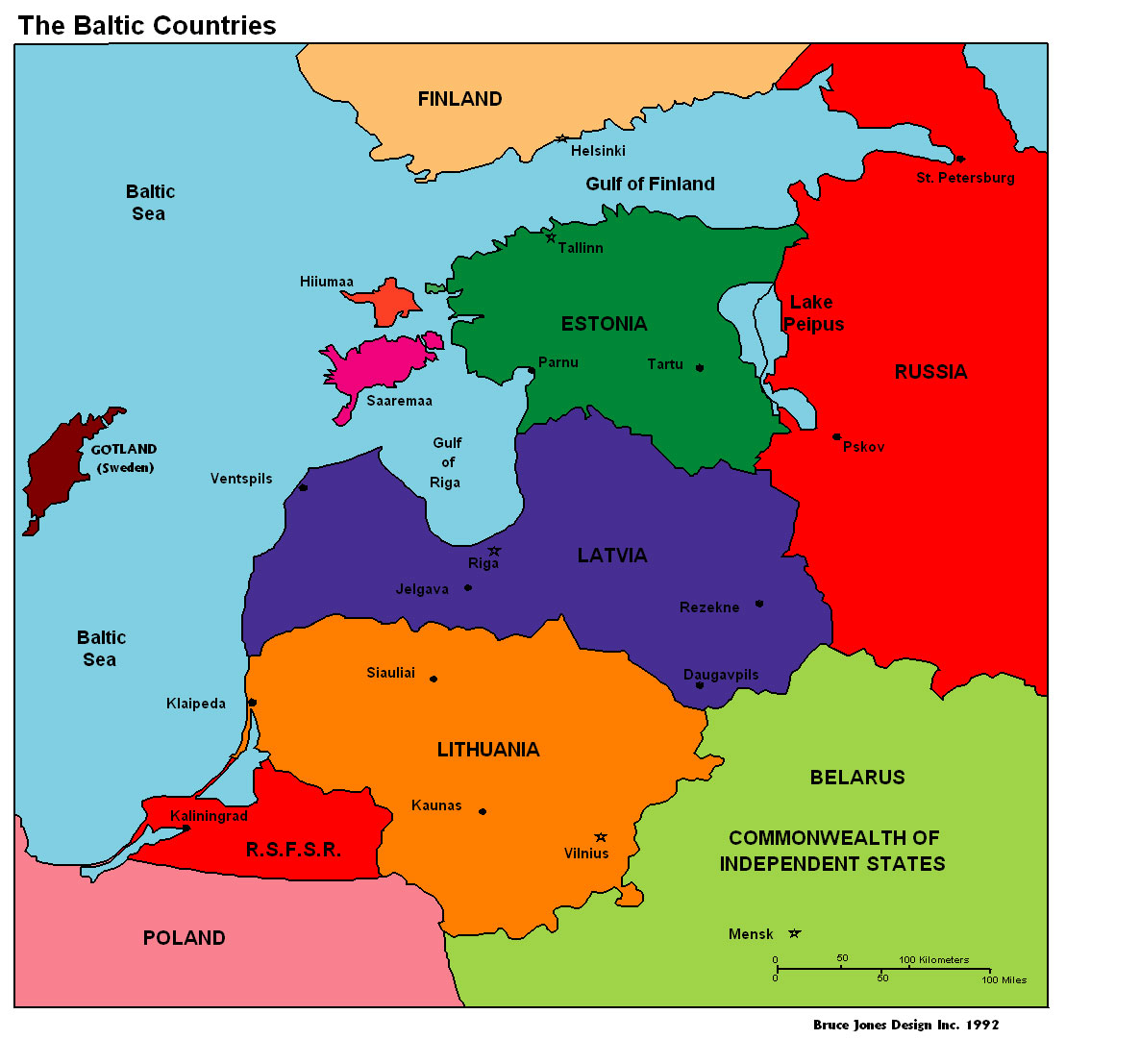

The Baltic nations of Estonia, Lithuania, and Latvia also deserve some credit. They allowed spending to rise far too rapidly in the middle of last decade – an average of nearly 17 percent per year between 2002 and 2008! But they have since moved in the right direction, with genuine spending cuts (unlikely the fake cuts that characterize fiscal policy in nations like the United States and United Kingdom). Yes, the Baltic countries did raise some taxes, which undermined the positive effects of spending reductions, but at least they focused primarily on spending and preserved their attractive flat tax systems. No wonder growth has rebounded in these nations.

The situation in the rest of Europe is more bleak, particularly for the so-called PIIGS. To varying degrees, Portugal, Italy, Ireland, Greece, and Spain have lost the ability to borrow, received bailouts, and been mired in recession.

The silver lining is that the fiscal crisis has forced them to finally cut spending. All of those nations implemented real spending cuts in 2011 according to European Commission data, bringing spending below 2010 levels. Final figures for 2012 aren’t available, of course, but the International Monetary Fund estimates that spending will drop in every nation other than Italy (where it will climb by less than 1 percent).

That’s the good news. The public sector finally is being subjected to some long-overdue fiscal discipline.

The bad news is that politicians also imposed very significant tax increases on the private sector. Income tax rates have been increased. Value-added taxes have been hiked, and other taxes have climbed as well. These penalties on productive activity undermine potential growth.

The politicians say that this is a “balanced approach,” but this view is misguided, First, as Veronique de Rugy has shown, it generally means lots of new taxes and very little spending restraint. Second, it is based on the IMF view of “austerity,” which mistakenly focuses on the symptom of red ink rather than the underlying disease of too much spending.

What Europe really needs is a combination of lower spending and lower tax rates.

Portugal may actually be moving in that direction, according to a report in the Wall Street Journal.

The Portuguese government is seeking to cut its corporate tax rate for new businesses to one of the lowest in Europe as part of a plan to attract investment and revitalize ailing industries, the minister of economy said. The government is in talks with the European Commission’s competition agency in Brussels to get approval to cut the tax on corporate income for new investors to 10% from the current 25%, the minister, Alvaro Santos Pereira, said in an interview. …”We want to make Portugal one of the most attractive countries in Europe for new investment,” Mr. Santos Pereira said. “We believe that by providing very strong fiscal incentives to new investments we will safeguard the budget side and at the same time become a lot more competitive,” he added. …While wealthy euro-zone countries and the IMF are beginning to recognize the need for measures to boost growth in austerity-hit countries, they have been reluctant to endorse tax cuts in countries under bailout programs. If implemented, the proposed tax cut would be a departure from a series of tax increases that countries including Portugal, Greece and Spain were forced to take as part their bailout conditions.

Before getting too excited, it’s important to note that the Portuguese proposal is a bit gimmicky. It’s not a corporate tax rate of 10 percent, it’s a special rate of 10 percent for new investment, however that’s defined.

But at least it might be a small step in the right direction. As the article indicates, it “would be a departure from a series of tax increases.” And Portugal definitely has been guilty in recent years of raping and pillaging the private sector.

To be fair, though, this chart shows that government spending in Portugal did decline last year. And the IMF is projecting that it will fall again this year and next year.

But the key to good fiscal policy is reducing government spending as a share of economic output. And if tax increases keep the private economy in the dumps, then the actual burden of government spending doesn’t change much even when nominal outlays decline.

A pro-growth policy is needed to boost economic performance. Portugal’s corporate tax rate proposal, by itself, won’t make much of a difference. But if it’s the start of a trend, that could be significant.

By the way, it’s amusing to see that one of the bureaucrats from the European Commission is pouring cold water on the plan, implying that a decision to take less money from a company somehow is akin to government assistance.

“We would want to be sure that anything proposed would help the competitiveness of the economy,” said spokesman Simon O’Connor, “but at the same time it would have to be in line with state aid rules,” referring to EU regulations that limit the assistance governments can give to the private sector. “There really isn’t any scope for them to reduce revenue,” he added.

But I guess that’s not too surprising. Along with their tax-free colleagues at the Organization for Economic Cooperation and Development, the European Commission has been trying to undermine tax competition and make it easier for nations to impose bad tax policy.

Returning to our main topic, what’s next for Portugal?

Your guess is as good as mine, but Portugal’s leaders already have acknowledged that Keynesian fiscal policy is ineffective. Perhaps they’ve gotten to the point where they realize punitive tax systems also are destructive.

European nations may be finding that fiscal discipline is a good thing and that it encourages growth. But I think they are really following these policies to demonstrate their racial hatred of a black man in the White House.

(/Democrat)

I’ve been waiting for Greece to “go bankrupt” and “pull out of the Euro” for 3 years.

Frankly, I think the EU governing clique, along with the ECB are a lot stronger and more capable of muddling through (and totally willing to fight until the bitter end for their progressive dreams) than everyone believes

And they are planning to tax their way out of it?

Nice- we’re planning to do the same thing- let’s watch to see how well it works.

I guess the past 100% of the times it has been tried and it failed were all different somehow

Without the Euro the German export model has big problems; other Europeans couldn’t afford to buy their stuff. (Well, not as much of it)

Despite the peoples’ frustration at having to bail out the irresponsible southerners, they’ll keep doing it. Their jobs depend on it.

Sounds like a good place to be!

Switzerland is surely one of the more successful nations in today’s world.

Place the praise for this achievement where it belongs - the native good sense of the Swiss people, which demands that every male Swiss citizen also be a member of the Swiss army, and as such, MUST keep a firearm in good working order in every household.

This is one of the primary reasons Switzerland has never been invaded. When Hitler threatened to do just that in 1940, when he was overrunning the rest of Europe, the Swiss coldly informed him that every mountain pass, every railroad and road tunnel, every bridge, would be dynamited, making passege through the country impossible, and the Swiss citizenry would be firing down on every member of the Wehrmacht still remaining in the borders of Switzerland.

Enemy combatants from either side, should they land in Swiss territory, were interned until the end of the war, asylum was not considered.

Switzerland was also very resistant to accepting any “displaced persons” or refugees from other areas in the years following the end of the war, only agreeing to accept a very minimum of “stateless” persons, but granting them only residency, not citizenship, and only on a limited basis.

Ownership of property is one of the paramont virtues of the Swiss, and that includes the limitations on that which may be claimed by any level of government. Swiss banks have a reputation for secrecy, but that was more a courtesy to the foreign depositors there, than from any bound requirement for privacy. Earning on investments orginating from Switzerland are subject to only very modest Swiss taxation, which makes the banking profession there among the most respected and conservative in the world. The Swiss are not in it to LOSE money.

Their money, the franc, is backed with very solid reserves of gold and silver, and in fact, the one-half to five franc coins were among the few in the world still coined with silver content, but this was changed in 1967. Swiss francs are still one of the premier currencies in the world, and the central treasury keeps tight rein on supplies of this currency.

Kind an annoying editorial thing is that when a subject is in your headline, you should begin by discussing it. In this article, there is little substantive mention of Portugal until halfway through page 2.

Imagine that! And they have strict immigration controls. OTOH, The non-Swiss euroweenies had a "brilliant" idea in regard to immigration.

"Hey, Luigi, Jacques, Sven ... let's go get millions of third worlders to come here and work and pay taxes to support our pensions and welfare programs!" Instead, their third worlders merely jumped into welfare ... somehow skipping the work thing... and screwing up the culture thing ... the schools ... and pig-farming, among other things.

Same thing happens here when an immigrant two weeks in the country gets SS benefits, to which system they of course never contributed ... or goes on welfare ... foodstamps .... AFDC ... Section 8 ... Cash Grants, etc. Not to mention that we all of a sudden have to deal with polygamy, female circumcision, etc. etc. Extreme example? The Somali "refugees" in Maine.

Maybe we can get Switzerland to take just a few?

I hoping I could get them to take me and my wife...

What do you mean? Switzerland was last invaded in 1790s by France which set up the Helvetic REpublic which was really a French subsidiary and that lasted for nearly 15 years...

Hitler never had any firm plans to invade Switzerland -- it didn't make any sense as Switzerland was completely surrounded by Germany or its allies and it served a purpose as a conduit for trade with the Western allies (covert of course) and for banking purposes.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.