Skip to comments.

In Fed and Out, Many Now Think Inflation Helps

New York Times ^

| October 26, 2013

| BINYAMIN APPELBAUM

Posted on 10/27/2013 1:10:29 PM PDT by reaganaut1

WASHINGTON — Inflation is widely reviled as a kind of tax on modern life, but as Federal Reserve policy makers prepare to meet this week, there is growing concern inside and outside the Fed that inflation is not rising fast enough.

Some economists say more inflation is just what the American economy needs to escape from a half-decade of sluggish growth and high unemployment.

The Fed has worked for decades to suppress inflation, but economists, including Janet Yellen, President Obama’s nominee to lead the Fed starting next year, have long argued that a little inflation is particularly valuable when the economy is weak. Rising prices help companies increase profits; rising wages help borrowers repay debts. Inflation also encourages people and businesses to borrow money and spend it more quickly.

The school board in Anchorage, Alaska, for example, is counting on inflation to keep a lid on teachers’ wages. Retailers including Costco and Walmart are hoping for higher inflation to increase profits. The federal government expects inflation to ease the burden of its debts. Yet by one measure, inflation rose at an annual pace of 1.2 percent in August, just above the lowest pace on record.

“Weighed against the political, social and economic risks of continued slow growth after a once-in-a-century financial crisis, a sustained burst of moderate inflation is not something to worry about,” Kenneth S. Rogoff, a Harvard economist, wrote recently. “It should be embraced.”

The Fed, in a break from its historic focus on suppressing inflation, has tried since the financial crisis to keep prices rising about 2 percent a year. Some Fed officials cite the slower pace of inflation as a reason, alongside reducing unemployment, to continue the central bank’s stimulus campaign.

(Excerpt) Read more at nytimes.com ...

TOPICS: Business/Economy; Front Page News

KEYWORDS: federalreserve; inflation

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-132 next last

To: i_robot73

My copy of the Constitution indicates gold/silver You might want to read that entire section of the Constitution. That should clear up your confusion.

101

posted on

10/28/2013 5:58:07 AM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: mikey_hates_everything

If you are living off cash savings, have no other source(s) of income and don't have assets whose values will increase with inflation...--then you need to climb out of bed and get a job that pays better than 'professional victim'. OK, so we all know that 'professional victim' may seem like a booming career field these days, but that line's never been something with any kind of future even when it becomes national policy. Especially when it becomes national policy.

To: Toddsterpatriot

No confusion. Would you like (try to) to ‘enlighten’ me?

A1S8: The Congress shall have Power...To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

A1S10: No State shall...make any Thing but gold and silver Coin a Tender in Payment of Debts;

I see any Power granted to Congress to PRINT $$, nor give that authority to any 3rd party (Fed. Reserve). Nor do I see where States are obligated to take ONLY what the Fed. offers (aside from that noted above).

At the worst, I see only the authority to COIN, and, since A1S10 states States can only take gold/silver, why would Congress make anything BUT?! One does not need the full faith and trust for gold/silver to be of any ‘worth’, but a piece of paper....

Maybe your own copy has a few more ‘grey areas’?

103

posted on

10/28/2013 9:53:41 AM PDT

by

i_robot73

(Give me one example and I will show where gov't is the root of the problem(s).)

To: 1010RD

Recent history bears out what you say in your second paragraph. For decades, we have had so much deflation in the tech sector that it has overwhelmed any inflation in other sectors. For instance, while the housing bubble was inflating, there was little evidence of inflation in the economy as a whole.

All I was trying to do was point out that many (perhaps most) economists have been wringing their hands about deflation for about 20 years now. The majority of economists have advocated a small amount of inflation for many decades. For the author to suggest that this is in any way new, or surprising, is a measure of some combination of: incredible ignorance; astounding stupidity, or willful bias.

BTW, IMHO, inflation does have one important use — it allows for the gradual adjustment of wage rates, to reflect changes in the real economy. Workers (and especially unionized workers) don’t mind wage increases; but, they hate wage cuts (Duh!). Inflation provides the smoke and mirrors that allow for gradual wage cuts, while giving the illusion of wage increases. Most text books on the subject stress this point — although I doubt the article writer has ever cracked an economics text.

To: i_robot73

The Congress shall have Power...To coin Money, regulate the Value thereof So they can make the dollar one ounce of silver, 1/2 ounce of silver or no ounces of silver.

No State shall...make any Thing but gold and silver Coin a Tender in Payment of Debts;

Florida can't print their own bills, but if they want to mint gold or silver coins, that's okay. The Federal government has no such metallic requirement.

Nor do I see where States are obligated to take ONLY what the Fed. offers

That's covered by the Legal Tender Act.

and, since A1S10 states States can only take gold/silver,

Make, not take.

105

posted on

10/28/2013 2:40:17 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: 1010RD

Deflation resolves itself and has done so historically.Wait a sec, so does Disco, nuke war, and hot fudge steak sauce, but it doesn't mean we still don't want to avoid them...

To: USFRIENDINVICTORIA

For decades, we have had so much deflation in the tech sector that it has overwhelmed any inflation in other sectors.... ...economists have been wringing their hands about deflation for about 20 years nowWe need to agree on what we mean by deflation. Usually a standard definition (from here)--

deflation [dɪˈfleɪʃən]n(Economics) Economics a reduction in the level of total spending and economic activity resulting in lower levels of output, employment, investment, trade, profits, and prices Compare disinflation

deflationary adj

deflationist n & adj

Collins English Dictionary – Complete and Unabridged © HarperCollins Publishers 1991, 1994, 1998, 2000, 2003

--involves prices in general and not an isolated sector. That's why if we like jobs and wealth creation, then we don't like hyperinflation, we can live with low inflation, and deflation is total disaster.

To: expat_panama

Those we can agree on, but when you say “we” do you mean Americans in the aggregate; FReepers; just you and I; or a group of unelected bureaucrats aka the FED?

108

posted on

10/29/2013 5:37:59 AM PDT

by

1010RD

(First, Do No Harm)

To: Dilbert San Diego

The way QE is done now the newly(digitally) printed fiat money ends up in bank vaults(spreadsheet balances) and in the stock market. The "common" man has no place at the trough. Hence no price inflation of goods. Only commodities are inflated like oil, gas etc.

The free traders put a lot of the manufacturing sector out of work(90% of whom were non union). There is not now and never will be wage inflation. In the professional sector the H1B program puts a cap on wages there too so NOBODY has wage pricing power, except the politically connected, i.e. government workers etc.

109

posted on

10/29/2013 5:48:52 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: 1010RD

Most people know that enduring something that will eventually ‘resolve itself’ doesn’t make the enduring any less painful. That’s the general line of thinking for folks surviving deflation for not wanting it again. We’re still struggling thru the aftermath of the last one.

To: expat_panama

We agree that deflations are painful. I believe they’re necessary and a part of the regular economic cycle. My complaint is that the Fed isn’t the best method for handling the problem.

Keep in mind that one of the reasons we’re still in this bubble is that we never had a full accounting from the last bubbles. The Fed just kept the party going and enabled bad fiscal policy to be implemented.

If interest rates were allowed to rise as they would have naturally the market would already have been cleared. That’s my contention. Pre-Fed, deflations cured themselves and the economy thrived. Think Gilded Age.

If we were to return to those growth rates the debt would be repaid in a little over a decade, the need for welfare entitlements, including Social Security which is simply a tax, would come to a swift end. The disruptions in employment would be resolved on the state and local level, along with welfare. I don’t blame the Fed for everything, but it is a big part of the problem.

I believe in the free market and there are free market alternatives to the Fed. Can you think of some?

111

posted on

10/29/2013 6:42:43 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

...deflations are painful. I believe they’re necessary and a part of the regular economic cycle. My complaint is that the Fed isn’t the best method... ...there are free market alternatives to the Fed...--just as there are free market alternatives to the courts, the legislature, and law enforcement.

Most people want no part of that kind of thinking because the best justice money can buy is simply not very good justice. Governments do have a purpose. We want them to maintain order and provide an environment where laws are standard and contracts can be enforced. It's a function that must remain entirely separate from the market place --like religion. Nobody likes a religion that's primarily a business, or even one that's an agency of the government for that matter.

To: expat_panama

You’re clouding the issue. The free market can replace many government functions, but not the Constitution. Congress uses the Fed as a method. It is a legal monopoly. Might there not be a better way?

In the past bank clearing houses operated and were a de facto Fed, issuing currency (illegally, but they were never prosecuted or pursued for it) as needed during crises.

Your concern that the free market is some how polluted relative to the political market is prima facie nonsense. You know better.

113

posted on

10/29/2013 11:05:46 AM PDT

by

1010RD

(First, Do No Harm)

To: USFRIENDINVICTORIA

Your final paragraph I think tells the entire tale. People are emotional, not as logical as we’d hope, and mildly to extremely ignorant of economic reality.

For instance, you could have falling wages, yet a net gain if prices fall faster.

I believe that the purpose of the Fed is, like all bureaucracies, to serve the politics of a situation. It provides cover and lulls the masses into complacency.

I believe there’s a better way, one less susceptible to political pressure or Wall Street manipulation. I’d like to see a free market solution, via bank clearing houses and some constraint on bank types and risk.

114

posted on

10/29/2013 11:09:52 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

I mostly agree with everything you wrote, except for your last sentence.

You’re right to insist on a more precise operational definition of deflation. In my response to 1010RD, I was focusing on his point that deflation (defined narrowly as steadily lowering prices) isn’t necessarily bad. We have had many historical precedents.

The good times toward the end of the 19th century, which 1010RD alluded to, were mainly the result of huge increases in productivity owing to the building of transcontinental railways. The overall economy also grew at an impressive rate, although overall prices dropped by about half.

The parallel between the laying of railway tracks, and the revolution in computing and telecommunications technology is obvious.

The key factor is the level of demand — which is also given prominent mention in most definitions of deflation. Overall demand did not decrease in the late 1800’s, and thus there was not excess (overall) capacity, with it’s resulting job losses, etc. that comprise the deflationary spiral. The same could be said about the last couple of decades of the 20th century. Aggregate demand in the tech sector has increased dramatically, at the same time that prices have been dropping by (about) half every three years. (Much could also be said about the gold standard that was operating in the 19th century, vs. fiat money managed by central banks.)

We are currently seeing new deflationary pressures coming from the energy sector (of all places!) — with shale oil and gas, fracking, oil sands, etc. Lower prices for energy will, in effect, put more money into the pockets of consumers (in oil-consuming nations, at least). It will lower prices of products of every other sector. Lower energy prices add to our real wealth, just as building railways and the internet have done. So long as aggregate demand doesn’t fall, we might enjoy a long period of “good” deflation (once again, narrowly defined to focus on lower prices — and leaving out the bad stuff). IOW, deflation is not necessarily a bad thing — just as a moderate amount of inflation can be a good thing.

I’ll come back to my original point: the author is some combination of: stupid, lazy, ignorant, or disingenuous to suggest that there is anything “new” about economists worrying about deflation.

To: 1010RD

To: USFRIENDINVICTORIA; expat_panama

Thanks and good stuff. Expat is a sharp fellow and I am curious to see his reply. Definitions are definitely important and without them, misunderstandings occur. I appreciate your clarity.

117

posted on

10/29/2013 12:41:51 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD; expat_panama

Thanks.

Something was bothering me about the definition that Expat cited. I figured it out -- that definition (and there are many others like it), goes beyond just

defining deflation and includes speculation on the

results of deflation. On even further reflection, I find that I can't completely agree with

any part of that definition.

Let me offer my preferred definition first: Deflation = a state of falling prices. Now, compare that with the one Expat cited.

Economics) Economics a reduction in the level of total spending

Sort of right -- but, there's an implicit assumption that growth in aggregate demand does not at least match the reduction in average prices. That assumption is simply not supported by economic history.

and economic activity resulting in lower levels of output, employment, investment, trade, profits, and prices.

Now, the assumptions are becoming quite explicit. Once again, these assumptions are not supported by economic history. Sometimes that's the result -- sometimes it isn't. The cited definiton is really more of a definition of a "deflationary sprial" -- while that's not a good thing, it is not the inevitable result of lower prices.

If we were to accept the definition that Expat cited (note: I am not saying "Expat's definition"), then there is nothing to debate. Nothing is left but a tautological argument: deflation is bad, because it's bad by definition.

If we stick to the narrow definition deflation = a state of decreasing prices; then we can debate what comes next. That's what we've been doing here.

To use an analogy derived from a childhood literary classic: too much deflation makes the economy too cold; too much inflation makes the economy too hot; a little bit of one or the other makes the economy just right. (I know that's simplistic -- no analogy or metaphor is completely right; but some are useful.)

To: USFRIENDINVICTORIA; 1010RD

post 90 1010RD a very healthy economy with persistent deflation.... ...like the US in the 1800s, post 115 USFRIENDINVICTORIA ...deflation (defined narrowly as steadily lowering prices) isn’t necessarily bad. We have had many historical precedents. The good times toward the end of the 19th century, which 1010RD alluded to... ...overall prices dropped by about half.

OK, if everyone wants we can use this inflation definition (from here):

de·fla·tion (d -fl

-fl

sh

sh n)

n)

n.A persistent decrease in the level of consumer prices or a persistent increase in the purchasing power of money because of a reduction in available currency and credit.

The American Heritage® Dictionary of the English Language, Fourth Edition copyright ©2000 by Houghton Mifflin Company. Updated in 2009. Published by Houghton Mifflin Company. All rights reserved.

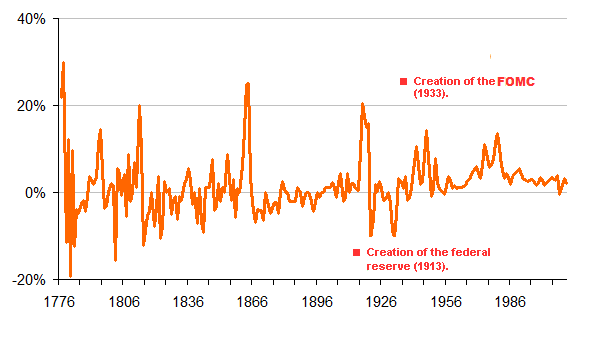

--but let's please stop changing it. Next we need to quit tossing out historical records which (like the definitions) sound made up and arbitrary. Here's a website we can use and y'all are welcome to share another if someone thinks they got a better one, but they got to either 'splain why first.

Here are the general price indexes during America's first century and a half in half century jumps:

| year |

cpi |

average annual inflation |

| 1774 |

7.82 |

|

| 1824 |

9.35 |

0.4% |

| 1874 |

11.04 |

0.3% |

| 1926 |

17.7 |

0.9% |

There was no "persistent deflation" with any of those time periods, and "overall prices dropped by about half" is simply not there. Long range prices were flat. Of course, nobody works one day, gets paid 50 years later, and buys food after another 50 years. The historical record of year over year general prices trends was all over the place --ranging from 30% inflation one year to a 19% deflation in another. Crazy. Absolute living hell. Now look at how price stability increased as Congress used the Fed for regulating money's value:

OK so y'all are not happy with how Congress is coining Fed regulated money. I've yet to hear what y'all do want, but let's understand that most people don't want it back the way it was.

To: expat_panama

Allow me to respond in kind, to your thoughtful response.

1. Your new definition is much better -- it would be perfect, if the part starting with "because" were left off. That part is nothing but an assumption -- and we could fill a hard drive debating it.

2. Please note that your new definition includes: "or a persistent increase in the purchasing power of money."

3. You reposted this statement of mine: "The good times toward the end of the 19th century, which 1010RD alluded to... ...overall prices dropped by about half." You also provided us with a link to a website, from which you extracted some facts about American price indices. Using the calculators on that website, I've extracted the following facts:

| year |

cpi |

average annual inflation |

| 1865 |

15.79 |

|

| 1899 |

8.04 |

-1.97% |

IOW, the website you pointed to proves my statement about prices dropping by about half. My historical records were neither made up nor arbitary. Same as my definition -- for which I've already provided plenty of rationale.

4. I don't recall taking a position one way or another regarding the Fed -- nor the efficacy of monetary policy in general.

I would just like to point out two things: (i) as your chart shows, a huge bubble began inflating

after the fed was created, and famously burst in 1929 -- leading to the Great Depression. (ii) Keynesiasm started in the mid 1930's as a

fiscal policy solution to the depression.

The debate about the relative efficacy of fiscal and monetary policy tools rages on to this day. Your chart could be used to bolster the arguments of either side.

5. FWIW, I do think that monetary policy matters, and that central banks

can be a force for stability. They can also be a source of economic disasters.

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-132 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

-fl

-fl

sh

sh n)

n)