and the futures market update --so let me know if anyone wants on or off this ping.

and the futures market update --so let me know if anyone wants on or off this ping. Posted on 03/23/2014 4:10:35 PM PDT by expat_panama

Investment & Finance Thread (Mar. 23 edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here.

We usually see this showing up on Monday mornings w/ a ping to freeper investors, but it seems the write up is being done on Sunday night anyway so starting now it's being shared as it comes out. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

Tomorrow morning of course we'll still have our -- and the futures market update --so let me know if anyone wants on or off this ping.

and the futures market update --so let me know if anyone wants on or off this ping.

======================

======================

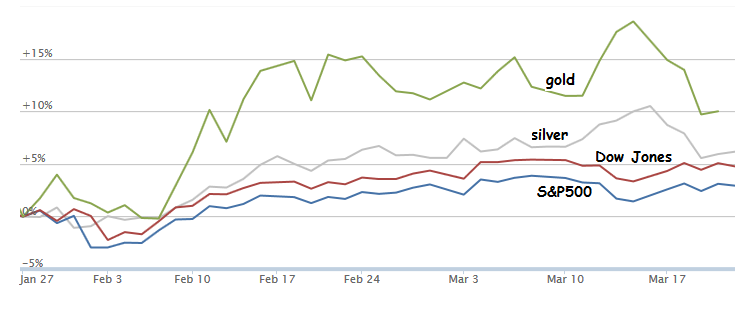

Last week's thread began wondering if stocks were going into the bigger drop like we had back around the beginning of Feb., but instead the drop happened with metals and stocks leveled up.

OK, so this is when the guy on the radio says "past performance is no guarantee of future returns" --that and you've been following IBD TV (free to non-subscribers) the market pulse is still 'market under pressure'.

The threat of the US losing it's status as benchmark currency, coupled with debt to GDP ratios indicate that this QE induced smoke and mirrors propped up market is not sustainable. The recent uptick in the 30 year bond is what I am feeling is the first sign.

Think about it. What is going to happen to an economy fueled by credit, when credit is too expensive to use or get. It is going to get ugly with what will be a blend of the 30's and the '70's.

I think those of us who have a portfolio blended across the board should be alright, but 50-80% of our population is in for a tough go.

Right now I am 50% cash and the rest is in the market. I am losing on two of my picks. The rest are doing really well and will hopefully survive the rough seas ahead. I so want to go in, but that little voice is telling me, “Patience Little Grasshopper.” ; )

High inflation will hurt me very badly if I am not in a position to take advantage of it, hence my cash position. Contrary views are welcome. Don't worry, I will probably ignore them. : )

huh, describes my current setup atm!

What I'm seeing is that market pricing patterns for the past few years have been more often than not a slow rise over a matter of weeks punctuated by in a matter of days or hours --this changes trading rules that worked so much better in past decades into rules can that no longer be depended on. SAJ & I were talking about it and his view is that this is typical of what he called an 'unstable market'.

Seems to me that getting back into the kinds of returns we had before '08 means tailoring market timing and stock screening to fit Obamanomics.

this QE induced smoke and mirrors propped up market

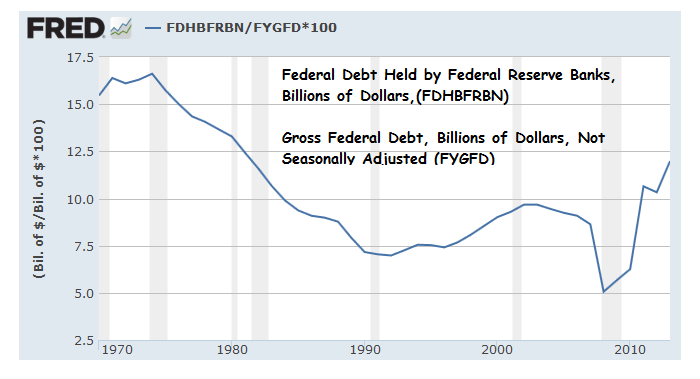

We're hearing that a lot but we're not hearing what that means in actual monetary policy and stock prices. Like what QE are we talking about --the Fed buying treasuries? The fed's alway's bought treasuries, it's what they do. In fact, the fed held a bigger share of the T-bill market during the Reagan years than now. Inflation's far more tame now than those days too.

For me all this "QE's fault" nonsense is just a bunch of loony-left union talk intended to shift the blame away from the left-wing's war on business in time for the 2014 election.

BINGO. Fisher's quote on fiscal policy nails it (although he ignored the regulatory impact).

That would be a nifty graph and visual eye candy to easily and quickly rebut the “QE’s fault” argument.

Inflation's far more tame now than those days too.

There will be no inflation until 1) there is real economic growth, 2) median income increases and 3) labor participation gets back to where it was pre Obama. Obamanomics promotes a part time work force which limits take home pay which is built an anti-inflationary measure and anti-wealth build up for the middle class. The cost of Obamacare Plans are prohibitive for anyone who makes more than 4 X poverty level (again anti-inflationary and wealth build up).

Census office survey scandal grows as inflation stats faked

http://www.freerepublic.com/focus/f-news/3138009/posts

QE in general coupled with runaway spending by our government is the full text of what I am getting at. This infusion of capital into our economy is doing nothing but postponing the inevitable. Only once in our nation's history has accumulated debt exceeded 100% of GDP. WWII. WWII however had the dynamics to trend into a powerhouse economy due to many post war competitive advantages since we were the least impacted by the war from infrastructure perspective.

Fastfoward to now. It is almost the opposite. We have become a mostly one dimensional service economy, with no prospects to compete on a global level. You speak that inflation is tame, but what happens when the Bond and lending rates go to 5, 7, 10%? The implosion will be severe, and many in country hurt by it.

I respect your opinion, but in this case we may have to just agree to disagree.

Wow, good for you! How do you do it? Are there certain indicators or charts that you watch? (Sorry if this is a dumb question!)

And I though we were doing well by only going down 20% in 2008!

The % of the national debt held by the feds averaged over 10% during Reagan's two terms and it's averaged less than 9% since Jan. '09. Of course this info would never make a difference in a political argument, this is just useful for those of us interested in knowing what's going on.

That's a debate that may well last through the ages.

What we got is that the reason the debt burden fell after it peaked in '46 wasn't because of some big fiscal surplus, it was the soaring GDP. OK, so lots of people still buy into the lefty song&dance about how the war fixed the GDP but what I'm seeing is that business activity came back because our nation's survival demanded a stop to FDR's war on business. Burying that insanity in the graveyard of loopy policy kept us prosperous for decades --then came the '09 election...

It's baaaaack.

Whoa there!

I don’t have the inputs to the chart. But is seems that the feddebtyheldbybanks to the grossfeddebt ratio peaked during the Nixon years, then during the Carter years through the Reagan years were on a downward slope, bottomed out during Bush 1, began increasing under Clinton and continued increasing under Bush 2, then DRAMATICALLY crashed during Bush 2 and is now DRAMATICALLY increasing under Obama.

Now, those two DRAMATICALLY(ies) seem unhealthy and should be something we need to be concerned about.

That sounds about right. In fact, that last reading was actually above the average of all monthly levels since 1970. That also means that all the other monthly levels of Fed held debt has been 'below average'. The point is that people can say that QE-fed-owned-national-debt is something that's bigger than ever, super-extraordinary, is gonna kill everyone, and is why the the stock market's so high. It's not true though.

Now on the other hand if we're talking about how the national debt's unsustainable madness and fiscal budget policy really needs to be muzzled, then well, OK. That part's not on the graph tho because it's got nothing to do with the Fed buying T-bills.

Damn right. Except this time there is this entrenched bureaucracy that is strangling every aspect of business.

In 1946 there was no EPA, DOT, FDA, etc. etc. etc. This legislative "surcharge" has cost this country dearly. Don't quote me, but I remember reading somewhere that in post WWII America that one out of three jobs were directly tied to manufacturing. Now it somewhere around 1 in 15. I agree with your comment that FDR waged war on business. But's FDR's war is child's play to what has ensued especially since the '70's. A deficit is acceptable, as long as you have the ability to grow your economy. Being that we are a service economy, we have ran out buttons to push.

Now on the other hand if we're talking about how the national debt's unsustainable madness and fiscal budget policy really needs to be muzzled, then well, OK. That part's not on the graph tho because it's got nothing to do with the Fed buying T-bills.

I don't mind deficits (approx. $100-$350 billion/yr.) if growth policies are in place such as lowering taxes and regulations, promoting responsible energy polices determined by the market place NOT the oval office etc.

I have no clue how we the people get the budget under control. That is not the case presently. Our President, House Reps and Senators are acting like idiots and on top of that, they have lost control over the cost of the bureaucracies.

We have increased the national debt by $7.7 Trillion in five years and have no space ships (hitching rides with the Russians), have no military any more, no new roads or airports, no new dams, no new post offices, no new harbors, giving away the US control of the internet.....NOTHING for $7.7 Trillion. I take that back. The NSA has a super duper warehouse to store OUR metadata. WTF????

As far as charts, I mostly watch sector performance, bonds, and use good common sense, and draw from experience. Get a CFP to use to bounce or vet any large moves. I also hate to sound simplistic, but whoever first stated "buy low- sell high" conquered 90% of the puzzle. Do good research, and only buy into investments that you feel have potential for sustained growth, or can deliver div's on a sound and consistent basis.

Expat has some excellent links on these.

The lady talking about her "Obamaphone" pretty well sums it up.

http://www.businessinsider.com/worlds-best-airport-awards-2014-3?op=1

I agree with you Catfish1957, agencies such as the FDA, EPA, DOE, DOT have cost this country dearly. With all the monies we are spending we should be #1 in every category.

And while I'm at it NO MORE ObamaPhones and EBT cards!

“I agree with you Catfish1957, agencies such as the FDA, EPA, DOE, DOT have cost this country dearly. With all the monies we are spending we should be #1 in every category.”

You’re making a good case, the only thing I might add is that we also have a bunch more layers of mini-me bureaucracies on the state and local level designed to choke anything that makes it through the fed.

Wrapping up the week here we're starting this morning with soaring metals futures and upbeat expectations for stocks. This after yesterday's new lows ( Market Wrap The indexes headed lower Thurs. as leaders continued to falter and the market correction rolled on. Watch Video ). fwiw, remember that yesterday's stock futures began upbeat too. Other news:

Warning flags are flashing on Wall Street As stocks near end of first quarter, warning flags spike as momentum trade stalls USA TODAY

Income-Inequality Whiners Are Today's Neo-Marxists - Jeff Snider, RCM

Stocks Slapped Down After Rally Attempt 03/27/2014 07:03 PM ET - Stocks tried to rally from a weak open Thursday, but the bears eventually took control. The Nasdaq lost 0.5% after being up 0.3%. The S&P 500 trimmed 0.2%. The Dow Jones utility average rose 0.7%, pointing to a defensive bias... (subscribers only)

Market Hustle: Stock Futures Rise as China Stimulus Hopes ResurfaceStock futures are pointing to an upbeat start on Wall Street Friday ahead of a number of consumer gauges and as China stimulus hopes resurface. TheStreet.com31 mins ago

U.S. Stock-Index Futures Rise After S&P 500 Two-Day Drop U.S. stock-index futures climbed, signaling the Standard & Poor’s 500 Index will rise after a two-day decline, as investors await a report that may show consumer confidence fell less than previously estimated. Zynga Inc. (ZNGA) climbed 4.7 percent in early New York trading after billionaire Steven… Bloomberg

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.