Skip to comments.

Of Course No-One is Buying: Average Cost of New Home is 6x Median Income

Townhall ^

| 06/12/2014

| Mike Shedlock

Posted on 06/13/2014 7:10:01 AM PDT by SeekAndFind

A couple of recent reports will help put the bifurcated US home "recovery" in perspective.

Priced Out

First, please consider Many Seek New Homes Near Cities but are Priced Out

The average price of a newly built home nationwide has reached $320,100 — a 20.5 percent jump since 2012 began. That puts a typical new home out of reach for two-thirds of Americans, according to government data.

Yet many builders have made a calculated bet: Better to sell fewer new homes at higher prices than build more and charge less.

Their calculation is partly a consequence of the growing wealth gap in the United States. Average inflation-adjusted income has declined 9 percent for the bottom 40 percent of households since 2007, while incomes for the top 5 percent exceed where they were when the recession began that year, according to the Census Bureau.

Buyers have historically paid about 15 percent more for a new home than for an existing one, a premium that's reached 40 percent today, according to the real estate data firm Zillow. An average new home costs about six times the median U.S. household income. Historically, Americans have bought homes worth about three times their income.

Construction has yet to rebound with vigor. Just 433,000 new homes were sold on an annualized basis in April. Over the previous half-century — when the United States had a smaller population — annual sales had averaged 660,000.

Sales of Priciest 1% Homes Soar (Bottom 99% Down)

Second, please note that a Redfin research luxury report shows Sales of Priciest 1% of Homes Climb While Rest of Home Sales Still Down

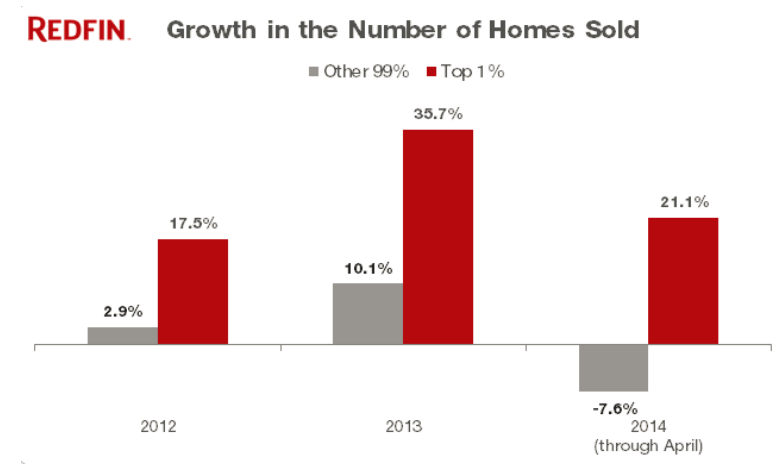

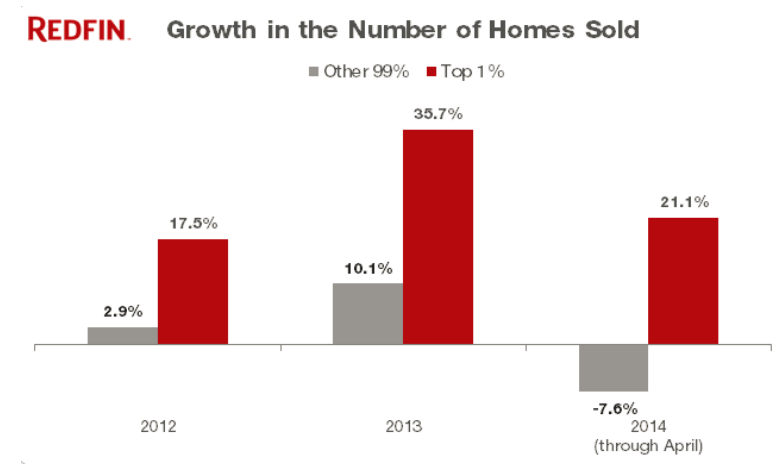

Home sales so far this year are lower than they were in 2013, but there’s one sliver of the housing market that’s going strong: the very top of it. Sales of the priciest 1 percent of homes are up 21.1 percent so far this year, following a gain of 35.7 percent in 2013. Meanwhile, in the other 99 percent of the market, home sales have fallen 7.6 percent in 2014.

Nationwide Sales

Select City Sales

The price to reach the top 1 percent of the housing market varies widely by metro. In San Francisco, the most expensive 1 percent of homes sold for $5.35 million or more. In Los Angeles, joining the high-end luxury market will set you back at least $3.65 million, but if you’re willing to live a bit farther south in Orange County, you can squeeze into a luxury home for just $3.45 million. The budget luxury buyer could look to Atlanta ($861,000), Minneapolis ($881,000) or Raleigh ($815,000), where access to the top 1 percent of the market can be purchased for six figures rather than seven.

So who can afford these luxury homes? Banks don’t offer conventional loans for homes in this price range. But to put things in perspective, here’s what it would take: In San Francisco, a luxury homebuyer would need a million-dollar down payment and an annual salary of $916,000 to qualify for a 30-year fixed-rate loan, and to afford what would be a $21,369 monthly mortgage payment. In a lower-priced luxury market such as Raleigh, an annual income of just $140,000 could keep a buyer comfortably among the 1 percent in this hypothetical scenario.

Redfin reports 44.7% of luxury buyers paid cash. The overall average was 32%. For additional details, please see Cash is Still King in Home Buying

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: home; housing

2

posted on

06/13/2014 7:15:39 AM PDT

by

smokingfrog

( sleep with one eye open (<o> ---)

To: SeekAndFind

Don’t go posting this here on Free Republic.

You will make the idiots that insisted there was no real estate bubble that was going to collapse angry with you.

Unless six years of the bubble not reinflating has broken their spirits.

3

posted on

06/13/2014 7:20:36 AM PDT

by

MrEdd

(Heck? Geewhiz Cripes, thats the place where people who don't believe in Gosh think they aint going.)

To: MrEdd

My opinion is CASH IS KING today. If you have the money, buy real estate and rent it out. That’s better than putting it in a bank making less than 1% and letting inflation eat it away.

To: SeekAndFind

Obozo has killed the middle class. His punishment for America stealing its wealth from the rest of the world is almost complete. One thing he never measured is the fact we will have all he has redistributed back in ten years. Once you know how to reach success duplicating it is no problem.

To: SeekAndFind

Of Course No-One is Buying: Average Cost of New Home is 6x Median Income Lots of statistical tricks can be done when comparing average to median. Because the average will generally be larger than the median when the data is limited at the bottom end, anyone who compares the average of one data set to the median of another is usually up to no good.

In spite of that, it does look like years of the Fed giving away cash to the banks is having the effect the banks wanted of driving up the price of their housing inventory.

6

posted on

06/13/2014 7:35:46 AM PDT

by

KarlInOhio

(Republican amnesty supporters don't care whether their own homes are called mansions or haciendas.)

To: SeekAndFind

The Asians are buying lots of property and letting it sit empty. My 90 year old mother-in-law had this happen and she will not believe it.

To: MrEdd

“You will make the idiots that insisted there was no real estate bubble that was going to collapse angry with you.”

It depends on how you define ‘real estate’.

Farm land is still going for $3,000 - $4,500 an acre. It goes up every year.

10 years ago it could be had for $1,000 or less an acre.

8

posted on

06/13/2014 7:48:22 AM PDT

by

Beagle8U

(Unions are an Affirmative Action program for Slackers! .)

To: SeekAndFind

I’m paying 2200.00 a mo rent for a 4 bdrm. I could put down 40 or 50 grand cash on a loan. No one wants it.

9

posted on

06/13/2014 7:54:04 AM PDT

by

TalBlack

(Evil doesn't have a day job.)

To: SeekAndFind

To: SeekAndFind

Building a house for 50k and selling it for 5 million is a bit much though

11

posted on

06/13/2014 8:14:30 AM PDT

by

molson209

(Blank)

To: SeekAndFind

I’ve been saying for years that home prices are still inflated and there must be another correction. The banks and builders are only stalling the inevitable, and prolonging an unsustainable situation.

To: MrEdd

“You will make the idiots that insisted there was no real estate bubble that was going to collapse angry with you.”

Well, idiots is a good word for people like that. Anyone with any clue about real estate knows there are always real estate bubbles. It’s a cycle that doesn’t stop. If one bubble is burst, another starts growing.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson