Posted on 08/14/2014 9:12:25 AM PDT by AngelesCrestHighway

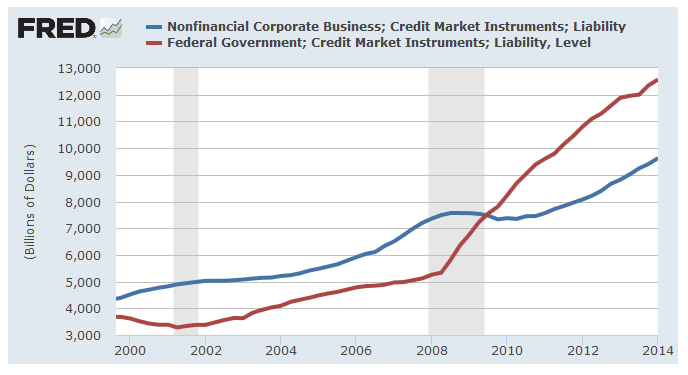

It’s not just the stock market we have to worry about. It’s also the bond market. For the past five years, U.S. corporations have been living in a financial paradise. Interest rates have been on the floor. Wages have been flat. Companies have been able to lay off workers and slash costs. Profits have skyrocketed to record levels. And they’ve spent almost nothing on new capital equipment, either. And what effect has this had? In 2007, at the peak of the last credit mania, U.S. nonfinancial corporations owed $7.2 trillion according to data compiled by the U.S. Federal Reserve. Today? After years of this bonanza, those debts have tumbled all the way down to… er… $9.6 trillion. All that talk you hear about how corporate balance sheets are in great shape is a bunch of hooey. Corporations borrowed $993 billion just in the first quarter of this year. Corporate debts have actually doubled since 1999.

(Excerpt) Read more at marketwatch.com ...

Have you guys got any thoughts on this?

The problem ultimately lies with the executive class. Most are MBA grads who did not start at the bottom. Few executives really pay for a company’s failure, because if they fail, they get fired and cash out their stocks and go on to the next company that they are also not invested in.

All that needs to happen is interest rates rise...

When interest rates are low, it makes sense to raise more money through borrowing, as opposed to selling stock.

It is a rational business decision to maximize shareholder value.

What matters is what they have done with the money. If it was well invested, it will pay off.

Productive good debt or reckless/corrupt bad debt - that is the real question.

That’s my view also. Interest rates need to be allowed to return to their natural level.

Good post. I would add that the U.S. tax code actually incentivizes borrowing like this.

The article points out that the quality of consumer debt has declined - less of it is mortgage, more of it is credit card.

Mortgages have lower rates, for appreciating assets. Credit card debt is at a higher rate for assets that depreciate, or are completely worthless after purchase (like restaurant meals).

That is the scary part for me. Consumers average net worth is declining (unusual), real wages are declining, and total debt is rising while its quality is declining.

Government debt is ballooning at a scary rate in the US, and it is overwhelmingly driven by non-productive (i.e. no resulting income or residual asset) spending like food stamps. That is some serious dead weight on finance.

The quality of Corporate debt is a lot less clear. Corporations may just be raising dollars here at favorable rates, to invest overseas where the returns are greater.

My problem is when the debt directly or indirectly is used to buy back stock. This artificially raises the earnings per share, and ironically the share price. Then the executives stock options are increased in value.

Yes corporate debt is up, because if you are going to borrow the time to do it is when interest rates are low, not when they are high.

Now, comparison with “net worth” is fair, but it is also fair to note, that a fair measure of borrowing is the cost of that borrowing against fair-to-assume income, and the lower the interest rate is, the less per-revenue-period is a $1 of debt.

Even if the GDP growth slows, I am not sure the lower financing costs per-dollar borrowed, on the greater amount borrowed, will make for “systemic risk”.

Bingo. MBA grads are destroying the world economy, and society in general. We’ve fallen into a black hole of dangerous, selfish, short-sighted groupthink.

Scott Shellady (a trader in Chicago who appears on Varney & co. in a really cool cow pattern coat) said it looks like the US is on the road to being like Japan, in a slow decline, rather than there being a risk of hyperinflation.

So, you have 2 opposing camps - one thinks deflation and depression, the other runaway inflation. Either way we’re tooled.

Don’t bother to thank me for the happy thoughts!

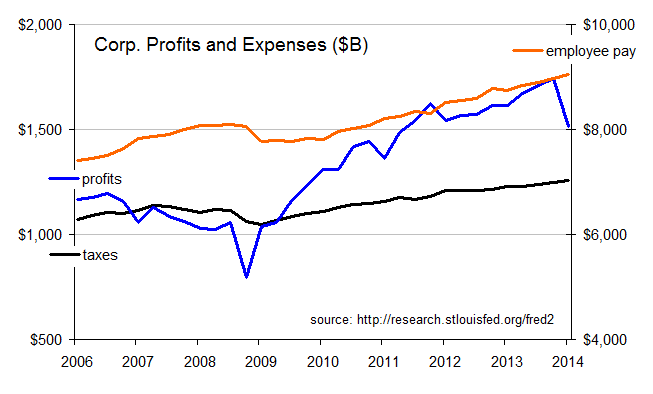

Profits this past quarter have fallen back to where they were years ago, payouts to employees have been steadily climbing and (as usual) are at an all time high --just like taxes.

Corp. debt growth has been slowing, not accelerating. Historically it's supposed to grow at ten percent yearly, but ever since the '08 election it's grown at half that rate. Arends is a journalist and knows a lot about getting folks to read what he writes. He knows nothing about business but that doesn't seem to bother either him or his readers.

Applicable only if corporations have variable rate debt and aren’t hedged through swaps.

Good time to borrow and create leverage. Just make sure you do the “stress test” analysis to make sure the interest coverage is feasible in a downturn. Problem is I font know what they’ve been doing with the money (assuming all new money). CapEx has been weak until recently. M&A market has been white hot so maybe that’s it. Sure as hell cheaper than financing with equity. Lower your WACC with Kd rates sub 5%. Not bad.

My company has reduced debt by $500 million the last five years and just announced a call on another tranche to reduce it even more. Our net debt to EBITDA ratio has fallen from over 6x in 2009 to 2.6x this last quarter. We are looking at acquisitions now because the debt cost is so low.

“MBA grads are destroying the world economy, and society in general. “

What’s that you say?

As an MBA graduate, I would argue that a sizable percentage of us have been sounding the clarion on poor fiscal policy, poor monetary policy, obscene government largess, an ever-expanding welfare state and the lack of true statesmen at the helm in our body-politic.

Long before today I might add.

The problem is, damned few are listening....

...a sizable percentage of us have been sounding the clarion on poor fiscal policy, poor monetary policy, obscene government largess, an ever-expanding welfare state...

Horrible gov't policies have made a mess of things yet too many folks prefer to toss the blame on MBA's and CEO's. As a corp. CEO to an MBA, you and I know for a fact that corp debt's normal while gov't debt's been soaring:

Those of us who read the economy by the numbers are under attack from those whose econ take comes from TV sitcoms.

These articles are attempts by left of center capitalists to cover for BigGov’s wastrel debts.

Corporate debt has a purpose. If that fails, then the private company fails. Good bye.

If government fails, then all fail.

Totalitarian regimes need all out effort from their followers but under normal conditions that’s just a fad that wears off. The way despots continue over time is by convincing the faithful that they’re in a war with a vicious enemy —it’s what both the Fascists and the Marxists did. Looks like the Obamanists are following suit...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.