Posted on 08/26/2014 12:22:14 PM PDT by thackney

Since about 2009 and until just recently, Saudi Arabia shipped discounted crude to the U.S. in growing volumes even as total U.S. waterborne imports fell. But while Saudi Arabia isn’t about to exit the U.S. market, cheaper domestic crude oils are beginning to displace Saudi imports.

Daily U.S. crude imports fell from 11.8 million barrels in 2010 to 9.8 million barrels in 2013. Over roughly the same period, U.S. daily oil imports from Saudi Arabia rose from an annual average of just under 1.1 million barrels to about 1.5 million barrels, according to data from the U.S. Energy Information Administration.

In a bid to keep its shipments to the U.S. relatively constant, Saudi Arabia’s state-owned producing company, Saudi Arabian Oil Company or Saudi Aramco, has at times offloaded its oil in the U.S. for less than it could get in other world markets, said John Auers, an analyst and executive vice president with Dallas’ Turner Mason & Co.

Auers said Saudi Aramco sometimes has sold to the U.S. at double-digit discounts relative to prices on other markets. Supply disruptions within some other members of the Organization of the Petroleum Exporting Countries also have helped the Saudis maintain market share in the U.S.

Most of that discounted oil finds its way to the refineries of the Gulf Coast, where Saudi Aramco has partnerships and interests with refiners.

The discount has leveled off in the past few months, however, as Saudi imports dipped along with other waterborne crude shipments. Saudi imports fell from an April 2014 high of 1.6 million to around 1.2 million barrels per day in May, according to the Energy Information Administration.

Auers estimated the July imports from Saudi Arabia were around 1 million barrels a day, and are likely to fall further.

“The question is to what extent is that,” Auers said. “I don’t believe (Saudi imports) are going to be the 1.5 million barrels a day they’ve been supplying,” Auers said. “It’s not going to go down to zero, but is it going to be 200,000, 500,000, or 800,000?”

Auers wonders if the Saudis are moving away from the discounted oil sales to the United States, but said he doesn’t expect any big change in how they sell their oil in the U.S.

“Their strategy has always been to develop markets in different places. They’re a very disciplined, long-term player,” Auers said. “They’re not having to discount very much today. Going forward they’ll have to discount. I think $5 is something they can live with.”

A series of partnerships and long-term contracts will help insulate Saudi Arabia’s market share somewhat if if oil prices fall.

For example, Saudi Aramco owns half of Houston-based refining company Motiva Enterprises and will likely keep sending its crude oil to refineries equipped to handle the range of crude that comes from Saudi fields.

By sending their crude to a refinery in which they own an interest, the Saudis would make up for a price discount through a larger refining margin, said Philip Verleger, an economist and president of PKVerleger LLC.

In addition, Verleger said that pricing for the oil markets isn’t as structured as it may seem. If the Saudis began selling oil in Asia that previously would have gone to the U.S., prices in Asia may fall and the Saudi’s would end up with a similar discount in that market.

Saudi Aramco has taken steps to insulate its exports from fluctuating prices, Verleger said, and changes would be made gradually.

“One of the things that the Saudis have done very carefully is to make sure that their crude is not bought and sold on the spot market at the end of the day,” he said. “The volumes are fluctuating, but the Saudis are not going to walk out of the market. They’re going to keep sending a large chunk of oil to the Gulf Coast.”

GOOD

Just as reference, how many barrels does the average oil tanker carry?

Obamarx is going to be troubled by this. He may take a triple on 5.

Pray America wakes up

I agree with your comment. That doesn’t look like anything more than normal fluctuation.

One reason would be that Saudi Arabia wasn’t providing the majority of U. S. oil in recent years. We had spread around our imports rather wisely. (Hard to believe) Canada and other suppliers were far less problematic than the Middle-East.

A fellow FReeper brought this to my attention a few years back. I’m glad he did.

If we do continue to expand production, at some point it might high the Saudi supply line negatively.

It couldn’t go on forever. It begs the question, just how much decline would it take to destabilize the Saudi government. Big income generally means big outlays and commitments. Does a 25% cut in revenue cause chaos?

It will be interesting to watch as Saudi does decline. People here who thought Saudi was our biggest enemy over there may get to see what it would be like without the leadership it has now. My take is that it would be a very dangerous entity.

The government moderated a lot more than people here think it did. That’s been my take. Without that leadership and moderation, we’re talking some very anti-West people with a fair amount of deep pockets.

Perhaps I’m wrong, but I believe it get way worse in decline.

Valarie Jarrett is deeply saddened.

Bump

Not good enough, as it only costs Saudi Arabia $6.00 to produce one barrel of oil. Oil produced from shale in the US costs $65.00 a barrel to produce.

Thanks Moose07

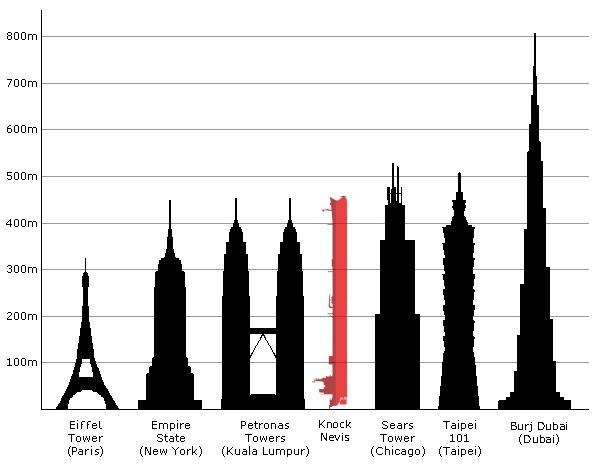

Very Large Crude Carrier (VLCC): any oil tanker 200,000 dwt (deadweight tonnage) and above. Which is further sub-categorized into Ultra Large Crude Carriers (ULCCs), vessels 320,000 DWT and above. There are currently approximately 500 VLCCs in operation, though a significant proportion of these ships are used for floating storage or have been converted into Floating Production Storage and Offloading vessels (FPSOs).

Typically, VLCCs carry 2.1 million barrels of oil, the largest VLCC can carry approximately 3.1 million barrels.

VLCCs commonly carry more than one type or grade of crude oil; their hulls are separated into up to ten tanks, allowing for multiple loads and discharges.

http://theenergylibrary.com/node/8152

I believe the Knock Nevis has gone to the Indian Ship Graveyard.

Also, smaller ships have their place as well.

Aframaxes are best suited to short to medium-haul routes.

Examples: North Sea/Baltic, Former Soviet Union to Europe and Venezuala to the U.S.

An Aframax is a medium-sized oil tanker which ranges in size between 80,000 and 119,999 deadweight tonnes. Aframax tankers have an average cargo carrying capacity of 750,000 barrels.

Suezmaxes are best suited to medium to long-haul routes.

Examples: West Africa to the U.S. Atlantic Coast and Black Sea to Mediterrean/Europe

Suezmaxes are medium-sized oil tankers that are slightly larger than Aframaxes, ranging in size between 120,000 and 199,999 deadweight tonnes, with an average cargo carrying capacity of 1.0 million barrels and are named for their status as the largest size oil tanker able to travel fully laden through the Suez Canal.

http://www.teekaytankers.com/Investors/FAQ/About-our-Fleet/default.aspx

And the gas prices don’t come down for what reason exactly?

U.S. Crude Oil Imports by Country of Origin

http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_epc0_im0_mbblpd_m.htm

Old myth

Greed? Taxes?

While global oil production is up, so is demand.

I’m more inclined to believe that he’ll take 3 mulligans ...

Aren’t these the guys that polled 92% in favor of ISIS?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.