Posted on 10/05/2014 12:26:47 PM PDT by expat_panama

Investment & Finance Thread TOTAL Market Crash Wrap-up

Jeesh! The bond bubble, just popped (Bond market may be more fragile than you think),stocks'n'metals are in the terlet, all while unemployment plunges below the big 6! Big deal. This so-called 'recovery' may be a boom time for all the elites on Main Street but those of us middle class working stiffs on Wall Street know better.

On Friday's gold and silver punched new lows and now weekend trading's putting them clearly into prices from four years ago.

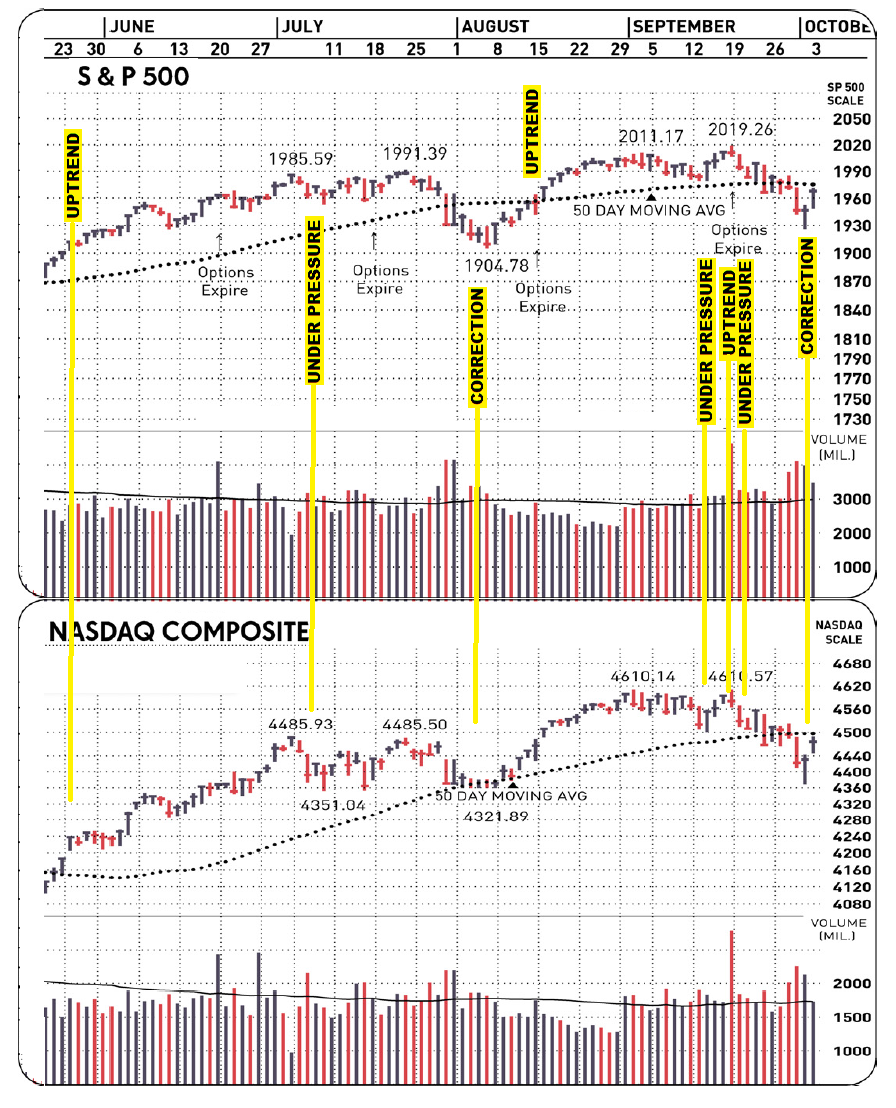

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

Bottom line though is I plan to watch this "red light" with a bit more enthusiasm than before.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

So, should i buy some silver or not?

For about twenty years I put all my money in houses and lots. Whore houses and lots of whiskey. Didn’t pay off much but was a lot of fun.

Seriously, that depends on things like your risk tolerance, how much time and energy for keeping an eye on it to be ready to dump at the right moment, etc. The price of silver swings wild --over the past ten years it's been up 600% and right now it's "only" up 160% --compared to stocks that have "only" doubled (interactive charting here).

There are people who are comfortable w/ commodities (like SAJ in post # 19) and have a far better handle on what to expect than I do. Mining stocks are more my forte, though atm none have popped up on my radar.

The Weekend Is Over, And Gold Is Falling ($1185)

http://www.freerepublic.com/focus/f-news/3211705/posts

Next time you need to warn me so I don’t spit my soda all over my keyboard. Again. I ought to make you clean it up...

tx for the link.

Just keepin it real. ;^)

CNBC had an interview with a man who knows energy, and he said Saudia Arabia wants crude at around $100, and the Saudi’s still call the shots on world prices - I assume by adjusting output.

If true (on both counts), then it would seem you’re right that $90 oil is only temporary.

keyboard spew alert

those charts make it seem as if the Fed is not printing enuf paper money... very strange...

A very good morning everyone! Futures traders are expecting a rebound in stock indexes with further declines in metals --although actual metals trading prices @ 3 hrs before opening are up a tad.

World Bank trims China, East Asia 2014-2016 growth forecasts By Masayuki Kitano SINGAPORE (Reuters) - The World Bank cut its 2014-2016 growth forecasts for developing East Asia and China, and cautioned of capital-flight risks to Indonesia while growth in China is ... Reuters

America’s Banks Pile Up Treasuries as Deposits Overwhelm Lending American banks are loading up on U.S. Commercial lenders increased their holdings of Treasuries (BUSY) and debt from federal agencies in September by $54 billion to an unprecedented $1.99 trillion, data from the Federal Reserve show. Bank of America Corp. (BAC) and Citigroup Inc. (C) are among the… Bloomberg

Gold Drops to Lowest This Year as Platinum Slumps With Palladium Gold extended losses to the lowest this year after U.S. Platinum fell to a five-year low and silver declined to the lowest since 2010. Bullion for immediate delivery lost as much as 0.7 percent to $1,183.24 an ounce, a level last seen on Dec. 31, and was at $1,187.97 by 9:49 a.m. in Singapore,… Bloomberg

btw, that last one (h/t Abb) not only makes a lot of sense as is, but it could also be useful rewritten in reverse for preparing for the next run-up.

The final numbers do have a habit messing up expectations, but the key question here is "Fed printing enuf for what?". They're not trying to make stocks go up even though they wouldn't mind if they did, and they're not trying to devaluate the dollar or make the money supply grow more --which they aren't because they can't. All they want is preventing deflation --they did so they're stopping.

We got twelve million Americans wanting but not getting work (at least that the BLS knows about) and the Fed's winding down.

Good to see you! Yeah, energy stocks have taken quite a hit --down 16% since June-- but some how that can either be stock price consolidation on a long time support (translation: bounce time!) or maybe we're in for a longer term drop. The oil price is weird though, for many decades oil (in 2014$) was always $40 but ten years ago it went to say, $100 and it's been there for 5 years now. Maybe SAJ or Wyatt knows why...

I see where you follow mining. Any opinion on the iron ore market? I bought some VALE last week when it dropped below $11. It's really been beaten down and comes with a nice yield. Can't imagine steel production will collapse, but we will see.

GS 40 Cheapest Stocks In The Market:

http://www.businessinsider.com/goldman-stocks-with-most-upside-2014-10?op=1

Whoa, welcome to Tuesday --the day we say "huh!". Yesterday futures marts began w/ stocks up and metals down but the day's action saw metals up 'n stocks down. Maybe that's why today's futures traders are now seeing metals up a half percent and stock indexes equally down. Only reports today are JOLTS - Job Openings and Consumer Credit. Meanwhile : Weak German output numbers send Europe into reverse --that and post #36...

Global stocks lower after Wall Street decline

This is why you're paying more for groceries

Greenspan Lets His Hair Down, Talks Up Gold - Brian Domitrovic, Forbes

How Low Can Oil Go? - Michael Kahn, Barron's

The Statistical Recovery Continues - Lance Roberts, StreetTalk Live

LOL!

Wow, we are the bright spot! Now isn't that amazing?

—and the weird thing will be how the global slowdown will be blamed on not enough tax’n’spending!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.