Skip to comments.

The dangers of deflation The pendulum swings to the pit

The Economist ^

| Oct 25th 2014

| [editors]

Posted on 10/23/2014 10:43:12 AM PDT by expat_panama

[snip]

The lowflation of being consistently below an already low target is bad in itself; the deflation it could easy lead to is even worse. There are several reasons. The belief that money made tomorrow will be worth less than money today stymies investment; the belief that goods bought tomorrow will be cheaper than goods bought today chokes consumption. Central bankers can no longer set real (that is, inflation-adjusted) interest rates low enough to restore demand. Wages, incomes and tax revenue all stall, undermining the ability of households, businesses and governments to pay their debts—debts which, in real terms, will grow more burdensome under deflation.

The threat is especially acute because central banks in much of the rich world have already lowered their interest rates to zero.

[snip]

A short spell of deflation driven by cheaper oil would in some circumstances be a tolerable thing. Indeed there are times when deflation can be a symptom of encouraging underlying developments. It can, for example, be brought about when advancing productivity enables the economy to produce more goods and services at lower cost, raising consumers’ real incomes. There were several such periods of “good deflation” while the world was on the gold standard; with growth in the money supply constrained, prices were pushed down whenever the volume of output grew rapidly. Michael Bordo and Andrew Filardo, two economic historians, point to America’s 1880s as a period of “good deflation”, with output rising by 2% to 3% a year from 1873 to 1896. For all the aggregate benefit, though, falling real wages hurt workers in many sectors.

[snip]

(Excerpt) Read more at economist.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: business; deflation; economy; inflation

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

To: palmer

I disagree. The author was pointing out thatDang! The more I reread that paragraph the less sense it makes. I'm going to ignore it as a useless waste of ink.

...real problem is that the government's war on deflation is killing investment and ironically creating more deflation,,,

Problem is that "the government" is it a bunch of different factions all w/ different agendas. We got the Executive Branch tax'n'spending'n'regulating us up the wazoo, there's the House saying they'll stop it but they don't, and we got the Fed struggling to keep the dollar stable --which (imho) they've done pretty well up to now.

To: Individual Rights in NJ

Why would deflation cut my wageSometimes it's automatic as some firms tweek wages yearly for the cpi. Tweeking up is easy but tweeking down is different, what some economists call 'sticky' prices that don't move easily like say, food prices. When employers lower wages they cut benefits or they lay folks off, delay raises, and then hire new workers at lower rates.

Deflation is lower prices -including the price of labor.

To: Wyatt's Torch; 1010RD

What I'm remembering was a commission audit requirement that came out of the old S&L crisis. The intent was to push financial institutions away from listing purchase prices and instead go for up-to-date market prices. Unfortunately what happened was it brought about a panic sale where funders were being forced to balance books by dumping say, T-bills at big losses simply because that particular week there were no buyers on tap. The panic sales were propagating in to a mass hysteria --and it was all per gov't regs in force at the time.

To: expat_panama

Thanks, that makes sense. So it isn’t like one day they come and say hey bud you make XK less now.

It is just laying off low-performers and hiring new people at cheaper salaries.

Makes sense. heh. Our company does that all the time anyway.

To: expat_panama

Mark to market... Reading Street Fighters about the collapse of Bear, showed what happens when there are liquidity rumors. Bear could not get anyone to accept their collateral for daily repo funding. Then it became a vicious cycle that put them out of business in 3 days. Lehman went through the same thing. Merrill was next. Imagine that with Citi, Wells, JPM, GS, BAC etc. That's what would have happened if TARP didn't backstop the system.

To: Wyatt's Torch

Mark to market...THAT'S what it was!!! Forgot the stupid name and it was like trying to remember say, the name of a song or something. Whew!

Yeah, TARP saved our butz and it always ticks me off when folks here call it a bailout --even after it all got paid back at a profit to the taxpayers. Only nobody feels like admitting that the slur implies taxpayers were given a 'bailout' from Wall Street when it was over...

To: Individual Rights in NJ

Since we got on the subject this morning I came across

an entire Fed data set on 'sticky wages'My son-in-law was telling us that at the factory where he works the accountants figured out that they'd have to layoff a huge bunch of people so what happened was everyone was at work on the production line and gradually one by one individuals started being called into the office and they were never seen again. The 'notice' was to put them outside w/ severance pay but no goodbys/talking to co-workers.

Spooky, but it's what workplace safety requires these days I guess...

To: expat_panama

Zero inflation? Never any change in any prices? Ever? No, not a change in prices. A change (decrease) in the purchasing power of the monetary unit (dollar). You know, the one that I have today that is worth $0.10 compared to the one my grandpa had.

68

posted on

10/24/2014 8:11:49 AM PDT

by

MileHi

(Liberalism is an ideology of parasites, hypocrites, grievance mongers, victims, and control freaks.)

To: expat_panama

A lot of people lump the GM bailout with TARP. Very very very different things. GM was a union bailout. There was no systemic risk if GM has to file chapter 11 which is exactly what should have happened. The banks, and AIG (who was the counterparty to all the CDS’s), were systemic risks.

To: MileHi

...not a change in prices. A change (decrease) in the purchasing power...Any change in one is a change in the other. If there's no change in prices then there's no change in purchasing power and we got zero inflation.

Price

An amount of money exchanged for something of value. The Complete Real Estate Encyclopedia by Denise L. Evans, JD & O. William Evans, JD. Copyright © 2007 by The McGraw-Hill Companies, Inc.

Purchasing Power

1. The value of a currency expressed as the amount of goods or services one unit of the currency can buy. Purchasing power is important to inflation, as the higher an inflation rate is, the fewer goods and services one unit of a currency can buy. To measure purchasing power, one must compare it with an objective standard; that is, one might compare how much one dollar can buy now versus how much it could buy 10 year ago. See also: CPI,

Purchasing power parity.

Farlex Financial Dictionary. © 2012 Farlex, Inc. All Rights Reserved

To: expat_panama

Any change in one is a change in the other. Nope. If beef goes up because half the cattle died in a given year, that ain't inflation. That is supply and demand.

71

posted on

10/24/2014 8:48:42 AM PDT

by

MileHi

(Liberalism is an ideology of parasites, hypocrites, grievance mongers, victims, and control freaks.)

To: 1010RD

“It’s policies hurt savers and the prudent.”

That’s been true in spades since about 2001.

“Furthermore, there’s no precedent for a deflation spiral in American history. “

I think “the Long Depression” of 1873-1879 was one. The first global depression. In the US it went along with the tight monetary policy required to restore the gold standard that Lincoln had abrogated. Nominal wages fell by 25%.

72

posted on

10/24/2014 10:37:27 AM PDT

by

Pelham

("This is how they do it in Mexico"- California State Motto)

To: Wyatt's Torch; 1010RD

“Complete collapse of the credit system for years as banks unwound billions of derivatives and took massive losses. Runs on liquidity as everyone pulled out cash. Thousands of banks go under.. “

That’s the scenario that I was thinking of as well. Allowing an asset collapse to go forward would have meant a near replay of the 1930s. The main difference being that FDIC would at least protect average Americans from being completely wiped out as they were in the ‘30s.

But while necessary TARP was implemented without sufficient oversight and protection for the taxpayer. I think there is evidence that TARP was abused for the benefit of the well connected.

73

posted on

10/24/2014 10:49:39 AM PDT

by

Pelham

("This is how they do it in Mexico"- California State Motto)

To: Pelham

No doubt it was abused. That what I meant by the “porked up Congress version”. I would also say that a lot of the bankers got away scott free. There should have more people thrown in jail. The massive fines don’t make any “person” accountable except the shareholders.

To: Wyatt's Torch

I’d like to find a study that goes into some depth on the abuses of TARP. It’s the failure to hold the guilty accountable that really sours people on government involvement in the financial sector.

Those who know the danger of a system wide failure of the banking system ought to be the first in line to see that these programs are not abused, but it looks like it was just another case of the financial fraternity taking care of each other at the expense of the average American. The prominence of Goldman Sachs alumni in the last three administrations may not be a coincidence.

75

posted on

10/24/2014 4:05:42 PM PDT

by

Pelham

("This is how they do it in Mexico"- California State Motto)

To: Pelham; Wyatt's Torch; expat_panama

Take a second and deeper look at the Long “Depression”. I think you’ll find the study interesting. Wages dropped, but prices dropped in proportion mitigating a significant part of the harm.

Furthermore, industry expanded during this time period and it had real national product growth of 6.8%. The money supply also grew over the same “depressed” period. I’d take that kind of “depression” any time. This is all pre-Fed and a significant reason I don’t think the Fed has been good for the country.

I know that flies in the face of conventional wisdom, but surmise about what might have been is just that. We can always imagine it being much worse. We’ve each had the flu. I had one so terrible I couldn’t even move for three days. Then it was over and life went on.

Take a deeper look at this time period and tell me your thoughts.

76

posted on

10/26/2014 4:56:03 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

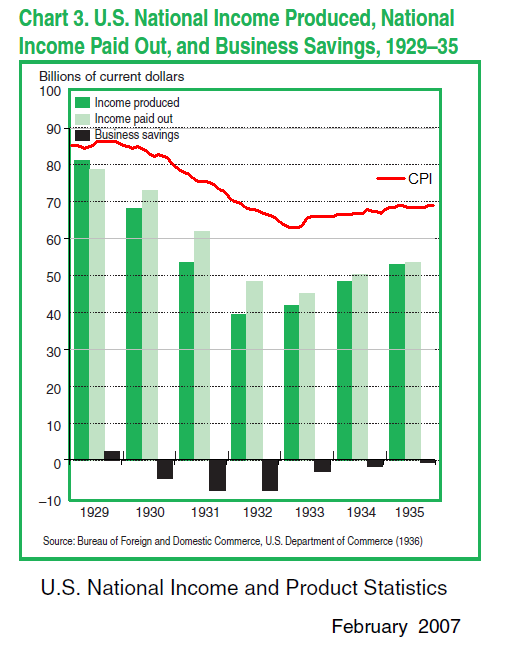

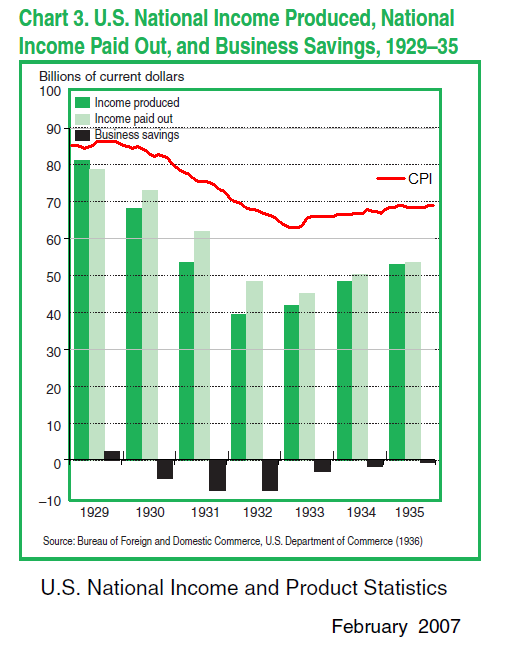

Take a second and deeper look at the Long “Depression”. I think you’ll find the study interesting. Wages dropped, but prices dropped in proportion mitigating a significant part of the harm.Not sure what 'study' you mean or where you got the numbers you posted, but let's do our own study together and compare for ourselves the actual BEA records of incomes along with BLS price levels:

From 1929 to 1933 prices fell and wages fell much faster. Even though businesses suffered heavy losses struggling to slow the decline in wages, employee's incomes still took a hit far greater than any deflation gains. It was so bad that if the trend had been allowed to continue, by 1940 wages would have disappeared completely --no incomes at all to enjoy the 2/3rds drop in prices. We can't call this "insignificant".

We also need to accept the reality that when inflation returned in 1933 (such as it was) wages proceeded to grow faster than overall prices. This wage growth didn't just "mitigate" the burden of inflation, it represented a recovery.

To: expat_panama; 1010RD

78

posted on

10/26/2014 9:33:44 AM PDT

by

Pelham

("This is how they do it in Mexico"- California State Motto)

To: Pelham

That makes a lot of sense —thanks. I’ve been able to find wage and inflation numbers annually back to those years, but I can wait & see if that’s what we’re talking about before we look into it.

To: Pelham; expat_panama; Wyatt's Torch

I’m referring to the closest parallel to today’s economy sans the Fed. That’s the misnamed Long Depression. It wasn’t a depression at all.

Take a look here:

http://wiki.mises.org/wiki/Panic_of_1873

and here:

https://en.wikipedia.org/wiki/Long_Depression

We need always to keep in mind that the US economy didn’t just start at the latest Fed intervention. Over and over again they’ve missed the coming shock, despite being warned about it. The Long Depression is proof positive that we don’t need the Fed. It’s actually allowed poor fiscal policy to be rewarded and directly helped socialists/Democrats stay in power.

80

posted on

10/27/2014 12:04:32 PM PDT

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson