Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

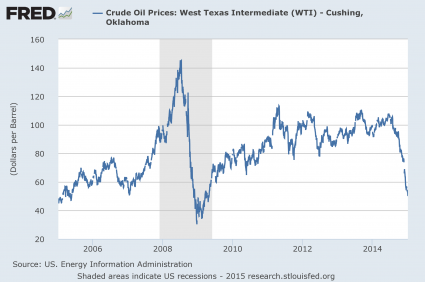

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Exactly! Government assumed the Risk! If I owned a mortgage company and the government said, “Make sure EVERYONE gets a mortgage, and Freddie and Fannie will pay for it!”. Why not give everyone a mortgage?! It is called a “perverse incentive”. Every time government gets involved in free markets, it creates them! (e.g. $700 hammers, $900 toilette seats, trips to vegas, etc.)

In 1991, my employer took out a long-term lease on the Zapata Lexington, a semisubmersible rig rated (then) to 1500' water depth. This was before Zapata's sale/merger. At that time, we had that rig for $15,000/day, and they also offered us the sister rig Concord for similar money. There was a $1000/day difference because one rig had a Varco top drive drilling system and the other did not.

Those were depressed rates occasioned by the aforementioned depression in natural-born prices in 1990/91. Rates like that were barely enough to "keep the dog alive" and wouldn't even allow for a fresh coat of paint for the rig.

Now you couldn't sniff the diesel exhaust of a rig like that for that kind of money.

Although I should imagine that rates are coming down rapidly.... I should go look at Rigzone.com.

“Only if you make up your own definition for the word.”

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

I define a depression as a falling average standard of living and by that definition we are in one and it is deepening as far as I can see. I disregard the official figures and propaganda, the only thing that matters to me is what I see happening.

I define a depression as a falling average standard of living

You have your own definition then.

recession - identified by a fall in GDP in two successive quarters

depression - a decline in real GDP exceeding 10%, or

a recession lasting 2 or more years.

The largest number I'd heard so far was around $100-110 Trillion, much of it Credit Default Swaps.

When a swap derivative based on Lehman Bros. crossed the market at 20 cents on the dollar, is when AIG trading stopped and every major money-center and investment bank in the world went broke. Thereafter, they were fiercely pumped up with fiat money and declared solvent by, again, fiat.

That's my understanding of it, anyway. But what do I know?

Not if they are objects of government policy, whom the government wants to screw for non-marketarian reasons.

Examples: People who hedged against dollar inflation in 2008 by diversifying into international funds and precious metals. Messrs. Bush, Bernanke, and the Bernanke co-conspirators at Goldman and Morgan, Stanley set out to break those people off and discourage others from seeking non-dollar stores of value. They killed everybody in the commodities space.... Like a scene out of a Punisher movie.... And that had certain, ah, consequences, one of which was the Lehman Bros. crash (they were hosed when their commodities fund disappeared up its own hoohah).

The panic selling of commodities was accomplished by a new rule-making requiring that derivatives trades be settled in dollars, even in Europe, creating an extra push of demand for dollars that moved the leveraged hedgers to start selling off their positions to raise dollars for settlement in a cascade of selling. Everything non-dollar suffered as overextended (and suddenly broken-off-in-them) traders and investors (some were 30:1 or so) in commodities spaces started getting margin calls, and the slaughter was on. They started dumping winning positions and safe preferred issues to raise cash. Everything went to hell except the dollar, which was exactly what the Fed wanted.

Second example, motives similar to first example, was the sudden tidal wave of Fed funny-money that fueled the 2009 bounce off bottom. Which wasn't a bottom, so it wasn't a bounce but a command levitation exercise. The idea was to monetize the market artificially and reward Lehman and Morgan Stanley for playing along and using the Fed money to create a short-covering panic, by giving them the Bears to eat, figuratively speaking.

The Fed's motive in the second event was similar to the first: to drive large numbers of investors back into the stock and bond markets, to pump up the balance sheets of the big (broke) banks and restore confidence in the markets and the dollar.

"Jesus saves, Moses invests..... But, sitting at the Fed's elbow, Goldman harvests. "

I agree with you that there will be very significant political results, I was mainly looking at the US economic impacts - financial markets vs. the real economy of goods, services and jobs.

The sudden end of an inflow of petro-dollar profits into our financial markets will take some steam out of them, and may cause prices to crash for a while. Domestic consumers and producers will benefits from lower costs.

I agree that Russia and Iran will be under a lot of pressure. Venezuela may be the first to crack.

Risky? Yes, no doubt. But the risk is much higher to some of the most Anti-American regimes on Earth than it is to us. Better that they are weakened than strengthened. In many ways, they can least afford to risk striking out at us when they are in financial crisis.

And enslaves us, which was the intention all along.

Ann Coulter just wrote an opinion piece about college and university tuition. It has gone up 1,000% since 1978. Why? Government (read: taxpayers) assumed the risk on the loans, so the greedy academia crowd has been ratcheting up the price like a flywheel.

And they succeeded, so far. The Papier-mâché market has soared to gasping heights. But, I firmly believe the day of reckoning cannot be avoided.

I agree - you have a humble and gracious attitude towards it. No one really knows except God.

Reading the Book of Revelation, however, clues me in that the world will be enslaved economically, religiously, and politically. When will that occur exactly? I don't know.

There was a situation with Swiss Franc a few years back. The currency was bid up to the point that exports were seriously threatened by unfavorable currency exchange. Safe haven, perceived as gold-backed, so it was a popular place to park scared money at the time. They more or less decided to print to bring the exchange rate back in line but that didn’t work as well as they’d hoped.

What really calmed it down was a de facto agreement to backstop the Euro, which was having difficulties at that time as well. Euro hasn’t been doing so well recently, either. Curious move on that front.

A sudden announcement like this leading to an almost immediate spike of 30% over the course of a single day says to me that this was planned and that there were favored entities positioned to benefit. The current worrisome scenario creating currency distortion is oil.

So, for the curious, I’d suggest looking there for the culprits/beneficiaries, imho. Somebody just got a major windfall given to them. Who needs shoring up that’s too big to fail, either in the Eurozone itself or a major player there?

A person who is allowed to place bets which he might not be able to cover will, as a result of such ability, be able to achieve a higher payoff expectation than someone without that ability. In some cases, a such person may be able to combine multiple negative-expectation bets in such a way as to have a net positive outcome for the person placing them (and a huge negative outcome for someone else who will be left holding the bag).

I don't think companies that issued credit default swaps far in excess of their net worth failed to understand the dangers of correlated risks. More likely, they understood that the optimal way to monetize their ability to place bets they couldn't cover is to concentrate all the risk into one negative outcome, so all other outcomes would be positive. If the most one would stand to actually lose would be $10M, having a 1/1000 chance of being "obligated" (but unable) to pay $1B dollars is less "risky" than a 1/100 chance of having to pay $10M even though the former "expectation" is $1M and the latter expectation is only $100K. Accepting the latter risk in exchange for $80K cash would be a losing proposition, but "accepting" the former for $50K would be a winning proposition (since it really represents a 1/1000 chance of losing not $1B, but only $10M).

If one couldn't avoid one's obligations to pay, accepting $50K for a promise to make a 1B payment for a 1/1000 event would be a grossly losing proposition. On the other hand, if one isn't going to be paying anyhow, any premium one gets beyond what would be required to justify one's actual risk exposure is pure gravy.

” Freddie and Fannie purchased the Mortgages. They may have used those other organizations to do their dirty work...”

Well I don’t deal with make believe so if you’re more interested in blaming Fannie and Freddie than in investigating what happened you’re free to invent your own story.

Fannie and Freddie purchased and sold conforming loans, A-paper, just as they always have. The bubble was fueled by high risk, high yield, non-conforming paper invented and sold by F&F’s private market rivals. F&F had their own problems but they weren’t the source of the high risk mortgages.

“Who assumed the risk? Not the banks? “

Any investor who bought the CDOs assumed the risk. Collateralized debt typically is purchased by investors looking for a reliable rate of return. Insurance companies, pension funds, mutual funds, banks, private investors. The problem for these buyers is that rating agencies had given it a triple A rating when it was really toxic junk.

Yeah because cheap energy is always so bad for the economy.

That would be a valid point if the source of the crisis had come out of government intervention.

It didn’t in this case. This was the result of financial engineering in the private sector that entirely divorced mortgage creation from mortgage ownership, effectively removing any inherent concern that a mortgage writer had when writing a loan. Previously a lender stood to lose his own money. In the new model the mortgage writer had no skin in the game.

If anything the bubble was a time of less government regulation. The new mortgage market developed after Glass Steagall was scrapped giving financial firms more freedom to act. And the Commodity Futures Modernization Act of 2000 prevented the regulation of some of the derivatives involved in the bubble.

That could certainly be an explanation of what was going on in the CDS market.

One reason that the CDS market was able to develop the way that it did appears to be due to the Commodity Futures Modernization Act of 2000 which left it mostly free of any oversight.

But there was also a well documented disregard of risk in some firms unrelated to swaps. The mortgage part of their business was where their profit was coming from and they didn’t want to hear anything negative about it. If their risk officers understood how exposed they were no one wanted to listen.

I guess our governor decided against fracking for NY State at the right time. The economy-challenged eco-freaks were cheering their heads off and taking the credit last night but we may have been saved by the bell.

“depression - a decline in real GDP exceeding 10%, or

a recession lasting 2 or more years.”

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

It’s rather arbitrary but I would probably go along with it if the official figures bore a little more resemblance to reality. The way they figure it if everyone went to work for the government we would have the biggest boom in history.

Regardless what the US does....A healthier U.S. and cheaper energy “won’t suffice to actually accelerate the growth or the potential for growth in the rest of the world,”.....“If the global economy is weak, on its knees, it’s not going to help,”..... Lagarde in remarks previewing the IMF’s latest forecasts for the global economy due out on Monday.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.