Skip to comments.

A Darkening Market Sky [Maybe; Investment & Finance Thread Feb. 1]

Weekly investment & finance thread ^

| January 30, 2015

| Freeper Investors

Posted on 02/01/2015 10:49:28 AM PST by expat_panama

On the left is the excerpt --from the expert linked in Real Clear Markets: A Darkening Market Sky - Anthony Mirhaydari, The Fiscal Times

|

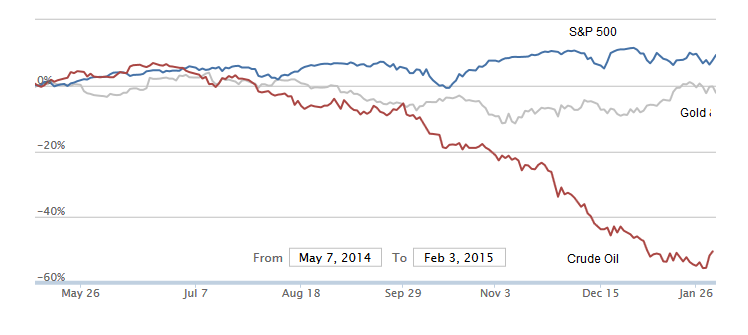

With the first month of the new year coming to a close, it's clear that 2015 is shaping up to be quite different from the smooth, easy climb investors enjoyed in 2013 and 2014. As recently as late December, the market optimism seemed indefatigable as stocks powered to new record highs on hopes for new stimulus from the European Central Bank, solid U.S. economic data and a strengthening tailwind to consumer spending from the collapse of energy prices. Now, four weeks later, the sky has darkened. Stocks have returned to their mid-December lows, with a retest of the October lows — which represented the most severe selloff since 2011 — looking likely. Why? First, investors are losing faith with the lynchpin of this bull market: The belief in the omnipotence of the world's central bankers. Plus, Greece is riling up the global financial establishment once again. Corporate profits and outlooks have included some serious disappointments as oil keeps falling to fresh lows and currency market volatility depresses the value of repatriated foreign earnings. [snip] On top of all that, a weaker-than-expected U.S. durable goods report suggested that the slowdowns in Europe and Asia might be having an effect here at home. Orders dropped 3.4 percent in December, marking the fourth consecutive contraction and the worst reading since August. |

|

In 2012 and 2013, the market uptrend rose out of the ashes of the fiscal cliff scare and relief over the results of the last Greek election, with plenty of help from global central bankers who locked arms and unleashed a wave of stimulus. ECB chief Mario Draghi made his "whatever it takes" promise in July 2012. The Federal Reserve unveiled its "QE3" bond-buying program that September. And "Abenomics" kicked in after Japan’s December 2012 election, with the Bank of Japan unleashing the most aggressive use of cheap money stimulus so far, including the purchases of both stocks and bonds. [snip] Drags include the impact of the stronger dollar on foreign profits, overseas weakness and the drop in energy prices. Although these factors were known heading into the reporting season, the actual impact on results has been more severe than expected, shattering expectations — formed by years of seemingly unstoppable corporate profitability — that results would always and forever surprise to the upside. According to FactSet, S&P 500 earnings per share growth expectations for 2015 stand at 4.9 percent, down from 8.6 percent earlier this month. Moreover, expected revenue growth has been cut in half to 1.5 percent. [snip] In response, I've recommended clients embrace a more defensive posture including long bets on volatility. For the more conservative, consider simply raising the cash allocation in your portfolios. |

|

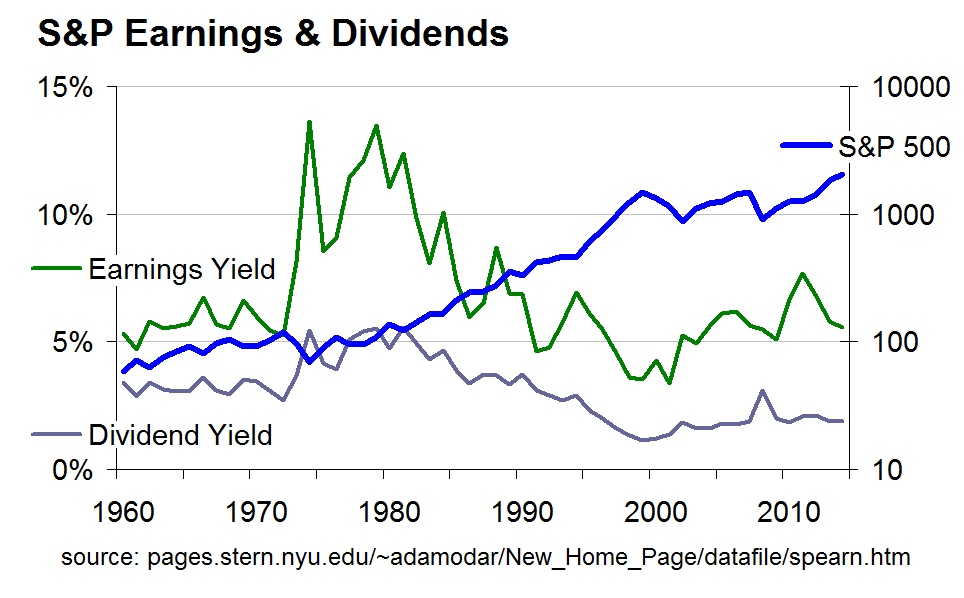

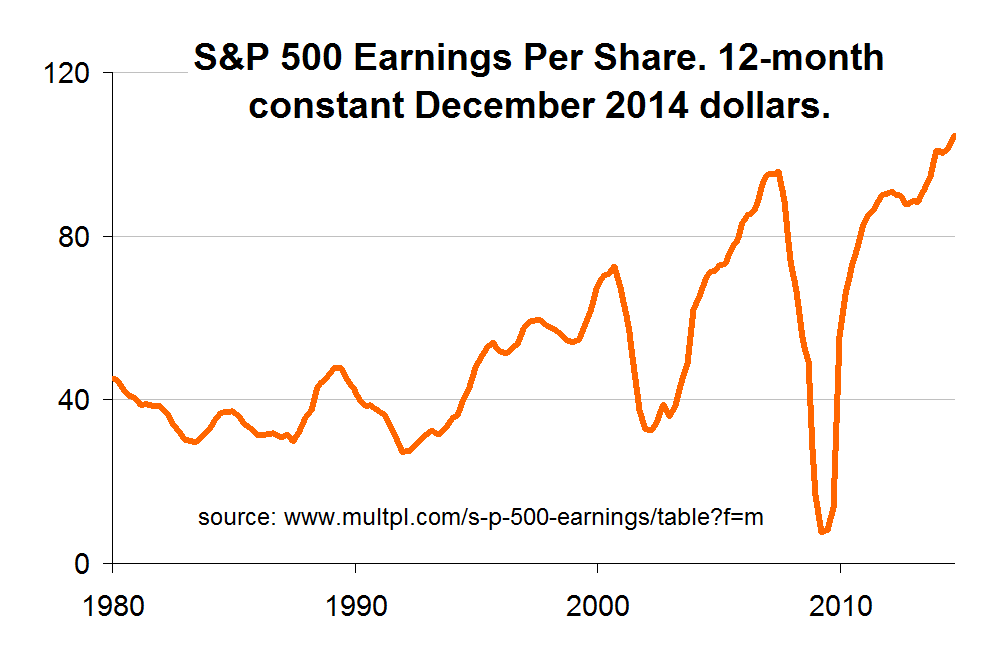

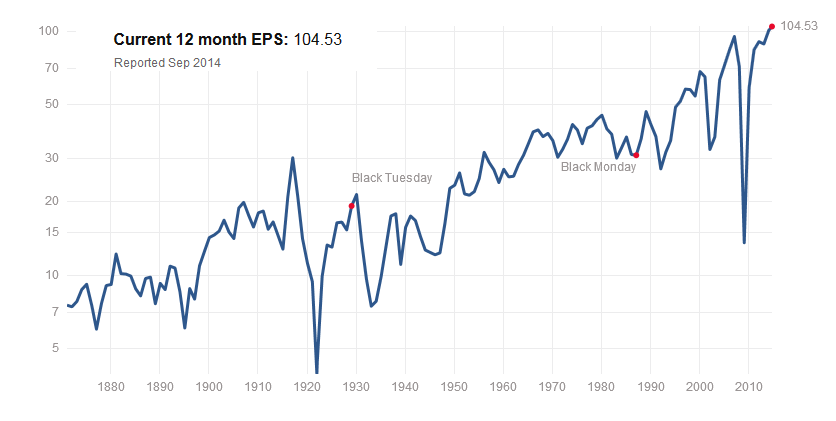

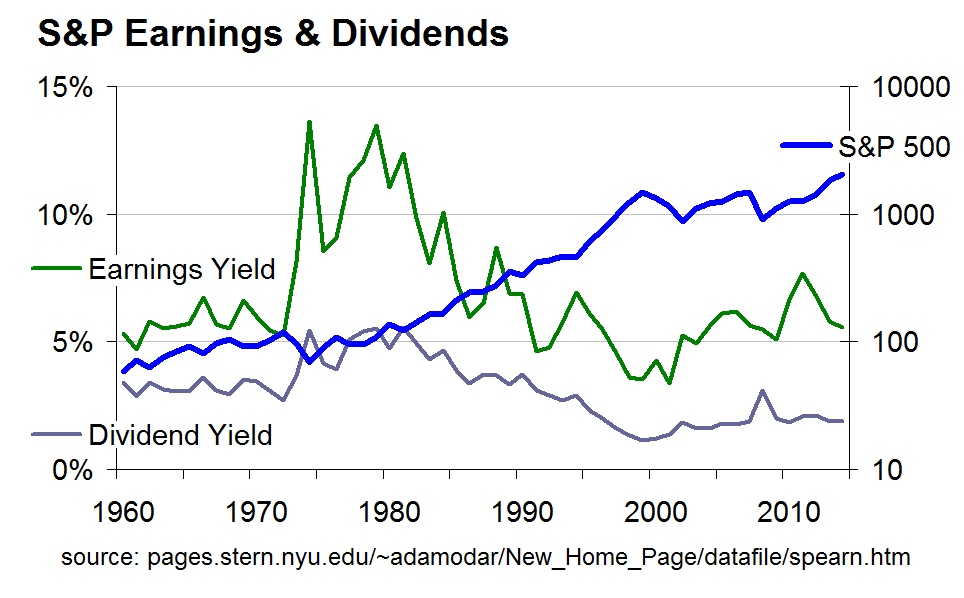

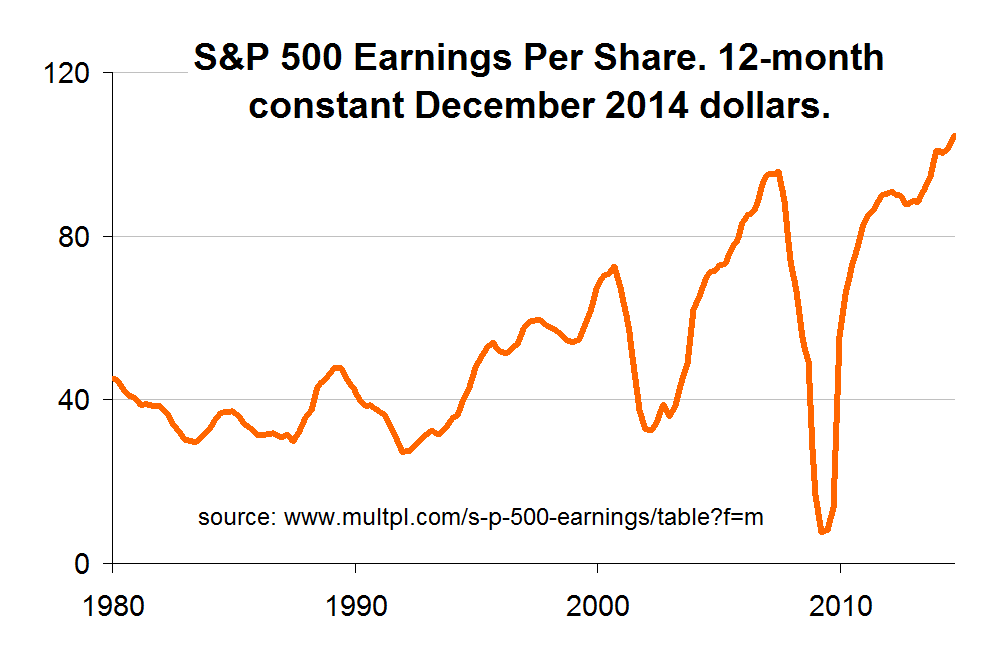

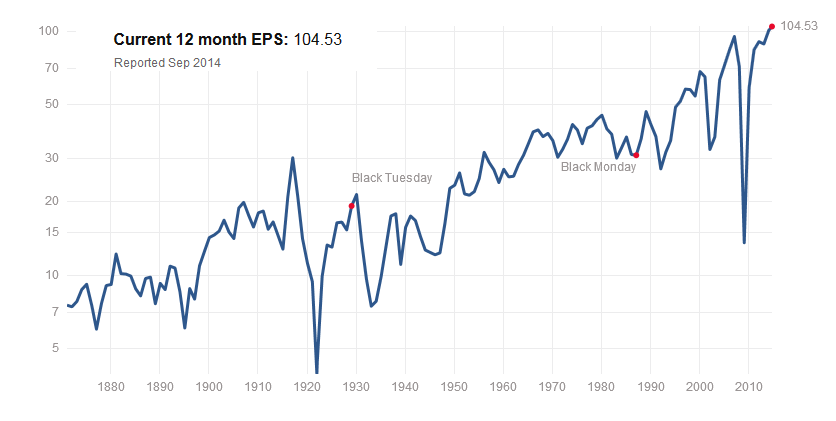

* * * * * * * * * * * * * * * * * * This piece originally caught my eye because it made some sense: seems to me like the investment markets are not going anywhere. While metals are failing to climb from their bases the major stock indexes sank below their 50-day moving averages and IBD keeps calling it 'market under pressure' as the distribution days pile up. So Mirhaydari's take satisfied my need for a daily dose of doom'n'gloom. OK, lets think about this. Maybe someone can help me but what I'm getting here is that that the world's in turmoil, the economy's underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. The writer hangs his hat on "S&P 500 earnings per share growth expectations" and in this wonderful info-age we can check it out for ourselves. This site has the historical numbers and a look at the past and yeah, EPS's are in fact stalling like they did back in the dot.com days and in mid '08. Looking harder I'm also seeing that failing 'growth expectations' really don't help much as a predictor of worse investment returns in the future.  I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual. I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual. Got to love how we got all the facts here and the facts on stock valuations usually go to both earnings and dividends, and the way they relate to over all market stock prices. Our friends at NYU got a site where we can download S&P500 earnings'n'dividend stats back to 1960 and imho there's food for thought. Then again, I would have proffered some magic indicator proving with all certainty that the market's going up or the market's going down.  It don't work that way. Maybe we're back to seeing Mirhaydari as being right after all. Maybe not w/ the doom'n'gloom shtick, but with the idea that it's good advice to "embrace a more defensive posture including long bets on volatility". Or as IBD calls it, we got a yellow light that means 'proceed with caution'. Then again, I can't remember ever wanting to invest in any other manner... * * * * * * * * * * * * * * * * * *

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; mirhaydari; sandp; stockcharts; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-55 next last

To: Wyatt's Torch

understood.

My thinking is that as an individual it's safe to assume (for interview purposes) to talk like you know the economy will get better and you know rates will go up, but it's the exact "when" or the exact % rate hike amount that tends to make even governors look down 'n mumble. Meanwhile the official fed press release has to stoop to 'greenspan talk'...

To: expat_panama

"What in the wide wide world of sports is a goin' on here!?!?"

Oil's gone crazy the past few days!!!

22

posted on

02/03/2015 11:38:44 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Blazing Saddles —complete with Apaches that spoke Yiddish...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

|

Markets |

|

Past Trades |

|

Ahead |

| metals |

|

Solid on new base, currently @ $1,265.20 and $17.40 |

|

trending up w/ futures +0.11 |

|

|

|

|

|

|

| stocks |

|

NASDAQ and S&P500 punching back up over the 50-day MA in higher volume |

|

mixed/off, overall -0.06% |

News:

Threads:

To: expat_panama

The “experts” are saying the oil bump is the classic “dead cat bounce.”

Who knows?

But I still have some dry powder in case another buying opportunity presents itself.

25

posted on

02/04/2015 4:09:44 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

“experts” are saying the oil bump is the classic “dead cat bounce.”

That's what it looks like for price, but a 'DCB' usually shows less volume on the upside than it did before and since I only got price here I can't say. Regardless, while a DCB usually points the way down I've seen more than a few times it led into a bigtime rally...

To: abb; Wyatt's Torch

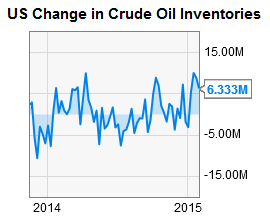

Yesterday we got the

Crude Inventories report for Jan. and it showed another big increase. Problem is that trends in prices and inventories can mean anything we want for the next year or two because the industry takes so long to react --we can't just drill a new well overnight any more than we can quickly get a new job closer to home to use less gas.

So like the first half of 2014 inventories went up and down while the price of oil just went up, and then inventories went up down and up in the other half of 2014 while the price plunged. What I'm getting is that meaningful price trends in oil take decades to set in, and month/year timeframes are just noise static.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Happy "Claims" day to everyone! This morning (any minute now):

Initial Claims

Continuing Claims

Trade Balance

Productivity-Prel

Unit Labor Costs

Natural Gas Inventories

--and this on top of futures trades pointing +0.6% for stock indexes and metals off -0.81. Lotsa juicy news blurbs:

To: expat_panama

Out from under my earnings call rock... What did I miss?

To: expat_panama

30

posted on

02/05/2015 5:43:49 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

... What did I miss?lot's of big changes --back and forth and all ending up about the same place as where you left off...

To: Lurkina.n.Learnin

...Data Breach At Health Insurer...My biggest fear is that my private records could end up in the hands of IRS auditors and vindictive Democrat party hacks. No wait, that's already happening...

To: expat_panama

Obama said electronic health records would save buccoo bucks. Seems like we’ll spend all on getting all of the identity theft straightened out.

33

posted on

02/05/2015 7:44:05 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama; Wyatt's Torch; Lurkina.n.Learnin

Now what!?!?!?!?! I thought we was all ‘experts!!’

(Who is “we,” paleface?)

LOL!!

34

posted on

02/05/2015 12:36:17 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

I didn’t even stay at a Holiday Inn.

35

posted on

02/05/2015 4:41:03 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

LOL! If we “KNEW,” we would all be on our gret big ol’ yachts down in the Caribbean right about now.

36

posted on

02/05/2015 4:45:45 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Look what a judge did to the very private information of Prop 8 donors. Then the Left went after them big time. We need to hold the Congress and move the country back toward the Constitution.

I like Mike Lee for a lot of this.

37

posted on

02/05/2015 6:30:29 PM PST

by

1010RD

(First, Do No Harm)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

A very happy morning to you, a great way to wrap up the week! Metals (+0.10%), bonds (+0.04%), and stock indexes (+0.02%) are all solid with both this morning's futures and yesterday's performance. Even the price of oil continues clawing its way back up and right now energy futures are +1.88%.

To: 1010RD

...very private information of Prop 8 donors. Then the Left went after them...It's always been that way, the lefts can steal or illegally tap concervatives (Pentagon Papers, Gingrich celphone tapes) but publically released emails from the global warmers are suddenly called 'private'.

To: abb; Lurkina.n.Learnin; Wyatt's Torch

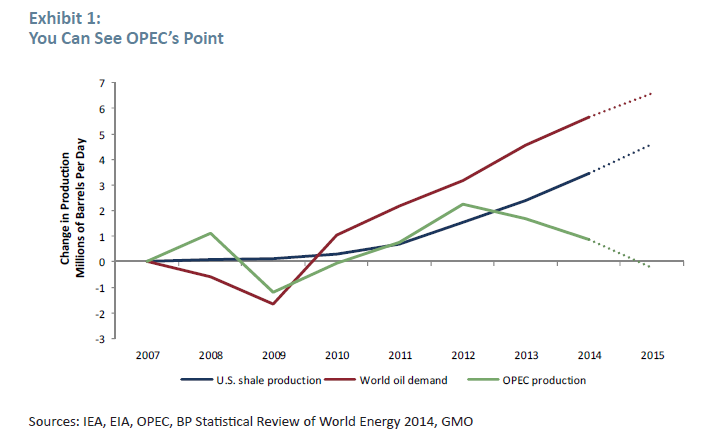

...If we “KNEW,” we would all...Thing is that there really are signs that can warn us. I just read "Why Were We So Surprised? - Jeremy Grantham/Ben Inker, GMO Quarterly", they showed--

--that for years the trend of shale oil production had been overwhelming and obvious.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-55 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations.

underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual.

I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual.