[excerpt from Stock-market crash of 2016: The countdown begins]

[excerpt from Stock-market crash of 2016: The countdown begins]Dow will drop 50% as market replays 2008, 2000 and 1929. That will translate into the DJIA crashing from today’s 18,117 down 50% to about 9,000. Ouch, the Dow crashing all the way below 10,000. Unimaginable. Bulls will hate it. No wonder our brains tune out, turn off. Instead, we prefer the happy talk that will just keep coming out of Wall Street and Washington till the 2016 collapse. We’ll just keep denying reality ... till it’s too late, and we suffer another $10 trillion loss is on the books.

Deja vu 2000: irrational exuberance, dot-com technologies

Remember 1999. Just 16 years ago. Roaring hot “irrational exuberance.” Renewed stock market mania. Wall Street was hot. Stocks roaring. Back then investors demanded insane annual returns during the worldwide millennium celebrations: the top 19 mutual funds had 179% to 323% annual returns.

Yes, dot-com stockholders expected 100% plus returns on zero revenues...

[snip]

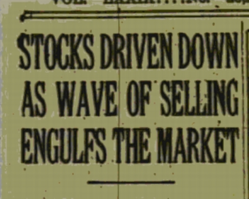

...Deja vu the Crash of 1929: and the long Great Depression...

[snip]

...Yikes, it took 13 long years to break even from Wall Street’s losses of 2000 and 2008. And now investors are being warned that the Crash of 2016 will be even worse, with new losses of 50%. In short, the market really is bad news.

But still, here we are again, panicking: Fearing that 2016 will repeat 1929, fearing that Wall Street and Main Street, tens of millions of Americans, plus the Fed, the SEC, Washington politicians in both parties will refuse to prepare for the Crash of 2016. Will deny hearing the warnings ... of the Crash of 2016, one that promises in the end to become bigger and badder and far more dangerous than 2008, 1999 and 1929 combined. Listen closely, the countdown to the Crash of 2016 has started.

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]DI’ll give veteran MarketWatch columnist Paul B. Farrell his due: The man knows how to draw clicks.

It’s hard to avoid an article with the headline: “Stock Market Crash of 2016: The Countdown Begins.”

While many seasoned consumers of financial journalism might be inclined to dismiss an article with such a bombastic headline right off the bat, I’m always willing to at least consider the arguments behind such a claim.

If such a crash is a year off, it’s important to start preparing. A 50% decline in stock-market value is a sharper drop than we endured in 2008.

Fortunately for long investors everywhere, there is little about the article that should send anyone cashing out of stocks...

[snip]

...The bigger issue on trial here is the idea that investors should make big asset bets based on bold market forecasts, whether by professional money managers or journalists....

[snip]

...“Sure, they suffered steep losses (and likely lost some serious sleep) as stocks cratered during the financial crisis,” Egan writes. “Yet they also enjoyed a dramatic rebound in U.S. stocks as the system stabilized. The S&P 500 is up over 200% since the bottoming out in March 2009.”

He adds that it may be tempting to stay on the sidelines. However, holding too much cash for fear of a market crash will almost certainly cause you to miss extended periods when markets perform well.

More precision confusion from experienced professionals:

More precision confusion from experienced professionals: